Alberta

Local moving company donating 101 moves to support vulnerable Canadians this holiday season

Submitted by Two Small Men with Big Hearts Moving

Two Small Men with Big Hearts Moving is moving joy, one community organization at a time

This holiday season, Two Small Men with Big Hearts Moving (“Two Small Men”) is spreading joy, seeking to donate 101 moves to community organizations that support at-risk individuals. With inflation at an all-time high and the higher stresses that come with the holiday season and colder weather, Two Small Men is looking to give back to the local markets they operate in during this time of need. This marks the third year for this initiative, which Two Small Men was inspired to launch in 2020, following the hardships of COVID-19. The campaign has grown year-over-year, from 25 donated moves in 2020, to 80 moves in 2021, and now with a goal of 101 moves for 2022.

Two Small Men has a long history in Red Deer having supported the Red Deer Food Bank, Bridges Community Living, and the Alberta Motor Association in past years. They are also always actively searching for new community organizations to partner with to support with donated moving services.

This holiday season, Two Small Men will be helping organizations that support vulnerable communities with everything from moving mass amounts of food to local food banks, to supporting shelters with moving individuals into new homes, to moving toys for underprivileged children.

Two Small Men’s community-first mindset is a key part of its identity. Written right into the name, it is a moving company with a big heart, that cares deeply about giving back. Two Small Men has developed a robust community giving program that supports a variety of non-profit and charitable organizations with in-kind moving services, donation collection initiatives, and other financial contributions. Each year, the business redirects 10 per cent of its annual profits to community giving and other charitable operations. In 2022, Two Small Men projects this will translate into a donation fund of $200,000, with the goal of growing to give $750,000 annually in the next 10 years.

“Moving people’s possessions is our business, but the heart of what we do is really all about supporting the people who make up our communities,” says Addison Parfeniuk, CEO, Two Small Men Big Hearts Moving. “We know that the winter season can be an especially challenging time for many people, and it is our hope that by partnering with local organizations such as the Red Deer Food Bank, we will be able to fill the real needs of real people in the Red Deer community.”

Charitable and non-profit organizations are encouraged to submit their moving needs for consideration in this year’s Season of Giving campaign.

For more information, please visit https://twosmallmen.com/about-us/giving-back/.

About Two Small Men

Two Small Men with Big Hearts Moving is a Canadian moving company focused on supporting customers through every stage of their move, big or small. Founded in 1982, the company has 25 offices across the country with major operations in Calgary, Edmonton, Vancouver, Kelowna, and Winnipeg, and a fleet of more than 100 moving trucks. Committed to giving back to their communities, they donate 10 per cent of their profits each year to relevant charities and organizations that are serving the community.

Alberta

Upgrades at Port of Churchill spark ambitions for nation-building Arctic exports

In August 2024, a shipment of zinc concentrate departed from the Port of Churchill — marking the port’s first export of critical minerals in over two decades. Photo courtesy Arctic Gateway Group

From the Canadian Energy Centre

By Will Gibson

‘Churchill presents huge opportunities when it comes to mining, agriculture and energy’

When flooding in northern Manitoba washed out the rail line connecting the Town of Churchill to the rest of the country in May 2017, it cast serious questions about the future of the community of 900 people on the shores of Hudson Bay.

Eight years later, the provincial and federal governments have invested in Churchill as a crucial nation-building corridor opportunity to get resources from the Prairies to markets in Europe, Africa and South America.

Direct links to ocean and rail

Aerial view of the Hudson Bay Railway that connects to the Port of Churchill. Photo courtesy Arctic Gateway Group

The Port of Churchill is unique in North America.

Built in the 1920s for summer shipments of grain, it’s the continent’s only deepwater seaport with direct access to the Arctic Ocean and a direct link to the continental rail network, through the Hudson Bay Railway.

The port has four berths and is capable of handling large vessels. Having spent the past seven years upgrading both the rail line and the port, its owners are ready to expand shipping.

“After investing a lot to improve infrastructure that was neglected for decades, we see the possibilities and opportunities for commodities to come through Churchill whether that is critical minerals, grain, potash or energy,” said Chris Avery, CEO of the Arctic Gateway Group (AGG), a partnership of 29 First Nations and 12 remote northern Manitoba communities that owns the port and rail line.

“We are pleased to be in the conversation for these nation-building projects.”

