Opinion

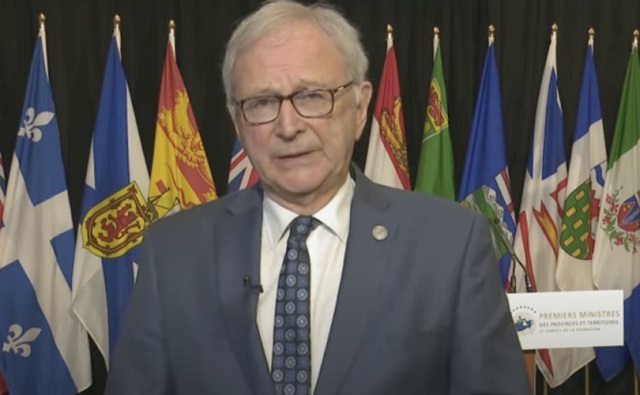

New Brunswick premier bans ‘sex-ed’ group from schools after presentation on porn, immoral sex acts

New Brunswick Premier Blaine Higgs

From LifeSiteNews

Sharing slides of a presentation given by a third-party group to New Brunswick school children that contained questions about pornography, masturbation and ‘anal’ sex, Premier Blaine Higgs said he is ‘furious’ and that the group has been banned, ‘effective immediately.’

Once again, New Brunswick Premier Blaine Higgs is showing Canadian politicians how to effectively advocate for common sense socially conservative policies. On May 24, he tweeted out a photograph of a slide from a sex education presentation given in a New Brunswick school. The slide featured red lips closing on a lollipop, the title “Thirsty For The Talk,” and the questions: “Is it normal to watch porn like people watch TV series?”; “Do girls masturbate?” and: “Is it good or bad to do anal?”

Premier Higgs posted his response:

A number of concerned parents have shared with me photos and screenshots of clearly inappropriate material that was presented recently in at least four New Brunswick high schools.

To say I am furious would be a gross understatement.

This presentation was not part of the New Brunswick curriculum and the content was not flagged for parents in advance. My office has been told by Department of Education officials that this was supposed to be a presentation on HPV.

However, the group shared materials well beyond the scope of an HPV presentation. The fact that this was shared shows either improper vetting was done, the group misrepresented the content they would share … or both.

This group will not be allowed to present again at New Brunswick schools, effective immediately.

Our government will have further discussions about whether additional rules about third-party presentations need to be updated.

Children should be protected, and parents should be respected.

I want parents to know that we are with you. We will continue to make decisions based on the principle that parents need to be aware of what is happening at schools, so they can make informed parenting decisions.

Do you think we need stronger rules about third-party presentations in our schools? I want to hear directly from you. Take our survey by clicking here:

Presentations like this – and indeed, presentations containing far more graphic material – are common in Canadian public schools. Plenty of schools actually feature in-house content that is substantially worse than this. But every time a debate about explicit, how-to sexual content in schools erupts, progressive activists and politicians dodge the issue by retreating to vagueness. Instead of defending the idea of an activist group like Planned Parenthood coming in to talk to students about why anal sex is just fine, they insist that this content is essential for “inclusion” and “tolerance” while scrupulously avoiding the specifics. Inevitably, most of the press coverage of the debate fails to include the specifics of what actually upset parents in the first place, and instead presents objectors as opposed to common sense progressive educational policies.

When the explicit content in question is described, however, progressives are denied the opportunity to defend their policy of encouraging and introducing fringe sex acts to children in vague, friendly, liberal-sounding buzzwords. Last year, for example, Planned Parenthood got caught handing out graphic “ABC” sex cards to students as young as 14 that explained, for example, how they could engage in “yellow and brown showers” (urinating and defecating on their partners). Plenty of other dangerous and immoral sex acts are encouraged, with Planned Parenthood’s presentation stating that each sexual urge must be “affirmed” – the amorality, in short, was up front.

But when the sex cards were covered in a handful of press outlets, parents were outraged the Saskatchewan government got involved. Planned Parenthood is now banned from presenting in Saskatchewan schools (although it was never explained why they were invited to do so in the first place). Planned Parenthood was reportedly confused by this decision, as they didn’t see the problem with the content they had distributed – but the only reason they were denied access to Canadian kids is because the graphic sexual information they were distributing was exposed publicly.

Premier Blaine Higgs appears to have realized that to implement common sense policies, exposing what is actually being taught in public schools is the only way forward. Progressives cannot be allowed to hide behind buzzwords like “toleration” and “inclusion.” Politicians and activists – including the prime minister – who wish to defend this content should be made to defend specifics, and the only way to force them to do that is to show the public what the kids are being taught in schools.

Daily Caller

‘I Know How These People Operate’: Fmr CIA Officer Calls BS On FBI’s New Epstein Intel

From the Daily Caller News Foundation

By Hailey Gomez

CIA whistleblower John Kiriakou said Monday on Fox News’ “Jesse Watters Primetime” he doesn’t believe anything about the new intelligence from the FBI on deceased pedophile Jeffrey Epstein adds up.

A report released by Axios Sunday said that, based on a two-page memo, the Department of Justice (DOJ) and FBI concluded that there had been no “client list” left by Epstein, despite ongoing public doubt. Discussing the new intelligence, Fox’s Jesse Watters asked Kiriakou if he believed the information from officials “adds up.”

