Business

Carney’s Energy Mirage: Why the Prospects of Economic Recovery Remain Bleak

By Gwyn Morgan

By Gwyn Morgan

Gwyn Morgan argues that Mark Carney, despite his polished image and rhetorical shift on energy, remains ideologically aligned with the Trudeau-era net-zero agenda that stifled Canada’s energy sector and economic growth. Morgan contends that without removing emissions caps and embracing real infrastructure investment, Canada’s recovery will remain a mirage — not a reality.

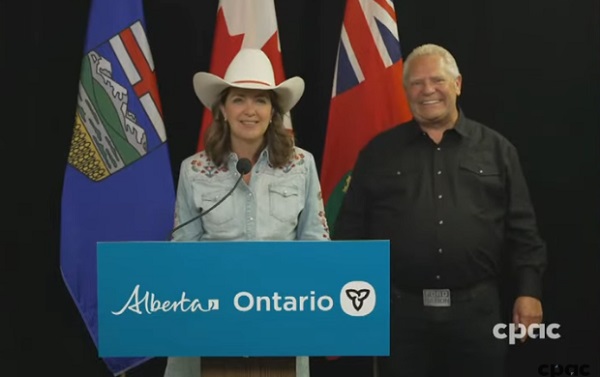

Pete Townshend’s famous lyrics, “Meet the new boss / Same as the old boss,” aptly describe Canada’s new prime minister. Touted as a fresh start after the Justin Trudeau years, Mark Carney has promised to turn Canada into a “clean and conventional energy superpower.” But despite the lovey-dovey atmosphere at Carney’s recent meeting with Canada’s premiers, Canadians should not be fooled. His sudden apparent openness to new energy pipelines masks a deeper continuity, in my opinion: Carney remains just as ideologically committed to net-zero emissions.

Carney’s carefully choreographed scrapping of the consumer carbon tax before April’s election helped reduce gasoline prices and burnished his centrist image. In fact, he simply moved Canada’s carbon taxes “upstream”, onto manufacturers and producers, where they can’t be seen by voters. Those taxes will, of course, be largely passed back onto consumers in the form of higher prices for virtually everything. Many consumers will blame “greedy” businesses rather than the real villain, even as more and more Canadian companies and projects are rendered uncompetitive, leading to further reductions in capital investment, closing of beleaguered factories and facilities, and lost jobs.

This sleight-of-hand is hardly surprising. Carney spent years abroad in a career combining finance and eco-zealotry, co-founding the Glasgow Financial Alliance for Net Zero (GFANZ) and serving as the UN’s Special Envoy for Climate Action and Finance. Both roles centred on pressuring institutions to stop investing in carbon-intensive industries – foremost among them oil and natural gas. Now, he speaks vaguely of boosting energy production while pledging to maintain Trudeau’s oil and natural gas emissions cap – a contradiction that renders new pipeline capacity moot.

Canada doesn’t need a rhetorical energy superpower. It needs real growth. Our economy has just endured a lost decade of sluggish overall growth sustained mainly by a surging population, declining per-capita GDP and a doubling of the national debt. A genuine recovery requires the kind of private-sector capital investment and energy infrastructure that Trudeau suppressed. That means lifting the emissions cap, clearing regulatory bottlenecks and building pipelines that connect our resources to global markets.

We can’t afford not to do this. The oil and natural gas industry’s “extraction” activities contribute $70 billion annually to Canada’s GDP; surrounding value-added activities add tens of billions more. The industry generates $35 billion in annual royalties and supports 900,000 direct and indirect jobs. Oil and natural gas also form the backbone of Canada’s export economy, representing nearly $140 billion per year, or about 20 percent of our balance of trade.

Yet Quebec still imports oil from Algeria, Saudi Arabia and Nigeria because Ottawa won’t push for a pipeline connecting western Canada’s producing fields to Quebec and the Maritimes. Reviving the cancelled Energy East pipeline would overcome this absurdity and give Canadian crude access to European consuming markets.

Carney has hinted at supporting such a project but refuses to address the elephant in the room: without scrapping the emissions cap, there won’t be enough production growth to justify new infrastructure. So pipeline CEOs shouldn’t start ordering steel pipe or lining up construction crews just yet.

I continue to believe that Carney remains beholden to the same global green orthodoxy that inspired Trudeau’s decade of economic sabotage. While the United States shifts course on climate policy, pulling out of the Paris Accord, abandoning EV mandates and even investigating GFANZ itself, Canada is led by a man at the centre of those systems. Carney’s internationalist career and personal life – complete with multiple citizenships and a spouse known for environmental activism – underscore how far removed he is from ordinary Canadians.

Carney’s version of “clean energy” also reveals his bias. Despite the fact that 82 percent of Canada’s electricity already comes from non-greenhouse-gas-emitting sources like hydro and nuclear, Carney seems fixated on wind and solar-generated power. These options are less reliable and more expensive – though more ideologically fashionable. To climate zealots, not all zero-emission energy is created equal.

Even now, after all the damage that’s been done, Canada has the potential to resume a path to prosperity. We are blessed with vast natural resources and skilled workers. But no economy can thrive under perpetual policy uncertainty, regulatory obstruction and ideological hostility to its core industries. Energy projects worth an estimated $500 billion were blocked during the Trudeau years. That capital won’t return unless there is clarity and confidence in the government’s direction.

Some optimists argue that Carney is ultimately a political opportunist who may shift pragmatically to boost the economy. But those of us who have seen this movie before are sceptical. During my time as a CEO in the oil and natural gas sector, I witnessed Justin’s father Pierre Trudeau try to dismantle our industry under the guise of progress. Carney, despite or perhaps because of his polish, may be the most dangerous of the three.

