Alberta

Canadians in three provinces will spend roughly the same on debt interest as K-12 education

From the Fraser Institute

By Grady Munro and Jake Fuss

From 2008/09 to 2023/24, the federal government is projected to have run deficits every single year, with no interruptions. This has resulted in federal net debt (total debt minus financial assets) increasing by $603.6 billion (inflation-adjusted).

For more than a decade, Canadian governments have increasingly relied on borrowed money to fund their excessive spending habits. However, as debt has continued to pile up so have the costs associated with this debt—namely interest costs. A recent study shows that in some of the largest provinces, governments now spend nearly as much or more on debt interest costs than on K-12 education.

Since the 2008/09 financial crisis, governments across Canada have fallen into the habit of utilizing debt to fund their spending habits. For example, consider the federal government.

From 2008/09 to 2023/24, the federal government is projected to have run deficits every single year, with no interruptions. This has resulted in federal net debt (total debt minus financial assets) increasing by $603.6 billion (inflation-adjusted). Conversely, from 1996/97 to 2007/08, the federal government actually lowered its net debt by $348.1 billion (inflation-adjusted). Clearly, there’s been a shift in the government’s approach towards debt accumulation.

This is not simply a federal problem, as provinces have also seen their debt burdens rise as well. Cumulatively, provincial and federal net debt has increased by $1.0 trillion (inflation-adjusted) from 2007/08 to 2023/24.

Government debt carries costs, primarily in the form of the interest payments, which represent money that doesn’t go towards paying down the actual debt amount, nor does it go towards providing government services or tax relief. And since governments must utilize tax revenues to pay interest, taxpayers are ultimately on the hook for servicing government debt.

But how much do Canadians actually pay in debt interest costs?

Using data from the most recent fiscal updates, a new study compares combined (federal and provincial) debt interest costs for residents in three of the largest provinces (Ontario, Quebec and Alberta) with what those provinces expect to spend on K-12 education in 2023/24. The study utilizes combined debt interest costs because Canadians are ultimately responsible for interest costs incurred by both the federal government and the province in which they live. The following chart summarizes the comparisons from the study.

As is clear from the chart, combined interest costs for residents in these provinces are nearly as much or more than their province expects to spend on K-12 education in 2023/24. Specifically, combined interest costs are $31.5 billion for Ontarians, which is only $3.2 billion less than the province will spend on K-12 education in 2023/24. Combined interest costs for Quebecers ($20.3 billion) will actually exceed the $19.9 billion the province will devote towards K-12 education. And combined interest costs for Albertans are only slightly lower than the $8.9 billion that will be spent on K-12 education.

In other words, taxpayers in Ontario, Quebec and Alberta are paying nearly as much or more to service federal and provincial government debt than they are paying to fund K-12 education in their province. This budget season, it’s important to remember the costs associated with growing government debt.

Authors:

Alberta

‘Weird and wonderful’ wells are boosting oil production in Alberta and Saskatchewan

From the Canadian Energy Centre

Multilateral designs lift more energy with a smaller environmental footprint

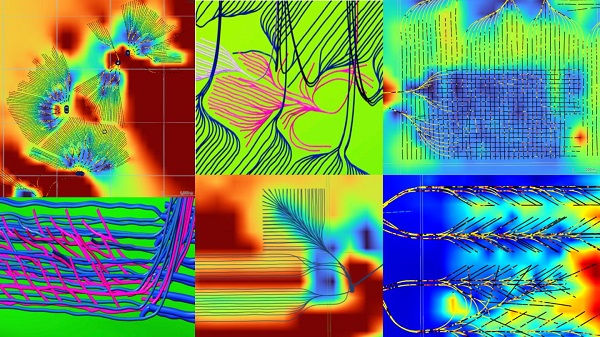

A “weird and wonderful” drilling innovation in Alberta is helping producers tap more oil and gas at lower cost and with less environmental impact.

With names like fishbone, fan, comb-over and stingray, “multilateral” wells turn a single wellbore from the surface into multiple horizontal legs underground.

“They do look spectacular, and they are making quite a bit of money for small companies, so there’s a lot of interest from investors,” said Calin Dragoie, vice-president of geoscience with Calgary-based Chinook Consulting Services.

Dragoie, who has extensively studied the use of multilateral wells, said the technology takes horizontal drilling — which itself revolutionized oil and gas production — to the next level.

“It’s something that was not invented in Canada, but was perfected here. And it’s something that I think in the next few years will be exported as a technology to other parts of the world,” he said.

Dragoie’s research found that in 2015 less than 10 per cent of metres drilled in Western Canada came from multilateral wells. By last year, that share had climbed to nearly 60 per cent.

Royalty incentives in Alberta have accelerated the trend, and Saskatchewan has introduced similar policy.

Multilaterals first emerged alongside horizontal drilling in the late 1990s and early 2000s, Dragoie said. But today’s multilaterals are longer, more complex and more productive.

The main play is in Alberta’s Marten Hills region, where producers are using multilaterals to produce shallow heavy oil.

Today’s average multilateral has about 7.5 horizontal legs from a single surface location, up from four or six just a few years ago, Dragoie said.

One record-setting well in Alberta drilled by Tamarack Valley Energy in 2023 features 11 legs stretching two miles each, for a total subsurface reach of 33 kilometres — the longest well in Canada.

By accessing large volumes of oil and gas from a single surface pad, multilaterals reduce land impact by a factor of five to ten compared to conventional wells, he said.