“No, I don’t think this adds up,” Kiriakou said. “You’ve hit it on the head, and so has Barry. I think you’re both exactly right on this. We really don’t know anything because the FBI doesn’t want us to know anything. I’m not blaming the FBI Director Kash Patel or the Deputy Director Dan Bongino.”

In 2019, Epstein was arrested and charged with sex trafficking, only to be found dead in his New York Metropolitan Correctional Center cell a month later. Officials said the deceased pedophile hanged himself in the cell. Speculations grew online due to the circumstances of his death.

WATCH:

During his 2024 campaign, President Donald Trump vowed to release all Epstein’s files, with Patel also vowing to release as many files as he could. However, in May, Patel and Bongino told Fox News they remained firm that Epstein committed suicide, with Bongino flatly saying Epstein “killed himself.”

“I think that that layer beneath them, that’s part of what we like to call the deep state, has taken this bull by the horns, and they’ve probably destroyed information,” Kiriakou added. “Look at what the CIA did in 1975 after Congress ordered that it release all of its files related to an operation called MKUltra. The director of the CIA went back to headquarters and ordered everything to be destroyed, and, in the end, only about 20% of the documents survived.”

“We’re still learning about the FBI’s operations against Martin Luther King 50, 55 years after the fact, so now we’re supposed to believe that everybody’s telling the truth, that there were no files, there were no dossiers?” Kiriakou asked. “I’m sorry. I just don’t buy it because I know how these people operate.”

Despite the newly released memo from the DOJ and FBI, Attorney General Pam Bondi said in February that she had personally reviewed Epstein’s list.

Daily Caller

Blackouts Coming If America Continues With Biden-Era Green Frenzy, Trump Admin Warns

From the Daily Caller News Foundation

By Audrey Streb

The Department of Energy (DOE) released a new report Monday warning of impending blackouts if the United States continues to shutter power plants without adequately replacing retiring capacity.

DOE warned in its Monday report that blackouts could increase by 100% by 2030 if the U.S. continues to retire power plants without sufficient replacements, and that the electricity grid is not prepared to meet the demand of power-hungry data centers in the years to come without more reliable generation coming online quickly. The report specifically highlighted wind and solar, two resources pushed by Biden, as responsible for eroding grid stability and advised that dispatchable generation from sources like coal, oil, gas and nuclear are necessary to meet the anticipated U.S. power demand.

“This report affirms what we already know: The United States cannot afford to continue down the unstable and dangerous path of energy subtraction previous leaders pursued, forcing the closure of baseload power sources like coal and natural gas,” DOE Secretary Chris Wright said. “In the coming years, America’s reindustrialization and the AI race will require a significantly larger supply of around-the-clock, reliable, and uninterrupted power. President Trump’s administration is committed to advancing a strategy of energy addition, and supporting all forms of energy that are affordable, reliable, and secure. If we are going to keep the lights on, win the AI race, and keep electricity prices from skyrocketing, the United States must unleash American energy.”

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

All regional grid systems across the U.S. are expected to lose reliability in the coming years without the addition of more reliable power, according to the DOE’s report. The U.S. will need an additional 100 gigawatts of new peak hour supply by 2030, with data centers projected to require as much as half of this electricity, the report estimates; for reference, one gigawatt is enough to power up to one million homes.

President Donald Trump declared a national energy emergency on his first day back in the Oval Office and signed an executive order on April 8 ordering DOE to review and identify at-risk regions of the electrical grid, which the report released Monday does. In contrast, former President Joe Biden cracked down on conventional power sources like coal with stringent regulations while unleashing a gusher of subsidies for green energy developments.

Electricity demand is projected to hit a record high in the next several years, surging 25% by 2030, according to Energy Information Administration (EIA) data and a recent ICF International report. Demand was essentially static for the last several years, and skyrocketing U.S. power demand presents an “urgent need” for electricity resources, according to the North American Electric Reliability Corporation (NERC), a major grid watchdog.

Wright has also issued several emergency orders to major grid operators since April. New Orleans experienced blackouts just two days after Wright issued an emergency order on May 23 to the Midcontinent Independent System Operator (MISO), the regional grid operator covering the New Orleans area.

-

Business2 days ago

Business2 days agoThe Digital Services Tax Q&A: “It was going to be complicated and messy”

-

International2 days ago

International2 days agoElon Musk forms America Party after split with Trump

-

Alberta1 day ago

Alberta1 day agoAlberta Next: Immigration

-

Crime19 hours ago

Crime19 hours agoNews Jeffrey Epstein did not have a client list, nor did he kill himself, Trump DOJ, FBI claim

-

COVID-1917 hours ago

COVID-1917 hours agoFDA requires new warning on mRNA COVID shots due to heart damage in young men

-

Business14 hours ago

Business14 hours agoCarney’s new agenda faces old Canadian problems

-

Bruce Dowbiggin14 hours ago

Bruce Dowbiggin14 hours agoEau Canada! Join Us In An Inclusive New National Anthem

-

Alberta Sports Hall of Fame and Museum1 day ago

Alberta Sports Hall of Fame and Museum1 day agoAlberta Sports Hall of Fame 2025 Inductee Profiles – Para Nordic Skiing – Brian and Robin McKeever