National

Liberal Patronage: $330 Million in Questionable Allocations at Canada’s Green Tech Agency

What we learned from the committee is as clear as it is disturbing: Liberal ministers and appointees at SDTC have been funneling taxpayer dollars to friends under the guise of green technology funding.

In a damning House of Commons Public Accounts Committee (PACP) meeting, details emerged that Canada’s flagship “green” agency, Sustainable Development Technology Canada (SDTC), funneled hundreds of millions of taxpayer dollars into companies connected to Liberal insiders. An Auditor General’s report shed light on the staggering scale of this apparent Liberal patronage scheme, revealing that $330 million was awarded to projects with board members tied to the SDTC itself. Another $59 million found its way into initiatives that didn’t even meet SDTC’s green-tech mandate, fueling accusations of political favoritism and cronyism within Prime Minister Trudeau’s government.

Opposition MPs, led by Conservatives Rick Perkins and Michael Cooper, along with Bloc MP Nathalie Sinclair-Desgagné and NDP MP Richard Cannings, took turns dissecting former Liberal Minister Navdeep Bains’ role in appointing Annette Verschuren as SDTC’s board chair. Testimony from the hearing, corroborated by statements from SDTC’s CEO, revealed that Bains reached out to Verschuren multiple times about her appointment, despite his claims of following an “open, transparent, and arm’s-length” process. Yet, when grilled by the opposition, Bains repeatedly invoked “process” and shifted blame onto the Privy Council Office (PCO), claiming he merely encouraged a diverse pool of applicants.

But the evidence doesn’t line up with the former minister’s narrative. Witnesses testified that Assistant Deputy Minister Noseworthy had informed SDTC CEO Leah Lawrence of Verschuren’s appointment even before it was finalized, indicating a behind-the-scenes process driven by Liberal influence. These revelations throw the credibility of the appointment process into question, suggesting it may have been less about selecting qualified candidates and more about ensuring loyal Liberal allies held key positions.

The committee’s findings, sparked by the Auditor General’s investigation, expose a serious issue of conflicts of interest within SDTC’s funding operations. This is a public agency with a mission to advance sustainable development, yet the Liberal government’s management seems to have turned it into a cash machine for insiders. The Auditor General’s report has revealed a troubling pattern of funding allocations going to companies with board connections, undercutting the government’s credibility on environmental stewardship and transparency.

What we learned from the committee is as clear as it is disturbing: Liberal ministers and appointees at SDTC have been funneling taxpayer dollars to friends under the guise of green technology funding. This isn’t just a lapse in oversight; it’s a systematic approach that prioritizes insider deals over real environmental progress, putting the Trudeau government’s commitment to transparency and sustainability squarely in doubt.

Opposition MPs Call Out Lack of Accountability

During this pivotal Public Accounts Committee meeting, opposition MPs went on the offensive, exposing a deep pattern of evasion and mismanagement in how taxpayer dollars were funneled into the hands of Liberal insiders under former Liberal Minister Navdeep Bains. Conservative MPs Rick Perkins and Michael Cooper led the charge, calling out Bains’ deflections and demanding straight answers. They pointed to the $330 million awarded by Sustainable Development Technology Canada (SDTC) to projects connected to its own board members, questioning why this blatant conflict of interest was permitted under Bains’ watch.

Perkins and Cooper’s approach was blunt. They challenged Bains on his repeated reliance on vague, bureaucratic defenses, pointing out that as minister, he had a duty to exercise oversight on SDTC’s operations. Perkins in particular questioned Bains about his involvement in appointing Annette Verschuren as chair of SDTC’s board. Despite Bains’ claims that he couldn’t “recall” specific discussions with Verschuren, evidence surfaced that he contacted her multiple times prior to her appointment. For Perkins and Cooper, this level of involvement, coupled with Bains’ repeated refusal to acknowledge conflicts of interest within SDTC, painted a damning picture of a Liberal minister who prioritized insider appointments over accountability to Canadian taxpayers.

