Business

Federal government could save $10.7 billion this fiscal year by eliminating eight ineffective spending programs

From the Fraser Institute

By Jake Fuss and Grady Munro

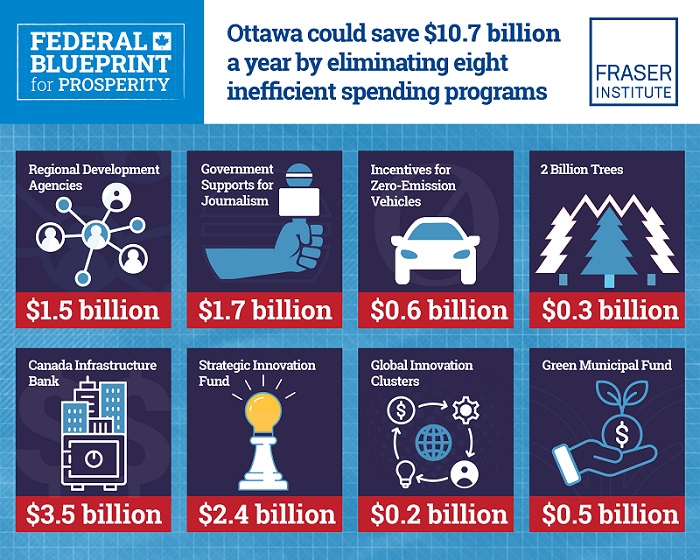

The federal government could save up to $10.7 billion this fiscal year by ending eight ineffective spending programs, finds a new report published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Canada’s federal finances have deteriorated markedly over the last decade, largely due to a rapid run up in spending, deficits and debt,” said Jake Fuss, director of fiscal studies at the Fraser Institute.

“As previous governments have done before, a comprehensive line-by-line review of Ottawa’s spending is required to identify those programs or initiatives that are not fulfilling their purpose, or are not providing good value for tax dollars.”

The study, Identifying Potential Savings from Specific Reductions to Federal Government Spending, highlights eight federal programs where government spending

does not appear to be accomplishing its stated goals, or where government funding is unnecessary:

– $1.5 billion — Regional Development Agencies

– $1.7 billion — Federal support for journalism

– $587.6 million — Federal support for electric vehicle production and purchases

– $340.0 million — Two Billion Trees program

– $3.5 billion — Canada Infrastructure Bank

– $2.4 billion — Strategic Innovation Fund

– $202.3 million — Global Innovation Clusters

– $530.0 million — Green Municipal Fund

Critically, eliminating these eight programs could reduce federal government spending by $10.7 billion in 2024-25: “Though just a starting point, a savings of $10.7 billion would meaningfully improve federal finances and help Ottawa put the country’s finances back on a stable footing,” Fuss said.

This study is part of a larger series of collected essays on federal policy reforms, Federal Blueprint for Prosperity, edited by Fraser Institute Senior Fellows Jock Finlayson and Lawrence Schembri.

The essay series, also released today, details federal policy reforms in health care, environmental and energy regulations, tax policy, immigration, housing, trade, etc. to increase prosperity for Canadians and improve living standards.

To learn more and to read the entire collected essay series, visit www.fraserinstitute.org.

Identifying Potential Savings from Specific Reductions in Federal Government Spending

- A marked deterioration in the state of Canada’s finances, driven largely by rapidly increasing spending, has created a need to review federal government spending to identify programs that are inefficient and/or ineffective. This study highlights eight spending areas that have easily identifiable problems, and should be a starting point for a more comprehensive review.

- The eight spending areas identified are: Regional Development Agencies, Government Supports for Journalism, Federal Support for Electric Vehicle Production and Purchases, the 2 Billion Trees Program, the Canada Infrastructure Bank, the Strategic Innovation Fund, the Global Innovation Clusters, and the Green Municipal Fund.

- These programs represent instances where government spending does not appear to be accomplishing the stated goals, and where government involvement is questionable.

- For instance, despite research suggesting business subsidies do little to promote widespread economic growth, the seven regional development agencies report vague objectives and results that make it difficult for government officials or Parliamentarians to assess the efficacy of the spending.

- Since the Canada Infrastructure Bank was first established in 2017, it has approved up to $13.2 billion in investments across 76 projects, but only two projects have been completed. These projects represent just $93.2 million (or 0.71 percent) of the total approved investments.

- The federal government could save $10.7 billion in 2024–25 alone if it eliminated spending in these eight areas. This amount would be impactful in improving the state of Canada’s finances, and more savings could be achieved through a comprehensive review of all spending.

Business

Liberal’s green spending putting Canada on a road to ruin

Once upon a time, Canadians were known for our prudence and good sense to such an extent that even our Liberal Party wore the mantle of fiscal responsibility.

Whatever else you might want to say about the party in the era of Jean Chrétien and Paul Martin, it recognized the country’s dire financial situation — back when The Wall Street Journal was referring to Canada as “an honorary member of the Third World” — as a national crisis.

And we (remember, I proudly served as Member of Parliament in that party for 18 years) made many hard decisions with an eye towards cutting spending, paying down the debt, and getting the country back on its feet.

