Canadian Energy Centre

Mexico leapfrogging Canada on LNG and six other global oil and gas megaprojects

By Deborah Jaremko of the Canadian Energy Centre Ltd.

Major investments in countries like the United States, Norway, Qatar and Saudi Arabia are being made to meet world demand

New major oil and gas megaprojects around the world are proceeding amid concern about underinvestment in conventional energy leading to painful supply shortages.

“The energy future must be secure and affordable, as well as sustainable,” said Daniel Yergin, vice-chairman of S&P Global, earlier this year.

“Adequate investment that avoids shortages and price spikes, and the economic hardship and social turbulence that they bring, is essential to that future.”

Even if oil and gas demand growth slows, a cumulative $4.9 trillion will be needed between 2023 and 2030 to prevent a supply shortfall, according to a report by the International Energy Forum and S&P Global Commodity Insights.

Major investments in countries like the United States, Norway, Qatar, Saudi Arabia and Mexico are being made to meet world demand.

Meanwhile, due to regulatory uncertainty and concerns over proposed policies like an emissions cap for oil and gas production, Canada’s vast resources – produced with among the world’s highest standards for environmental protection and social progress – are being left behind.

Here’s a look at just a handful of global oil and gas megaprojects, listed in rising order of development cost.

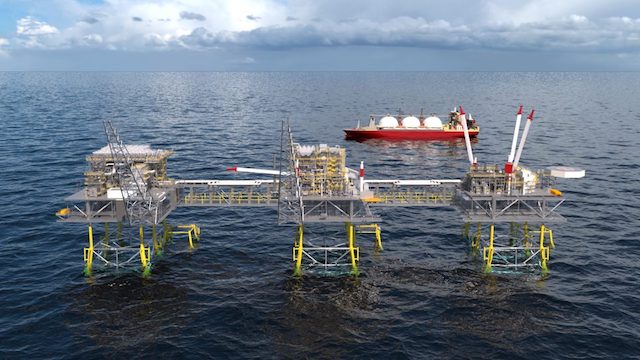

Mexico: Altamira LNG

US$1 billion

New Fortress Energy

Mexico is leapfrogging over Canada to become an LNG exporter.

While Canada’s first LNG export project is expected to start operating in 2025, Mexico’s could come online this August – less than 10 months after Mexico’s government finalized a deal with U.S.-based New Fortress Energy to make it happen.

While relatively small at 1.4 million tonnes of LNG per year (LNG Canada’s first phase will have capacity of 14 million tonnes per year), under Mexico’s agreement the Altamira site is to become an LNG hub.

New Fortress Energy is to deploy multiple same-sized floating LNG units to produce LNG from natural gas transported through TC Energy’s Sur de Texas-Tuxpan pipeline.

An existing LNG import terminal at Altamira is also expected to be converted into a 2.8-million-tonne-per-year export facility.

United States: Willow Oil Project

US$8 billion

ConocoPhillips

The U.S. government granted approval this March for the giant Willow oil project on Alaska’s North Slope to proceed.

The project, owned by ConocoPhillips, is designed to produce 180,000 barrels per day at peak and operate for 30 years. It includes a processing facility, operations centre, and three drilling sites.

The Willow leases are inside the National Petroleum Reserve – Alaska, which was established in 1923 as an emergency oil supply for the U.S. Navy. It is now administered by the U.S. Bureau of Land Management.

Willow would occupy about 385 acres (around half the area of Central Park in New York City) in the northeast portion of the 23-million-acre reserve. It is expected to deliver nearly US$9 billion in government revenue, creating about 2,500 jobs during construction and 300 long-term positions.

ConocoPhillips has yet to make a final investment decision, but is anticipating starting production in 2029, according to the Anchorage Daily News.

United States: Golden Pass LNG

US$10 billion

QatarEnergy, Exxon Mobil

Golden Pass LNG is one of four natural gas export terminals under construction on the U.S. Gulf Coast as the United States continues to build its platform as an LNG powerhouse.

With about 90 million tonnes per year of LNG export capacity today, analysts with Wood Mackenzie expect that if current momentum continues, another 190 million tonnes per year could come online by the end of this decade.

The US$10-billion Golden Pass project owned by QatarEnergy and Exxon Mobil will have three production trains with total export capacity of about 18 million tonnes of LNG per year.

The U.S. began exporting LNG in 2016 and has since built more LNG capacity than anywhere else in the world, according to the U.S. Energy Information Administration.

First LNG exports from Golden Pass are planned for 2024.

Norway: Njord Field Restart

US$29 billion

Wintershall Dea, Equinor, Neptune Energy

Norway has officially reopened a major offshore oil and gas field, with the goal to extend its life beyond 2040 and double its total production.

