Opinion

Canada’s Financial Freefall: When Rosy Rhetoric Meets Hard Reality

|

|

|

|

This article is from The Opposition With Dan Knight substack.

The Trudeau Government’s Economic Alchemy: Turning Gold Hopes Into Lead Numbers

Good morning, my fellow Canadians. It’s September 3, 2023, and if you’re expecting to wake up to a bright, financially secure Canada, well, I have some sobering news for you. The latest figures from Statistics Canada are in, and they confirm what many of us have suspected: the Canadian economy is not on the up-and-up. Despite the rosy pictures painted by Prime Minister Justin Trudeau and Finance Minster Chrystia Freeland, the real numbers don’t lie, and they point to an economic landscape in turmoil. Allow me to break it down for you.

The new Statistics Canada data is in, and it paints a rather bleak picture of the Canadian economy under the watchful eyes of the federal government and Justin Trudeau. Let’s delve into some numbers, shall we? A staggering $16.5 billion in debt was added by Canadian households in the first quarter of this year alone, with $11.2 billion being in mortgage debt. In an environment of 5% interest rates, a rate we haven’t seen for over a decade, this is a financial bomb waiting to explode.

And let’s not forget inflation. Since 2021, we’ve seen a cumulative inflation rate of around 16.5%. Now, remember, these aren’t just abstract numbers on a ledger somewhere; these are realities hitting your grocery bills, your gas prices, your rents, and slowly emptying your wallets. But it’s not just households feeling the pinch. The economy as a whole is stalling, with real GDP nearly unchanged in the second quarter of 2023, following a measly 0.6% rise in the first quarter.

Amidst all this, Justin Trudeau and the federal government seem content piling on debt like there’s no tomorrow. The Parliamentary Budget Officer’s March 2023 report shows Canada’s deficit is expected to rise to $43.1 billion in 2023-24, up from $36.5 billion in 2022-23. And let’s not forget that 1 out of every 5 dollars in this debt spree didn’t even exist pre-pandemic. Essentially, we’re spending money we don’t have, to solve problems we’re not solving, all while making new ones.

So, where has all this spending gone? Not into securing a robust future for Canadians, I can tell you that. Despite the monumental deficits and the reckless spending, housing investment fell 2.1% in the second quarter,marking its fifth consecutive quarterly decrease. Canadians are struggling to make ends meet, and the government’s financial imprudence is exacerbating, not alleviating, the situation.

But here’s a twist to the story: while investments in housing decline, Justin Trudeau decided it was prime time to open the floodgates of immigration. There’s an aspect of governance called planning, something that seems foreign to this administration. How does one justify allowing over a million immigrants into Canada without even hinting at a solution for housing them? The result is basic economics – demand outstrips supply, and prices soar.

Remember the days before Trudeau’s reign, when the average home in Canada cost around $400,000? Eight years under his watch and that figure has doubled. Trudeau’s policies seem like a cruel jest to young families, professionals, and, frankly, anyone aspiring to own a piece of the Canadian dream. It’s almost as if he expected the housing market to “balance itself”.

And before you think this is just a ‘rough patch,’ let me remind you that household spending is also slowing. So not only are Canadians going into debt, but they’re also cutting back on spending. They’re being hit from both sides, and there’s no end in sight. The government’s promises of prosperity seem increasingly hollow when we see that per capita household spending has declined in three of the last four quarters.

The Trudeau administration’s approach to governing appears to be in a parallel universe, one where debt is limitless, and financial responsibilities are for the next government or even the next generation to sort out. And don’t even get me started on the higher taxes lurking around the corner to pay off this bonanza of spending. This isn’t governance; it’s financial negligence.

When Canadians were told that this level of inflationary spending could turn our country into something akin to Venezuela, many scoffed at the idea. But let’s face it: the signs are becoming hard to ignore. The truth is, many Canadians have been led to believe they can have gold-plated social services without paying an ounce of gold in taxes. Prime Minister Justin Trudeau seemed more than happy to sell that narrative. He promised a utopia, a social safety net woven from dreams and aspirations. But what has that net caught? Rising costs, crippling debt, and a harder life for everyday Canadians.

Trudeau has turned out to be less a responsible steward of the economy and more of a Pied Piper, leading us all off a fiscal cliff while playing a cheerful tune. Or perhaps he’s more like the Cheshire Cat from “Alice in Wonderland,” grinning broadly as he disappears, leaving behind only his grin and a trail of false promises.