Bloc MP Nathalie Sinclair-Desgagné and NDP MP Richard Cannings focused their questioning on the government’s failure to ensure responsible oversight of SDTC’s environmental funds. Sinclair-Desgagné highlighted Bains’ “arm’s-length” defense as an excuse, given the testimony indicating that senior officials had preemptively informed SDTC’s CEO about Verschuren’s appointment, suggesting an internal network of influence rather than a transparent, merit-based process. She called out the apparent detachment of Bains from SDTC’s operations, underscoring how his office either ignored or bypassed red flags.

NDP MP Cannings raised critical points about the hypocrisy of a government that claims to champion green innovation while allowing SDTC to devolve into a taxpayer-funded favor bank. Cannings pointed out that SDTC’s funds, meant for real environmental progress, were instead granted to projects with questionable ties and little sustainability impact. For Canadians concerned with climate action, Cannings’ questions laid bare the truth: the Liberal government’s commitment to “green” initiatives is far weaker than their dedication to keeping insiders funded.

This unified front by Conservative, Bloc, and NDP MPs highlighted the same disturbing trend: a Liberal government that talks about accountability and climate action but delivers neither, choosing instead to use taxpayer funds to benefit those closest to the party.

Bains’ Defense: Hiding Behind “Process” and Arm’s-Length Excuses

When faced with tough questions on SDTC’s mismanagement, former Liberal Minister Navdeep Bains clung tightly to procedural defenses, repeatedly deflecting responsibility to the Privy Council Office (PCO) and downplaying his role as minister. Bains insisted that the PCO alone was responsible for vetting board members, suggesting his involvement was “hands-off” and strictly procedural. Yet, opposition MPs saw right through this tactic, viewing it as a clear attempt to dodge accountability.

Throughout the hearing, Bains deflected pointed questions by portraying SDTC’s oversight as out of his hands, claiming his office only followed standard processes. He avoided addressing why his appointee, Annette Verschuren, landed the SDTC board chair role despite potential conflicts of interest, with millions later flowing to companies linked to board members. By painting himself as a mere bystander to PCO’s vetting process, Bains sidestepped responsibility for ensuring taxpayer funds went to projects with genuine environmental merit, rather than those benefiting Liberal insiders.

When pressed about specific discussions surrounding Verschuren’s appointment, Bains leaned on what can only be described as selective memory. Asked about his personal involvement, he claimed he “couldn’t recall” multiple key conversations — a response that only raised eyebrows among committee members. Testimonies from SDTC’s CEO and other witnesses indicated Bains contacted Verschuren several times, yet his failure to acknowledge this directly cast doubt on his narrative of impartial oversight.

Opposition MPs argued that Bains’ procedural evasions were thinly veiled attempts to cover for what looks like a Liberal patronage pipeline. His refusal to answer clearly and his dependence on “I don’t recall” responses drew sharp criticism, with opposition leaders labeling it as a standard Liberal tactic to avoid admitting responsibility. The result? A testimony that shed little light on how SDTC was run but spoke volumes about the government’s willingness to dodge accountability whenever insiders are involved.

Inclusion and “Transparency” Won’t Save Liberals from Accountability

Throughout the Public Accounts Committee hearing, Liberal MPs Jean Yip and Francis Drouin took on a clear mission: protect Navdeep Bains at all costs. Instead of addressing the mountain of allegations around SDTC’s blatant cronyism and taxpayer waste, Yip and Drouin turned the hearing into a platform for Liberal talking points, spinning tales of “transparency” and “diversity” that conveniently dodged the actual corruption in front of them. Let’s be clear: hiding behind “inclusivity” doesn’t make the Liberals less corrupt, nor does it absolve them of responsibility when taxpayer money is at stake.

Jean Yip’s questioning gave Bains endless opportunities to recite the “open and competitive” process that supposedly led to Annette Verschuren’s appointment as SDTC board chair. Yet she never asked about Verschuren’s Liberal ties, or why so many millions were awarded to companies connected to SDTC board members. Yip’s focus on “inclusion” and “diverse voices” on the board was a distraction — a slick attempt to shift attention away from the Auditor General’s findings and avoid the reality that those “diverse voices” are well-connected Liberal insiders benefiting from your money.