Nearly US$30 billion in upgrades to the Njord project’s production platform and offloading vessel started in 2016, after nearly 20 years of operations. It was originally only expected to run until 2013, but improvements in recovery technology have opened the door to accessing substantially more resources.

Production restarted in December 2022, just in time to help address Europe’s energy crisis.

“With the war in Ukraine, the export of Norwegian oil and gas to Europe has never been more important than now. Reopening Njord contributes to Norway remaining a stable supplier of gas to Europe for many years to come,” Norway’s oil and energy minister Terje Aasland said in a statement.

The project will drill 10 new wells and tie in two new subsea oil and gas fields, with the work expected to add approximately 250 million barrels of oil equivalent to the European market. Partial electrification of equipment is expected to reduce greenhouse gas emissions.

Qatar: North Field East LNG expansion

Qatar Energy, Shell, TotalEnergies, Eni, Exxon Mobil, ConocoPhillips, Sinopec

US$29 billion

The largest LNG project ever built is underway in Qatar.

State-owned QatarEnergy’s US$29 billion North Field East Expansion will increase the country’s LNG export capacity to 110 million tonnes per year, from 77 million tonnes per year today. Startup is planned in 2025.

A planned second phase of the project will further increase capacity to 126 million tonnes per year.

World LNG demand reached a record 409 million tonnes in 2022, according to data provider Revintiv. It’s expected to rise to over 700 million tonnes by 2040, according to Shell’s most recent industry outlook.

Saudi Arabia: Jafurah Gas Project

US$110 billion

Saudi Aramco

State-owned Saudi Aramco is moving ahead with development of the massive Jafurah gas project, which it says will help meet growing energy demand and provide feedstock for hydrogen production.

First gas from the $110-billion project is expected in 2025, rising to reach two billion cubic feet per day by 2030. That’s about one-third the volume of all the natural gas produced in British Columbia. Saudi Aramco produced 10.6 billion cubic feet of natural gas per day in 2022, or more than half the gas produced in Canada.

Last year the company started construction work on the gas processing facility that is the anchor of the Jafurah project. Aramco is reportedly in talkswith potential partners to back the US$110 billion development.

Russia: Vostok Oil

US$170 billion

Rosneft

Russian state-owned oil company Rosneft continues to barrel ahead with the massive Vostok oil project in the country’s arctic, which Rosneft calls the largest investment in the world.

The US$170 billion project will use the Northern Sea Route to export about 600,000 barrels per day by 2024. Production is expected to increase to two million barrels per day after the second phase. For comparison, Canada’s entire oil sands industry produces about three million barrels per day.

The main problem the energy industry faces is global underinvestment in conventional sources, Rosneft CEO Igor Sechin said earlier this year. He stressed the importance of Vostok’s oil supply for growing Asian economies.

“Vostok Oil project will provide long-term, reliable, and guaranteed energy supplies,” Sechin said.

Two new icebreaker vessels recently helped deliver 4,600 tonnes of cargo including oil pipes for the project to the arctic development sites, the Barents Observer reported.

Alberta

The permanent CO2 storage site at the end of the Alberta Carbon Trunk Line is just getting started

Wells at the Clive carbon capture, utilization and storage project near Red Deer, Alta. Photo courtesy Enhance Energy

From the Canadian Energy Centre

Inside Clive, a model for reducing emissions while adding value in Alberta

It’s a bright spring day on a stretch of rolling farmland just northeast of Red Deer. It’s quiet, but for the wind rushing through the grass and the soft crunch of gravel underfoot.

The unassuming wellheads spaced widely across the landscape give little hint of the significance of what is happening underground.

In just five years, this site has locked away more than 6.5 million tonnes of CO₂ — equivalent to the annual emissions of about 1.5 million cars — stored nearly four CN Towers deep beneath the surface.

The CO₂ injection has not only reduced emissions but also breathed life into an oilfield that was heading for abandonment, generating jobs, economic activity and government revenue that would have otherwise been lost.

This is Clive, the endpoint of one of Canada’s largest carbon capture, utilization and storage (CCUS) projects. And it’s just getting started.

Rooted in Alberta’s first oil boom

Clive’s history ties to Alberta’s first oil boom, with the field discovered in 1952 along the same geological trend as the legendary 1947 Leduc No. 1 gusher near Edmonton.

“The Clive field was discovered in the 1950s as really a follow-up to Leduc No. 1. This is, call it, Leduc No. 4,” said Chris Kupchenko, president of Enhance Energy, which now operates the Clive field.

Over the last 70 years Clive has produced about 70 million barrels of the site’s 130 million barrels of original oil in place, leaving enough energy behind to fuel six million gasoline-powered vehicles for one year.

“By the late 1990s and early 2000s, production had gone almost to zero,” said Candice Paton, Enhance’s vice-president of corporate affairs.

“There was resource left in the reservoir, but it would have been uneconomic to recover it.”