As we approach the pivotal year of 2025, don’t forget who sold you this bill of goods. Remember the skyrocketing costs of living, the unmanageable debt, and the empty words that were supposed to make everything better. I, for one, certainly won’t forget. And I suspect, come election time, neither will you.

Click here to see more from The Opposition with Dan Knight.

For the full experience, upgrade your subscription.

Focal Points

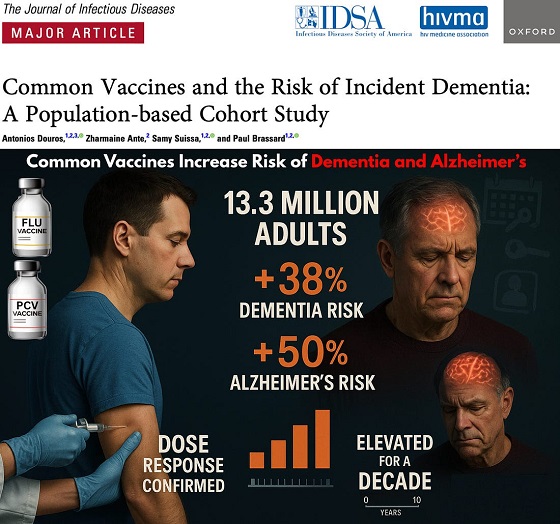

Common Vaccines Linked to 38-50% Increased Risk of Dementia and Alzheimer’s

The single largest vaccine–dementia study ever conducted (n=13.3 million) finds risk intensifies with more doses, remains elevated for a full decade, and is strongest after flu and pneumococcal shots.

The single largest and most rigorous study ever conducted on vaccines and dementia — spanning 13.3 million UK adults — has uncovered a deeply troubling pattern: those who received common adult vaccines faced a significantly higher risk of both dementia and Alzheimer’s disease.

The risk intensifies with more doses, remains elevated for a full decade, and is strongest after influenza and pneumococcal vaccination. With each layer of statistical adjustment, the signal doesn’t fade — it becomes sharper, more consistent, and increasingly difficult to explain away.

And critically, these associations persisted even after adjusting for an unusually wide range of potential confounders, including age, sex, socioeconomic status, BMI, smoking, alcohol-related disorders, hypertension, atrial fibrillation, heart failure, coronary artery disease, stroke/TIA, peripheral vascular disease, diabetes, chronic kidney and liver disease, depression, epilepsy, Parkinson’s disease, cancer, traumatic brain injury, hypothyroidism, osteoporosis, and dozens of medications ranging from NSAIDs and opioids to statins, antiplatelets, immunosuppressants, and antidepressants.

Even after controlling for this extensive list, the elevated risks remained strong and remarkably stable.

Vaccinated Adults Had a 38% Higher Risk of Dementia

The primary adjusted model showed that adults receiving common adult vaccines (influenza, pneumococcal, shingles, tetanus, diphtheria, pertussis) had a:

38% increased risk of developing dementia (OR 1.38)

This alone dismantles the narrative of “vaccines protect the brain,” but the deeper findings are far worse.

Alzheimer’s Disease Risk Is Even Higher — 50% Increased Risk

Buried in the supplemental tables is a more shocking result: when the authors restricted analyses to Alzheimer’s disease specifically, the association grew even stronger.

50% increased risk of Alzheimer’s (Adjusted OR 1.50)

This indicates the effect is not random. The association intensifies for the most devastating subtype of dementia.

Clear Dose–Response Pattern: More Vaccines = Higher Risk

The authors ran multiple dose–response models, and every one of them shows the same pattern:

Dementia (all types)

From eTable 2:

- 1 vaccine dose → Adjusted OR 1.26 (26% higher risk)

- 2–3 doses → Adjusted OR 1.32 (32% higher risk)

- 4–7 doses → Adjusted OR 1.42 (42% higher risk)

- 8–12 doses → Adjusted OR 1.50 (50% higher risk)

- ≥13 doses → Adjusted OR 1.55 (55% higher risk)

Alzheimer’s Disease (AD) Shows the Same—and Even Stronger—Trend

From eTable 7:

- 1 dose → Adjusted OR 1.32 (32% higher risk)

- 2–3 doses → Adjusted OR 1.41 (41% higher risk)

- ≥4 doses → Adjusted OR 1.61 (61% higher risk)

This is one of the most powerful and unmistakable signals in epidemiology.

Time–Response Curve: Risk Peaks Soon After Vaccination and Remains Elevated for Years

Another signal strongly inconsistent with mere bias: a time-response relationship.

