Energy

Electric Cars: Inconvenient Facts, Part One

From Stossel TV

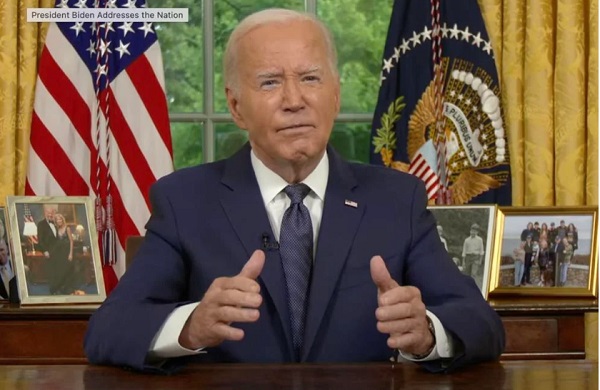

Politicians and activists who want all cars to go electric are guilty of magical thinking.

Electric car sales are up 66% this year. President Biden says the future is “electric… and there’s no turning back.” California and New York are banning sales of new gas-powered vehicles. We’re told they’ll help us use less oil. But most of what politicians, activists, and electric car sellers say about electric cars is just wrong.

In this video, and a second one coming soon, I show you 5 inconvenient facts about electric cars.

———— To make sure you see the new weekly video from Stossel TV, sign up here: https://www.johnstossel.com/#subscribe ————

John Stossel created Stossel TV to explain liberty and free markets to young people. Prior to Stossel TV he hosted a show on Fox Business and co-anchored ABC’s primetime newsmagazine show, 20/20.

Stossel’s economic programs have been adapted into teaching kits by a non-profit organization, “Stossel in the Classroom.” High school teachers in American public schools now use the videos to help educate their students on economics and economic freedom. They are seen by more than 12 million students every year.

Stossel has received 19 Emmy Awards and has been honored five times for excellence in consumer reporting by the National Press Club. Other honors include the George Polk Award for Outstanding Local Reporting and the George Foster Peabody Award.

Economy

Federal government’s GHG reduction plan will impose massive costs on Canadians

From the Fraser Institute

Many Canadians are unhappy about the carbon tax. Proponents argue it’s the cheapest way to reduce greenhouse gas (GHG) emissions, which is true, but the problem for the government is that even as the tax hits the upper limit of what people are willing to pay, emissions haven’t fallen nearly enough to meet the federal target of at least 40 per cent below 2005 levels by 2030. Indeed, since the temporary 2020 COVID-era drop, national GHG emissions have been rising, in part due to rapid population growth.

The carbon tax, however, is only part of the federal GHG plan. In a new study published by the Fraser Institute, I present a detailed discussion of the Trudeau government’s proposed Emission Reduction Plan (ERP), including its economic impacts and the likely GHG reduction effects. The bottom line is that the package as a whole is so harmful to the economy it’s unlikely to be implemented, and it still wouldn’t reach the GHG goal even if it were.

Simply put, the government has failed to provide a detailed economic assessment of its ERP, offering instead only a superficial and flawed rationale that overstates the benefits and waives away the costs. My study presents a comprehensive analysis of the proposed policy package and uses a peer-reviewed macroeconomic model to estimate its economic and environmental effects.

The Emissions Reduction Plan can be broken down into three components: the carbon tax, the Clean Fuels Regulation (CFR) and the regulatory measures. The latter category includes a long list including the electric vehicle mandate, carbon capture system tax credits, restrictions on fertilizer use in agriculture, methane reduction targets and an overall emissions cap in the oil and gas industry, new emission limits for the electricity sector, new building and motor vehicle energy efficiency mandates and many other such instruments. The regulatory measures tend to have high upfront costs and limited short-term effects so they carry relatively high marginal costs of emission reductions.

The cheapest part of the package is the carbon tax. I estimate it will get 2030 emissions down by about 18 per cent compared to where they otherwise would be, returning them approximately to 2020 levels. The CFR brings them down a further 6 per cent relative to their base case levels and the regulatory measures bring them down another 2.5 per cent, for a cumulative reduction of 26.5 per cent below the base case 2030 level, which is just under 60 per cent of the way to the government’s target.

