Carbon Tax

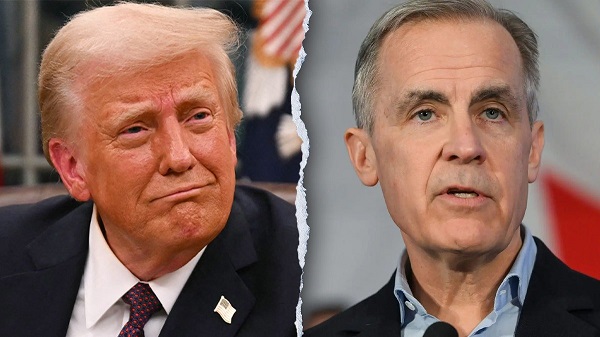

Carney now prime minister of Canada after trying for years to defund it

From the Fraser Institute

Conservative Leader Pierre Poilievre is very concerned about financial conflicts of interest that Prime Minister Mark Carney may be hiding. But I’m far more concerned about the one out in the open; namely that while Carney is supposed to act for the good of the country he’s lobbied to defund and drive out of existence Canada’s oil and gas companies, steel companies, car companies and any other sector dependent on fossil fuels. He’s done this through the Glasgow Financial Alliance for Net Zero (GFANZ), which he founded in 2021.

Carney is a climate zealot. He may try to fool Canadians into thinking he wants new pipelines, liquified natural gas (LNG) terminals and other hydrocarbon infrastructure, but he doesn’t. Far from it. He wants half the existing ones gone by 2030 and the rest soon after.

He has said so, repeatedly and emphatically. He believes that the world “must achieve about a 50% reduction in [greenhouse gas] emissions by 2030” and “rapidly scale climate solutions to provide cleaner, more affordable, and more reliable replacements for unabated fossil fuels.” (By “unabated” he means usage without full carbon capture, which in practice is virtually all cases.) And since societies don’t seem keen on doing this, Carney created GFANZ to pressure banks, insurance companies and investment firms to cut off financing for recalcitrant firms. “This transition to net zero requires companies across the whole economy to change behaviors through application of innovative technologies and new ways of doing business” he writes, using bureaucratic euphemisms to make his radical agenda somehow seem normal.

The GFANZ plan (outlined on page 9 of the final report) puts companies into four categories. Those selling green technologies or engaged in work that displaces fossil fuels will be rewarded with full financing. Those that still use fossil fuels, or have investments in others that do, but are committed to being “climate leaders” and have set a path to net-zero, will also still be eligible for financing. Those that still do business with “high-emitting firms” but plan to reach net-zero targets on an approved time scale can get financing for now. And companies that own or invest in high-emitting assets must operate under a “Managed Phaseout” regime or may be cut-off from investment capital.

What are “high-emitting assets”? Carney’s group hasn’t released a complete list but a June 2022 report (p. 10) listed examples—coal mines, fossil-fuel power stations, oil fields, gas pipelines, steel mills, ships, cement plants and consumer gasoline-powered vehicles. The finance sector must either sever all connections to such assets or put them under a “Managed Phaseout” regime, which means exactly what it sounds like.

So when Carney jokingly suggested it doesn’t matter if his climate plan drives up costs for steel mills because people don’t buy steel, he could have added that under his plan there won’t be any steel mills before long anyway. Or cars, gas-fired power plants, pipelines, oil wells and so forth.

GFANZ boasts at length about its members strong-arming clients into embracing net-zero. For instance, it extols Aviva for its “climate engagement escalation program… Aviva is prepared to send a message to all companies through voting actions when those companies do not have adequate climate plans or do not act quickly enough.”

To support these coercive goals Carney’s lobbying helped secure the implementation in Canada of rule B-15, the Climate Risk Management Directive from the federal Office of the Superintendent of Financial Institutions (OSFI), which requires banks, life insurance companies, trust and loan companies and others to develop and file reports disclosing their “climate transition risk.” This requires asset holders to conduct extensive and costly research into their holdings to determine whether value may be at risk from future climate policies. The vagueness and potential liabilities created by this menacing regulation means that Canada’s largest investment firms will eventually decide it’s easier to divest altogether from fossil fuel and heavy industry sectors, furthering Carney’s ultimate goal.

