Fraser Institute

It’s budget season—but more money won’t solve Canada’s health-care woes

From the Fraser Institute

In light of regular reports of hallway health care, regular closures of emergency rooms, and the longest wait times for care on record, it’s understandable that Canadians want dramatic improvements to their health-care system. For governments, particularly during budget season, improvement often means an increase in spending.

However, Canada already ranks among the most expensive universal health-care systems in the world. In 2022 (the latest year of comparable data), and after adjusting for population age in each country, Canada ranked fourth-highest for health-care spending as a share of the economy (11.5 per cent). For per-person spending, Canada ranked ninth. In other words, whichever way you look at it, Canada ranked among the top-third of spenders among 31 universal health-care countries.

That’s a lot of money. But what do Canadians get in return?

Canada ranked near the bottom (28th of 30) on the availability of physicians. Canada also had some of the fewest hospital beds and diagnostic equipment (including CT scanners and MRI units) per person.

Moreover, among nine universal health-care countries surveyed by the Commonwealth Fund, a health-care research organization, 65.2 per cent of Canadian patients reported waiting more than one month for a specialist appointment (8th worst out of 9 countries) compared to 35.7 per cent in top-ranked the Netherlands.

We see the same thing for patients trying to access timely non-emergency surgical care. In Canada, 58.3 per cent of patients reported waiting more than two months (9th worst of 9 countries), far more than in the Netherlands (20.3 per cent), Germany (20.4 per cent) and Switzerland (21.1 per cent).

While Canada clearly struggles on measures of availability and timely access to medical resources, it reported mixed results in other areas. For example, Canada performed well on measures of heart attack survival (ranked 8th of 26). And while Canada had average performance for stroke survivability, it remained a bottom of the barrel performer on safety measures such as obstetric trauma during birth (23rd of 23).

With relatively fewer key medical resources and long waits for non-emergency surgery, patients in Canada face major challenges. And this budget season, while governments may be keen to simply spend more, in reality Canadians do not currently receive commensurate value for their health-care dollars. Without fundamental reform, based on the experiences of other more successful universal health-care systems, it’s unlikely we’ll see improvement.

Mackenzie Moir

Fraser Institute

Democracy waning in Canada due to federal policies

From the Fraser Institute

By Lydia Miljan

In How Democracies Die, Harvard political scientists Steven Levitsky and Daniel Ziblatt argue that while some democracies collapse due to external threats, many more self-destruct from within. Democratic backsliding often occurs not through dramatic coups but through the gradual erosion of institutions by elected leaders—presidents or prime ministers—who subvert the very system that brought them to power. Sometimes this process is swift, as in Germany in 1933, but more often it unfolds slowly and almost imperceptibly.

The book was written during Donald Trump’s first presidential term, when the authors expressed concern about his disregard for democratic norms. Drawing on Juan Linz’s 1978 work The Breakdown of Democratic Regimes, Levitsky and Ziblatt identified several warning signs of democratic decline in Trump’s leadership: rejection of democratic rules, denial of the legitimacy of political opponents, tolerance or encouragement of violence, and a willingness to restrict dissent including criticism from the media.

While Trump is an easy target for such critiques, Levitsky and Ziblatt’s broader thesis is that no democracy is immune to these threats. Could Canada be at risk of democratic decline? In light of developments over the past decade, perhaps.

Consider, for example, the state of free speech and government criticism. The previous Liberal government under Justin Trudeau was notably effective at cultivating a favourable media environment. Following the 2015 election, the media enjoyed a prolonged honeymoon period, often focusing on the prime minister’s image and “sunny ways.” After the 2019 election, which resulted in a minority government, the strategy shifted toward direct financial support. Citing pandemic-related revenue losses, the government introduced “temporary” subsidies for media organizations. These programs have since become permanent and costly, with $325 million allocated for 2024/25. During the 2025 election campaign, Mark Carney pledged to increase this by an additional $150 million.

