Canadian Energy Centre

European governments are reassessing EU-directed green policies amid public unease

From the Canadian Energy Centre

By Shawn Logan

How ‘greenlash’ is forcing Europe to scale back ambitious net zero policies

European governments are beginning to sound the retreat on some foundational net zero policies in the wake of “greenlash” from increasingly overburdened citizens.

Russia’s invasion of Ukraine in 2022 prompted European governments to begin pivoting away from cheap Russian natural gas, which Europe increasingly relied on to backstop a laundry list of ambitious green policies.

But despite pledges by the European Union to “divest away from Russian gas as quickly as possible,” nearly 15% of overall EU gas imports still came from Russia in the first half of 2023, while the amount of liquefied natural gas (LNG) imported from Russia actually increased by 39.5% compared to the same period in 2021, prior to the Ukraine invasion.

Energy security and affordability have become central issues for Europeans amid a persistent global energy crisis, and that’s translated into a rethink of what had once seemed like unassailable green policies across Europe.

Here’s a look at how some countries are dealing with the new global reality:

Germany

Nothing is more symbolic of Europe’s retreat from its net zero ambitions than Germany seeing a wind farm dismantled to make room for the expansion of a lignite coal mine just outside of Dusseldorf.

And no European country has been more affected by the changing energy landscape than Germany, which introduced its multi-billion dollar Energiewende program in 2010, calling for a broad phaseout of fossil fuels and nuclear power, replacing them primarily with wind and solar power.

Today, without cheap and reliable natural gas backups due to sanctions against Russia, Germany has gone from Europe’s economic powerhouse to the world’s worst performing major developed economy, facing “deindustrialization” due to skyrocketing energy costs.

In addition to extending its deadline for shutting down coal plants until 2024, the German government has also scrapped plans for imposing tougher building insulation standards to reduce emissions as well as extending the deadline on controversial legislation to phase out oil and gas heating systems in homes, a decision the government admits will make it impossible to reach the country’s 2030 emissions targets.

A major car manufacturer, Germany’s opposition to an EU-wide ban on the sale of new combustion vehicles by 2035 softened the legislation to allow exceptions for those that run on e-fuels.

Germany’s quest for reliable energy exports prompted Chancellor Olaf Scholz to travel to Canada to make a personal appeal for Canadian LNG. He was sent home empty handed, advised there wasn’t a strong business case for the resource.

Great Britain

Britons have grown increasingly concerned about the cost of net zero policies, despite being largely supportive of striving for a greener future.

A YouGov poll in August found while 71% generally favoured Great Britain’s aim to reduce carbon emissions to net zero by 2050, some 55% agreed that policies should only be introduced if they don’t impose any additional costs for citizens. Only 27% agreed reaching the goal was important enough to warrant more spending.

That shift in public sentiment prompted Prime Minister Rishi Sunak to pump the brakes on some key policies enacted to reach the U.K.’s legally binding target of reaching net zero emissions by 2050.

In September, the government delayed its looming ban on new gas- and diesel-powered cars by five years to 2035, while also extending its phaseout of gas boilers in homes and suggesting exemptions for certain households and types of property.

“If we continue down this path, we risk losing the British people and the resulting backlash would not just be against specific policies, but against the wider mission itself,” Sunak said of the potential consequences of maintaining strict net zero policies.

The U.K. government also gave the green light for hundreds of new North Sea oil and gas licences, citing the need to bolster both energy security and the nation’s economy.

France

France’s net zero ambitions enjoy an advantage compared to its European peers due in large part to its significant fleet of nuclear power stations, which provide around 70 per cent of its electricity.

However, President Emmanuel Macron has often opted for a more pragmatic approach to reaching climate targets, noting any energy transition can’t leave citizens disadvantaged.

“We want an ecology that is accessible and fair, an ecology that leaves no one without a solution,” Macron said in September after ruling out a total ban on gas boilers, instead offering incentives to those looking to replace them with heat pumps.

Macron also famously dropped a proposed fuel tax in 2018 that sparked sweeping yellow vest protests across France when it was announced.

France has also extended the timeframe of its two remaining coal plants to continue operating until 2027, five years later than the plants were originally set to be shuttered.

Italy

Feeling the impacts of the global energy crisis, Italy has begun reassessing some of its previous commitments to transition goals.