Yet Carney will become prime minister just when Canadians face a trade crisis that requires we quickly build new coastal energy infrastructure to ensure our fossil fuel commodities can be exported without going through the United States. I have listened to him say he will take emergency measures to support “energy projects” but I assume he means windmills and solar panels. He has not (to my knowledge) said he supports pipelines, LNG terminals, fracking wells or new refineries. Unless he disowns everything he has said for years, we must assume he doesn’t.

Canadian journalists should insist he clear this up. Ask Carney if he supports the repeal of OSFI rule B-15. Show Carney his GFANZ report. His name and photo are on page vi, in case he has forgotten it. Ask him, “Do you still endorse the contents of this document?” If he says yes, ask him how we can build new pipelines and LNG terminals, expand our oil and gas sector, run our electricity grid using Canadian natural gas, heat our homes and put gasoline in our cars if his plan succeeds and the financing for all these activities is cut off. If he tries to claim he no longer endorses it, ask him when he changed his mind, and why we should believe him now if he seems to change his core convictions so easily.

I hope the media will not let Carney be evasive or ambiguous on these matters. We don’t have time for a bait-and-switch prime minister. If Mark Carney still believes the rhetoric he published through GFANZ, he should say so openly, so Canadians can assess whether he really is the right man to address our current crisis.

Alberta

Taxpayers: Alberta must scrap its industrial carbon tax

-

Carney praises carbon taxes on world stage

-

Alberta must block Carney’s industrial carbon tax

The Canadian Taxpayers Federation is calling on the government of Alberta to completely scrap its provincial industrial carbon tax.

“It’s baffling that Alberta is still clinging to its industrial carbon tax even though Saskatchewan has declared itself to be a carbon tax-free zone,” said Kris Sims, CTF Alberta Director. “Prime Minister Mark Carney is cooking up his new industrial carbon tax in Ottawa and Alberta needs to fight that head on.

“Alberta having its own industrial carbon tax invites Carney to barge through our door with his punishing industrial carbon tax.”

On Sept. 16, the Alberta government announced some changes to Alberta’s industrial carbon tax, but the tax remains in effect.

On Friday night at the Global Progress Action Summitt held in London, England, Carney praised carbon taxes while speaking onstage with British Prime Minister Keir Starmer.

“The direct carbon tax which had become a divisive issue, it was a textbook good policy, but a divisive issue,” Carney said.

During the federal election, Carney promised to remove the more visible consumer carbon tax and change it into a bigger hidden industrial carbon tax. He also announced plans to create “border adjustment mechanisms” on imports from countries that do not have national carbon taxes, also known as carbon tax tariffs.

“Carney’s ‘textbook good policy’ comments about carbon taxes shows his government is still cooking up a new industrial carbon tax and it’s also planning on imposing carbon tax tariffs,” Sims said. “Alberta should stand with Saskatchewan and obliterate all carbon taxes in our province, otherwise we are opening the door for Ottawa to keep kicking us.”

Business

Mark Carney’s “Worst of All Possible Worlds”

Matthew Ehret

Matthew Ehret

Originally published on Pluralia

Is it possible that Canadian Prime Minister Mark Carney has selected the worst of all possible pathways in his tight-rope balancing effort to resolve severe tensions with the USA on the one hand, while simultaneously increasing trade/security relations between Canada and the EU?

The incredible untapped resource potential of Canada, fused with a vast northern territories, undeveloped lands, and low population levels makes Canada a living embodiment of potential and value for the entire world.

If a spirit of genuine multipolarity, cooperation, and future-oriented thinking were alive among policy making circles of Ottawa, then there is no doubt that Canada could offer much to the world both in terms of resources, energy, and ingenuity. The vast Arctic, which Canada shares with partners like the USA, several European states, the Russian Federation (and near Arctic partners like China), provides an opportunity for dialogue, scientific cooperation, and economic development, the likes of which humanity has never seen.

