Fraser Institute

New Prime Minister Carney’s Fiscal Math Doesn’t Add Up

From the Fraser Institute

By Jason Clemens and Jake Fuss

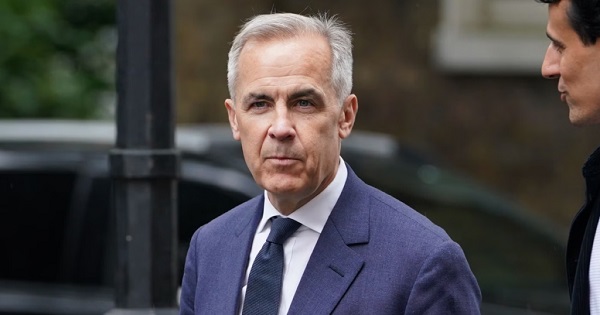

For the first time in Canada’s history, the Prime Minister has never sought or won a democratic election in any parliament. Mark Carney’s victory to replace Justin Trudeau as the leader of the Liberal Party means he is now the Prime Minister. Carney’s resume and achievements make him one of the most accomplished prime ministers ever. Still, there are a number of basic questions about Carney’s fiscal and economic math that Canadians need to consider carefully as we enter an election.

Carney’s accomplishments should be recognized. He has a bachelor’s degree in economics from Harvard and both a masters and doctoral degrees in economics from Oxford University. He spent over a decade at Goldman Sachs, a leading US-based financial firm then left to take up senior positions at both the Bank of Canada and later the Department of Finance. He became the Governor of the Bank of Canada in 2007 and then the Governor of the Bank of England in 2012. After his tenure at the Bank of England, Carney took up a number of private sector posts including chairman at Brookfield Asset Management, a major Canadian company.

Despite these obvious accomplishments and a deep CV, Carney’s proposed fiscal policies pose a number of serious questions.

Carney self-characterizes as a pragmatist and someone who will bring the Liberal Party back to the political centre after having been pushed to the left by former prime minister Justin Trudeau. Even former prime minister Jean Chrétien, one of the country’s most electorally successful prime ministers called for the party to move back to the centre.

Specifically, Carney said he would “cap” the size of the federal government workforce and reduce federal spending through a review of program spending as was done in 1994-95. He also indicated that the operating budget would be balanced within three years. He criticized the current government for spending too much and not investing enough, and for missing spending targets and violating its own fiscal guardrails. The implication of all these policies is that the role of the federal government will be rolled back with reductions in spending and federal employment, and reducing regulations. In many ways, these policies mirror those of former prime minister Chrétien.

However, there are numerous statements by Carney that seem to contradict these policies, or at the very least, water them down significantly. Consider, for instance, that Carney has indicated there will be no cuts to transfers to provincial governments (19.8 per cent of budget spending), no reductions in the income-transfers to individuals and families (25.8 per cent), and the government doesn’t determine interest charges on its debt (another 9.7 per cent). So, Carney has already taken over half the federal budget off the table for reductions.

It’s not clear whether he would reduce what’s referred to as “Other Transfers” which includes support for EV programs and investment incentives. This represents 17.9 per cent of the current budget. And if you read any of Carney’s climate-related initiatives, it appears this category of spending will actually increase, not decrease. Moreover, Carney stated he won’t touch some transfers such as the national dental care and pharmacare programs.

The major remaining category of federal spending is “operating expenses”, which includes the costs of running more than 100 government departments, agencies and Crown corporations. It’s expected to reach $130.6 billion this year and represents 23.4 per cent of the federal budget. But again, Carney has only committed to “capping” the federal workforce despite significant growth since 2015 and then review programs. Unless he’s willing to actually reduce federal employment and/or challenge existing contracts with the civil service, it’s not clear how he can find meaningful savings in the short term.

Recall that the expected deficit this year is $42.2 billion and to balance the budget over the next three years, Carney needs to find roughly $30 billion in savings. (Some of the deficit reduction is expected to come from economic growth, which increases government revenues).

However, this ignores the pressure on the federal government to markedly and quickly increase defense spending. A recent analysis estimated that the federal government would have to increase defense spending in 2027-28 by $68.8 billion to meet its NATO commitment, which is what President Trump is demanding. This single measure of spending could materially derail the new prime minister’s commitment to a balanced budget within three years.

But Carney has complicated the nation’s finances by committing to separating operating spending from capital spending. The former are annual spending requirements like salaries and wages to federal employees, income transfers to people through programs like EI and Old Age Security, and transfers to the provinces for health and social programs. Carney has committed to balancing the revenues collected for these purposes against spending.

However, he wants to remove anything that is deemed an “investment” or “capital”. That means spending on infrastructure like roads and ports, defense spending on equipment, and energy projects.

