Energy

No calling in sick or waiting for a nice day – The grid has to perform on the worst of them

From the Frontier Centre for Public Policy

By Terry Etam

Saturday night, the middle of the cold snap, was something to be endured

Saturday night, the middle of the cold snap, was something to be endured. Things break at -36 degrees. A quick run to the grocery store was rerouted by a fleet of city vehicles tearing up the street in a considerable manner, most likely chasing a broken water main or some such. Imagine being without water on a night like that.

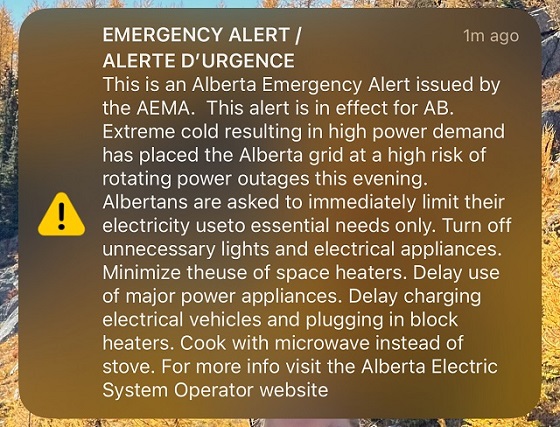

Half an hour later it got worse – the provincial grid operator issued an alert for people to “immediately limit their electrical use to essential needs only.”

Keep in mind the staggering circumstance, and location, of that alert: Alberta. Even the province’s biggest naysayer would have to admit that the province is an energy juggernaut, blessed with resources most of the world can only dream of, including and especially energy.

If power consumption levels were not reduced, there could have been rolling blackouts. Anyone care to imagine what that would have been like at -35 degree temperatures?

Hopefully every single voter in Canada, and the US for that matter, is paying attention. The false prophecies of utopian energy transitions visions are, quite clearly, dangerously false.

The media feeds you dumbed-down pablum; don’t take it at face value. Instead of listening to blathering about “new installed capacity”, pay attention to actual output. In extreme cold, wind and solar output fall to zero, or very close. It doesn’t matter if there are a billion gigawatts of ‘capacity’ installed.

Everyone needs to understand the fundamental issue that was best described by Nassim Taleb via his turkey analogy. A turkey has 364 days of a very good life, followed by one very bad day come Thanksgiving. It is the bad day that matters, not 364 good ones. A deadly day is a deadly day.

It’s the same with renewables penetration, and how it makes the news ‘on the good days’. Activists and simplistic policymakers (but I repeat myself) tout how a particular jurisdiction may have at such and such a time sourced “xx percent” of power from renewables. Yay, look at the progress, marching ever higher. But it’s not what it sounds like. It doesn’t matter if a country or state or province gets 80% of its power from solar at the peak of a good sunny day, nor if 80% comes from wind on a particularly windy day. Those are misleading numbers, because the system must be fully capable of meeting peak demand every day, and not just ‘on a good day’.

According to AESO, the provincial grid operator, Alberta has 4,481 MW of wind power capacity. At the peak of last weekend’s deepfreeze, it was producing about 1/3 of one percent of that total. Not just useless, but far worse: useless when needed exactly the most.

What matters is: how does the system perform at peak times – what is going to show up on demand?

Just like everyone else that’s trying to bring rationality to this conversation, I need also point out that wind and solar are welcome additions, in moderate amounts, sited where they do the least damage, and as supplements to a grid.

But that’s where the conversation needs to get serious. The real danger out there are people that want an energy transition so badly, or are employed as ‘climate architects’ such that their career depends on it, who sweep some mighty big things under the rug.

“We just need more storage, then wind and solar will be able to carry the load.” Not possible, not if batteries are the vision. Imagine a day’s worth of battery power supply for the entire province. Or two days. The cost would be off the charts, and, then after two days of ‘usage’, how would the batteries get recharged if the cold spell persisted more than a few days? Is that the kind of backup anyone would accept? We’ll have power again if the wind picks up strongly and consistently for the next week, if not, well, good luck?

“Sure we can handle an all-EV world because users can charge at night.” I’ve seen this argument now and then, based on some simplistic studies that show, correctly, that financial enticements can get people to charge EVs at off peak hours. But that’s a red herring in the world we are headed for, “electrify everything”. If we do electrify even half of what we could, then peak demand will still go way up, as will our life-perched dependency on it. More EVs just mean more load. And not all EVs will shift to night charging; it is some pretty weak thinking to imagine that all EV owners will have that optionality, or live in a place that allows it, or won’t be travelling, etc. And remember that the feds’ plan is for all vehicles to be electrified. So maybe J. Consumer in suburbia can shift his EV to night charging, but what about a fleet of city buses, or Uber drivers, or forklifts, or taxis, or…the list is endless.