Sadly, a different spirit is currently shaping Canadian policy, which lacks that positive vision.

Carney’s Canada–EU Integration Gambit

On June 23rd of this year, Mark Carney signed the Canada European Strategic Partnership for the Future on the basis of increasing trade and security relations with the European Union.

Despite proposing to increase Canada–EU trade and Canada energy/mineral exports to the EU, the program is entirely driven by a military agenda, which sadly threatens the lives of all Europeans and Canadians alike. The “Strategic Partnership” moves in tandem with another pact enmeshing Canada into the $800 billion Re-Arm Europe plan and additionally ties Canada into the Security Action for Europe (SAFE) program. The ironically-named “SAFE” program serves as a sort of “World Bank,” specifically designed for building up the military defense capabilities of participating nations.

Capitalized with $235 billion, this fund allows the European Union to take loans out at preferential rates and then extend those loans to all European (and soon possibly Canadian) members who may then invest in military industrial capabilities while simultaneously evading the 3% of GDP debt ceiling imposed on all EU nations.

With Trump’s recent appeal to EU states to increase their NATO spending to a dizzying 5% GDP, it appears that both SAFE and Canada’s participation in the EU War gambit are two vital parts of solving this bewildering challenge.

The new Canada–EU Strategic Partnership promises to “boost cooperation on maritime security, cyber security, and other threats to peace, expand Maritime security cooperation and coordination activities, increase defense industrial cooperation” and will “increase ties between Canada and The European Defense Agency.”

De-Growth and Militarization: The Challenge of Mixing Water and Oil

After many decades of slow de-industrialization, Europe now finds itself trapped within a paradigm that demands military confrontation with Russia, on the one hand (requiring a robust industrial powerhouse that hasn’t existed in generations), while simultaneously holding firm to the decarbonization program outlined by Agenda 2030, Paris Accords, and EU–Canada Green Alliance.

The Fraud of ‘Global Warming’ |

||

|

In a recent article, Defeating the Depopulation Agenda, I took aim at an insidious ideology which has infiltrated society in the form of a movement to ‘protect nature from humanity’. |

||

|

While satisfying both dynamics may be impossible (as decarbonization, carbon prices, and windmills have not been known to enhance industrial growth), the ivory-tower technocrats surrounding the likes of Mark Carney and Mario Draghi appear to believe that this circle can be squared… and hence Canada’s participation in the new plan is vital.

In tandem with Canada’s partnership with the EU, on June 26, 2025 Canada’s Governor General gave “Royal Assent” to the passage of one of the most comprehensive omnibus bills in history called the “One Canada Economy Act” (Bill C5).

This bill sets the stage for the repeal of decades of environmental legislation and the end of all trade barriers, which have held back inter-provincial cooperation for generations. An Ottawa press release stated: “The government of Canada is fulfilling its promise to build one Canadian economy out of thirteen” (referencing the 13 provinces and territories making up Canada).

Despite a backlash of First Nations leaders who have recognized that a cancellation of centuries of treaties is taking place amidst a dictatorial gambit to override their voice in any economic or military plans for Canada, it appears the reset in governance is going forward in full steam.

If this bill had been advanced as a genuine endeavor to create for the first time in history a unified Canada capable of executing top-down mega-projects devoid of red tape (not dissimilar from China’s capacity to wield the forces of the nation state in the building of the Belt and Road Initiative), it would appear that Bill C5 were a truly positive blessing. After all, Canada has never been permitted to have free trade among the provinces since its earliest days and has thus been kept artificially underdeveloped and divided within itself, so an end to this unfortunate fate would be most welcomed.

However, when we are reminded that a logic of Orwellian geopolitics is shaping the new emerging iron walls and AI-driven-space-based warfare is now threatening world peace, then a more dystopic reality presents itself.

Not Just Canada: Three of Five Eyes Go for a Eurotrip

However, it is not only Canada that is being drawn into this new dystopic vision of an Eastasia, Eurasia, Oceania division of the globe, but other British Commonwealth nations have also been brought onboard with simultaneous Strategic Partnerships with the EU, beginning with the UK–EU Strategic Partnership, first announced in April 2025, and followed weeks after by an Australian–EU Strategic Partnership, which reads like a replica of the Canada–EU pact.

