Canadian Energy Centre

Mexico leapfrogging Canada on LNG and six other global oil and gas megaprojects

By Deborah Jaremko of the Canadian Energy Centre Ltd.

Major investments in countries like the United States, Norway, Qatar and Saudi Arabia are being made to meet world demand

New major oil and gas megaprojects around the world are proceeding amid concern about underinvestment in conventional energy leading to painful supply shortages.

“The energy future must be secure and affordable, as well as sustainable,” said Daniel Yergin, vice-chairman of S&P Global, earlier this year.

“Adequate investment that avoids shortages and price spikes, and the economic hardship and social turbulence that they bring, is essential to that future.”

Even if oil and gas demand growth slows, a cumulative $4.9 trillion will be needed between 2023 and 2030 to prevent a supply shortfall, according to a report by the International Energy Forum and S&P Global Commodity Insights.

Major investments in countries like the United States, Norway, Qatar, Saudi Arabia and Mexico are being made to meet world demand.

Meanwhile, due to regulatory uncertainty and concerns over proposed policies like an emissions cap for oil and gas production, Canada’s vast resources – produced with among the world’s highest standards for environmental protection and social progress – are being left behind.

Here’s a look at just a handful of global oil and gas megaprojects, listed in rising order of development cost.

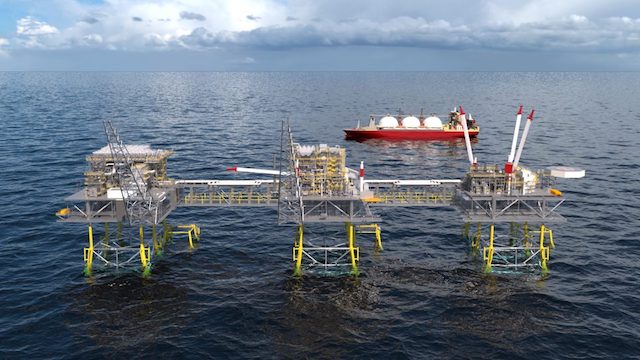

Mexico: Altamira LNG

US$1 billion

New Fortress Energy

Mexico is leapfrogging over Canada to become an LNG exporter.

While Canada’s first LNG export project is expected to start operating in 2025, Mexico’s could come online this August – less than 10 months after Mexico’s government finalized a deal with U.S.-based New Fortress Energy to make it happen.

While relatively small at 1.4 million tonnes of LNG per year (LNG Canada’s first phase will have capacity of 14 million tonnes per year), under Mexico’s agreement the Altamira site is to become an LNG hub.

New Fortress Energy is to deploy multiple same-sized floating LNG units to produce LNG from natural gas transported through TC Energy’s Sur de Texas-Tuxpan pipeline.

An existing LNG import terminal at Altamira is also expected to be converted into a 2.8-million-tonne-per-year export facility.

United States: Willow Oil Project

US$8 billion

ConocoPhillips

The U.S. government granted approval this March for the giant Willow oil project on Alaska’s North Slope to proceed.

The project, owned by ConocoPhillips, is designed to produce 180,000 barrels per day at peak and operate for 30 years. It includes a processing facility, operations centre, and three drilling sites.

The Willow leases are inside the National Petroleum Reserve – Alaska, which was established in 1923 as an emergency oil supply for the U.S. Navy. It is now administered by the U.S. Bureau of Land Management.

Willow would occupy about 385 acres (around half the area of Central Park in New York City) in the northeast portion of the 23-million-acre reserve. It is expected to deliver nearly US$9 billion in government revenue, creating about 2,500 jobs during construction and 300 long-term positions.

ConocoPhillips has yet to make a final investment decision, but is anticipating starting production in 2029, according to the Anchorage Daily News.

United States: Golden Pass LNG

US$10 billion

QatarEnergy, Exxon Mobil

Golden Pass LNG is one of four natural gas export terminals under construction on the U.S. Gulf Coast as the United States continues to build its platform as an LNG powerhouse.

With about 90 million tonnes per year of LNG export capacity today, analysts with Wood Mackenzie expect that if current momentum continues, another 190 million tonnes per year could come online by the end of this decade.