“We can switch to heat pumps.” This one takes the cake. Heat pumps will exacerbate the problem at the exact worst time – when it is coldest, and when power demand is highest, and when the grid is maxed out. It is the opposite of proponents who say EVs can charge at off peak hours – heat pumps will be called into full service precisely at peak hours. Taleb’s turkey again: a mass-heat-pump system will be wonderful on many days, but on the very worst day, all goes black. And cold.

There is no joy in this silly debate we seem to be in with ideologues, particularly when the threat of rolling blackouts is announced by the grid operator. But there is also no time to waste indulging people who want to rewire the grid with “well academic studies say this should work.” Set up your own commune somewhere and experiment for a few years and at least one winter cold snap, then let us know how it goes.

Wishful thinking doesn’t turn many wrenches, nor does it heat homes. Wishful thinking is not what an energy system can or should be built on. Energy is life or death in extreme weather. Ideology is the last thing that should be involved in energy supply, and yet we are up to our ears in it, a situation that is becoming dangerous.

People can see this. They may not understand how grids (and energy) work, but they know when something smells bad. That’s why federal government support is at such lows, and why distrust in the media is at such highs. Political scientists telling you “Don’t worry, we know how to design a new grid” are no match for the likes of, for example, real-world experiences such as this relayed by a gentleman named John Wright on LinkedIn: “Currently out at our cabin trying to help out our heat pumps (we run three geothermal units and they are running full out with auxiliary/ supplemental heating coils engaged). We have two propane fireplaces burning full time in addition to all the firewood that we’re also splitting and burning, and all of the burners on the cooktop are on. It’s probably about +12.5° C inside here vs -36°C outside…Everyone seems to ignore the fact that heat pumps are a huge draw on the power grid. Our power bill could easily be $1500.00 to $2000.00 for January…By the way, the power consumption and poor performance is the same in the summer when it is +36°C here.”

And finally, it is important to note that the gradual but persistent undermining of the hydrocarbon industry will have massive consequences, because hydrocarbons underpin everything we use and do. Governmental and media animosity will drive away capital (don’t wonder why dividends are such a popular thing in the oil and gas sector – capital flight in full view) and ultimately weaken a pillar of our economy. Until nuclear energy is ubiquitous, or some technological breakthrough happens, we need reliable, baseload power, which at this time in history means hydrocarbons, here and around the world. That baseload is not guaranteed, it is not a right, it is not going to be sustained if capital is chased away from it.

Voters, it’s up to you. Demand more from your politicians, but also demand better conversations from the entire energy industry as well. We owe you that.

Terry Etam is a columnist with the BOE Report, a leading energy industry newsletter based in Calgary. He is the author of The End of Fossil Fuel Insanity. You can watch his Policy on the Frontier session from May 5, 2022 here.

Automotive

Federal government should swiftly axe foolish EV mandate

From the Fraser Institute

Two recent events exemplify the fundamental irrationality that is Canada’s electric vehicle (EV) policy.

First, the Carney government re-committed to Justin Trudeau’s EV transition mandate that by 2035 all (that’s 100 per cent) of new car sales in Canada consist of “zero emission vehicles” including battery EVs, plug-in hybrid EVs and fuel-cell powered vehicles (which are virtually non-existent in today’s market). This policy has been a foolish idea since inception. The mass of car-buyers in Canada showed little desire to buy them in 2022, when the government announced the plan, and they still don’t want them.

Second, President Trump’s “Big Beautiful” budget bill has slashed taxpayer subsidies for buying new and used EVs, ended federal support for EV charging stations, and limited the ability of states to use fuel standards to force EVs onto the sales lot. Of course, Canada should not craft policy to simply match U.S. policy, but in light of policy changes south of the border Canadian policymakers would be wise to give their own EV policies a rethink.

And in this case, a rethink—that is, scrapping Ottawa’s mandate—would only benefit most Canadians. Indeed, most Canadians disapprove of the mandate; most do not want to buy EVs; most can’t afford to buy EVs (which are more expensive than traditional internal combustion vehicles and more expensive to insure and repair); and if they do manage to swing the cost of an EV, most will likely find it difficult to find public charging stations.