The designs save money by skipping casing strings and cement in each leg, and production is amplified as a result of increased reservoir contact.

Here are examples of multilateral well design. Images courtesy Chinook Consulting Services.

Parallel

Fishbone

Fan

Waffle

Stingray

Frankenwells

Alberta

Alberta to protect three pro-family laws by invoking notwithstanding clause

From LifeSiteNews

Premier Danielle Smith said her government will use a constitutional tool to defend a ban on transgender surgery for minors and stopping men from competing in women’s sports.

Alberta Premier Danielle Smith said her government will use a rare constitutional tool, the notwithstanding clause, to ensure three bills passed this year — a ban on transgender surgery for minors, stopping men from competing in women’s sports, and protecting kids from extreme aspects of the LGBT agenda — stand and remain law after legal attacks from extremist activists.

Smith’s United Conservative Party (UCP) government stated that it will utilize a new law, Bill 9, to ensure that laws passed last year remain in effect.

“Children deserve the opportunity to grow into adulthood before making life-altering decisions about their gender and fertility,” Smith said in a press release sent to LifeSiteNews and other media outlets yesterday.

“By invoking the notwithstanding clause, we’re ensuring that laws safeguarding children’s health, education and safety cannot be undone – and that parents are fully involved in the major decisions affecting their children’s lives. That is what Albertans expect, and that is what this government will unapologetically defend.”

Alberta Justice Minister and Attorney General Mickey Amery said that the laws passed last year are what Albertans voted for in the last election.

“These laws reflect an overwhelming majority of Albertans, and it is our responsibility to ensure that they will not be overturned or further delayed by activists in the courts,” he noted.

“The notwithstanding clause reinforces democratic accountability by keeping decisions in the hands of those elected by Albertans. By invoking it, we are providing certainty that these protections will remain in place and that families can move forward with clarity and confidence.”

The Smith government said the notwithstanding clause will apply to the following pieces of legislation:

-

Bill 26, the Health Statutes Amendment Act, 2024, prohibits both gender reassignment surgery for children under 18 and the provision of puberty blockers and hormone treatments for the purpose of gender reassignment to children under 16.

-

Bill 27, the Education Amendment Act, 2024, requires schools to obtain parental consent when a student under 16 years of age wishes to change his or her name or pronouns for reasons related to the student’s gender identity, and requires parental opt-in consent to teaching on gender identity, sexual orientation or human sexuality.

-

Bill 29, the Fairness and Safety in Sport Act, requires the governing bodies of amateur competitive sports in Alberta to implement policies that limit participation in women’s and girls’ sports to those who were born female.”

Bill 26 was passed in December of 2024, and it amends the Health Act to “prohibit regulated health professionals from performing sex reassignment surgeries on minors.”

As reported by LifeSiteNews, pro-LGBT activist groups, with the support of Alberta’s opposition New Democratic Party (NDP), have tried to stop the bill via lawsuits. It prompted the Smith government to appeal a court injunction earlier this year blocking the province’s ban on transgender surgeries and drugs for gender-confused minors.

Last year, Smith’s government also passed Bill 27, a law banning schools from hiding a child’s pronoun changes at school that will help protect kids from the extreme aspects of the LGBT agenda.

Bill 27 will also empower the education minister to, in effect, stop the spread of extreme forms of pro-LGBT ideology or anything else to be allowed to be taught in schools via third parties.

Bill 29, which became law last December, bans gender-confused men from competing in women’s sports, the first legislation of its kind in Canada. The law applies to all school boards, universities, and provincial sports organizations.

Alberta’s notwithstanding clause is like all other provinces’ clauses and was a condition Alberta agreed to before it signed onto the nation’s 1982 constitution.

It is meant as a check to balance power between the court system and the government elected by the people. Once it is used, as passed in the legislature, a court cannot rule that the “legislation which the notwithstanding clause applies to be struck down based on the Charter of Rights and Freedoms, the Alberta Bill of Rights, or the Alberta Human Rights Act,” the Alberta government noted.

While Smith has done well on some points, she has still been relatively soft on social issues of importance to conservatives , such as abortion, and has publicly expressed pro-LGBT views, telling Jordan Peterson earlier this year that conservatives must embrace homosexual “couples” as “nuclear families.”

-

Uncategorized2 days ago

Uncategorized2 days agoCost of bureaucracy balloons 80 per cent in 10 years: Public Accounts

-

Addictions2 days ago

Addictions2 days agoActivists Claim Dealers Can Fix Canada’s Drug Problem

-

Alberta2 days ago

Alberta2 days agoEdmonton and Red Deer to Host 2027 IIHF World Junior Hockey Championship

-

Daily Caller1 day ago

Daily Caller1 day agoDemocrats Explicitly Tell Spy Agencies, Military To Disobey Trump

-

Daily Caller1 day ago

Daily Caller1 day agoALAN DERSHOWITZ: Can Trump Legally Send Troops Into Our Cities? The Answer Is ‘Wishy-Washy’

-

Alberta22 hours ago

Alberta22 hours agoAlberta on right path to better health care

-

Alberta2 days ago

Alberta2 days agoAlbertans choose new licence plate design with the “Strong and Free” motto

-

Crime19 hours ago

Crime19 hours ago‘Modern-Day Escobar’: U.S. Says Former Canadian Olympian Ran Cocaine Pipeline with Cartel Protection and a Corrupt Toronto Lawyer