The US$10-billion Golden Pass project owned by QatarEnergy and Exxon Mobil will have three production trains with total export capacity of about 18 million tonnes of LNG per year.

The U.S. began exporting LNG in 2016 and has since built more LNG capacity than anywhere else in the world, according to the U.S. Energy Information Administration.

First LNG exports from Golden Pass are planned for 2024.

Norway: Njord Field Restart

US$29 billion

Wintershall Dea, Equinor, Neptune Energy

Norway has officially reopened a major offshore oil and gas field, with the goal to extend its life beyond 2040 and double its total production.

Nearly US$30 billion in upgrades to the Njord project’s production platform and offloading vessel started in 2016, after nearly 20 years of operations. It was originally only expected to run until 2013, but improvements in recovery technology have opened the door to accessing substantially more resources.

Production restarted in December 2022, just in time to help address Europe’s energy crisis.

“With the war in Ukraine, the export of Norwegian oil and gas to Europe has never been more important than now. Reopening Njord contributes to Norway remaining a stable supplier of gas to Europe for many years to come,” Norway’s oil and energy minister Terje Aasland said in a statement.

The project will drill 10 new wells and tie in two new subsea oil and gas fields, with the work expected to add approximately 250 million barrels of oil equivalent to the European market. Partial electrification of equipment is expected to reduce greenhouse gas emissions.

Qatar: North Field East LNG expansion

Qatar Energy, Shell, TotalEnergies, Eni, Exxon Mobil, ConocoPhillips, Sinopec

US$29 billion

The largest LNG project ever built is underway in Qatar.

State-owned QatarEnergy’s US$29 billion North Field East Expansion will increase the country’s LNG export capacity to 110 million tonnes per year, from 77 million tonnes per year today. Startup is planned in 2025.

A planned second phase of the project will further increase capacity to 126 million tonnes per year.

World LNG demand reached a record 409 million tonnes in 2022, according to data provider Revintiv. It’s expected to rise to over 700 million tonnes by 2040, according to Shell’s most recent industry outlook.

Saudi Arabia: Jafurah Gas Project

US$110 billion

Saudi Aramco

State-owned Saudi Aramco is moving ahead with development of the massive Jafurah gas project, which it says will help meet growing energy demand and provide feedstock for hydrogen production.

First gas from the $110-billion project is expected in 2025, rising to reach two billion cubic feet per day by 2030. That’s about one-third the volume of all the natural gas produced in British Columbia. Saudi Aramco produced 10.6 billion cubic feet of natural gas per day in 2022, or more than half the gas produced in Canada.

Last year the company started construction work on the gas processing facility that is the anchor of the Jafurah project. Aramco is reportedly in talkswith potential partners to back the US$110 billion development.

Russia: Vostok Oil

US$170 billion

Rosneft

Russian state-owned oil company Rosneft continues to barrel ahead with the massive Vostok oil project in the country’s arctic, which Rosneft calls the largest investment in the world.

The US$170 billion project will use the Northern Sea Route to export about 600,000 barrels per day by 2024. Production is expected to increase to two million barrels per day after the second phase. For comparison, Canada’s entire oil sands industry produces about three million barrels per day.

The main problem the energy industry faces is global underinvestment in conventional sources, Rosneft CEO Igor Sechin said earlier this year. He stressed the importance of Vostok’s oil supply for growing Asian economies.

“Vostok Oil project will provide long-term, reliable, and guaranteed energy supplies,” Sechin said.

Two new icebreaker vessels recently helped deliver 4,600 tonnes of cargo including oil pipes for the project to the arctic development sites, the Barents Observer reported.

Alberta

The case for expanding Canada’s energy exports

From the Canadian Energy Centre

For Canada, the path to a stronger economy — and stronger global influence — runs through energy.

That’s the view of David Detomasi, a professor at the Smith School of Business at Queen’s University.

Detomasi, author of Profits and Power: Navigating the Politics and Geopolitics of Oil, argues that there is a moral case for developing Canada’s energy, both for Canadians and the world.

CEC: What does being an energy superpower mean to you?

