Alberta

Canopy Growth reports $648 million net loss in Q4 as it parts way with BioSteel staff

Canopy Growth Corp.’s chief executive said the company has made management changes and parted ways with some staff as it continues to review its BioSteel business after uncovering “material misstatements” in the sports drink unit’s previous financial filings.

“Based on the results of the review, we’ll be implementing several remedial actions to strengthen our controls for the BioSteel business,” David Klein, chief executive of the Smiths Falls, Ont.-based cannabis company, said on a Thursday call with analysts.

“We felt it was important to act swiftly to provide stability to the business at this pivotal time, so to this effect, we have exited several members of the BioSteel leadership team and are considering all legal remedies available to us including litigation to recover damages and costs associated with and resulting from the findings of the BioSteel review.”

His remarks came after Canopy promised in May to refile three of its past quarterly financial statements because of misstatements linked to BioSteel, a brand of dietary supplement products targeting athletes.

The misstatements were in its first-, second- and third-quarter filings from 2022 and included sales information from that period which Canopy said in regulatory filings “should no longer be relied upon.”

It discovered the misstatements when it was preparing its financial results for the financial year ended March 31, and determined on May 4 that there were errors in its filings after a review of BioSteel results with independent external counsel and forensic accountants.

Canopy now says the sales misstatements found are linked to BioSteel’s “timing and amount of revenue recognition.”

The company revealed new details about the misstatements as it released its fourth-quarter and full-year results Thursday. Canopy’s fourth-quarter net loss amounted to $648 million, $59 million more than the loss it incurred a year earlier.

It attributed much of the loss to $164 million in asset impairment and restructuring costs, but says those costs were partially offset by improved gross margins.

The corrected numbers for BioSteel resulted in a decrease of roughly $10 million in net revenue for the company’s 2022 financial year, or about two per cent of its total net revenue.

For the nine months ended December 31, 2022, Canopy said the correction resulted in a decrease of about $14 million in net revenue or four per cent of total consolidated revenue.

“Despite this, we have great confidence in the BioSteel brand, which saw a 101 per cent revenue increase in fiscal (2023),” Klein said.

Canopy also noted that BioSteel is continuing to gain market share in Canada, especially through NHL partnerships.

Meanwhile, Canopy is continuing with a transformation plan for its overall business that included the departure of 800 workers — roughly 35 per cent of its workforce — in February.

At the time, it also planned to wind down 1 Hershey Dr. in Smiths Falls, Ont., its flagship facility where chocolate company Hershey once had a factory, and move post-production flower activity to a building across the street.

Canopy said it would cease to source flower from its Mirabel, Que., facility, which is owned and operated through Les Serres Vert Cannabis Inc., a joint venture partnership between the company and Les Serres Stephane Bertrand Inc., a tomato greenhouse operator.

Canopy previously purchased pot from the joint venture, but will cease that activity and now move to a more flexible sourcing strategy to ensure Quebec-grown products are brought to consumers in the province.

Consolidation was also planned for its Kincardine, Ont. and Kelowna, B.C. sites.

Canopy’s net revenue for the period ended March 31 totalled $88 million, 14 per cent lower than the revenue reported a year prior.

Canopy’s adjusted loss for the quarter was $96 million, a $36 million improvement from its negative adjusted earnings before interest, taxes, depreciation, and amortization a year earlier.

This report by The Canadian Press was first published June 22, 2023.

Companies in this story: (TSX:WEED)

Tara Deschamps, The Canadian Press

Alberta

Emissions Reduction Alberta offering financial boost for the next transformative drilling idea

From the Canadian Energy Centre

$35-million Alberta challenge targets next-gen drilling opportunities

‘All transformative ideas are really eligible’

Forget the old image of a straight vertical oil and gas well.

In Western Canada, engineers now steer wells for kilometres underground with remarkable precision, tapping vast energy resources from a single spot on the surface.

The sector is continually evolving as operators pursue next-generation drilling technologies that lower costs while opening new opportunities and reducing environmental impacts.

But many promising innovations never reach the market because of high development costs and limited opportunities for real-world testing, according to Emissions Reduction Alberta (ERA).

That’s why ERA is launching the Drilling Technology Challenge, which will invest up to $35 million to advance new drilling and subsurface technologies.

“The focus isn’t just on drilling, it’s about building our future economy, helping reduce emissions, creating new industries and making sure we remain a responsible leader in energy development for decades to come,” said ERA CEO Justin Riemer.

And it’s not just about oil and gas. ERA says emerging technologies can unlock new resource opportunities such as geothermal energy, deep geological CO₂ storage and critical minerals extraction.

“Alberta’s wealth comes from our natural resources, most of which are extracted through drilling and other subsurface technologies,” said Gurpreet Lail, CEO of Enserva, which represents energy service companies.

ERA funding for the challenge will range from $250,000 to $8 million per project.

Eligible technologies include advanced drilling systems, downhole tools and sensors; AI-enabled automation and optimization; low-impact rigs and fluids; geothermal and critical mineral drilling applications; and supporting infrastructure like mobile labs and simulation platforms.

“All transformative ideas are really eligible for this call,” Riemer said, noting that AI-based technologies are likely to play a growing role.