Beyond the sheer scale of these subsidies, there’s growing concern that legacy media outlets—now financially dependent on government support—may struggle to maintain objectivity, particularly during national elections. This dependency risks undermining the media’s role as a watchdog of democracy.

Second, on April 27, 2023, the Trudeau government passed Bill C-11, an update to the Broadcasting Act that extends CRTC regulation to digital content. While individual social media users and podcasters are technically exempt, the law allows the CRTC to regulate platforms that host content from traditional broadcasters and streaming services—raising concerns about indirect censorship. This move further restricted freedom of speech in Canada.

Third, the government’s invocation of the Emergencies Act to end the Freedom Convoy protest in Ottawa was ruled unconstitutional by Federal Court Justice Richard Mosley who found that the government had not met the legal threshold for such extraordinary powers. The same day of the ruling the government announced it would appeal the 200-page decision, doubling down on its justification for invoking the Act.

In addition to these concerns, federal government program spending has grown significantly—from 12.8 per cent of GDP in 2014/15 to a projected 16.2 per cent in 2023/24—indicating that the government is consuming an increasing share of the country’s resources.

Finally, Bill C-5, the One Canadian Economy Act, which became law on June 26, grants the federal cabinet—and effectively the prime minister—the power to override existing laws and regulations for projects deemed in the “national interest.” The bill’s vague language leaves the definition of “national interest” open to broad interpretation, giving the executive branch unprecedented authority to micromanage major projects.

Individually, these developments may appear justifiable or benign. Taken together, they suggest a troubling pattern—a gradual erosion of democratic norms and institutions in Canada.

Business

Carney government should apply lessons from 1990s in spending review

From the Fraser Institute

By Jake Fuss and Grady Munro

For the summer leading up to the 2025 fall budget, the Carney government has launched a federal spending review aimed at finding savings that will help pay for recent major policy announcements. While this appears to be a step in the right direction, lessons from the past suggest the government must be more ambitious in its review to overcome the fiscal challenges facing Canada.

In two letters sent to federal cabinet ministers, Finance Minister François-Philippe Champagne outlined plans for a “Comprehensive Expenditure Review” that will see ministers evaluate spending programs in each of their portfolios based on the following: whether they are “meeting their objectives” are “core to the federal mandate” and “complement vs. duplicate what is offered elsewhere by the federal government or by other levels of government.” Ultimately, as a result of this review, ministers are expected to find savings of 7.5 per cent in 2026/27, rising to 10 per cent the following year, and reaching 15 per cent by 2028/29.

This news comes after the federal government has recently made several major policy announcements that will significantly impact the bottom line. Most notably, the government added an additional $9.3 billion to the defence budget for this fiscal year, and committed to more than double the annual defence budget by 2035. Without any policies to offset the fiscal impact of this higher defence spending (along with other recent changes), this year’s budget deficit (which the Liberal’s election platform initially pegged at $62.3 billion) will likely surpass $70.0 billion, and potentially may reach as high as $92.2 billion.

A spending review is long overdue. Recent research suggests that each year the federal government spends billions towards programs that are inefficient and/or ineffective, and which should be eliminated to find savings. Moreover, past governments (both federal and provincial) have proven that fiscal adjustments based on spending reviews can be very successful—just look at the Chrétien government’s 1995 Program Review.

In its 1995 budget, the federal Chrétien government launched a comprehensive review of all federal spending that—along with several minor tax increases—ultimately balanced the federal budget in two years and helped Canada avert a fiscal crisis. Two aspects of this review were critical to its success: it reviewed all federal spending initiatives with no exceptions, and it was based on clear criteria that not only tested whether spending was efficient, but which also reassessed the federal government’s role in delivering programs and services to Canadians. Unfortunately, the Carney government’s review is missing these two critical aspects.

The Carney government already plans to exclude large swathes of the budget from its spending review. While it might be reasonable for the government to exclude defence spending given our recent commitments (though that doesn’t appear to be the plan), the Carney government has instead chosen to exclude all transfers to individuals (such as seniors’ benefits) and provinces (such as health-care spending) from any spending cuts. Based on the last official spending estimates for this year, these two areas alone represent a combined $254.6 billion—or more than half of total spending after excluding debt charges—that won’t be reviewed.