Francis Drouin was right there to keep the narrative going, pivoting to SDTC’s supposed “green mandate” and giving Bains a platform to tout his government’s commitment to sustainability. But let’s call it what it is: a cover. By talking up sustainability and diversity, Drouin helped Bains avoid explaining why SDTC mismanaged $330 million on projects tied to its own board members, and why an additional $59 million went to ineligible initiatives. This wasn’t accountability — it was damage control, plain and simple.

Yip and Drouin’s interventions were textbook Liberal tactics: deflect, divert, and dilute the discussion. They may have repeated “transparency” and “inclusivity” all they wanted, but these buzzwords are nothing more than a smokescreen for taxpayer-funded favoritism. For Canadians watching, it was an unmistakable display of damage control — the Liberals doing everything they can to dodge real accountability while your tax dollars keep flowing to their inner circle.

Broader Implications: A Systemic Liberal Culture of Avoiding Accountability

The revelations from this Public Accounts Committee meeting show us something far darker than the mismanagement of a single agency. They expose a deeply entrenched system where Trudeau’s Liberal government doesn’t just waste taxpayer money — they use it to reward political cronies and shield insiders from accountability. This isn’t just negligence; it’s the Trudeau Swamp in action, a well-oiled machine funneling your money to friends and allies under the thin cover of bureaucratic “process.”

At the center of this scandal is a strategy the Liberals have perfected: hide behind procedural jargon and “arm’s-length” defenses to dodge any responsibility. The moment former Minister Navdeep Bains took the stand, you could see the tactics at work. Facing questions on how Sustainable Development Technology Canada (SDTC) turned into a cash cow for Liberal insiders, Bains and his fellow Liberal MPs defaulted to the same tired script — insisting every questionable allocation, every insider appointment, was just “routine process.” They claim “independence,” they claim “transparency,” but the evidence paints a different picture: Liberal insiders filling key roles and pulling the strings to channel your money into their pockets.

This scandal isn’t an isolated incident. It’s a glimpse into a troubling pattern, where taxpayer funds — meant for genuine public service — have become Trudeau’s political currency, up for grabs to those with the right connections. And make no mistake: Navdeep Bains’ refusal to answer real questions isn’t just about protecting himself. It’s about preserving a whole Liberal network that thrives on government patronage, hidden behind bureaucratic red tape. The Liberals have turned “process” into a shield, protecting ministers from facing the consequences of their actions.

The stakes couldn’t be higher for Canadians. This isn’t just about misusing a few dollars — it’s about a government prioritizing loyalty over public good, rewarding insiders while millions of Canadians wonder where their taxes are actually going. Under Trudeau’s watch, the promise of accountability has become a punchline, replaced with cronyism and evasion. So here’s the real question: Is Canada governed for its citizens, or for an elite network of well-connected Liberal insiders? Because after this committee meeting, the answer seems painfully clear.

Subscribe to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

Bruce Dowbiggin

How Did PEI Become A Forward Branch Plant For Xi’s China?

scoopercooper DEA Busts Canadian Narco Whose Chinese Supplier Promised to Ship 100 Kilos of Fentanyl Precursors per Month From Vancouver to Los Angeles

https://x.com/scoopercooper/status/1945489327892365716

The Chinese Communist Party is flooding America with dirty pesticide marijuana disguised as THCa hemp flower and hemp-derived products sold in smoke shops.

Official Silence on Medical Waste From PRC-Linked Monasteries Must Be Broken .

We were talking very recently to a Toronto friend about the threat of drug trafficking—in particular fentanyl— to the U.S. as a threat to Canada’s sovereignty. This businessman, who does considerable international trade, shrugged and said it’s no big deal. He’d heard the Yanks had only caught 59 pounds at the border between 2022-2024. To his eye, things were under control.