DD: It means Canada is strong enough to affect the system as a whole by its choices.

There is something really valuable about Canada’s — and Alberta’s — way of producing carbon energy that goes beyond just the monetary rewards.

CEC: You talk about the moral case for developing Canada’s energy. What do you mean?

DD: I think the default assumption in public rhetoric is that the environmental movement is the only voice speaking for the moral betterment of the world. That needs to be challenged.

That public rhetoric is that the act of cultivating a powerful, effective economic engine is somehow wrong or bad, and that efforts to create wealth are somehow morally tainted.

I think that’s dead wrong. Economic growth is morally good, and we should foster it.

Economic growth generates money, and you can’t do anything you want to do in social expenditures without that engine.

Economic growth is critical to doing all the other things we want to do as Canadians, like having a publicly funded health care system or providing transfer payments to less well-off provinces.

Over the last 10 years, many people in Canada came to equate moral leadership with getting off of oil and gas as quickly as possible. I think that is a mistake, and far too narrow.

Instead, I think moral leadership means you play that game, you play it well, and you do it in our interest, in the Canadian way.

We need a solid base of economic prosperity in this country first, and then we can help others.

CEC: Why is it important to expand Canada’s energy trade?

DD: Canada is, and has always been, a trading nation, because we’ve got a lot of geography and not that many people.

If we don’t trade what we have with the outside world, we aren’t going to be able to develop economically, because we don’t have the internal size and capacity.

Historically, most of that trade has been with the United States. Geography and history mean it will always be our primary trade partner.

But the United States clearly can be an unreliable partner. Free and open trade matters more to Canada than it does to the U.S. Indeed, a big chunk of the American people is skeptical of participating in a global trading system.

As the United States perhaps withdraws from the international trading and investment system, there’s room for Canada to reinforce it in places where we can use our resource advantages to build new, stronger relationships.

One of these is Europe, which still imports a lot of gas. We can also build positive relationships with the enormous emerging markets of China and India, both of whom want and will need enormous supplies of energy for many decades.

I would like to be able to offer partners the alternative option of buying Canadian energy so that they are less reliant on, say, Iranian or Russian energy.

Canada can also maybe eventually help the two billion people in the world currently without energy access.

CEC: What benefits could Canadians gain by becoming an energy superpower?

DD: The first and primary responsibility of our federal government is to look after Canada. At the end of the day, the goal is to improve Canada’s welfare and enhance its sovereignty.

More carbon energy development helps Canada. We have massive debt, an investment crisis and productivity problems that we’ve been talking about forever. Economic and job growth are weak.

Solving these will require profitable and productive industries. We don’t have so many economic strengths in this country that we can voluntarily ignore or constrain one of our biggest industries.

The economic benefits pay for things that make you stronger as a country.

They make you more resilient on the social welfare front and make increasing defence expenditures, which we sorely need, more affordable. It allows us to manage the debt that we’re running up, and supports deals for Canada’s Indigenous peoples.

CEC: Are there specific projects that you advocate for to make Canada an energy superpower?

DD: Canada’s energy needs egress, and getting it out to places other than the United States. That means more transport and port facilities to Canada’s coasts.

We also need domestic energy transport networks. People don’t know this, but a big chunk of Ontario’s oil supply runs through Michigan, posing a latent security risk to Ontario’s energy security.

We need to change the perception that pipelines are evil. There’s a spiderweb of them across the globe, and more are being built.

Building pipelines here, with Canadian technology and know-how, builds our competitiveness and enhances our sovereignty.

Economic growth enhances sovereignty and provides the resources to do other things. We should applaud and encourage it, and the carbon energy sector can lead the way.

Business

Oil tanker traffic surges but spills stay at zero after Trans Mountain Expansion

From the Canadian Energy Centre

Bigger project maintains decades-long marine safety record

The Trans Mountain system continues its decades-long record of zero marine spills, even as oil tanker traffic has surged more than 800 per cent since the pipeline’s expansion in May 2024.

The number of tankers calling at Trans Mountain’s Westridge Marine Terminal in the Port of Vancouver in one month now rivals the number that used to go through in one year.