In May, Canada’s Western premiers called for the Prime Minister’s full support for the development of an economic corridor connecting ports on the northwest coast and Hudson’s Bay, ultimately reaching Grays Bay, Nunavut.

Investments in Port of Churchill upgrades

AGG, which purchased the rail line and port from an American company in 2017, is not alone in the bullish view of Churchill’s future.

In February, Manitoba Premier Wab Kinew announced an investment of $36.4 million over two years in infrastructure projects at the port aimed at growing international trade.

“Churchill presents huge opportunities when it comes to mining, agriculture and energy,” Kinew said in a release.

“These new investments will build up Manitoba’s economic strength and open our province to new trading opportunities.”

In March, the federal government committed $175 million over five years to the project including $125 million to support the rail line and $50 million to develop the port.

“It’s important to point out that investing in Churchill was something that both the Liberal and Conservative parties agreed on during the federal election campaign,” said Avery, a British Columbian who worked in the airline industry for more than two decades before joining AGG.

Reduced travel time

The federal financial support helped AGG upgrade the rail line, repairing the 20 different locations where it was washed out by flooding in 2017.

Improvements included laying more than 1,600 rail cars worth of ballast rock for stabilization and drainage, installing almost 120,000 new railway ties and undertaking major bridge crossing rehabilitations and switch upgrades.

The result has seen travel time by rail reduced by three hours — or about 10 per cent — between The Pas and Churchill.

AGG also built a dedicated storage facility for critical minerals and other commodities at the port, the first new building in several decades.

Those improvements led to a milestone in August 2024, when a shipment of zinc concentrate was shipped from the port to Belgium. It was the first critical minerals shipment from Churchill in more than two decades.

The zinc concentrate was mined at Snow Lake, Manitoba, loaded on rail cars at The Pas and moved to Churchill. It’s a scenario Avery hopes to see repeated with other commodities from the Prairies.

Addressing Arctic challenges

The emergence of new technologies has helped AGG work around the challenges of melting permafrost under the rail line and ice in Hudson Bay, he said.

Real-time ground-penetrating radar and LiDAR data from sensors attached to locomotives can identify potential problems, while regular drone flights scan the track, artificial intelligence mines the data for issues, and GPS provides exact locations for maintenance.

The group has worked with permafrost researchers from the University of Calgary, Université Laval and Royal Military College to better manage the challenge. “Some of these technologies, such as artificial intelligence and LiDAR, weren’t readily available five years ago, let alone two decades,” Avery said.

On the open water, AGG is working with researchers from the University of Manitoba to study sea ice and the change in sea lanes.

“Icebreakers would be a game-changer for our shipping operations and would allow year-round shipping in the short-term,” he said.

“Without icebreakers, the shipping season is currently about four and a half months of the year, from April to early November, but that is going to continue to increase in the coming decades.”

Interest from potential shippers, including energy producers, has grown since last year’s election in the United States, Avery said.

“We’re going to continue to work closely with all levels of government to get Canada’s products to markets around the world. That’s building our nation. That’s why we are excited for the future.”

Alberta

OPEC+ is playing a dangerous game with oil

This article supplied by Troy Media.

OPEC+ is cranking up oil supply into a weak market. It’s tried this strategy before, and it backfired

OPEC+ is once again charging headfirst into a market share war—a strategy that has repeatedly ended in disaster. Despite weak global demand, falling prices and rising output from non-OPEC countries, the cartel has chosen to flood the market. History shows this tactic rarely ends well for

OPEC+ or oil producers worldwide, including Canada.

OPEC+, a group of major oil-exporting countries led by Saudi Arabia and Russia, works together to manage global oil supply and influence prices. Its decisions have far-reaching consequences for the global energy market—including for Canadian oil producers.

Last Saturday, eight leading members of OPEC+ announced, after a virtual meeting, that they would increase production by 548,000 barrels per day starting in August. That is significantly more than the group’s recent additions of 411,000 bpd, and it puts them on track to fully unwind their

previous 2.2 million bpd in cuts a full year ahead of schedule.

It is a bold move, but it comes at a questionable time.

There is little geopolitical premium built into current oil prices, and the global market is already oversupplied. Brent crude futures are down more than six per cent so far this year. Analysts estimate inventories have been climbing by a million barrels per day in 2025 due in part to cooling demand in China and rising output from countries outside OPEC.