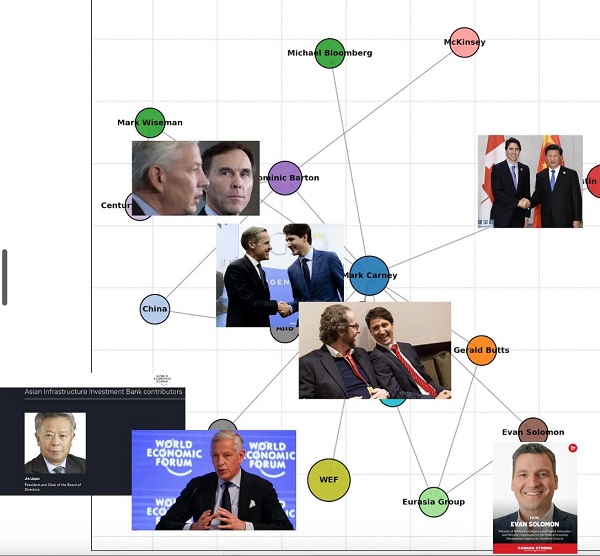

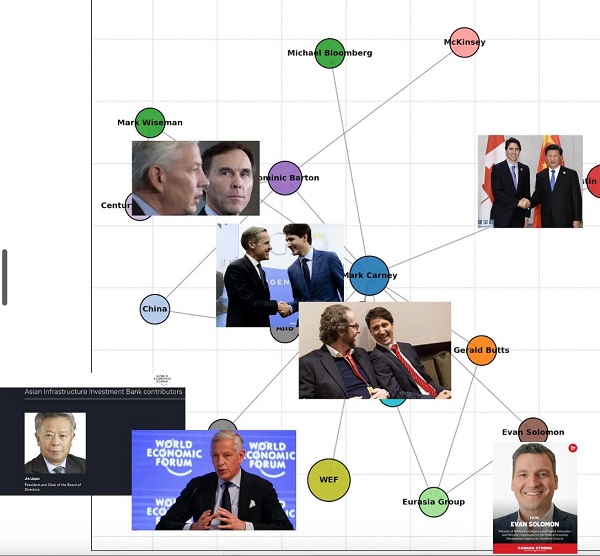

This statistic was, of course, the Liberals’ standard talking point in the 2025 election— part of Mark Carney’s What, Me Worry? appeal about China to anxious Boomers. My friend still repeating this twaddle is a tribute to the staying power of the Liberal’s media stranglehold in the face of evidence that has been out there courtesy of reporters such Sam Cooper and Garry Clement since 2015.

As the above stories illustrate drug trafficking and money laundering are believed to be rampant in Carney’s Canada— with the Chinese in the forefront and immigrant students-turned-truckers hauling the narcotics across the border. The fentanyl version of El Chapo and other confederates live openly in the Toronto area. As the recent bust promising 100 kilos a month to L.A. makes clear, the 59-pound fentanyl deflection insults the work of those who have been labouring under dangerous conditions to highlight the Liberals’ lassitude on crime.

As we wrote when Justin Trudeau was still swanning around as PM: “The sitting Canadian prime minister, who praised the Chinese form of governing before he reached the PM post, has been seen in photos with underground Asian gang figures. As were previous Liberal leaders like Jean Chretien who made no secret of his lust for the Chinese market. Chinese money was used to build extensively in Chretien’s Shawinigan riding.

Donations to Trudeau from all across Canada constituted up to 80 percent of the riding’s contributions that year. In May 2016, one such fundraiser saw Trudeau hosted by Benson Wong, chair of the Chinese Business Chamber of Commerce, along with 32 other wealthy guests in a pay-for-access event. The patterns exposed by Cooper finally prompted a commission by Quebec justice Marie-Josée Hogue looking into Chinese interference in Trudeau’s successful 2019 and 2021 elections.

Hogue later reported that Chinese interference in those elections did undermine the rights of Canadian voters because it “tainted the process” and eroded public trust. So petrified was Trudeau of the full Hogue Report that he prorogued parliament for three months and handed in his resignation rather than test his 22 percent approval rating in a Canadian election.”

