Dan McTeague

New Carbon Tax, Same Price Tags

We must keep energy affordable for Canadian families. I have been saying this for years. But despite this simple message, some politicians still don’t get it.

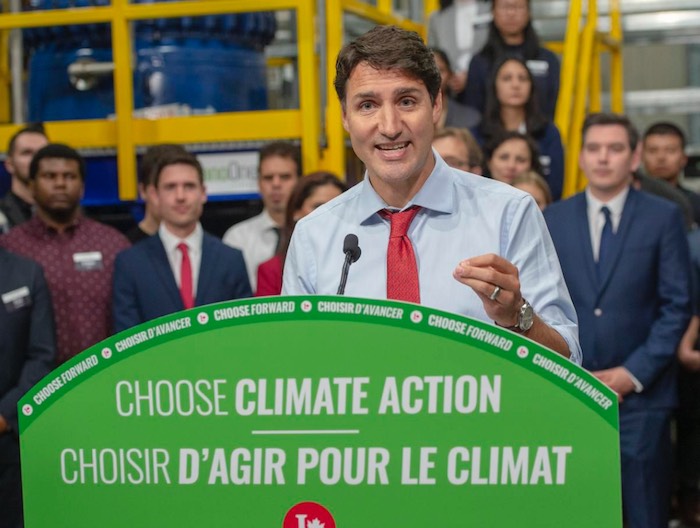

Justin Trudeau’s Liberal government keeps insisting on one new expensive energy policy after another, and all of these efforts are designed to make energy unaffordable for Canadians.

One of Trudeau’s latest initiatives is his “Second Carbon Tax,” also known as the “Clean Fuel Standard,” or “CFS.”

We’ve dubbed the Clean Fuel Standard a Second Carbon Tax because that is exactly what it is – simply another tax grab that will only make life more unaffordable for Canadians.

Trudeau’s friends in the media barely mention this new tax, so it falls to Canadians for Affordable Energy and a few like-minded people to alert Canadians to this latest assault on your pocketbook.

To this end, CAE is publishing a new report authored by economist Ross McKitrick on the Clean Fuel Standard a.k.a the ‘Second Carbon Tax’. You may recall I wrote about the Clean Fuel Standard a few years ago when it was first proposed.

The Clean Fuel Standard is a tax that aims to reduce the carbon intensity of liquid fuels used in transportation (gasoline, diesel) by 15% by 2030. This will be done by blending ethanol into traditional liquid fuels, and by the use of carbon credits which will be available to those switching to electric vehicles or increasing EV infrastructure.

The report released by LFX Associates ‘Economic Analysis of the 2022 Federal Clean Fuels Standard’ shows us just how expensive and ineffective this policy will be.

The conservative estimate is an increase of 2.2-6.5% per household. In real money terms this will an extra tax of $1,277 a year per worker.

In provinces that rely more heavily on liquid fuel sources such as oil – like Newfoundland and New Brunswick- these prices will be higher.

What a time to increase energy bills for families.

This new carbon tax is being released at a time of soaring household costs. Grocery prices have skyrocketed. Families are struggling to afford the basic necessities for their home. Now the government is going to make it even more expensive.

And will this policy be effective? Will it reduce emissions and bring Canada into a green renewable future?

No. No, it will not.

While locally (in Canada) emissions may go down, there will be no global reduction in greenhouse gas (GHG) emissions. That is because the ethanol used to dilute our liquid fuels will most likely be imported from the United States. US based ethanol has a higher lifetime carbon intensity than gasoline. To extract, store it, ship it, etc. produces more emissions than what would be produced by using gasoline to fill our cars.

This new “Second Carbon Tax” will not reduce emissions. But it will allow Justin Trudeau to state that he has reduced Canada’s carbon intensity footprint. Unfortunately, any such reduction resulting from this tax will be achieved on the backs of working Canadians.

This policy will not help Canadians lead better lives. But it will make it more expensive to drive your car to the grocery store, to hockey practices, to medical appointments, and to work.

And, contrary to the government’s claim that there will be virtually no effect on GDP, the impact of this new tax on the Canadian economy will be significant. By 2030 the Canadian GDP will be about 1.3 percent lower than without the CFS. In other words, we can expect that Trudeau’s new CFS carbon tax will actually harm the Canadian economy. Unemployment, higher cost of living and further diversion of investments from Canada will put downward pressure on government revenue. This will lead to an increase in the consolidated government deficit in every year of the policy’s implementation. The extra government debt accumulated by 2040 because of the Clean Fuel Standard is estimated to reach as high as $95.2 billion.

You may feel like I am starting to sound like a broken record. Believe me, I feel like that too. My message is always consistent: bad government policies mean prices go up for Canadian families, and Canadian families should not be punished for the sake of our government’s phony global image as climate heroes.

But that is because policies like the Clean Fuel Standard will have real, serious, even detrimental effects for Canadian families.

A new tax on energy? A second carbon tax, on top of the already disastrous and ever-increasing carbon tax that Trudeau insists on forcing Canadians to pay? Yep. Because, well, because it’s 2022.

Automotive

Canada’s EV gamble is starting to backfire

Things have only gone from bad to worse for the global Electric Vehicle industry. And that’s a problem for Canada, because successive Liberal governments have done everything in their power to hitch our cart to that horse.