The original, full-length version of this article was recently published in C2C Journal.

Gwyn Morgan is a retired business leader who was a director of five global corporations.

Business

Government distorts financial picture with definition of capital

“The government is acting fast and loose with the definition of ‘capital. Handing out corporate welfare shouldn’t be considered ‘capital.’

The Canadian Taxpayers Federation is calling on Prime Minister Mark Carney to focus on reducing debt rather than distorting the financial picture by watering down the definition of “capital” spending, as noted by the Parliamentary Budget Officer.

“The PBO shows the government is inappropriately expanding the definition of ‘capital’ spending,” said Franco Terrazzano, CTF Federal Director. “The reality is taxpayers need to cut through Carney’s budget spin and look at one number: How fast is the debt is going up?”

The Carney government announced it’s separating operating and capital spending in its budget. It also released its criteria for what it would consider capital spending.

The PBO’s analysis found that “Finance Canada’s definition and categories expand the scope of capital investment beyond the current treatment of capital spending in the Public Accounts of Canada.”

The PBO added that “based on our initial assessment, we find that the scope is overly expansive and exceeds international practice such as that adopted by the United Kingdom.”

“The government is acting fast and loose with the definition of ‘capital,’” Terrazzano said. “Handing out corporate welfare shouldn’t be considered ‘capital.’

“Regardless of the spending category, more debt means more interest payments and that’s what taxpayers need to focus on to hold the government accountable.”

The PBO’s Economic and Fiscal Outlook projects this year’s “deficit to increase sharply to $68.5 billion.” Debt interest charges will cost taxpayers $55.3 billion this year. That means that paying interest on the federal debt will cost each Canadian about $1,300 this year.

“The government is trying to muddy the water with its accounting nonsense,” Terrazzano said. “The government should stop focusing on cutting the numbers and instead focus on cutting the debt.

“Taxpayers will need to cut through all the accounting noise from the government and focus on one question: Is the debt going up or down?”

Business

Canada Post is failing Canadians—time to privatize it

From the Fraser Institute

By Jake Fuss and Alex Whalen

In the latest chapter of a seemingly never-ending saga, Canada Post workers are on strike again for the second time in less than a year, after the federal government allowed the Crown corporation to close some rural offices and end door-to-door deliveries. These postal strikes are highly disruptive given Canada Post’s near monopoly on letter mail across the country. It’s well past time to privatize the organization.

From 2018 to the mid-point of 2025, Canada Post has lost more than $5.0 billion, and it ran a shortfall of $407 million in the latest quarter alone. Earlier this year, the federal government loaned Canada Post $1.034 billion—a substantial sum of taxpayer money—to help keep the organization afloat.

As a Crown corporation, Canada Post operates at the behest of the federal government and faces little competition in the postal market. Canadians have nowhere to turn if they’re unhappy with service quality, prices or delivery times, particularly when it comes to “snail mail.”

Consequently, given its near-monopoly over the postal market, Canada Post has few incentives to keep costs down or become profitable because the government (i.e. taxpayers) is there to bail it out. The lack of competition also means Canada Post lacks incentives to innovate and improve service quality for customers, and the near-monopoly prohibits other potential service providers from entering the letter-delivery market including in remote areas. It’s clearly a failing business that’s unresponsive to customer needs, lacks creativity and continuously fails to generate profit.

But there’s good news. Companies such as Amazon, UPS, FedEx and others deliver more than two-thirds of parcels in the country. They compete for individuals and businesses on price, service quality and delivery time. There’s simply no justification for allowing Canada Post to monopolize any segment of the market. The government should privatize Canada Post and end its near-monopoly status on letter mail.

What would happen if Ottawa privatized Canada Post?

Well, peer countries including the Netherlands, Austria and Germany privatized their postal services two decades ago. Prices for consumers (adjusted for inflation) fell by 11 per cent in Austria, 15 per cent in the Netherlands and 17 per cent in Germany.

Denmark has taken it a step further and plans to end letter deliveries altogether. The country has seen a steep 90 per cent drop in letter volumes since 2000 due to the rise of global e-commerce and online shopping. In other words, the Danes are adapting to the times rather than continuing to operate an archaic business model.

In light of the latest attempt by the Canadian Union of Postal Workers to shakedown Canadian taxpayers, it’s become crystal clear that Canada Post should leave the stone age and step into the twenty-first century. A privately owned and operated Canada Post could follow in the footsteps of its European counterparts. But the status quo will only lead to further financial ruin, and Canadians will be stuck with the bill.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoElbows Up Part Deux: Liberal Canada Now Riding The Blue Jays

-

International2 days ago

International2 days agoNegotiations continue in Israel-Hamas peace deal

-

Crime1 day ago

Crime1 day agoThe Bureau Exclusive: Chinese–Mexican Syndicate Shipping Methods Exposed — Vancouver as a Global Meth Hub

-

espionage2 days ago

espionage2 days agoCanada’s federal election in April saw ‘small scale’ foreign meddling: gov’t watchdog

-

Crime1 day ago

Crime1 day agoCanadian Sovereignty at Stake: Stunning Testimony at Security Hearing in Ottawa from Sam Cooper

-

Opinion2 days ago

Opinion2 days agoJordan Peterson needs prayers as he battles serious health issues, daughter Mikhaila says

-

Energy2 days ago

Energy2 days agoBC NDP Premier Opposing a New Oil Pipeline to Tidewater

-

Immigration2 days ago

Immigration2 days agoConservatives blame Liberals for allowing man on UK child sex offender list to enter Canada