What the rest of the world knows— but Canadian officials refused to tell their citizens during the federal election campaign— is that Canada has been corrupted by openly approving of China’s method of controlling their citizens worldwide and placing operatives within Canada’s government.

The story of how Liberal candidate Paul Chiang told a Chinese-language media news conference that people could cash in if they turned in Conservative Joe Tay in to the Chinese consulate in Toronto is illustrative. At first Carney called it a “lapse in judgment”, but then he let Chiang continue as a candidate. After pushback, Peter Yuen, was appointed the Liberal party’s nominee in the Toronto-area riding. Yuen has ties to Chinese agencies that seek to control Chinese citizens in Canada. (He lost in the April vote.)

Equally concerning is how the CCP has turned peaceful PEI into a forward operating base. On a recent trip to PEI we were told by local sources about the Buddhist monasteries being allowed under the not-so-watchful eye of various layers of government and the paid-for Media Party. Using bags full of dirty cash, the Bliss & Wisdom Buddhists have bought up large tracts of PEI farmland and replaced it with a front for the CCP to launder dirty money and infiltrate its people into the community. (The Buddhists deny this.)

Meetings have drawn hundreds of concerned Islanders (but not, until recently, many politicians or media). The latest outrage was the discovery of medical waste left behind on a rural property. It is alleged that it stems from a tuberculosis outbreak among the monks, where still-infectious monks were quietly sent home to China on public airlines wearing masks. Fires that destroyed two buildings nearby are alleged to have been to protect against health officials finding evidence of TB on site.

Media attention from outside PEI is now pushing officials to investigate the attempt to plant “police” stations to monitor expatriate Chinese and affect elections. Former RCMP officer Garry Clement has done extensive research on this file with Michel Juneau-Katsuya and Dean Baxendale. For more detailed description on the infiltration and political manipulation read Canada Under Siege: How PEI Became A Forward Operating Base of the Chinese Communist Party.

These are dramatic times as its appears that Chairman Xi might be on his way out as the leader of China. Any changes in the regime are just rumours at the moment. But Xi has overseen this massive campaign to extend Chinese outreach globally. That it would include even tiny PEI is shocking. The hope there is that with the Chinese economy under strain a new ruling elite in Beijing might pull back on the worldwide network as an expensive gamble.

That the China cheering club in the Liberal party in involved is less surprising since the outreach by Trudeau’s father Pierre in the 1970s. But with tariff issues dominating the news it would do well for Canadians to sober up to how compromised they are by the Chinese. That— not Donald Trump— is their biggest challenge.

Bruce Dowbiggin @dowbboy is the editor of Not The Public Broadcaster A two-time winner of the Gemini Award as Canada’s top television sports broadcaster, his new book Deal With It: The Trades That Stunned The NHL And Changed hockey is now available on Amazon. Inexact Science: The Six Most Compelling Draft Years In NHL History, his previous book with his son Evan, was voted the seventh-best professional hockey book of all time by bookauthority.org . His 2004 book Money Players was voted sixth best on the same list, and is available via brucedowbigginbooks.ca.

Business

Is dirty Chinese money undermining Canada’s Arctic?

By Pauline Springer for Inside Policy

Pauline Springer warns that Canada’s lax rules on foreign investment are doing the dirty work for our geopolitical adversaries.

China’s interest in the Canadian Arctic is growing. The People’s Republic evidently views the Arctic as a strategic frontier rich in untapped resources and geopolitical leverage. China’s attempt to acquire stakes in mining operations such as the Izok Corridor and the Doris North gold mine in Nunavut indicate a broader strategy. China’s Arctic activity is a calculated bid to lock in influence under the friendly sounding banners of the Polar Silk Road and the Belt and Road Initiative, using investment and infrastructure to secure long-term influence.

Admittedly most Chinese investments in the Canadian Arctic to date have failed, are yet to be realized, or are relatively insignificant, but this should not lead Canadians to underestimate the threat or ignore the broader strategy behind China’s significant engagement across the Arctic. Some Canadian stakeholders view Chinese capital as a benign path to regional development and self-sufficiency but this is naïve and dangerous. The limited scale of successful, traceable Chinese investment to date should not be used as a justification for inaction against the clear threat to regional sovereignty.