Gearing up for CO2

Calgary-based Enhance bought Clive in 2013 and kept it running despite high operating costs because of a major CO2 opportunity the company was developing on the horizon.

In 2008, Enhance and North West Redwater Partnership had launched development of the Alberta Carbon Trunk Line (ACTL), one of the world’s largest CO2 transportation systems.

Wolf Midstream joined the project in 2018 as the pipeline’s owner and operator.

Completed in 2020, the groundbreaking $1.2 billion project — supported by the governments of Canada and Alberta — connects carbon captured at industrial sites near Edmonton to the Clive facility.

“With CO2 we’re able to revitalize some of these fields, continue to produce some of the resource that was left behind and permanently store CO2 emissions,” Paton said.

An oversized pipeline on purpose

Each year, about 1.6 million tonnes of CO2 captured at the NWR Sturgeon Refinery and Nutrien Redwater fertilizer facility near Fort Saskatchewan travels down the trunk line to Clive.

In a unique twist, that is only about 10 per cent of the pipeline’s available space. The project partners intentionally built it with room to grow.

“We have a lot of excess capacity. The vision behind the pipe was, let’s remove barriers for the future,” Kupchenko said.

The Alberta government-supported goal was to expand CCS in the province, said James Fann, CEO of the Regina-based International CCS Knowledge Centre.

“They did it on purpose. The size of the infrastructure project creates the opportunity for other emitters to build capture projects along the way,” he said.

CO2 captured at the Sturgeon Refinery near Edmonton is transported by the Alberta Carbon Trunk Line to the Clive project. Photo courtesy North West Redwater Partnership

Extending the value of aging assets

Building more CCUS projects like Clive that incorporate enhanced oil recovery (EOR) is a model for extending the economic value of aging oil and gas fields in Alberta, Kupchenko said.

“EOR can be thought of as redeveloping real estate,” he said.

“Take an inner-city lot with a 700-square-foot house on it. The bad thing is there’s a 100-year-old house that has to be torn down. But the great thing is there’s a road to it. There’s power to it, there’s a sewer connection, there’s water, there’s all the things.

“That’s what this is. We’re redeveloping a field that was discovered 70 years ago and has at least 30 more years of life.”

The 180 existing wellbores are also all assets, Kupchenko said.

“They may not all be producing oil or injecting CO2, but every one of them is used. They are our eyes into the reservoir.”

CO2 injection well at the Clive carbon capture, utilization and storage project. Photo for the Canadian Energy Centre

Alberta’s ‘beautiful’ CCUS geology

The existing wells are an important part of measurement, monitoring and verification (MMV) at Clive.

The Alberta Energy Regulator requires CCUS projects to implement a comprehensive MMV program to assess storage performance and demonstrate the long-term safety and security of CO₂.

Katherine Romanak, a subsurface CCUS specialist at the University of Texas at Austin, said that her nearly 20 years of global research indicate the process is safe.

“There’s never been a leak of CO2 from a storage site,” she said.

Alberta’s geology is particularly suitable for CCUS, with permanent storage potential estimated at more than 100 billion tonnes.

“The geology is beautiful,” Romanak said.

“It’s the thickest reservoir rocks you’ve ever seen. It’s really good injectivity, porosity and permeability, and the confining layers are crazy thick.”

CO2-EOR gaining prominence

The extra capacity on the ACTL pipeline offers a key opportunity to capitalize on storage potential while addressing aging oil and gas fields, according to the Alberta government’s Mature Asset Strategy, released earlier this year.

The report says expanding CCUS to EOR could attract investment, cut emissions and encourage producers to reinvest in existing properties — instead of abandoning them.

However, this opportunity is limited by federal policy.

Ottawa’s CCUS Investment Tax Credit, which became available in June 2024, does not apply to EOR projects.

“Often people will equate EOR with a project that doesn’t store CO2 permanently,” Kupchenko said.

“We like to always make sure that people understand that every ton of CO2 that enters this project is permanently sequestered. And we take great effort into storing that CO2.”

The International Energy Forum — representing energy ministers from nearly 70 countries including Canada, the U.S., China, India, Norway, and Saudi Arabia — says CO₂-based EOR is gaining prominence as a carbon sequestration tool.

The technology can “transform a traditional oil recovery method into a key pillar of energy security and climate strategy,” according to a June 2025 IEF report.

Tapping into more opportunity

In Central Alberta, Enhance Energy is advancing a new permanent CO2 storage project called Origins that is designed to revitalize additional aging oil and gas fields while reducing emissions, using the ACTL pipeline.

“Origins is a hub that’s going to enable larger scale EOR development,” Kupchenko said.

“There’s at least 10 times more oil in place in this area.”

Meanwhile, Wolf Midstream is extending the pipeline further into the Edmonton region to transport more CO2 captured from additional industrial facilities.