This is a major weakness in the government’s plan. Not only does this limit the dollar value of savings available, it also means a significant portion of the government’s budget is missing out on a reassessment that could lead to more effective delivery of services for Canadians.

For example, as part of the 1995 program review, the Chrétien government overhauled how it delivered welfare transfers to provincial governments. Specifically, the federal government replaced two previous programs with a new Canada Health and Social Transfer (CHST) that addressed some major flaws with how the government delivered welfare assistance. While the transition to the CHST did include a $4.6 billion reduction in spending on government transfers, the new structure gave the federal government better control over spending growth in the future and allowed provincial governments more flexibility to tailor social assistance programs to local needs and preferences.

In addition to considering all areas of spending, the Carney government’s spending review also needs to be more ambitious in its criteria. While the current criteria are an important start—for example, it’s critical the government identifies and eliminates spending programs that aren’t achieving their stated objectives or which are simply duplicating another program—the Carney government should take it one step further and explicitly reflect on the role of the federal government itself.

Among other criteria that focused on efficiency and affordability of programs, the 1995 program review also evaluated every spending program based on whether government intervention was even necessary, and whether or not the federal government specifically should be involved. As such, not only did the program review eliminate costly inefficiencies, it also included the privatization of government-owned entities such as Petro-Canada and Canadian National Railway—which generated considerable economic benefits for Canadians.

Today, the federal government devotes considerable amounts of spending each year towards areas that are outside of its jurisdiction and/or which government shouldn’t be involved in the first place—national pharmacare, national dental care, and national daycare all being prime examples. Ignoring the fact that many of these areas (including the three examples) are already excluded from the Carney government’s spending review, the government’s criteria makes no explicit effort to test whether a program is targeting an area that’s outside of the federal purview.

For instance, while the government will test whether or not a spending program fits within the federal mandate, that mandate will not actually ensure the government stays within its own jurisdictional lane. Instead, the mandate simply lays out the key priorities the Carney government intends to focus on—including vague goals including, “Bringing down costs for Canadians and helping them to get ahead” which could be used to justify considerable federal overreach. Similarly, the government’s other criterion to not duplicate programs offered by other levels of government provides little meaningful restriction on government spending that is outside of its jurisdiction so long as that spending can be viewed as “complementing” provincial efforts. In other words, this spending review is unlikely to meaningfully check the costly growth in the size of government that Canada has experienced over the last decade.

Simply put, the Carney government’s spending review, while a step in the right direction, is missing key elements that will limit its effectiveness. Applying key lessons from the Chrétien government’s spending review is crucial for success today.

Grady Munro

Policy Analyst, Fraser Institute

-

Alberta8 hours ago

Alberta8 hours agoMedian workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

Uncategorized2 days ago

Uncategorized2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

COVID-191 day ago

COVID-191 day agoTrump DOJ dismisses charges against doctor who issued fake COVID passports

-

Business1 day ago

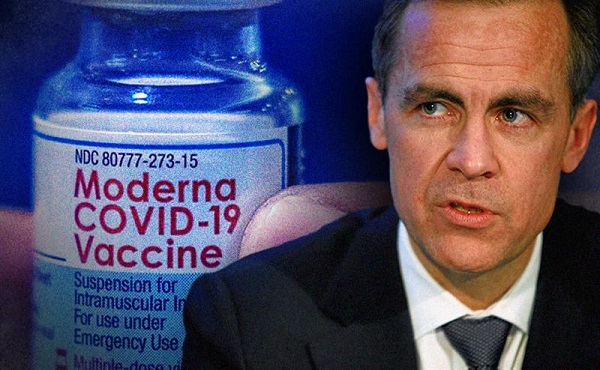

Business1 day agoCarney Liberals quietly award Pfizer, Moderna nearly $400 million for new COVID shot contracts

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Energy23 hours ago

Energy23 hours agoActivists using the courts in attempt to hijack energy policy