The highest dementia risk occurs 2–4.9 years after vaccination (Adjusted OR 1.56). The risk then slowly attenuates but never returns to baseline, remaining elevated across all time windows.

After 12.5 years, the risk is still meaningfully elevated (Adjusted OR 1.28) — a persistence incompatible with short-term “detection bias” and suggestive of a long-lasting biological impact.

This pattern is what you expect from a biological trigger with long-latency neuroinflammatory or neurodegenerative consequences.

Even After a 10-Year Lag, the Increased Risk Does Not Disappear

When the authors apply a long 10-year lag — meant to eliminate early detection bias — the elevated risk persists:

- Dementia: OR 1.20

- Alzheimer’s: OR 1.26

If this were simply “people who see doctors more often get diagnosed earlier,” the association should disappear under long lag correction.

Influenza and Pneumococcal Vaccines Drive the Signal

Two vaccines show particularly strong associations:

Influenza vaccine

- Dementia: OR 1.39 → 39% higher risk

- Alzheimer’s: OR 1.49 → 49% higher risk

Pneumococcal vaccine

- Dementia: OR 1.12 → 12% higher risk

- Alzheimer’s: OR 1.15 → 15% higher risk

And again, both exhibit dose–response escalation — the hallmark pattern of a genuine exposure–outcome relationship.

Taken together, the findings across primary, supplemental, dose–response, time–response, stratified, and sensitivity analyses paint the same picture:

• A consistent association between cumulative vaccination and increased dementia risk

• A stronger association for Alzheimer’s than for general dementia

• A dose–response effect — more vaccines, higher risk

• A time–response effect — risk peaks after exposure and persists long-term

• Influenza and pneumococcal vaccines strongly drive the signal

• The association remains after 10-year lag correction and active comparator controls

This is what a robust epidemiologic signal looks like.

In the largest single study ever conducted on vaccines and dementia, common adult vaccinations were associated with a 38% higher risk of dementia and a 50% higher risk of Alzheimer’s disease. The risk increases with more doses, persists for a decade, and is strongest for influenza and pneumococcal vaccines.

Epidemiologist and Foundation Administrator, McCullough Foundation

Support our mission: mcculloughfnd.org

Please consider following both the McCullough Foundation and my personal account on X (formerly Twitter) for further content.

FOCAL POINTS (Courageous Discourse) is a reader-supported publication.

To receive new posts and support my work, consider becoming a free or paid subscriber.

Opinion

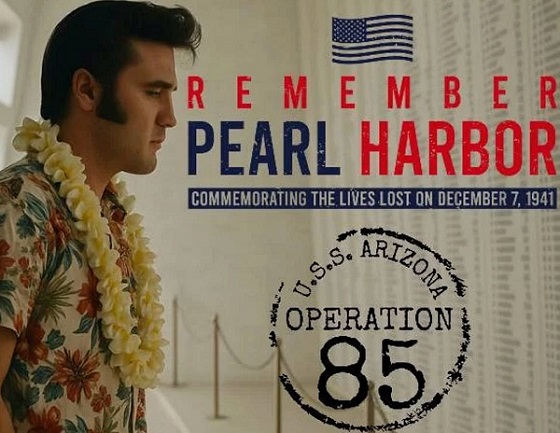

The day the ‘King of rock ‘n’ roll saved the Arizona memorial

“As we express our gratitude, we must never forget that the highest appreciation is not to utter words but to live by them.”

— President John F. Kennedy, visiting the Arizona Memorial on June 9, 1963

I was on an Aston Hotels media junket to Hawaii, and I had a morning off.

My wife took our daughter Rica, to spend a day at Waikiki beach, while I headed to Pearl Harbor on a bus.

It was my only chance to see the Arizona Memorial, and I was determined to do so.

A small ferry boat takes you there, and I have to say, it is a silent trip.

Everyone on board, seemed to feel the same weight of the moment.

The memorial is simple, but very impactful, to the say the least.

A list of the names, of the 1,177 sailors who died on Dec. 7, 1941, is posted along a wall.

That’s a lot of sailors, to go down with the ship, folks.

The Japanese attack on Pearl Harbor began at 7:55 that morning. The entire attack took only one hour and 15 minutes.

But the devastation, was immense.

Of the eight U.S. battleships present, all were damaged and four were sunk. All but Arizona were later raised, and six were returned to service during the war.

The Japanese also sank or damaged three cruisers, three destroyers, an anti-aircraft training ship, and a minelayer. More than 180 U.S. aircraft were destroyed.