National security threats arising from foreign investment led to the creation of the Investment Canada Act in early 2024, which requires disclosure of foreign investors and mandates transparency in the submission of investment information. With the passage of Bill C-34 in 2009, the Act was further strengthened to include specific timelines for security reviews and mechanisms for information-sharing with investigative bodies. These reforms were a late and incomplete admission that foreign capital is not just risky – it’s already rewriting the rules in sectors critical to national security.

Chinese state-linked and private entities have not only engaged in opaque investment practices but have also been implicated in large-scale money laundering operations across Canada. The money laundering schemes typically involve underground banking networks, convoluted ownership structures, and unregistered money service businesses, which funnel illicit capital into high-value assets such as real estate, infrastructure, and mining ventures. According to FINTRAC’s Laundering the Proceeds of Crime through Underground Banking Schemes, much of this money is moved through informal and untraceable financial channels, often linked to Chinese sources.

Money laundering typically unfolds in three stages: placement (introducing illicit funds into the financial system), layering (concealing the origin through complex transactions), and integration (reintroducing the money as seemingly legitimate income).

A particularly relevant mechanism in this context is trade-based money laundering (TBML) which enables illicit funds to be disguised as legitimate commerce through the manipulation of trade transactions.

In northern Canada, where oversight of mineral exports and industrial equipment imports is limited, the mining sector provides opportunities for trade based laundering of proceeds from transnational crime under the pretext of resource development. The Organized Crime and Corruption Reporting Project (OCCRP) reported that Chinese Triads and other transnational criminal organizations have laundered billions of dollars through Canadian financial and corporate systems, particularly in British Columbia.

This laundering activity is not a parallel issue to foreign investment – it is embedded within it. The same corporate tools used to facilitate transnational investments are often used to conceal the source of funds, mask ownership, and bypass national scrutiny. Shell companies and foreign actors can disguise themselves as Canadian or Indigenous-owned companies, while the actual control remains offshore.

One of the key enablers of this opacity is the phenomenon known as snow-washing: a term that refers to the use of Canada’s pristine international reputation to launder money through anonymous corporations. Canada’s corporate registration system still allows individuals to form companies without disclosing the true beneficial owner. As of late 2023, Canada ranked 70th in terms of ability to access information on companies, below Sri Lanka, El Salvador and Bahrain. Foreign actors can register companies, list local nominees as front directors, and then use these entities to invest in sensitive sectors with virtually no public oversight. Canada’s lax rules are doing the dirty work for our adversaries.

In early 2024, Canada introduced a requirement under the Canada Business Corporations Act (CBCA) to collect information on “individuals with significant control,” marking a step toward greater transparency. A federal public registry is in development. Crucially, publicly listed corporations are exempt from these disclosure requirements, and the system’s effectiveness hinges on alignment with provincial registries. Without full national coverage and seamless integration between federal and provincial systems, Canada’s transparency framework risks remaining fragmented, with loopholes that continue to benefit bad actors.

What might this look like operationally? The formation of such a shell company in Canada’s Arctic is relatively straightforward. A local entrepreneur registers a mining company in the High North, listing themselves as the owner. However, the actual financial backing originates from Chinese private or state-linked actors, who remain in the background. Due to the scale of their investment and the influence it affords, these individuals become de-facto beneficial owners. Yet, in the absence of effective monitoring mechanisms and a central, publicly accessible registry for beneficial ownership, the company continues to appear Canadian-owned. This poses a significant governance challenge: it is impossible to assess how many ostensibly local companies are, in fact, under foreign control and to what extent.

Bill C-34 aims to mitigate this risk by imposing minimum reporting requirements for foreign investment. Nonetheless, the challenge becomes even more acute when examined through the lens of money laundering. As previously discussed, there is substantial evidence that Chinese (including state-linked) entities have used Canada’s economy as a vehicle for laundering illicit funds. When those funds pass through complex corporate layers, where even identifying foreign ownership is already difficult, they can be easily embedded in the local economy. The profits, now “clean,” carry the appearance of legitimate origin, completing the cycle and reinforcing a system that is fundamentally opaque and unaccountable.

