Business

Mark Carney’s carbon tax plan hurts farmers

From the Canadian Taxpayers Federation

Liberal leadership front-runner Mark Carney recently announced his carbon tax plan and here are some key points.

It’s expensive for Canadians.

It’s even more expensive for farmers.

Carney announced he would immediately remove the consumer carbon tax if he became prime minister.

That sounds like good news, but it’s important to read the fine print.

Carney went on and announced that he would be “integrating a new consumer carbon credit market into the industrial pricing system.” Carney also said he would “improve and tighten” the industrial carbon tax and impose carbon tax tariffs on imports into Canada.

If that sounds like Carney isn’t getting rid of the carbon tax, that’s because he isn’t. He’s trying to hide the costs from Canadians by imposing higher carbon taxes on businesses.

What that means is that Carney’s plan would tax businesses and then businesses will pass those costs onto consumers.

That also means farmers.

Under the current carbon tax, farmers have an exemption from the carbon tax on the gas and diesel they use on their farm. The hidden industrial carbon tax is applied directly to industry. Businesses are forced to pay the carbon tax if they emit above the government’s prescribed limit.

But businesses don’t just swallow those costs. They pass them on. The trucking industry is a great example.

“Due to razor thin margins in the trucking industry, these added costs cannot be absorbed and must be passed on to customers,” said the Canadian Trucking Alliance when analyzing the current Trudeau carbon tax.

The same concept applies to the Carney scheme.

If Carney removes the consumer carbon tax and replaces it with a higher tax on businesses under the hidden industrial carbon tax, that means more costs for farmers.

There isn’t any exemption for farmers under the industrial carbon tax. Oil and gas refineries will be paying a higher carbon tax and they will be forced to pass that cost onto their consumers. Farmers use a lot of fuel.

The pain doesn’t stop there. Farmers also use a lot of fertilizer and Carney’s carbon tax means higher costs for fertilizer plants. Then farmers will be stuck paying more for fertilizer.

Some businesses, like those fertilizer plants, could pack up and move production south. But farmers are still going to need fertilizer. Carney’s plan compounds the pain with carbon tax tariffs.

Fertilizer is only one example. If Canadian farmers need to buy a part to fix equipment that can only come from the U.S., it could be more expensive because of Carney’s carbon tax tariffs.

This will hurt Canadian farmers when they’re buying supplies. But it’ll also hurt when farmers when they go to market. Canadian farmers compete with farmers around the world and majority of them aren’t paying carbon taxes.

Farmers wouldn’t be at a disadvantage because American farmers are smarter or farm better, but because, under Carney’s carbon tax, they would be stuck paying costs competitors don’t have to pay. And farmers know this all too well.

“My competitors to the south of me in the United States do not pay that [carbon] tax, so now my cost goes up and I have no alternative,” said Jeff Barlow, a corn, wheat and soybean farmer in Ontario. “By penalizing me there’s nothing else that I can do but just be penalized.”

And if farmers won’t be the only ones hurt.

Families across Canada are struggling with grocery prices and increasing the cost of production for farmers certainly won’t lower those prices.

Carney says that he wants to cancel the consumer tax because it’s too “divisive.” That statement misses the nail completely and hammers the thumb. Canadians don’t want to get rid of the carbon tax because of perception, they want to get rid of it because it makes life more expensive.

Carney needs to commit to getting rid of carbon taxes, not rebranding the failed policy into something that could end up costing Canadians and farmers even more.

Business

Coffee price explosion a self-inflicted wound: Liberal tariff drives up cost of coffee

This article supplied by Troy Media.

Since March 3, Canadian importers have been paying an additional 25 per cent tariff on imported coffee. This counter-tariff, introduced as part of Ottawa’s retaliatory response to a trade dispute triggered by new United States duties on Canadian agricultural exports earlier this year, directly affects a product that isn’t even grown in Canada.

Coffee is up 19 per cent—and global markets aren’t to blame. Ottawa’s political posturing is burning your wallet, one cup at a time

Canadians are paying 19 per cent more for ground coffee this year—and it’s not because of global supply issues. It’s because of a self-inflicted policy

mistake: a 25 per cent tariff imposed by Ottawa on imported coffee, a product Canada doesn’t even grow.

Many consumers may attribute the spike to global market volatility, especially after coffee futures soared to a record high of more than US$4.40 per

pound in February. But that explanation no longer holds—futures have since dropped by more than 30 per cent, yet retail prices remain stubbornly high. So, what’s driving this divergence?

The answer lies, in part, in trade policy.

Since March 3, Canadian importers have been paying an additional 25 per cent tariff on imported coffee.

This counter-tariff, introduced as part of Ottawa’s retaliatory response to a trade dispute triggered by new United States duties on Canadian agricultural exports earlier this year, directly affects a product that isn’t even grown in Canada.

Unlike dairy or poultry, coffee has no domestic farming sector to protect. These tariffs aren’t shielding Canadian producers—they’re punishing

Canadian consumers and businesses.

To grasp the scale of this impact, consider the size of the industry. According to Introspective Market Research, retail coffee sales in Canada total more than $2.7 billion annually and are projected to grow steadily over the next decade. Meanwhile, coffee shops and quick-service restaurants, from Tim Hortons to independent cafés, generate an additional $6.4 billion per year. Tim Hortons alone sells more than five million cups of coffee per day.

This is not a fringe sector; it’s a critical part of both our economy and our culture.

Ironically, the U.S.—our supposed trade adversary in this case—doesn’t grow coffee either. Yet both countries are now entangled in a tariff tug-of-war that serves no practical purpose. The same logic applies to tea, which is also subject to retaliatory measures.