Earlier this month, the Trump Administration rolled back more Biden-era regulations that effectively served as a back-door EV mandate in the United States. These rules mandated that all passenger cars be able to travel at least 65.1 miles (and for light trucks, 45.2 miles) per gallon of gasoline or diesel, by the year 2031. Since no Internal Combustion Engine (ICE) vehicle could realistically conform to those standards, that would have essentially boxed them out of the market.

Trump’s rolling them back was a fulfillment of his campaign promise to end the Biden Administration’s stealth EV mandates. But it was also a simple recognition of the reality that EVs can’t compete on their own merits.

For proof of that, look no further than our second bit of bad news for EVs: Ford Motor Company has just announced a massive $19.5 billion write-down, almost entirely linked to its aggressive push into EVs. They’ve lost $13 billion on EVs in the past two years alone.

The company invested tens of billions on these go-carts, and lost their shirt when it turned out the market for them was miniscule.

Ford’s EV division president Andrew Frick explained, “Ford is following the customer. We are looking at the market as it is today, not just as everyone predicted it to be five years ago.”

Of course, five years ago, the market was assuming that government subsidies-plus-mandates would create a market for EVs at scale, which hasn’t happened.

As to what this portends for the market, the Wall Street Journal argued, “The company’s pivot from all-electric vehicles is a fresh sign that America’s roadways – after a push to remake them – will continue to look in the near future much like they do today, with a large number of gas-powered cars and trucks and growing use of hybrids.”

And that’s not just true in the U.S. Across the Atlantic, reports suggest the European Union is preparing to delay their own EV mandates to 2040. And the U.K.’s Labour government is considering postponing their own 2030 ICE vehicle ban to align with any EU change in policy.

It’s looking like fewer people around the world will be forced by their governments to buy EVs. Which means that fewer people will be buying EVs.

Now, that is a headache for Canada. Our leaders, at both the federal and provincial levels, have bet big on the success of EVs, investing billions in taxpayer dollars in the hopes of making Canada a major player in the global EV supply chain.

To bolster those investments, Ottawa introduced its Electric Vehicle mandate, requiring 100 per cent of new light-duty vehicle sales to be electric by 2035. This, despite the fact that EVs remain significantly more expensive than gas-and-diesel driven vehicles, they’re poorly suited to Canada’s vast distances and cold climate, and our charging infrastructure is wholly inadequate for a total transition to EVs.

But even if these things weren’t true, there still aren’t enough of us to make the government’s investment make sense. Their entire strategy depends on exporting to foreign markets that are rapidly cooling on EVs.

Collapsing demand south of the border – where the vast majority of the autos we build are sent – means that Canadian EVs will be left without buyers. And postponed (perhaps eventually canceled) mandates in Europe mean that we will be left without a fallback market.

Canadian industry voices are growing louder in their concern. Meanwhile, plants are already idling, scaling back production, or even closing, leaving workers out in the cold.

As GM Canada’s president, Kristian Aquilina, said when announcing her company’s cancellation of the BrightDrop Electric delivery van, “Quite simply, we just have not seen demand for these vehicles climb to the levels that we initially anticipated…. It’s simply a demand and a market-driven response.”

Prime Minister Mark Carney, while sharing much of the same environmental outlook as his predecessor, has already been compelled by economic realities to make a small adjustment – delaying the enforcement of the 2026 EV sales quotas by one year.

But a one-year pause doesn’t solve the problem. It kicks the can down the road.

Mr. Carney must now make a choice. He can double down on this troubled policy, continuing to throw good money after bad, endangering a lot of jobs in our automotive sector, while making transportation more expensive and less reliable for Canadians. Or he can change course: scrap the mandates, end the subsidies, and start putting people and prosperity ahead of ideology.

Here’s hoping he chooses the latter.

The writing is on the wall. Around the world, the forced transition to EVs is crashing into economic reality. If Canada doesn’t wake up soon, we’ll be left holding the bag.

Dan McTeague

Will this deal actually build a pipeline in Canada?

By Dan McTeague

Will Carney’s new pipeline deal actually help get a pipeline built in Canada? As we said before, the devil is in the details.

While the establishment and mainstream media cheer on the new pipeline agreement, there are specific details you need to be aware of.

Dan McTeague explains in his latest video.

-

Alberta1 day ago

Alberta1 day agoThe Canadian Energy Centre’s biggest stories of 2025

-

Business1 day ago

Business1 day agoResurfaced Video Shows How Somali Scammers Used Day Care Centers To Scam State

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoIn Contentious Canada Reality Is Still Six Degrees Of Hockey

-

Business1 day ago

Business1 day agoOttawa Is Still Dodging The China Interference Threat

-

Business1 day ago

Business1 day agoMinneapolis day care filmed empty suddenly fills with kids

-

Business1 day ago

Business1 day agoDisclosures reveal Minnesota politician’s husband’s companies surged thousands-fold amid Somali fraud crisis

-

Business12 hours ago

Business12 hours agoDark clouds loom over Canada’s economy in 2026

-

Business2 days ago

Business2 days agoDOOR TO DOOR: Feds descend on Minneapolis day cares tied to massive fraud