Only six sailors were rescued from the burning USS Arizona, by a sailor from the nearby repair ship USS Vestal.

There is no evidence of men being trapped alive within the submerged hull of the Arizona after the ship settled on the harbor bottom, unlike on other ships like the USS Oklahoma and USS West Virginia, where trapped sailors were heard tapping on the hull for days.

SCUBA technology did not exist at that time, but at least one rescue was successful.

Civilian yard worker Julio DeCastro led a team that used pneumatic hammers to cut through the hull of the capsized USS Oklahoma and rescued 32 men who had been trapped for hours.

No U.S. aircraft carriers were present at Pearl Harbor during the attack, as USS Enterprise, USS Lexington, and USS Saratoga were all at sea on missions, while the six Japanese carriers that attacked; Akagi, Kaga, Sōryū, Hiryū, Shōkaku, Zuikaku — all returned to Japan safely after the raid, though most were sunk later in the war.

I only remember one moment of that day. A young Japanese woman dropped a garland of flowers, into the water above the wreck.

Like magic, it floated directly over the length of the ship, which is still leaking oil.

A moment of time, I can never forget.

Most people don’t know, that the Airzona Memorial almost didn’t happen.

If not for Elvis Presley.

In the early 1960s, fundraising for the memorial had stalled.

Less than half of the roughly $500,000 needed had been raised, and the project was slipping from view.

After his manager, Colonel Tom Parker, read about the struggle, Elvis organized a benefit concert in Hawaii.

Newly discharged from the U.S. Army and on his way to film Blue Hawaii — the King stepped in to help without hesitation.

With one carefully staged benefit at Pearl Harbor’s Bloch Arena on March 25, 1961, he reignited public interest, raising over US $60,000 (equivalent to millions today) for the stalled fundraising effort, which helped push President John F. Kennedy and Congress to finish the job.

The memorial opened the following year.

Bloch Arena on the Navy base became the venue, and Parker handled the details with a fundraiser’s ruthlessness: tickets would range from $3 to $100, and no complimentary tickets would be issued — not even to admirals or VIPs.

Reports from the time underscore Parker’s insistence that everyone pay, a point that generated headlines and maximized proceeds.

A crowd of about 4,000 packed the hall to see Elvis in his gold lamé jacket deliver a rare live set — one of only a handful of concerts he performed between his Army service and the 1968 “Comeback Special.”

He later admitted forgetting lyrics due to being out of practice but was grateful for the crowd’s noise, which covered his mistakes.

He would visit the memorial in 1965 and place a wreath there, showing his deep respect.

The Arizona, launched in June 1915, measured 608 ft, with a beam of 97 ft. She was fully modernized in 1929, after which she was crewed by 92 officers and 1,639 enlisted men.

A Pennsylvania class battleship, she was the flagship of Battleship Division One at the time.

The final living survivor of the Arizona, Lou Conter, died last year, on April 1, 2024.

At Pearl Harbor, the Arizona was hit by four bombs just after 8 a.m., the final one of these is believed to have gone through the armoured deck and blown up the ship’s forward magazines with devastating effects.

Both the captain of the Arizona, Franklin Van Valkenburgh, and rear admiral Isaac Campbell Kidd, the head of the Battleship Division One were killed on the bridge of the Arizona.

More than two million people visit the memorial each year. It is only accessible by boat and straddles the sunken hull of the Arizona, without touching it.

THE MAKICHUK REPORT is free today.

But if you enjoyed this post, you can tell THE MAKICHUK REPORT that their writing is valuable by pledging a future subscription.

You won’t be charged unless they enable payments.

-

Business24 hours ago

Business24 hours agoWhy Does Canada “Lead” the World in Funding Racist Indoctrination?

-

Focal Points2 days ago

Focal Points2 days agoPharma Bombshell: President Trump Orders Complete Childhood Vaccine Schedule Review

-

Automotive1 day ago

Automotive1 day agoTrump Deals Biden’s EV Dreams A Death Blow

-

Alberta2 days ago

Alberta2 days agoA Memorandum of Understanding that no Canadian can understand

-

Alberta2 days ago

Alberta2 days agoPremier Smith: Canadians support agreement between Alberta and Ottawa and the major economic opportunities it could unlock for the benefit of all

-

Automotive1 day ago

Automotive1 day agoCanada’s EV Mandate Is Running On Empty

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoFrances Widdowson’s Arrest Should Alarm Every Canadian

-

Opinion2 days ago

Opinion2 days agoCountry music star Paul Brandt asks Parliament to toughen laws against child porn