S&P Global Commodity Insights forecasts a supply surplus of 1.25 million barrels per day in the second half of the year. Brent crude stood at about US$68 per barrel on Friday, but S&P says it could fall to between US$50 and $60 later this year and into 2026. West Texas Intermediate, the U.S. benchmark, is also at risk of dropping below US$50 per barrel.

Canada is the world’s fourth-largest oil producer, with most of its output coming from Alberta’s oil sands. Though Canadian producers have higher costs than some OPEC+ members, their innovation and access to U.S. markets have made them increasingly competitive.

While the seasonal demand boost might justify a modest increase, OPEC+, especially Saudi Arabia, appears primarily motivated by market share concerns. With U.S. shale and countries like Canada, Kazakhstan and Guyana gaining ground, the cartel is falling back on its old tactic of flooding the market to squeeze out competitors.

Some observers, including Stanley Reed in The New York Times, have suggested that the move may be designed to please U.S. President Donald Trump, who “has made courting Saudi Arabia and regional allies like the United Arab Emirates a priority of his foreign policy.” But even geopolitical gamesmanship has not shielded OPEC+ from the consequences before—and likely will not this time either.

Back in 2014, fed up with the U.S. shale boom, OPEC opened the taps. The goal was to drive prices low enough to force out higher-cost producers. Instead, oil plunged into the US$30 range. According to the World Bank, the 70 per cent drop during that period was one of the three biggest oil crashes since the Second World War and the most prolonged since the supply-driven collapse of 1986. Saudi Arabia’s respected oil minister, Ali Al-Naimi, lost his job in the aftermath.

Then, in April 2020, as the COVID-19 pandemic loomed, OPEC and Russia launched a production war that sent oil prices into freefall, briefly into negative territory. Trump had to broker a ceasefire to rescue the U.S. shale industry, forcing Riyadh and Moscow to pull back. Both sides suffered significant economic damage.

For Canada, especially Alberta, the current fallout could be severe. The province is home to most of the country’s oil sands production. Cheaper global crude undercuts Canadian prices, squeezes royalty revenues, chills investment and puts jobs at risk across Canada. And this comes as governments are already grappling with fiscal pressures.

The oil market does not reward short-term thinking. If OPEC+ continues down this road, history suggests the outcome will be painful for them and the rest of us.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

-

COVID-192 days ago

COVID-192 days agoSen. Rand Paul: ‘I am officially re-referring Dr. Fauci to the DOJ’

-

Education2 days ago

Education2 days agoTrump praises Supreme Court decision to allow dismantling of Department of Education

-

International2 days ago

International2 days agoMatt Walsh slams Trump administration’s move to bury Epstein sex trafficking scandal

-

National2 days ago

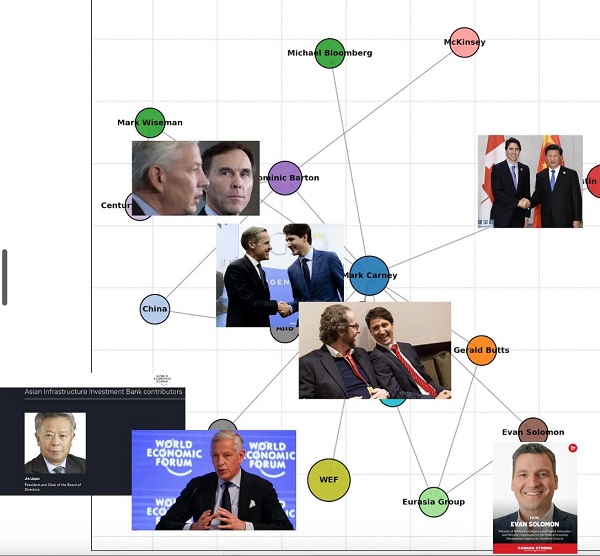

National2 days agoDemocracy Watch Blows the Whistle on Carney’s Ethics Sham

-

Energy1 day ago

Energy1 day agoIs The Carney Government Making Canadian Energy More “Investible”?

-

Business1 day ago

Business1 day agoCompetition Bureau is right—Canada should open up competition in the air

-

Immigration1 day ago

Immigration1 day agoUnregulated medical procedures? Price Edward Islanders Want Answers After Finding Biomedical Waste From PRC-Linked Monasteries

-

Business1 day ago

Business1 day agoDemocracy Watchdog Says PM Carney’s “Ethics Screen” Actually “Hides His Participation” In Conflicted Investments