Earlier this year, Italy pushed back on EU directives to improve the energy efficiency of buildings, which Italy’s national building association warned would cost some $400 billion euros over the next decade, with another $190 billion euros needed to ensure business properties met the required standards. The Italian government has called for exemptions and longer timelines.

Italy also warned the European Commission it would only support the EU’s phase out of combustion engine cars if it allows cars running on biofuels to eclipse the deadline, while further questioning a push to slash industrial emissions.

Paolo Angelini, deputy governor at the Bank of Italy, warned a rapid abandonment of fossil fuel-driven industries could have a devastating impact.

“If everybody divests from high-emitting sectors there will be a problem because if the economy does not adjust at the same time, things could blow up unless a miracle happens in terms of new technology,” he said.

Poland

Like Italy, Poland has dug in its heels against some EU net zero initiatives, and is actually suing the EU with the goal of overturning some of its climate-focused legislation in the courts.

“Does the EU want to make authoritarian decisions about what kind of vehicles Poles will drive and to increase energy prices in Poland? The Polish Government will not allow Brussels to dictate,” wrote Polish Climate and Environment Minister Anna Moskwa on X, formerly known as Twitter, in July.

In addition to looking to scrap the EU’s ban on combustion engine cars by 2035, Warsaw is also challenging laws around land use and forestry, updated 2030 emissions reduction targets for EU countries, and a border tariff on carbon-intensive goods entering the European Union.

With some 70% of its electricity generated by coal, Poland is one of Europe’s largest users of coal. And it has no designs on a rapid retreat from the most polluting fossil fuel, reaching an agreement with trade unions to keep mining coal until 2049.

Netherlands

The political consequences of leaning too far in on net zero targets are beginning to be seen in the Netherlands.

In March, a farmer’s protest party, the BBB or BoerBurgerBeweging (Farmer-Citizen Movement), shook up the political landscape by capturing 16 of 75 seats in the Dutch Senate, more than any other party, including the ruling coalition of the Labor and Green Parties.

The upstart party was formed in 2019 in response to government plans to significantly reduce nitrogen emissions from livestock by 2030, a move estimated to eliminate 11,200 farms and force another 17,600 farmers to significantly reduce their livestock.

What followed were nationwide protests that saw supermarket distribution centres blockaded, hay bales in flames and manure dumped on highways.

In November, Dutch voters will elect a new national government, and while BBB has dropped to fifth in polling, much of that support has been picked up by the fledgling New Social Contract (NSC), which has vowed to oppose further integration with EU policies, a similar stance offered by the BBB. The NSC currently tops the polls ahead of the Nov. 22 election.

Alberta

Upgrades at Port of Churchill spark ambitions for nation-building Arctic exports

In August 2024, a shipment of zinc concentrate departed from the Port of Churchill — marking the port’s first export of critical minerals in over two decades. Photo courtesy Arctic Gateway Group

From the Canadian Energy Centre

By Will Gibson

‘Churchill presents huge opportunities when it comes to mining, agriculture and energy’

When flooding in northern Manitoba washed out the rail line connecting the Town of Churchill to the rest of the country in May 2017, it cast serious questions about the future of the community of 900 people on the shores of Hudson Bay.

Eight years later, the provincial and federal governments have invested in Churchill as a crucial nation-building corridor opportunity to get resources from the Prairies to markets in Europe, Africa and South America.

Direct links to ocean and rail

Aerial view of the Hudson Bay Railway that connects to the Port of Churchill. Photo courtesy Arctic Gateway Group

The Port of Churchill is unique in North America.

Built in the 1920s for summer shipments of grain, it’s the continent’s only deepwater seaport with direct access to the Arctic Ocean and a direct link to the continental rail network, through the Hudson Bay Railway.

The port has four berths and is capable of handling large vessels. Having spent the past seven years upgrading both the rail line and the port, its owners are ready to expand shipping.

“After investing a lot to improve infrastructure that was neglected for decades, we see the possibilities and opportunities for commodities to come through Churchill whether that is critical minerals, grain, potash or energy,” said Chris Avery, CEO of the Arctic Gateway Group (AGG), a partnership of 29 First Nations and 12 remote northern Manitoba communities that owns the port and rail line.

“We are pleased to be in the conversation for these nation-building projects.”

