Fraser Institute

New Prime Minister Carney’s Fiscal Math Doesn’t Add Up

From the Fraser Institute

By Jason Clemens and Jake Fuss

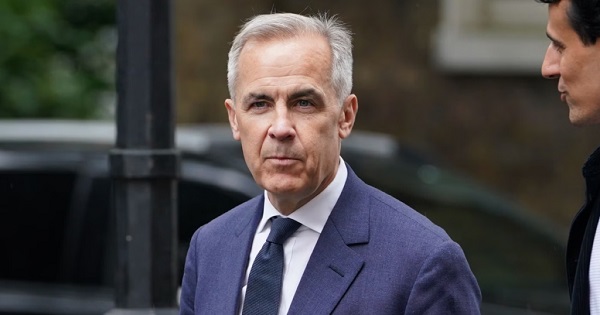

For the first time in Canada’s history, the Prime Minister has never sought or won a democratic election in any parliament. Mark Carney’s victory to replace Justin Trudeau as the leader of the Liberal Party means he is now the Prime Minister. Carney’s resume and achievements make him one of the most accomplished prime ministers ever. Still, there are a number of basic questions about Carney’s fiscal and economic math that Canadians need to consider carefully as we enter an election.

Carney’s accomplishments should be recognized. He has a bachelor’s degree in economics from Harvard and both a masters and doctoral degrees in economics from Oxford University. He spent over a decade at Goldman Sachs, a leading US-based financial firm then left to take up senior positions at both the Bank of Canada and later the Department of Finance. He became the Governor of the Bank of Canada in 2007 and then the Governor of the Bank of England in 2012. After his tenure at the Bank of England, Carney took up a number of private sector posts including chairman at Brookfield Asset Management, a major Canadian company.

Despite these obvious accomplishments and a deep CV, Carney’s proposed fiscal policies pose a number of serious questions.

Carney self-characterizes as a pragmatist and someone who will bring the Liberal Party back to the political centre after having been pushed to the left by former prime minister Justin Trudeau. Even former prime minister Jean Chrétien, one of the country’s most electorally successful prime ministers called for the party to move back to the centre.

Specifically, Carney said he would “cap” the size of the federal government workforce and reduce federal spending through a review of program spending as was done in 1994-95. He also indicated that the operating budget would be balanced within three years. He criticized the current government for spending too much and not investing enough, and for missing spending targets and violating its own fiscal guardrails. The implication of all these policies is that the role of the federal government will be rolled back with reductions in spending and federal employment, and reducing regulations. In many ways, these policies mirror those of former prime minister Chrétien.

However, there are numerous statements by Carney that seem to contradict these policies, or at the very least, water them down significantly. Consider, for instance, that Carney has indicated there will be no cuts to transfers to provincial governments (19.8 per cent of budget spending), no reductions in the income-transfers to individuals and families (25.8 per cent), and the government doesn’t determine interest charges on its debt (another 9.7 per cent). So, Carney has already taken over half the federal budget off the table for reductions.

It’s not clear whether he would reduce what’s referred to as “Other Transfers” which includes support for EV programs and investment incentives. This represents 17.9 per cent of the current budget. And if you read any of Carney’s climate-related initiatives, it appears this category of spending will actually increase, not decrease. Moreover, Carney stated he won’t touch some transfers such as the national dental care and pharmacare programs.

The major remaining category of federal spending is “operating expenses”, which includes the costs of running more than 100 government departments, agencies and Crown corporations. It’s expected to reach $130.6 billion this year and represents 23.4 per cent of the federal budget. But again, Carney has only committed to “capping” the federal workforce despite significant growth since 2015 and then review programs. Unless he’s willing to actually reduce federal employment and/or challenge existing contracts with the civil service, it’s not clear how he can find meaningful savings in the short term.

Recall that the expected deficit this year is $42.2 billion and to balance the budget over the next three years, Carney needs to find roughly $30 billion in savings. (Some of the deficit reduction is expected to come from economic growth, which increases government revenues).

However, this ignores the pressure on the federal government to markedly and quickly increase defense spending. A recent analysis estimated that the federal government would have to increase defense spending in 2027-28 by $68.8 billion to meet its NATO commitment, which is what President Trump is demanding. This single measure of spending could materially derail the new prime minister’s commitment to a balanced budget within three years.

But Carney has complicated the nation’s finances by committing to separating operating spending from capital spending. The former are annual spending requirements like salaries and wages to federal employees, income transfers to people through programs like EI and Old Age Security, and transfers to the provinces for health and social programs. Carney has committed to balancing the revenues collected for these purposes against spending.

However, he wants to remove anything that is deemed an “investment” or “capital”. That means spending on infrastructure like roads and ports, defense spending on equipment, and energy projects.