Also, consider this. Globally, the mining sector likely lacks the ability to keep up with the supply of metals needed to produce EVs and satisfy government mandates like we have in Canada, potentially further driving up production costs and ultimately sticker prices.

Finally, if you’re worried about losing the climate and environmental benefits of an EV transition, you should, well, not worry that much. The benefits of vehicle electrification for climate/environmental risk reduction have been oversold. In some circumstances EVs can help reduce GHG emissions—in others, they can make them worse. It depends on the fuel used to generate electricity used to charge them. And EVs have environmental negatives of their own—their fancy tires cause a lot of fine particulate pollution, one of the more harmful types of air pollution that can affect our health. And when they burst into flames (which they do with disturbing regularity) they spew toxic metals and plastics into the air with abandon.

So, to sum up in point form. Prime Minister Carney’s government has re-upped its commitment to the Trudeau-era 2035 EV mandate even while Canadians have shown for years that most don’t want to buy them. EVs don’t provide meaningful environmental benefits. They represent the worst of public policy (picking winning or losing technologies in mass markets). They are unjust (tax-robbing people who can’t afford them to subsidize those who can). And taxpayer-funded “investments” in EVs and EV-battery technology will likely be wasted in light of the diminishing U.S. market for Canadian EV tech.

If ever there was a policy so justifiably axed on its failed merits, it’s Ottawa’s EV mandate. Hopefully, the pragmatists we’ve heard much about since Carney’s election victory will acknowledge EV reality.

Daily Caller

Trump Issues Order To End Green Energy Gravy Train, Cites National Security

From the Daily Caller News Foundation

By Audrey Streb

President Donald Trump issued an executive order calling for the end of green energy subsidies by strengthening provisions in the One Big Beautiful Bill Act on Monday night, citing national security concerns and unnecessary costs to taxpayers.

The order argues that a heavy reliance on green energy subsidies compromise the reliability of the power grid and undermines energy independence. Trump called for the U.S. to “rapidly eliminate” federal green energy subsidies and to “build upon and strengthen” the repeal of wind and solar tax credits remaining in the reconciliation law in the order, directing the Treasury Department to enforce the phase-out of tax credits.

“For too long, the Federal Government has forced American taxpayers to subsidize expensive and unreliable energy sources like wind and solar,” the order states. “Reliance on so-called ‘green’ subsidies threatens national security by making the United States dependent on supply chains controlled by foreign adversaries.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

Former President Joe Biden established massive green energy subsidies under his signature 2022 Inflation Reduction Act (IRA), which did not receive a single Republican vote.

The reconciliation package did not immediately terminate Biden-era federal subsidies for green energy technology, phasing them out over time instead, though some policy experts argued that drawn-out timelines could lead to an indefinite continuation of subsidies. Trump’s executive order alludes to potential loopholes in the bill, calling for a review by Secretary of the Treasury Scott Bessent to ensure that green energy projects that have a “beginning of construction” tax credit deadline are not “circumvented.”

Additionally, the executive order directs the U.S. to end taxpayer support for green energy supply chains that are controlled by foreign adversaries, alluding to China’s supply chain dominance for solar and wind. Trump also specifically highlighted costs to taxpayers, market distortions and environmental impacts of subsidized green energy development in explaining the policy.

Ahead of the reconciliation bill becoming law, Trump told Republicans that “we’ve got all the cards, and we are going to use them.” Several House Republicans noted that the president said he would use executive authority to enhance the bill and strictly enforce phase-outs, which helped persuade some conservatives to back the bill.

-

Business2 days ago

Business2 days agoWEF-linked Linda Yaccarino to step down as CEO of X

-

Automotive2 days ago

Automotive2 days agoAmerica’s EV Industry Must Now Compete On A Level Playing Field

-

Business2 days ago

Business2 days ago‘Experts’ Warned Free Markets Would Ruin Argentina — Looks Like They Were Dead Wrong

-

International2 days ago

International2 days agoSecret Service suspends six agents nearly a year after Trump assassination attempt

-

Business1 day ago

Business1 day agoCarney government should recognize that private sector drives Canada’s economy

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoThe Covid 19 Disaster: When Do We Get The Apologies?

-

Alberta1 day ago

Alberta1 day agoFourteen regional advisory councils will shape health care planning and delivery in Alberta

-

Alberta1 day ago

Alberta1 day agoAlberta school boards required to meet new standards for school library materials with regard to sexual content