In May, Canada’s Western premiers called for the Prime Minister’s full support for the development of an economic corridor connecting ports on the northwest coast and Hudson’s Bay, ultimately reaching Grays Bay, Nunavut.

Investments in Port of Churchill upgrades

AGG, which purchased the rail line and port from an American company in 2017, is not alone in the bullish view of Churchill’s future.

In February, Manitoba Premier Wab Kinew announced an investment of $36.4 million over two years in infrastructure projects at the port aimed at growing international trade.

“Churchill presents huge opportunities when it comes to mining, agriculture and energy,” Kinew said in a release.

“These new investments will build up Manitoba’s economic strength and open our province to new trading opportunities.”

In March, the federal government committed $175 million over five years to the project including $125 million to support the rail line and $50 million to develop the port.

“It’s important to point out that investing in Churchill was something that both the Liberal and Conservative parties agreed on during the federal election campaign,” said Avery, a British Columbian who worked in the airline industry for more than two decades before joining AGG.

Reduced travel time

The federal financial support helped AGG upgrade the rail line, repairing the 20 different locations where it was washed out by flooding in 2017.

Improvements included laying more than 1,600 rail cars worth of ballast rock for stabilization and drainage, installing almost 120,000 new railway ties and undertaking major bridge crossing rehabilitations and switch upgrades.

The result has seen travel time by rail reduced by three hours — or about 10 per cent — between The Pas and Churchill.

AGG also built a dedicated storage facility for critical minerals and other commodities at the port, the first new building in several decades.

Those improvements led to a milestone in August 2024, when a shipment of zinc concentrate was shipped from the port to Belgium. It was the first critical minerals shipment from Churchill in more than two decades.

The zinc concentrate was mined at Snow Lake, Manitoba, loaded on rail cars at The Pas and moved to Churchill. It’s a scenario Avery hopes to see repeated with other commodities from the Prairies.

Addressing Arctic challenges

The emergence of new technologies has helped AGG work around the challenges of melting permafrost under the rail line and ice in Hudson Bay, he said.

Real-time ground-penetrating radar and LiDAR data from sensors attached to locomotives can identify potential problems, while regular drone flights scan the track, artificial intelligence mines the data for issues, and GPS provides exact locations for maintenance.

The group has worked with permafrost researchers from the University of Calgary, Université Laval and Royal Military College to better manage the challenge. “Some of these technologies, such as artificial intelligence and LiDAR, weren’t readily available five years ago, let alone two decades,” Avery said.

On the open water, AGG is working with researchers from the University of Manitoba to study sea ice and the change in sea lanes.

“Icebreakers would be a game-changer for our shipping operations and would allow year-round shipping in the short-term,” he said.

“Without icebreakers, the shipping season is currently about four and a half months of the year, from April to early November, but that is going to continue to increase in the coming decades.”

Interest from potential shippers, including energy producers, has grown since last year’s election in the United States, Avery said.

“We’re going to continue to work closely with all levels of government to get Canada’s products to markets around the world. That’s building our nation. That’s why we are excited for the future.”

Alberta

Temporary Alberta grid limit unlikely to dampen data centre investment, analyst says

From the Canadian Energy Centre

By Cody Ciona

‘Alberta has never seen this level and volume of load connection requests’

Billions of investment in new data centres is still expected in Alberta despite the province’s electric system operator placing a temporary limit on new large-load grid connections, said Carson Kearl, lead data centre analyst for Enverus Intelligence Research.

Kearl cited NVIDIA CEO Jensen Huang’s estimate from earlier this year that building a one-gigawatt data centre costs between US$60 billion and US$80 billion.

That implies the Alberta Electric System Operator (AESO)’s 1.2 gigawatt temporary limit would still allow for up to C$130 billion of investment.

“It’s got the potential to be extremely impactful to the Alberta power sector and economy,” Kearl said.

Importantly, data centre operators can potentially get around the temporary limit by ‘bringing their own power’ rather than drawing electricity from the existing grid.

In Alberta’s deregulated electricity market – the only one in Canada – large energy consumers like data centres can build the power supply they need by entering project agreements directly with electricity producers.

According to the AESO, there are 30 proposed data centre projects across the province.

The total requested power load for these projects is more than 16 gigawatts, roughly four gigawatts more than Alberta’s demand record in January 2024 during a severe cold snap.

For comparison, Edmonton’s load is around 1.4 gigawatts, the AESO said.