While Carney has committed to only running a “small deficit” on such spending, the commitment is eerily similar to Trudeau’s commitment in 2015 to run “small deficits” for just “three years” and the budget will balance itself through economic growth. The total federal gross debt has increased from $1.1 trillion when Trudeau took office in 2015 to an estimated $2.3 trillion this year.

The clear risk is that a Carney government will simply reduce spending in the operating budget and move it to the capital budget, thus balancing the latter while still piling up government debt.

Clarity is required from the new prime minister with respect to: 1) What operating expenses does he plan to reduce (or perhaps more generally is open to reducing) over the next three years to reach a balanced operating budget? 2) What specific commitment is Carney making on defense spending over the next three years? 3) What current spending will the new prime minister move or potentially move from the budget to his new capital budget? And finally, 4) What measures will be taken if revenues don’t materialize as expected and/or spending increases more than planned to ensure a balanced operating budget in three years?

Until greater clarity and details are provided, it’s hard, even near impossible, to know the extent to which the new prime minister is pragmatically offering a plan for more sustainable government finances versus playing politics by promising everything to everyone.

Business

Carney’s new agenda faces old Canadian problems

From the Fraser Institute

In his June speech announcing a major buildup of Canada’s military, Prime Minister Mark Carney repeated his belief that this country faces a “hinge moment” of the sort the allied countries confronted after the Second World War.

A better comparison might be with the beginning of the war itself.

Then, the Allies found themselves at war with an autocratic state bent on their defeat and possible destruction. Now, Carney faces an antagonistic American president bent on annexing Canada through economic warfare.

Then, Canada rose to the challenge, creating the world’s third-largest navy and landing an army at Normandy on D-Day. Now, Carney has announced the most aggressive reorienting of Canada’s economic, foreign and defence policies in generations.

Polls show strong support among Canadians for this new agenda. But the old Canada is still there. It will fight back. It may yet win.

The situation certainly would have been more encouraging had Carney not inherited Justin Trudeau’s legacy of severe economic and environmental restrictions—picking economic winners and losers rather than letting the market decide—and chronic deficits. The new prime minister would do well to dismantle as much of that legacy as he can.

Some advocate a return to the more laissez-faire approach of Stephen Harper’s government. But Harper didn’t confront a belligerent president hoping to annex Canada through the “economic force” of tariff walls.

The prime minister succeeded in getting Bill C-5, which is intended to weaken at least some of the restrictions on resource development and infrastructure, passed into law. He and the premiers pledge to finally dismantle generations of internal trade and labour mobility barriers. If we must trade less with the Americans, we can at least learn to trade with ourselves.

And the prime minister deserves high praise for reversing decades of military decline through increased spending and efforts to improve procurement. If Carney accomplishes nothing more than restoring Canada’s defences, especially in the Arctic, he will be well remembered.

That said, major challenges confront the Carney agenda.

There’s much talk about a new national energy corridor. But what does that mean? One KPMG executive defined it as a “dedicated, streamlined pathway for the energy, electricity, decarbonization, transportation and digital infrastructure.”

Yes, but what does that mean?

Whatever it means, some First Nations will oppose it tooth-and-nail. Not all of them, mind you. The First Nations Major Project Coalition is dedicated to assisting First Nations in working with government and the private sector for the benefit of all. But many First Nations people consider resource development further exploitation of their ancestral lands by a colonizing power. At the first major proposal to which they do not buy in, they will take the government to court.

What investor will be willing to commit to a project that could be blocked for years as First Nations and Ottawa fight it out all the way to the Supreme Court?

The prime minister, formerly a fervent advocate of combatting climate change, now talks about developing “conventional energy,” which means oil and gas pipelines. But environmental activists will fiercely oppose those pipelines.

There is so much that could go wrong. Sweep away those internal trade barriers? Some premiers will resist. Accelerate housing development? Some mayors will resist. Expand exports to Europe and Asia? Some businesses and entrepreneurs will say it’s not worth the risk.

As for the massive increase in defence spending, where will the money come from? What will be next year’s deficit? What will be the deficit’s impact on inflation, interest rates and sovereign creditworthiness? The obstacles are high enough to make anyone wonder how much, if any, of the government’s platform will be realized. But other factors are at work as well, factors that were also present in 1939.

To execute his mandate, Carney is surrounding himself with what, back in the Second World War, were called “dollar a year men”—executives who came to Ottawa from the private sector to mobilize the economy for wartime.

In Carney’s case he has brought in Marc-André Blanchard as chief of staff and Michael Sabia as clerk of the privy council. Both are highly experienced in government and the private sector. Both are taking very large pay cuts because, presumably, they understand the gravity of the times and believe in the prime minister’s plans.