The tariffs were introduced under the Trudeau government in a broader geopolitical strategy that often felt more performative than pragmatic. Trudeau’s combative approach to trade, seemingly crafted on a whiteboard without regard for economic fallout, may have resonated politically, but it ignored basic economic principles. Consumers were never part of the equation.

In contrast, Prime Minister Mark Carney appears to be taking a more measured approach. Tariffs on U.S. alcohol and citrus products remain, but those can be sourced from other markets with relatively little disruption. Coffee and tea, however, are a different matter. There are no alternative domestic sources. The cost of these tariffs is being passed directly to roasters, grocers, restaurants, and ultimately, to the consumer.

Compounding the problem is the volatility of American trade policy under U.S. President Donald Trump, which continues to inject uncertainty into food markets. Tariffs come and go with the political winds, forcing companies to engage in “buffer pricing.” Much like travelers buying insurance for

unpredictable weather, companies build in extra costs to guard against political surprises. It’s effectively a tax on unpredictability, and it’s now embedded in the price Canadians pay at the till.

And while consumers might not feel the same pinch at their local café, where coffee is a smaller fraction of the total cost of a cup, the grocery aisle tells a different story. That’s where the full weight of these policies lands.

Whether a new trade agreement can be reached by the self-imposed July 21 deadline—or a damaging 35 per cent tariff Trump has set for August 1 can be avoided—remains uncertain. But what should be obvious is this: both Canada and the U.S. need to keep essential agri-food imports like coffee and tea out of their geopolitical fights.

Canada has a vibrant coffee ecosystem, built on roasting, innovation and consumer culture, not cultivation. There is no economic rationale for taxing it. Canadians shouldn’t be paying more for their morning brew just to send a symbolic message to Washington.

It’s time Ottawa led by example and scrapped these pointless tariffs.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Automotive

Another sign Canada’s EV mandate is FAILING

By Dan McTeague

While other countries are moving away from EVs, the Carney government is doubling down.

Last week, it was reported that the feds are considering reimbursing car dealerships impacted by the sudden suspension of EV rebates. It’s becoming clear that Canada’s EV ambitions are failing as EV sales are plummeting and car manufacturers are backtracking on their EV plans.

It’s not too late for the Carney government to backdown from its EV mandate.

Dan McTeague explains.

-

Energy2 days ago

Energy2 days agoIs The Carney Government Making Canadian Energy More “Investible”?

-

Immigration2 days ago

Immigration2 days agoUnregulated medical procedures? Price Edward Islanders Want Answers After Finding Biomedical Waste From PRC-Linked Monasteries

-

Business2 days ago

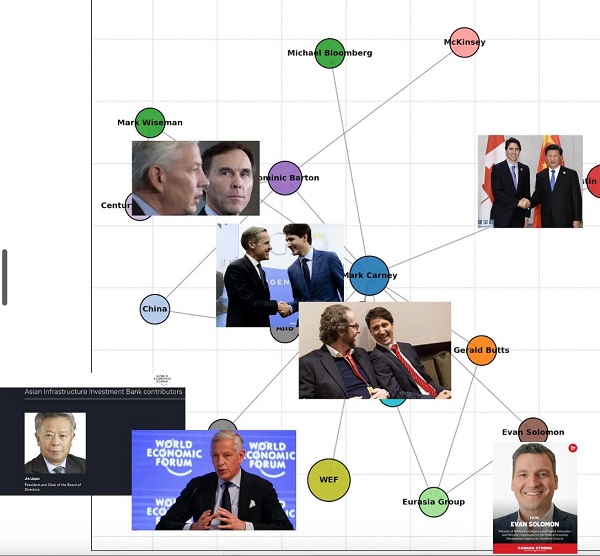

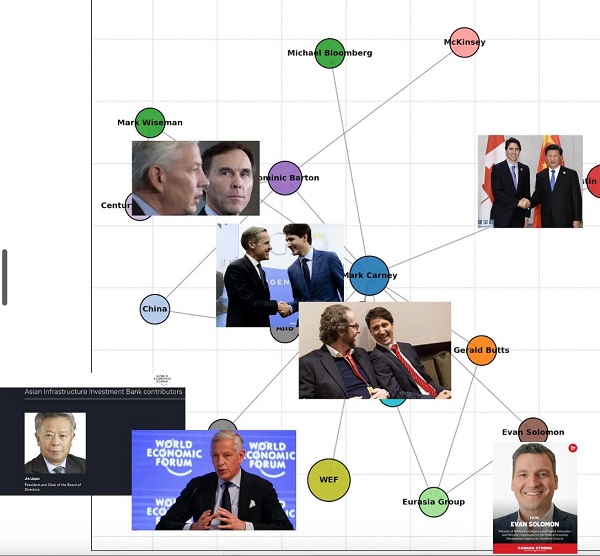

Business2 days agoDemocracy Watchdog Says PM Carney’s “Ethics Screen” Actually “Hides His Participation” In Conflicted Investments

-

Business2 days ago

Business2 days agoCompetition Bureau is right—Canada should open up competition in the air

-

Business2 days ago

Business2 days agoIt’s Time To End Canada’s Protectionist Supply Management Regime

-

COVID-192 days ago

COVID-192 days agoFreedom Convoy leaders’ sentencing hearing to begin July 23 with verdict due in August

-

Addictions2 days ago

Addictions2 days agoAfter eight years, Canada still lacks long-term data on safer supply

-

National2 days ago

National2 days agoLiberals push to lower voting age to 16 in federal elections