However, the costs of the various components are not the same.

The carbon tax reduces emissions at an initial average cost of about $290 per tonne, falling to just under $230 per tonne by 2030. This is on par with the federal government’s estimate of the social costs of GHG emissions, which rise from about $250 to $290 per tonne over the present decade. While I argue that these social cost estimates are exaggerated, even if we take them at face value, they imply that while the carbon tax policy passes a cost-benefit test the rest of the ERP does not because the per-tonne abatement costs are much higher. The CFR roughly doubles the cost per tonne of GHG reductions; adding in the regulatory measures approximately triples them.

The economic impacts are easiest to understand by translating these costs into per-worker terms. I estimate that the annual cost per worker of the carbon-pricing system net of rebates, accounting for indirect effects such as higher consumer costs and lower real wages, works out to $1,302 as of 2030. Adding in the government’s Clean Fuels Regulations more than doubles that to $3,550 and adding in the other regulatory measures increases it further to $6,700.

The policy package also reduces total employment. The carbon tax results in an estimated 57,000 fewer jobs as of 2030, the Clean Fuels Regulation increases job losses to 94,000 and the regulatory measures increases losses to 164,000 jobs. Claims by the federal government that the ERP presents new opportunities for jobs and employment in Canada are unsupported by proper analysis.

The regional impacts vary. While the energy-producing provinces (especially Alberta, Saskatchewan and New Brunswick) fare poorly, Ontario ends up bearing the largest relative costs. Ontario is a large energy user, and the CFR and other regulatory measures have strongly negative impacts on Ontario’s manufacturing base and consumer wellbeing.

Canada’s stagnant income and output levels are matters of serious policy concern. The Trudeau government has signalled it wants to fix this, but its climate plan will make the situation worse. Unfortunately, rather than seeking a proper mandate for the ERP by giving the public an honest account of the costs, the government has instead offered vague and unsupported claims that the decarbonization agenda will benefit the economy. This is untrue. And as the real costs become more and more apparent, I think it unlikely Canadians will tolerate the plan’s continued implementation.

Author:

Economy

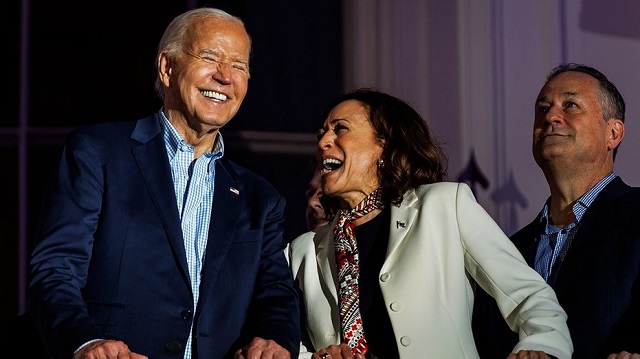

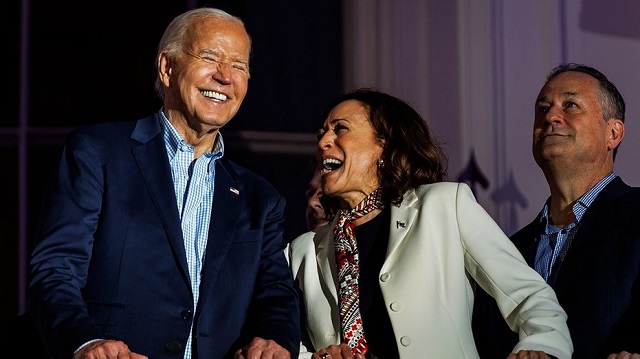

Kamala Harris’ Energy Policy Catalog Is Full Of Whoppers

From the Daily Caller News Foundation

From the Daily Caller News Foundation

The catalog of Vice President Kamala Harris’s history on energy policy is as thin as the listing of her accomplishments as President Joe Biden’s “Border Czar,” which is to say it is bereft of anything of real substance.

But the queen of word salads and newly minted presumptive Democratic presidential nominee has publicly endorsed many of her party’s most radical and disastrous energy-related ideas while serving in various elected offices — both in her energy basket-case home state of California and in Washington, D.C.