Most important, Carney’s agenda has broad support from a public that fears for the country’s future and will have little patience toward any group seeking to block the prime minister’s agenda.

Millions of Canadians want this government’s reform efforts to succeed. Those who would put it at risk of failing will have to contend with public anger. That gives Carney a shot at making real change.

Business

National dental program likely more costly than advertised

From the Fraser Institute

By Matthew Lau

At the beginning of June, the Canadian Dental Care Plan expanded to include all eligible adults. To be eligible, you must: not have access to dental insurance, have filed your 2024 tax return in Canada, have an adjusted family net income under $90,000, and be a Canadian resident for tax purposes.

As a result, millions more Canadians will be able to access certain dental services at reduced—or no—out-of-pocket costs, as government shoves the costs onto the backs of taxpayers. The first half of the proposition, accessing services at reduced or no out-of-pocket costs, is always popular; the second half, paying higher taxes, is less so.

A Leger poll conducted in 2022 found 72 per cent of Canadians supported a national dental program for Canadians with family incomes up to $90,000—but when asked whether they would support the program if it’s paid for by an increase in the sales tax, support fell to 42 per cent. The taxpayer burden is considerable; when first announced two years ago, the estimated price tag was $13 billion over five years, and then $4.4 billion ongoing.

Already, there are signs the final cost to taxpayers will far exceed these estimates. Dr. Maneesh Jain, the immediate past-president of the Ontario Dental Association, has pointed out that according to Health Canada the average patient saved more than $850 in out-of-pocket costs in the program’s first year. However, the Trudeau government’s initial projections in the 2023 federal budget amounted to $280 per eligible Canadian per year.

Not all eligible Canadians will necessarily access dental services every year, but the massive gap between $850 and $280 suggests the initial price tag may well have understated taxpayer costs—a habit of the federal government, which over the past decade has routinely spent above its initial projections and consistently revises its spending estimates higher with each fiscal update.

To make matters worse there are also significant administrative costs. According to a story in Canadian Affairs, “Dental associations across Canada are flagging concerns with the plan’s structure and sustainability. They say the Canadian Dental Care Plan imposes significant administrative burdens on dentists, and that the majority of eligible patients are being denied care for complex dental treatments.”

Determining eligibility and coverage is a huge burden. Canadians must first apply through the government portal, then wait weeks for Sun Life (the insurer selected by the federal government) to confirm their eligibility and coverage. Unless dentists refuse to provide treatment until they have that confirmation, they or their staff must sometimes chase down patients after the fact for any co-pay or fees not covered.

Moreover, family income determines coverage eligibility, but even if patients are enrolled in the government program, dentists may not be able to access this information quickly. This leaves dentists in what Dr. Hans Herchen, president of the Alberta Dental Association, describes as the “very awkward spot” of having to verify their patients’ family income.

Dentists must also try to explain the program, which features high rejection rates, to patients. According to Dr. Anita Gartner, president of the British Columbia Dental Association, more than half of applications for complex treatment are rejected without explanation. This reduces trust in the government program.

Finally, the program creates “moral hazard” where people are encouraged to take riskier behaviour because they do not bear the full costs. For example, while we can significantly curtail tooth decay by diligent toothbrushing and flossing, people might be encouraged to neglect these activities if their dental services are paid by taxpayers instead of out-of-pocket. It’s a principle of basic economics that socializing costs will encourage people to incur higher costs than is really appropriate (see Canada’s health-care system).

At a projected ongoing cost of $4.4 billion to taxpayers, the newly expanded national dental program is already not cheap. Alas, not only may the true taxpayer cost be much higher than this initial projection, but like many other government initiatives, the dental program already seems to be more costly than initially advertised.

-

Carbon Tax2 days ago

Carbon Tax2 days agoCanada’s Carbon Tax Is A Disaster For Our Economy And Oil Industry

-

Disaster2 days ago

Disaster2 days agoTexas flood kills 43 including children at Christian camp

-

Alberta1 day ago

Alberta1 day agoAlberta Next: Immigration

-

Daily Caller2 days ago

Daily Caller2 days agoTrump’s One Big Beautiful Bill Resets The Energy Policy Playing Field

-

Business2 days ago

Business2 days agoThe Digital Services Tax Q&A: “It was going to be complicated and messy”

-

International2 days ago

International2 days agoElon Musk forms America Party after split with Trump

-

Crime14 hours ago

Crime14 hours agoNews Jeffrey Epstein did not have a client list, nor did he kill himself, Trump DOJ, FBI claim

-

COVID-1912 hours ago

COVID-1912 hours agoFDA requires new warning on mRNA COVID shots due to heart damage in young men