While Carney has committed to only running a “small deficit” on such spending, the commitment is eerily similar to Trudeau’s commitment in 2015 to run “small deficits” for just “three years” and the budget will balance itself through economic growth. The total federal gross debt has increased from $1.1 trillion when Trudeau took office in 2015 to an estimated $2.3 trillion this year.

The clear risk is that a Carney government will simply reduce spending in the operating budget and move it to the capital budget, thus balancing the latter while still piling up government debt.

Clarity is required from the new prime minister with respect to: 1) What operating expenses does he plan to reduce (or perhaps more generally is open to reducing) over the next three years to reach a balanced operating budget? 2) What specific commitment is Carney making on defense spending over the next three years? 3) What current spending will the new prime minister move or potentially move from the budget to his new capital budget? And finally, 4) What measures will be taken if revenues don’t materialize as expected and/or spending increases more than planned to ensure a balanced operating budget in three years?

Until greater clarity and details are provided, it’s hard, even near impossible, to know the extent to which the new prime minister is pragmatically offering a plan for more sustainable government finances versus playing politics by promising everything to everyone.

Business

Brutal economic numbers need more course corrections from Ottawa

From the Fraser Institute

By Matthew Lau

Canada’s lagging productivity growth has been widely discussed, especially after Bank of Canada senior deputy governor Carolyn Rogers last year declared it “an emergency” and said “it’s time to break the glass.” The federal Liberal government, now entering its eleventh year in office, admitted in its recent budget that “productivity remains weak, limiting wage gains for workers.”

Numerous recent reports show just how weak Canada’s productivity has been. A recent study published by the Fraser Institute shows that since 2001, labour productivity has increased only 16.5 per cent in Canada vs. 54.7 per cent in the United States, with our underperformance especially notable after 2017. Weak business investment is a primary reason for Canada’s continued poor economic outcomes.

A recent McKinsey study provides worrying details about how the productivity crisis pervades almost all sectors of the economy. Relative to the U.S., our labour productivity underperforms in: mining, quarrying, and oil and gas extraction; construction; manufacturing; transportation and warehousing; retail trade; professional, scientific, and technical services; real estate and rental leasing; wholesale trade; finance and insurance; information and cultural industries; accommodation and food services; utilities; arts, entertainment and recreation; and administrative and support, waste management and remediation services.

Canada has relatively higher labour productivity in just one area: agriculture, forestry, fishing and hunting. To make matters worse, in most areas where Canada’s labour productivity is less than American, McKinsey found we had fallen further behind from 2014 to 2023. In addition to doing poorly, Canada is trending in the wrong direction.

Broadening the comparison to include other OECD countries does not make the picture any rosier—Canada “is growing more slowly and from a lower base,” as McKinsey put it. This underperformance relative to other countries shows Canada’s economic productivity crisis is not the result of external factors but homemade.

The federal Liberals have done little to reverse our relative decline. The Carney government’s proposed increased spending on artificial intelligence (AI) may or may not help. But its first budget missed a clear opportunity to implement tax reform and cuts. As analyses from the Fraser Institute, University of Calgary, C.D. Howe Institute, TD Economics and others have argued, fixing Canada’s uncompetitive tax regime would help lift productivity.

Regulatory expansion has also driven Canada’s relative economic decline but the federal budget did not reduce the red tape burden. Instead, the Carney government empowered cabinet to decide which large natural resource and infrastructure projects are in the “national interest”—meaning that instead of predictable transparent rules, businesses must answer to the whims of politicians.

The government has also left in place many of its Trudeau-era environmental regulations, which have helped push pipeline investors away for years. It is encouraging that a new “memorandum of understanding” between Ottawa and Alberta may pave the way for a new oil pipeline. A memorandum of undertaking would have been better.

Although the government paused its phased-in ban on conventionally-powered vehicle sales in the face of heavy tariff-related headwinds to Canada’s automobile sector, it still insists that all new light-duty vehicle sales by 2035 must be electric. Liberal MPs on the House of Commons Industry Committee recently voted against a Conservative motion calling for repeal of the EV mandate. Meanwhile, Canadian consumers are voting with their wallets. In September, only 10.2 per cent of new motor vehicle sales were “zero-emission,” an ominous18.2 per cent decline from last year.

If the Carney government continues down its current path, it will only make productivity and consumer welfare worse. It should change course to reverse Canada’s economic underperformance and help give living standards a much-needed boost.

Fraser Institute

Claims about ‘unmarked graves’ don’t withstand scrutiny

From the Fraser Institute

By Tom Flanagan

The new book Dead Wrong: How Canada Got the Residential School Story So Wrong is a follow-up to Grave Error, published by True North in 2023. Grave Error instantly became a best-seller. People wanted to read the book because it contained well-documented information not readily available elsewhere concerning the history of Canada’s Indian Residential Schools (IRS) and the facts surrounding recent claims about “unmarked graves.”

