Economy

Fossil fuels aren’t going anywhere, we benefit too much from them

From the MacDonald Laurier Institute

By Chris Sankey

Indigenous people are finally reaping the rewards.

Over the last eight years we have experienced an unprecedented push from environmental activists to phase out fossil fuels. The Government of Canada seems to think it is possible. During question period in the Senate earlier this year, Sen. David Wells noted that, according to the Liberals, the energy transition “will cost $100-$125 billion per year at least to 2050,” and asked “When Canada only emits 1.5 per cent of global emissions, how does this expenditure make sense?”

Let me repeat that. $125 billion each year.

Who is going to pay for this? This is simply not possible, unless people want to see the Canadian economy in ruins.

Without fossil fuels, life as we know it would not be possible. State-of-the-art lifesaving medical equipment comes from fossil fuels and critical minerals from mining. Critical infrastructure, vehicles, planes, trains, container ships, ferries, and the billions of household necessities we buy from Canadian Tire, Walmart, Amazon and Ikea come from fossil fuels and help us function in our everyday lives. Without these needs we simply do not prosper.

Take for instance the environmental marches we see on our streets. The protesters seemingly have zero understanding of what makes their marches possible? Yes, fossil fuels. If you are going to protest for “Just Stop Oil,” then climate activists have to stop blocking traffic, because an idling vehicle is so much harder on the environment. And what about showing up in clothing and holding up signs made of hydrocarbons demonstrates your commitment to saving the planet? Hypocrisy? Absolutely.

From the moment we come out of our mother’s body, fossil fuels make our lives better. From cradle to grave, our lives are intertwined with fossil fuels. Just think of the act of giving birth. Chances are the mother was rushed to hospital in an ambulance, helicopter, plane, your personal vehicle, or taxi. As grandparents, siblings, uncles, aunts and cousins arrive at the hospital in their fossil fuel-powered cars and trucks smiling ear to ear welcoming the new baby to the family. They show up with gifts likely made from fossil fuels and critical minerals. If it is not made from fossil fuels, they were most definitely transported to the store using fossil fuels.

It is time we stop kidding ourselves that we can step away from the oil and gas wealth upon which our country benefits so much.

Only now, it will be Indigenous communities who are going to lead the multi-billion-dollar opportunity and put Canada at the front of global markets as a preferred supplier. For far too long, activist’s voice have been the determining factor in how governments make decisions on this necessary industry in our territories.

We need to make sure we have a framework that lays out a technology transition where we produce cleaner oil and gas by using new technology that will reduce emissions and grow our economies.

Since the Liberals were elected in 2015 everywhere we turn, our resource sector is being badly hurt. Forestry, fishing, oil and gas are screaming for more production, but federal regulations threaten to not only destroy the energy industry, but all industries with the emissions cap. Renewables are costing taxpayers billions in subsidies and it will not end there.

Indigenous people have always took care of the environment and grown our economies. From fishing, logging, farming and hunting, we used fossil fuels to make it happen.

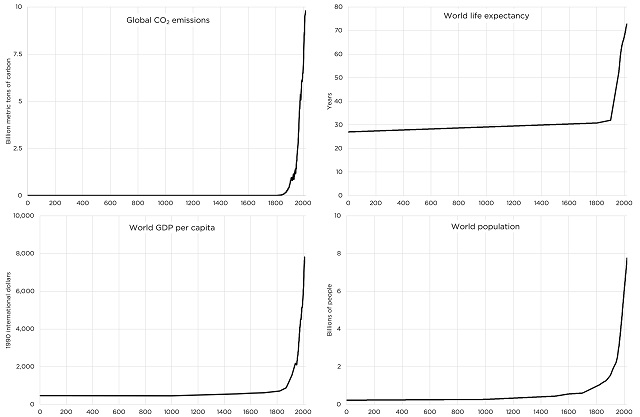

Obviously, humans did not use fossil fuels prior to the industrial revolution and indigenous people made hunting weapons out of wood and stone. Life was challenging for our ancestors back then; life expectancy was short for all people.

Over time, technology in the energy sector changed for the better. I would be remiss if I did not include the fact that industry did not always have modern clean tech; emissions were high and cancer-causing effects were widespread. That introduced chemicals foreign to indigenous people. Like all things, newer and safer technology emerged. Making life much easier and convenient.

However, historically speaking indigenous people lived on fat and protein. Everything we ate was natural. Like all things that come and go, European contact forever changed our way of life. We were greatly impacted in every possible manner, from social, cultural, status and creed. But like we always have, we persevered like our ancestors wanted us too.