“I think what we’re seeing is that the wells of the future are going to be guided by smart sensors and real-time data. You’re going to have a lot of AI-driven controls that help operators make instant decisions and avoid problems.”

Applications for the Drilling Technology Challenge close January 29, 2026.

Alberta

New era of police accountability

The Police Review Commission (PRC) is now fully operational, giving Albertans a single, independent process to file policing complaints and ensure accountability.

Alberta’s government is putting the province at the forefront of police oversight in Canada with the creation of the PRC. This new commission replaces the current patchwork of police investigating police with one independent body responsible for receiving complaints, conducting investigations and overseeing disciplinary hearings. By centralizing these functions within a single, independent agency, Alberta is ensuring complaints are handled fairly and consistently.

“The Police Review Commission represents a new era in how Alberta addresses policing complaints. These changes are part of a broader paradigm shift where police are no longer seen as an arm of the state, but rather an extension and a reflection of the community they serve. As an independent agency, it is committed to fairness, accountability and public trust, ensuring every complaint is investigated impartially and resolved openly.”

The Police Amendment Act, 2022 laid the groundwork for this new model, establishing a modern approach to oversight built on accountability, consistency and public confidence. The PRC will manage the full complaints process from receiving and assessing, to investigating and resolving complaints related to police conduct, including serious incidents and statutory offences.

“The Alberta Association of Chiefs of Police welcomes the launch of the Police Review Commission as a meaningful step toward enhanced oversight and greater transparency in policing. By ensuring complaints are reviewed fairly and impartially, the Commission will help strengthen accountability and reinforce public trust in Alberta’s police agencies. Police leaders across the province are committed to working with the Commission and our communities to ensure every Albertan has confidence in the integrity of our police services.”

A timely and transparent complaint resolution process is essential for both the public and police. That is why the PRC must complete investigations within 180 days, and if more time is needed, the chief executive officer must publicly report on delays and provide justification. This ensures clarity, predictability and accountability throughout the process. The commission will be arm’s length from government and police services, meaning people can have greater confidence that their complaints will be investigated and resolved impartially.

“Our goal is to build trust in policing by delivering timely resolutions and fair, consistent outcomes that put people first. Every complaint will be reviewed thoroughly and handled with the transparency and respect Albertans expect and deserve.”

The PRC can also initiate systemic reviews related to police conduct or emerging trends without the need for a public complaint, and these reviews must be made public. Together, these measures create a clear, accountable process that strengthens transparency, supports continuous improvement and enhances trust in how police oversight is carried out across Alberta.

“Public safety and the confidence the public has in our police services and service members are incumbent for effective and responsible service delivery. The PRC has been developed so that Albertans may have a responsible and impartial mechanism to voice concerns regarding delivery of policing services in Alberta. I am confident that the PRC will be an inclusive and diverse representation of the communities, so we may better understand the most appropriate and effective way to respond to concerns regarding police services. I look forward to the positive outcomes for the community.”

The commission’s design was informed by engagement with Indigenous communities, law enforcement partners, municipal officials and community organizations, ensuring its structure and training reflect Alberta’s diversity and values.

Quick facts

- The PRC will handle complaints in three categories:

- Level 1: Death, serious injury and serious or sensitive allegations involving all police services in Alberta, as well as peace officer agencies.

- Level 2: Allegations of criminal and other statutory offences involving all police services in Alberta.

- Level 3: Complaints about non-criminal misconduct involving officers employed by municipal and First Nations police services.

- Complaints that fall outside the three categories will be referred to the appropriate bodies or agencies for review.

- The Alberta Serious Incident Response Team (ASIRT) will now operate under the PRC.

-

COVID-192 days ago

COVID-192 days agoThe dangers of mRNA vaccines explained by Dr. John Campbell

-

Alberta2 days ago

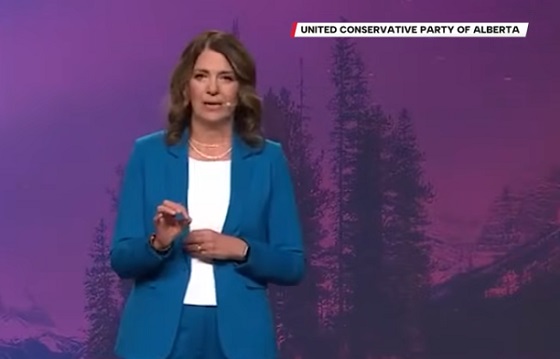

Alberta2 days agoKeynote address of Premier Danielle Smith at 2025 UCP AGM

-

Artificial Intelligence2 days ago

Artificial Intelligence2 days ago‘Trouble in Toyland’ report sounds alarm on AI toys

-

National1 day ago

National1 day agoMedia bound to pay the price for selling their freedom to (selectively) offend

-

Daily Caller2 days ago

Daily Caller2 days agoTom Homan Predicts Deportation Of Most Third World Migrants Over Risks From Screening Docs

-

Energy2 days ago

Energy2 days agoCanadians will soon be versed in massive West Coast LPG mega-project

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoSometimes An Ingrate Nation Pt. 2: The Great One Makes His Choice

-

Business5 hours ago

Business5 hours agoCanada’s future prosperity runs through the northwest coast