Thankfully we succeeded.

Unfortunately, since then the party has been hijacked by a group of reckless leftwing fanatics — Justin Trudeau and his lackeys — who have spent the past several years feeding what we built into the woodchipper.

Mark Carney’s finally released budget is the perfect illustration of that.

The budget is a 400 page monument to deficit delusion that raises spending to $644.4 billion over five years — including $141.4 billion in new spending — while revenues limp to $583.3 billion, yielding a record (non-pandemic) $78.3 billion shortfall, an increase of 116% from last year.

This isn’t policy; it’s plunder. Interest payments alone devour $55.6 billion this year, projected to hit $76.1 billion by 2029-30 — more than the entire defence budget and rising faster than healthcare transfers.

We can’t discount the possibility that this will lead to a downgrade of our credit rating, which will significantly increase the cost of borrowing and of doing business more generally.

Numbers this big start to feel very abstract. But think of it this way: that is your money they’re spending. Ottawa’s wealth is made up entirely of our tax dollars. We’ve entrusted that money to them with the understanding that they will use it responsibly. In the decade these Liberals have been in power, they have betrayed that trust.

They’ve pursued policies which have made life in Canada increasingly unaffordable. For example, at the time of writing it takes 141 Canadian pennies (up from 139 a few days ago) to buy one U.S. dollar, in which all of our commodities are priced. Well, that’s .25 cents per litre of gasoline. Imagine what that’s going to do to the price of heating, of groceries, of the various other commodities which we consume.

And this budget demonstrates that the Carney era will be more of the same.

Of course, the Elbows Up crowd are saying the opposite — that this shows how fiscally responsible Mark Carney is, unlike his predecessor. (Never mind that they also publicly supported everything that Trudeau did when he was in government.) They claim that Carney shows that he’s more open to oil and gas than Trudeau was.

Don’t believe it.

The oil and gas sector does get a half-hearted nod in the budget with, for instance, a conditional pathway to repeal the emissions cap. But those conditions are important. Repeal is tied to the effectiveness of Carney’s beloved industrial carbon tax. If that newly super-charged carbon tax, which continues to make our lives more expensive, leads to government-set emissions reductions benchmarks being met, then Ottawa might — might — scrap the emissions.

Meanwhile, the budget doubles down on the Trudeau government’s methane emissions regulations. It merely loosens the provisions of the outrageous Bill C-59, an act which should have been scrapped in its entirety. And it leaves in place the Trudeaupian “green” super structure, which has resource sector investment, and any business that can manage it, fleeing to the U.S.

In these perilous times, with Canada teetering on the brink of recession, a responsible government would be cutting spending and getting out of the way of our most productive sectors, especially oil and gas — the backbone of our economy.

It would be repealing the BC tanker ban and Bill C-69, the “no more pipelines act,” so that our natural resources could better generate revenue on the international market and bring down energy rates at home.

It would quit wasting millions on Electric Vehicle charging stations; mandating that all Canadians buy EVs, even with their elevated cost; and pressuring automakers to manufacture Electric Vehicles, regardless of demand, and even as they keep closing up shop and heading south.

But in this budget the Liberals are going the opposite direction. Spend more. Tax more. Leave the basic Net-Zero framework in place. Rearrange the deck chairs on the Titanic.

They’re gambling tomorrow’s prosperity on yesterday’s green dogma, And every grocery run, every gas fill-up, every mortgage payment will serve as a daily reminder that we are the ones footing the bill.

Once upon a time, the Liberals knew better. We made the hard decisions and got the country back on its feet. Nowadays, not so much.

Business

Carney doubles down on NET ZERO

If you only listened to the mainstream media, you would think Justin Trudeau’s carbon tax is long gone. But the Liberal government’s latest budget actually doubled down on the industrial carbon tax.

While the consumer carbon tax may be paused, the industrial carbon tax punishes industry for “emitting” pollution. It’s only a matter of time before companies either pass the cost of the carbon tax to consumers or move to a country without a carbon tax.

Dan McTeague explains how Prime Minister Carney is doubling down on net zero scams.

-

Alberta2 days ago

Alberta2 days agoFederal budget: It’s not easy being green

-

Health19 hours ago

Health19 hours agoLack of adequate health care pushing Canadians toward assisted suicide

-

Business2 days ago

Business2 days agoWill Paramount turn the tide of legacy media and entertainment?

-

Energy2 days ago

Energy2 days agoA picture is worth a thousand spreadsheets

-

Energy1 day ago

Energy1 day agoIt should not take a crisis for Canada to develop the resources that make people and communities thrive.

-

Dr John Campbell1 day ago

Dr John Campbell1 day agoCures for Cancer? A new study shows incredible results from cheap generic drug Fenbendazole

-

Artificial Intelligence19 hours ago

Artificial Intelligence19 hours agoAI Faces Energy Problem With Only One Solution, Oil and Gas

-

National11 hours ago

National11 hours agoWatchdog Demands Answers as MP Chris d’Entremont Crosses Floor