In all three Commonwealth/Five Eyes pacts with the EU, we find a special focus on intelligence sharing, minerals exports, cybersecurity, countering disinformation, and military industrial/national cooperation enhancement.

But does Canada’s re-alignment with the EU indicate that Ottawa’s relations with Washington are truly as dismal as some have been led to believe, or is there evidence of another game afoot?

The Golden Dome

Beyond the threats of tariffs, the shattering of rules-based order, and US ambition to acquire Canada as a 51st state, another more insidious war plan has emerged in the form of a $540-billion continental defensive shield, first announced as an Israeli-modelled “Iron Dome” for North America by Trump in January of 2025.

Rebranded “The Golden Dome” after its first two weeks of dismal publicity, both Mark Carney and leading strata of Canada’s defense establishment have shown themselves to be remarkably in favor of the integrated “defensive” security shield, which calls for surrounding North America with medium- and long-range ballistic missiles, space-based weapons, and integrated AI command systems.

This shouldn’t be entirely surprising, since it was only in April 2024 that then-Prime Minister Justin Trudeau (advised by Mark Carney and Chrystia Freeland) approved a Canadian Arctic Defense strategy upgrade permitting for the first time in history long-range missiles installed in Canada’s high Arctic.

The Golden Dome appears to simply be the next logical step.

Instead of showcasing his typical nationalist bravado in opposition US jingoism, which served him well in winning the latest Canadian elections, Carney has shown himself to be in favor of Canada’s participation in the Golden Dome, which will cost Canadian tax-payers approximately $100 billion, according to current estimates.

After meeting with President Trump and Defense Secretary Pete Hegseth on May 21, Carney stated: “We are conscious that we have an ability, if we so choose, to complete the Golden Dome with investments in partnership. And it’s something that we are looking at, and something that has been discussed at a very high level.”

Carney ended by stating: “Is it a good idea for Canada? Yes, it is good to have protections in place for Canadians.”

On June 10, CBC (the official state broadcasting service of Canada) featured a report outlining ongoing secret meetings being held between Ottawa and Washington policy makers to craft a final agreement on the Golden Dome says the draft agreement now under negotiation states “that Canada is willing to participate in the Golden Dome security program, originally proposed by U.S. President Donald Trump… It also mentions Canadian commitments to build more infrastructure in the Arctic, Canada’s pledge to meet its NATO defense spending targets, as well as previously announced border security investments.”

It is clear that a vast re-alignment of global relations is now underway, and it also appears that a consensus has been reached to adapt to a multipolar model… at least for a limited time. However, the word “multipolar” does not mean the same thing to everyone.

While a multipolar model premised on inter-civilizational cooperation and respect for the UN Charter would be a blessing for all nations, it appears increasingly likely that the pilots at the helm of the trans-Atlantic ship have read their George Orwell and prefer to live according to the rules of the jungle instead of embracing a more civilized identity at this stage of history.

-

Business1 day ago

Business1 day agoThe Grocery Greed Myth

-

COVID-192 days ago

COVID-192 days agoTamara Lich says she has no ‘remorse,’ no reason to apologize for leading Freedom Convoy

-

Crime2 days ago

Crime2 days agoCanada’s safety minister says he has not met with any members of damaged or destroyed churches

-

Business2 days ago

Business2 days agoTrump Warns Beijing Of ‘Countermeasures’ As China Tightens Grip On Critical Resources

-

International2 days ago

International2 days agoTrump gets an honourable mention: Nobel winner dedicates peace prize to Trump

-

Business1 day ago

Business1 day agoTax filing announcement shows consultation was a sham

-

Frontier Centre for Public Policy4 hours ago

Frontier Centre for Public Policy4 hours agoCanada’s Democracy Is Running On Fumes

-

Education4 hours ago

Education4 hours agoClassroom Size Isn’t The Real Issue