“Alberta has never seen this level and volume of load connection requests,” CEO Aaron Engen said in a statement.

“Because connecting all large loads seeking access would impair grid reliability, we established a limit that preserves system integrity while enabling timely data centre development in Alberta.”

As data centre projects come to the province, so do jobs and other economic benefits.

“You have all of the construction staff associated; electricians, engineers, plumbers, and HVAC people for all the cooling tech that are continuously working on a multi-year time horizon. In the construction phase there’s a lot of spend, and that is just generally good for the ecosystem,” said Kearl.

Investment in local power infrastructure also has long-term job implications for maintenance and upgrades, he said.

“Alberta is a really exciting place when it comes to building data centers,” said Beacon AI CEO Josh Schertzer on a recent ARC Energy Ideas podcast.

“It has really great access to natural gas, it does have some excess grid capacity that can be used in the short term, it’s got a great workforce, and it’s very business-friendly.”

The unaltered reproduction of this content is free of charge with attribution to the Canadian Energy Centre.

-

Energy2 days ago

Energy2 days agoIs The Carney Government Making Canadian Energy More “Investible”?

-

Immigration2 days ago

Immigration2 days agoUnregulated medical procedures? Price Edward Islanders Want Answers After Finding Biomedical Waste From PRC-Linked Monasteries

-

Business2 days ago

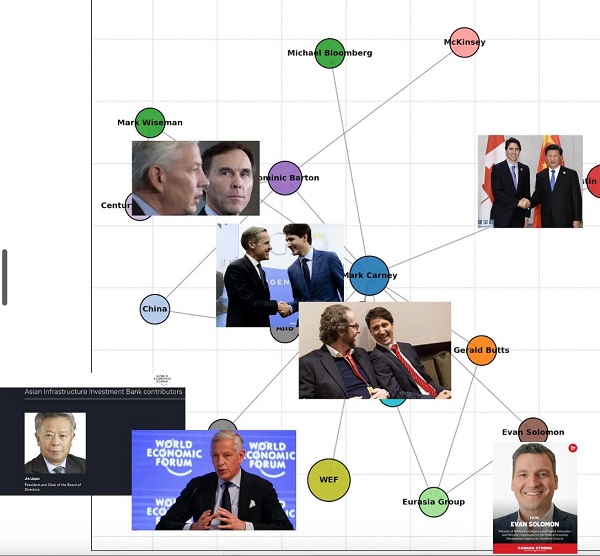

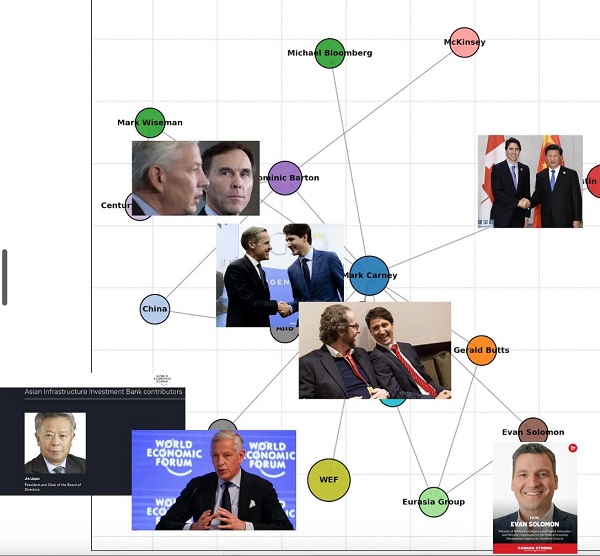

Business2 days agoDemocracy Watchdog Says PM Carney’s “Ethics Screen” Actually “Hides His Participation” In Conflicted Investments

-

Business2 days ago

Business2 days agoCompetition Bureau is right—Canada should open up competition in the air

-

Business2 days ago

Business2 days agoIt’s Time To End Canada’s Protectionist Supply Management Regime

-

COVID-192 days ago

COVID-192 days agoFreedom Convoy leaders’ sentencing hearing to begin July 23 with verdict due in August

-

COVID-1916 hours ago

COVID-1916 hours agoJapan disposes $1.6 billion worth of COVID drugs nobody used

-

Addictions1 day ago

Addictions1 day agoAfter eight years, Canada still lacks long-term data on safer supply