A global trend toward safer tanker operations

Trans Mountain’s safe operations are part of a worldwide trend. Global oil tanker traffic is up, yet spills are down, according to the International Tanker Owners Pollution Federation, a London, UK-based nonprofit that provides data and response support.

Transport Canada reports a 95 per cent drop in ship-source oil spills and spill volumes since the 1970s, driven by stronger ship design, improved response and better regulations.

“Tankers are now designed much more safely. They are double-hulled and compartmentalized to mitigate spills,” said Mike Lowry, spokesperson for the Western Canada Marine Response Corporation (WCMRC).

WCMRC: Ready to protect the West Coast

One of WCMRC’s new response vessels arrives in Barkley Sound. Photo courtesy Western Canada Marine Response Corporation

From eight marine bases including Vancouver and Prince Rupert, WCMRC stands at the ready to protect all 27,000 kilometres of Canada’s western coastline.

Lowry sees the corporation as similar to firefighters — training to respond to an event they hope they never have to see.

In September, it conducted a large-scale training exercise for a worst-case spill scenario. This included the KJ Gardner — Canada’s largest spill response vessel and a part of WCMRC’s fleet since 2024.

“It’s part of the work we do to make sure everybody is trained and prepared to use our assets just in case,” Lowry said.

Expanding capacity for Trans Mountain

The K.J. Gardner is the largest-ever spill response vessel in Canada. Photo courtesy Western Canada Marine Response Corporation

WCMRC’s fleet and capabilities were doubled with a $170-million expansion to support the Trans Mountain project.

Between 2012 and 2024, the company grew from 13 people and $12 million in assets to more than 200 people and $213 million in assets.

“About 80 per cent of our employees are mariners who work as deckhands, captains and marine engineers on our vessels,” Lowry said.

“Most of the incidents we respond to are small marine diesel spills — the last one was a fuel leak from a forest logging vessel near Nanaimo — so we have deployed our fleet in other ways.”

Tanker safety starts with strong rules and local expertise

Tanker loading at the Westridge Marine Terminal in the Port of Vancouver. Photo courtesy Trans Mountain Corporation

Speaking on the ARC Energy Ideas podcast, Trans Mountain CEO Mark Maki said tanker safety starts with strong regulations, including the use of local pilots to guide vessels into the harbour.

“On the Mississippi River, you have Mississippi River pilots because they know how the river behaves. Same thing would apply here in Vancouver Harbour. Tides are strong, so people who are familiar with the harbor and have years and decades of experience are making sure the ships go in and out safely,” Maki said.

“A high standard is applied to any ship that calls, and our facility has to meet very strict requirements. And we have rejected ships, just said, ‘Nope, that one doesn’t fit the bill.’ A ship calling on our facilities is very, very carefully looked at.”

Working with communities to protect sensitive areas

Beyond escorting ships and preparing for spills, WCMRC partners with coastal communities to map sensitive areas that need rapid protection including salmon streams, clam beds and culturally important sites like burial grounds.

“We want to empower communities and nations to be more prepared and involved,” Lowry said.

“They can help us identify and protect the areas that they value or view as sensitive by working with our mapping people to identify those areas in advance. If we know where those are ahead of time, we can develop a protection strategy for them.”

-

Digital ID17 hours ago

Digital ID17 hours agoCanada releases new digital ID app for personal documents despite privacy concerns

-

Business1 day ago

Business1 day agoMajor tax changes in 2026: Report

-

International1 day ago

International1 day agoRussia Now Open To Ukraine Joining EU, Officials Briefed On Peace Deal Say

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoDeath by a thousand clicks – government censorship of Canada’s internet

-

Energy16 hours ago

Energy16 hours agoCanada’s sudden rediscovery of energy ambition has been greeted with a familiar charge: hypocrisy

-

Alberta1 day ago

Alberta1 day agoSchools should go back to basics to mitigate effects of AI

-

Daily Caller1 day ago

Daily Caller1 day agoChinese Billionaire Tried To Build US-Born Baby Empire As Overseas Elites Turn To American Surrogates

-

Daily Caller1 day ago

Daily Caller1 day agoTwo states designate Muslim group as terrorist