Canadian Energy Centre

Cross-Canada economic benefits of the proposed Northern Gateway Pipeline project

From the Canadian Energy Centre

Billions in government revenue and thousands of jobs across provinces

Announced in 2006, the Northern Gateway project would have built twin pipelines between Bruderheim, Alta. and a marine terminal at Kitimat, B.C.

One pipeline would export 525,000 barrels per day of heavy oil from Alberta to tidewater markets. The other would import 193,000 barrels per day of condensate to Alberta to dilute heavy oil for pipeline transportation.

The project would have generated significant economic benefits across Canada.

The following projections are drawn from the report Public Interest Benefits of the Northern Gateway Project (Wright Mansell Research Ltd., July 2012), which was submitted as reply evidence during the regulatory process.

Financial figures have been adjusted to 2025 dollars using the Bank of Canada’s Inflation Calculator, with $1.00 in 2012 equivalent to $1.34 in 2025.

Total Government Revenue by Region

Between 2019 and 2048, a period encompassing both construction and operations, the Northern Gateway project was projected to generate the following total government revenues by region (direct, indirect and induced):

British Columbia

- Provincial government revenue: $11.5 billion

- Federal government revenue: $8.9 billion

- Total: $20.4 billion

Alberta

- Provincial government revenue: $49.4 billion

- Federal government revenue: $41.5 billion

- Total: $90.9 billion

Ontario

- Provincial government revenue: $1.7 billion

- Federal government revenue: $2.7 billion

- Total: $4.4 billion

Quebec

- Provincial government revenue: $746 million

- Federal government revenue: $541 million

- Total: $1.29 billion

Saskatchewan

- Provincial government revenue: $6.9 billion

- Federal government revenue: $4.4 billion

- Total: $11.3 billion

Other

- Provincial government revenue: $1.9 billion

- Federal government revenue: $1.4 billion

- Total: $3.3 billion

Canada

- Provincial government revenue: $72.1 billion

- Federal government revenue: $59.4 billion

- Total: $131.7 billion

Annual Government Revenue by Region

Over the period 2019 and 2048, the Northern Gateway project was projected to generate the following annual government revenues by region (direct, indirect and induced):

British Columbia

- Provincial government revenue: $340 million

- Federal government revenue: $261 million

- Total: $601 million per year

Alberta

- Provincial government revenue: $1.5 billion

- Federal government revenue: $1.2 billion

- Total: $2.7 billion per year

Ontario

- Provincial government revenue: $51 million

- Federal government revenue: $79 million

- Total: $130 million per year

Quebec

- Provincial government revenue: $21 million

- Federal government revenue: $16 million

- Total: $37 million per year

Saskatchewan

- Provincial government revenue: $204 million

- Federal government revenue: $129 million

- Total: $333 million per year

Other

- Provincial government revenue: $58 million

- Federal government revenue: $40 million

- Total: $98 million per year

Canada

- Provincial government revenue: $2.1 billion

- Federal government revenue: $1.7 billion

- Total: $3.8 billion per year

Employment by Region

Over the period 2019 to 2048, the Northern Gateway Pipeline was projected to generate the following direct, indirect and induced full-time equivalent (FTE) jobs by region:

British Columbia

- Annual average: 7,736

- Total over the period: 224,344

Alberta

- Annual average: 11,798

- Total over the period: 342,142

Ontario

- Annual average: 3,061

- Total over the period: 88,769

Quebec

- Annual average: 1,003

- Total over the period: 29,087

Saskatchewan

- Annual average: 2,127

- Total over the period: 61,683

Other

- Annual average: 953

- Total over the period: 27,637

Canada

- Annual average: 26,678

- Total over the period: 773,662

-

Alberta1 day ago

Alberta1 day agoAlberta judge sides with LGBT activists, allows ‘gender transitions’ for kids to continue

-

Business1 day ago

Business1 day agoCanada Caves: Carney ditches digital services tax after criticism from Trump

-

Crime1 day ago

Crime1 day agoSuspected ambush leaves two firefighters dead in Idaho

-

Alberta1 day ago

Alberta1 day agoAlberta Independence Seekers Take First Step: Citizen Initiative Application Approved, Notice of Initiative Petition Issued

-

Crime14 hours ago

Crime14 hours agoNational Health Care Fraud Takedown Results in 324 Defendants Charged in Connection with Over $14.6 Billion in Alleged Fraud

-

Health14 hours ago

Health14 hours agoRFK Jr. Unloads Disturbing Vaccine Secrets on Tucker—And Surprises Everyone on Trump

-

Business3 hours ago

Business3 hours agoElon Musk slams Trump’s ‘Big Beautiful Bill,’ calls for new political party

-

Censorship Industrial Complex3 hours ago

Censorship Industrial Complex3 hours agoGlobal media alliance colluded with foreign nations to crush free speech in America: House report