This is our turn to take our rightful place on the global stage. We are watching it play out in real time around the world. Energy and food security is the number one priority around the world. Indigenous communities near and far are leading the way in the pursuit of sustainable development, but government and activists are hindering our ability to progress.

It is important that Canadians be realistic when it comes to the use of oil and gas. All of us want to leave our planet better for the next generation. To do so, we must manage expectations. Many countries are just now finally transitioning to oil and gas from more environmentally harmful coal and countries like India will not be carbon neutral until 2070 or later.

Our country has an abundance of resources that the world wants. They are literally knocking on our door to get access to our wealth. We can help countries like China, India and Indonesia move away from burning coal and wood, and thereby help lift millions out of certain poverty, and improve their health.

New climate change technology has emerged in the energy sector, such as carbon capture and storage that will reduce and eliminate emissions and the need for diluent in oil pipelines. Our combination of Indigenous knowledge and history to the land makes for a stronger argument to partner with Indigenous communities. Alignment amongst indigenous communities is key to securing a project. Proper alignment will de-risk a project and attract investment and industry to the table where we will have a seat and even equity.

Engagement with Indigenous communities is the solution. The vast majority of our people are not against development. We are only against development when we are excluded from the opportunities, or if the evaluation process was developed without Indigenous input.

It is not rocket-science. Include the people whose territory you want to build on. This is an opportunity to build relationships through meaningful dialogue and trust. We must have nation to nation dialogue and build leadership to leadership relationships. No hidden agendas, just up-front, honest conversations about oil and gas and the costs and benefits of development.

I am tired of watching our people struggle. Our people do not want to watch the prosperity boat sail by Poverty Island. Markets do not wait for anyone. We cannot keep waiting for the right time. We cannot keep waiting for life to get better. First Nations can make it better by being at the economic table where our people can bring traditional knowledge to industry and make decisions in the best interests of our communities. Whether we agree or not in the first instance, we need to be in the room working towards a brighter future, because at the end of the day we all need rubber boots too.

Chris Sankey is a Senior fellow at the MacDonald Laurier Institute, a former Elected Councilor for the Lax Kw Alaams Band and Businessman.

Business

Taxpayers criticize Trudeau and Ford for Honda deal

From the Canadian Taxpayers Federation

Author: Jay Goldberg

The Canadian Taxpayers Federation is criticizing the Trudeau and Ford governments to for giving $5 billion to the Honda Motor Company.

“The Trudeau and Ford governments are giving billions to yet another multinational corporation and leaving middle-class Canadians to pay for it,” said Jay Goldberg, CTF Ontario Director. “Prime Minister Justin Trudeau is sending small businesses bigger a bill with his capital gains tax hike and now he’s handing out billions more in corporate welfare to a huge multinational.

“This announcement is fundamentally unfair to taxpayers.”

The Trudeau government is giving Honda $2.5 billion. The Ford government announced an additional $2.5 billion subsidies for Honda.

The federal and provincial governments claim this new deal will create 1,000 new jobs, according to media reports. Even if that’s true, the handout will cost taxpayers $5 million per job. And according to Globe and Mail investigation, the government doesn’t even have a proper process in place to track whether promised jobs are actually created.

The Parliamentary Budget Officer has also called into question the government’s claims when it made similar multi-billion-dollar handouts to other multinational corporations.

“The break-even timeline for the $28.2 billion in production subsidies announced for Stellantis-LGES and Volkswagen is estimated to be 20 years, significantly longer than the government’s estimate of a payback within five years for Volkswagen,” wrote the Parliamentary Budget Officer said.

“If politicians want to grow the economy, they should cut taxes and red tape and cancel the corporate welfare,” said Franco Terrazzano, CTF Federal Director. “Just days ago, Trudeau said he wants the rich to pay more, so he should make rich multinational corporations pay for their own factories.”

Business

Maxime Bernier warns Canadians of Trudeau’s plan to implement WEF global tax regime

From LifeSiteNews

If ‘the idea of a global corporate tax becomes normalized, we may eventually see other agreements to impose other taxes, on carbon, airfare, or who knows what.’

People’s Party of Canada leader Maxime Bernier has warned that the Liberal government’s push for World Economic Forum (WEF) “Global Tax” scheme should concern Canadians.

According to Canada’s 2024 Budget, Prime Minister Justin Trudeau is working to pass the WEF’s Global Minimum Tax Act which will mandate that multinational companies pay a minimum tax rate of 15 percent.