What Harris’s statements add up to is a potential disaster for America’s future energy security.

“The vice president’s approach to energy has been sophomorically dilettantish, grasping not only at shiny things such as AOC’s Green New Deal but also at the straws Americans use to suck down the drinks they need when she starts talking like a Valley Girl,” Dan Kish, a senior research fellow at Institute for Energy Research, told me in an email this week. “To be honest, she’s no worse than many of her former Senate colleagues who have helped cheer on rising energy costs and the fleeing American jobs that accompany them. She doesn’t seem to understand the importance of reliable and affordable domestic energy, good skilled jobs or the national security implications of domestically produced energy, but maybe she will go back to school on the matter. No doubt on her electric school bus.”

During her first run for the Senate in 2016, Harris said she would love to expand her state’s economically ruinous cap-and-trade program to the national level. She also endorsed then-Gov. Jerry Brown’s harebrained scheme to ban plastic straws as a means of fighting climate change.

Tim Stewart, president of the U.S. Oil and Gas Association, told me proposals like that one would lead during a Harris presidency to the “Californication of the entire U.S. energy policy.” “Historically,” he added, “the transition of power from a president to a vice president is designed to signal continuity. This won’t be the case, because a Harris administration will be much worse.”

But how much worse could it be than the set of Biden policies that Harris has roundly endorsed over the last three and a half years? How much worse can it be than having laughed through a presidency that:

— Cancelled the $12 billion Keystone XL Pipeline on day one.

— Enacted what many estimate to be over $1 trillion in debt-funded, inflation-creating green energy subsidies.

— Refused to comply with laws requiring the holding of timely federal oil and gas lease sales.

— Instructed its agencies to slow-play permitting for all manner of oil and gas-related infrastructure.

— Tried to ban stoves and other gas appliances.

— Listed the Dunes Sagebrush Lizard as an endangered species despite its protection via a highly-successful conservation program.

— Invoked a “pause” on permitting of new LNG export infrastructure for the most specious reasons imaginable.

— Drained the Strategic Petroleum Reserve for purely political reasons.

As Biden’s successor for the nomination, Harris becomes the proud owner of all these policies, and more.

But Harris’ history shows it could indeed get worse. Much worse, in fact.

While mounting her own disastrous campaign for her party’s presidential nomination in 2020, Harris endorsed a complete ban on hydraulic fracturing, i.e., fracking. She later conformed that position to Biden’s own, slightly less insane view, but only after being picked as his running mate.

Consider also that while serving in the Senate in early 2019, Harris chose to sign up as a co-sponsor of the ultra-radical Green New Deal proposed by New York Rep. Alexandria Ocasio Cortez. It is not enough that the Biden regulators appeared to be using that nutty proposal and climate alarmism as the impetus to transform America’s entire economy and social structure: Harris favors enacting the whole thing.

As I have detailed here many times, every element of climate-alarm-based energy policies adopted by the Biden administration will inevitably lead the United State to become increasingly reliant on China for its energy needs, in the process decimating our country’s energy security. By her own words and actions, Harris has made it abundantly clear she wants to shift the process of getting there into a higher gear.

She is an energy disaster-in-waiting.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

International19 hours ago

International19 hours agoSecret Service Repeatedly Rejected Offers To Use Drones At Deadly Trump Rally, Whistleblower Says

-

Business1 day ago

Business1 day agoEstonia’s solution to Canada’s stagnating economic growth

-

Alberta1 day ago

Alberta1 day ago‘Fireworks’ As Defence Opens Case In Coutts Two Trial

-

International1 day ago

International1 day agoSwitzerland’s new portable suicide ‘pod’ set to claim its first life ‘soon’

-

International20 hours ago

International20 hours agoHouse Passes Bipartisan Resolution Establishing Trump Assassination Attempt Task Force

-

Bruce Dowbiggin12 hours ago

Bruce Dowbiggin12 hours agoGarbage In, Garbage Out: The Democrats 2024 Election Coup

-

COVID-191 day ago

COVID-191 day agoLeaked documents: German gov’t lied about shots preventing COVID, knew lockdowns did more harm than good

-

Business1 day ago

Business1 day agoFederal government seems committed to killing investment in Canada