Why another book? Because the struggle for accurate information continues. Let me share with you a little of what’s in Dead Wrong.

Outrageously, the New York Times, one of the world’s most prestigious newspapers, has never retracted its absurd headline that “mass graves” were uncovered in Kamloops, British Columbia. Jonathan Kay, the North American editor of Quillette, exposes that scandal.

The legacy media were enthused about the so-called documentary Sugarcane, a feature-length film sponsored by National Geographic, which was nominated for an Academy Award. The only reporter to spot the dozens of factual errors in Sugarcane was independent journalist Michelle Stirling; Dead Wrong includes her analysis “The Bitter Roots of Sugarcane.”

In the spring of 2024, the small city of Quesnel, B.C., made national news when the mayor’s wife bought 10 copies of Grave Error for distribution to friends. After noisy protests held by people who had never read the book, Quesnel city council voted to censure Mayor Ron Paull and tried to force him from office. It’s all described in Dead Wrong.

Also not to be forgotten is how the Law Society of B.C. forced upon its members training materials asserting against all evidence that children’s remains have been discovered in Kamloops. As told by James Pew, B.C. MLA Dallas Brodie was expelled from the Conservative caucus for daring to point out the emperor’s lack of clothing.

Then there’s the story of Jim McMurtry, suspended by the Abbotsford District School Board shortly after the 2021 Kamloops announcement about “unmarked graves.” McMurtry’s offence was to tell students the truth that, while some Indigenous students did die in residential schools, the main cause was tuberculosis. His own book The Scarlet Lesson is excerpted here.

Historian Ian Gentles and former IRS teacher Pim Wiebel offer a richly detailed analysis of health and medical conditions in the schools. They show that these were much better than what prevailed in the Indian reserves from which most students came.

Another important contribution to understanding the medical issues is by Dr. Eric Schloss, narrating the history of the Charles Camsell Indian Hospital in Edmonton. IRS facilities usually included small clinics, but students with serious problems were often transferred to Indian Hospitals for more intensive care. Schloss, who worked in the Camsell, describes how it delivered state-of-the-art medicine, probably better than the care available to most children anywhere in Canada at the time.

Rodney Clifton’s contribution, “They would call me a ‘Denier,’” describes his experiences working in two IRS in the 1960s. Clifton does not tell stories of hunger, brutal punishment and suppression of Indigenous culture, but of games, laughter and trying to learn native languages from his Indian and Inuit charges.

Toronto lawyer and historian Greg Piasetzki explains how “Canada Wanted to Close All Residential Schools in the 1940s. Here’s why it couldn’t.” For many Indian parents, particularly single parents and/or those with large numbers of children, the IRS were the best deal available. And they offered paid employment to large numbers of Indians as cooks, janitors, farmers, health-care workers, and even teachers and principals.

Finally, Frances Widdowson analyzes the charge of residential school “denialism” used by true believers in the Kamloops narrative to shut down criticism or questions. Winnipeg Centre MP Leah Gazan in 2022 persuaded the House of Commons to give unanimous consent to a resolution on residential school genocide: “That, in the opinion of the House this government must recognize what happened in Canada’s Indian residential schools as genocide.”

In 2024, Gazan took the next step by introducing a private member’s bill to criminalize dissent about the IRS system. The bill failed to pass, but Gazan reintroduced it in 2025. Had these provisions been in force back in 2021, it might well have become a crime to point out that the Kamloops ground-penetrating radar (GPR) survey had identified soil anomalies, not buried bodies.

While the wheels of legislation and litigation grind and spin, those who wish to limit open discussion of residential schools attack truth-tellers as “denialists,” a term drawn from earlier debates about the Holocaust. As the proponents of the Kamloops narrative fail to provide convincing hard evidence for it, they hope to mobilize the authority of the state to stamp out dissent. One of the main goals of publishing Dead Wrong is to head off this drive toward authoritarianism.

Happily, Dead Wrong, like Grave Error, has already become an Amazon best-seller. The struggle for truth continues.

-

National1 day ago

National1 day agoCanada’s free speech record is cracking under pressure

-

Digital ID19 hours ago

Digital ID19 hours agoCanada considers creating national ID system using digital passports for domestic use

-

Business1 day ago

Business1 day agoAlbertans give most on average but Canadian generosity hits lowest point in 20 years

-

Crime2 days ago

Crime2 days agoU.S. seizes Cuba-bound ship with illicit Iranian oil history

-

Daily Caller2 days ago

Daily Caller2 days agoUS Supreme Court Has Chance To End Climate Lawfare

-

Business1 day ago

Business1 day agoTaxpayers Federation calls on politicians to reject funding for new Ottawa Senators arena

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoCarney Hears A Who: Here Comes The Grinch

-

International1 day ago

International1 day ago100 Catholic schoolchildren rescued, Nigeria promises release of remaining hostages