“Canadians should be very concerned, for several reasons,” People’s Party leader Maxime Bernier told LifeSiteNews, in response to the proposal.

“First, the WEF is a globalist institution that actively campaigns for the establishment of a world government and for the adoption of socialist, authoritarian, and reactionary anti-growth policies across the world,” he explained. “Any proposal they make is very likely not in the interest of Canadians.”

“Second, this minimum tax on multinationals is a way to insidiously build support for a global harmonized tax regime that will lower tax competition between countries, and therefore ensure that taxes can stay higher everywhere,” he continued.

“Canada reaffirms its commitment to Pillar One and will continue to work diligently to finalize a multilateral treaty and bring the new system into effect as soon as a critical mass of countries is willing,” the budget stated.

“However, in view of consecutive delays internationally in implementing the multilateral treaty, Canada cannot continue to wait before taking action,” it continued.

The Trudeau government also announced it would be implementing “Pillar Two,” which aims to establish a global minimum corporate tax rate.

“Pillar Two of the plan is a global minimum tax regime to ensure that large multinational corporations are subject to a minimum effective tax rate of 15 per cent on their profits wherever they do business,” the Liberals explained.

“The federal government is moving ahead with legislation to implement the regime in Canada, following consultations last summer on draft legislative proposals for the new Global Minimum Tax Act,” it continued.

According to the budget, Trudeau promised to introduce the new legislation in Parliament soon.

The global tax was first proposed by Secretary-General of Amnesty International at the WEF meeting in Davos this January.

“Let’s start taxing carbon…[but] not just carbon tax,” the head of Amnesty International, Agnes Callamard, said during a panel discussion.

According to the WEF, the tax, proposed by the Organization for Economic Co-operation and Development (OECD), “imposes a minimum effective rate of 15% on corporate profits.”

Following the meeting, 140 countries, including Canada, pledged to impose the tax.

While a tax on large corporations does not necessarily sound unethical, implementing a global tax appears to be just the first step in the WEF’s globalization plan by undermining the sovereignty of nations.

While Bernier explained that multinationals should pay taxes, he argued it is the role of each country to determine what those taxes are.

“The logic of pressuring countries with low taxes to raise them is that it lessens fiscal competition and makes it then less costly and easier for countries with higher taxes to keep them high,” he said.

Bernier pointed out that competition is good since it “forces everyone to get better and more efficient.”

“In the end, we all end up paying for taxes, even those paid by multinationals, as it causes them to raise prices and transfer the cost of taxes to consumers,” he warned.

Bernier further explained that the new tax could be a first step “toward the implementation of global taxes by the United Nations or some of its agencies, with the cooperation of globalist governments like Trudeau’s willing to cede our sovereignty to these international organizations.”

“Just like ‘temporary taxes’ (like the income tax adopted during WWI) tend to become permanent, ‘minimum taxes’ tend to be raised,” he warned. “And if the idea of a global corporate tax becomes normalized, we may eventually see other agreements to impose other taxes, on carbon, airfare, or who knows what.”

Trudeau’s involvement in the WEF’s plan should not be surprising considering his current environmental goals – which are in lockstep with the United Nations’ 2030 Agenda for Sustainable Development – which include the phasing out coal-fired power plants, reducing fertilizer usage, and curbing natural gas use over the coming decades.

The reduction and eventual elimination of so-called “fossil fuels” and a transition to unreliable “green” energy has also been pushed by the World Economic Forum – the aforementioned group famous for its socialist “Great Reset” agenda – in which Trudeau and some of his cabinet are involved.

-

Business2 days ago

Business2 days agoTaxpayers criticize Trudeau and Ford for Honda deal

-

Business2 days ago

Business2 days agoUN plastics plans are unscientific and unrealistic

-

Fraser Institute2 days ago

Fraser Institute2 days agoCanadians should decide what to do with their money—not politicians and bureaucrats

-

Addictions2 days ago

Addictions2 days agoBritish Columbia should allow addicts to possess even more drugs, federal report suggests

-

Alberta2 days ago

Alberta2 days agoAlberta rejects unconstitutional cap on plastic production

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoAustralian politicians attack Elon Musk for refusing to remove video of Orthodox bishop’s stabbing

-

Alberta2 days ago

Alberta2 days agoAlberta official reveals ‘almost all’ wildfires in province this year have been started by humans

-

Alberta2 days ago

Alberta2 days agoPolitical parties will be part of municipal elections in Edmonton and Calgary pilot projects