Crucially, the use of shell companies for money laundering in the Arctic is extraordinarily difficult to prove, as both the existence of shell structures and the laundering activities themselves are inherently opaque and challenging to detect. Canadian oversight bodies are playing catch-up while foreign actors exploit the shadows.

As a result, there is a serious lack of reliable data in the public domain on the actual extent of the problem. Investigative bodies face structural and legal obstacles in tracing ownership or financial flows, especially when they intersect with international jurisdictions or nominal Indigenous ownership structures that shield the real beneficiaries.

This lack of hard evidence makes it easy for policymakers to downplay or disregard the threat. However, the absence of precise numbers should not be misread as an absence of risk. On the contrary, the reasonable deduction that such structures are ripe for abuse – especially given China’s documented use of opaque financial networks and strategic investments – provides sufficient grounds to act. The deep concealment and the below-threshold tactics are precisely what make it dangerous.

The risks posed by unmonitored foreign investment stem, in part, from deeper domestic shortcomings. Chronic underfunding and a top-down governance model where decisions about the North are made in Ottawa, have left northern regions exposed. Canada’s northern provinces and territories, despite covering over 40 per cent of the national landmass, remain economically marginalized and structurally underdeveloped. This vacuum may invite external actors like China to step in where the federal government has long neglected to act. This further underscores the need for any policy response, whether from the RCMP, FINTRAC, or CSIS, to be coordinated with territorial and Indigenous governments, ensuring their meaningful involvement in the policymaking process and law enforcement actions.

Canada must act decisively on two fronts:

First, it must adopt robust transparency measures in corporate law and foreign investment screening, including following through with establishing a publicly accessible beneficial ownership registry on a national level, and closing loopholes that allow nominee directors or shell entities to hide foreign control.

Second, domestic investment must be scaled up dramatically. Canada needs to close the infrastructure and development gap in the Arctic by directly funding northern communities. Rather than simply increasing spending, policy should focus on making capital more accessible to northern and Indigenous-led projects through transparent, well-regulated mechanisms. This includes expanding grant and loan programs tailored to regional development, enhancing Indigenous financial institutions, and embedding anti-money laundering safeguards into all funding streams. These efforts would not only support reconciliation but also defend against covert financial influence.

Only strong domestic foundations and clear regulations can protect Canada from the corrosive threats of dirty foreign money. A threat exists where both intent and opportunity align; and the opportunity to launder money through shadow companies and foreign investment is undeniably present. The Canadian government must stop treating Arctic security as a seasonal concern, starting with the laws and loopholes that allow foreign money to buy silence, access, and influence in the Arctic.

Pauline Springer is a graduate researcher in International Relations specializing in Arctic security and Chinese influence.

-

COVID-192 days ago

COVID-192 days agoSen. Rand Paul: ‘I am officially re-referring Dr. Fauci to the DOJ’

-

International2 days ago

International2 days agoMatt Walsh slams Trump administration’s move to bury Epstein sex trafficking scandal

-

National2 days ago

National2 days agoDemocracy Watch Blows the Whistle on Carney’s Ethics Sham

-

Energy1 day ago

Energy1 day agoIs The Carney Government Making Canadian Energy More “Investible”?

-

Business1 day ago

Business1 day agoCompetition Bureau is right—Canada should open up competition in the air

-

Immigration1 day ago

Immigration1 day agoUnregulated medical procedures? Price Edward Islanders Want Answers After Finding Biomedical Waste From PRC-Linked Monasteries

-

Business1 day ago

Business1 day agoDemocracy Watchdog Says PM Carney’s “Ethics Screen” Actually “Hides His Participation” In Conflicted Investments

-

John Stossel2 days ago

John Stossel2 days agoThe Green Industrial Complex: Power, Panic, and Profits