Business

Canada Scrambles To Secure Border After Trump Threatens Massive Tariff

From the Daily Caller News Foundation

By Jason Hopkins

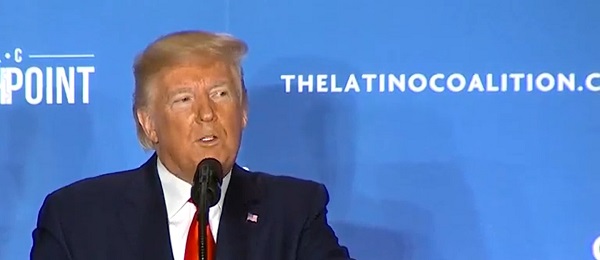

The Canadian government made clear its beefing up its border security apparatus after President-elect Donald Trump threatened to impose sweeping tariffs against Canada and Mexico if the flow of illegal immigration and drugs are not reined in.

Trump in November announced on social media that he would impose a 25% tariff on all products from Canada and Mexico unless both countries do more to limit the level of illicit drugs and illegal immigration entering into the United States. In response, Canada Prime Minister Justin Trudeau met with the president-elect at his residence in Mar-a-Largo and his government has detailed what more it’s doing to bolster immigration enforcement.

“We got, I think, a mutual understanding of what they’re concerned about in terms of border security,” Minister of Public Safety Dominic LeBlanc, who accompanied Trudeau at Mar-a-Largo, said of the meeting in an interview with Canadian media. “All of their concerns are shared by Canadians and by the government of Canada.”

“We talked about the security posture currently at the border that we believe to be effective, and we also discussed additional measures and visible measures that we’re going to put in place over the coming weeks,” LeBlanc continued. “And we also established, Rosemary, a personal series of rapport that I think will continue to allow us to make that case.”

Trudeau’s Liberal Party-led government has pivoted on border enforcement since its first days in power.

The Royal Canadian Mounted Police (RCMP) — the country’s law enforcement arm that patrols the border — is preparing to beef up its immigration enforcement capabilities by hiring more staff, adding more vehicles and creating more processing facilities, in the chance that there is an immigration surge sparked by Trump’s presidential election victory. The moves are a change in direction from Trudeau’s public declaration in January 2017 that Canada was a “welcoming” country and that “diversity is our strength” just days after Trump was sworn into office the first time.

While encounters along the U.S.-Canada border remain a fraction of what’s experienced at the southern border, activity has risen in recent months. Border Patrol agents made nearly 24,000 apprehensions along the northern border in fiscal year 2024 — marking a roughly 140% rise in apprehensions made the previous fiscal year, according to the latest data from Customs and Border Protection.

“While a change to U.S. border policy could result in an increase in migrants traveling north toward the Canada-U.S. border and between ports of entry, the RCMP now has valuable tools and insights to address this movement that were not previously in place,” read an RCMP statement provided to the Daily Caller News Foundation. “New mechanisms have been established which enable the RCMP to effectively manage apprehensions of irregular migrants between the ports.”

Trudeau’s pivot on illegal immigration enforcement follows the Canadian population growing more hawkish on the issue, public opinion surveys have indicated. Other polls also indicate Trudeau’s Liberal Party will face a beating at the voting booth in October 2025 against the Conservative Party, led by Member of Parliament Pierre Poilievre.

Trudeau’s recent overtures largely differ from Mexican President Claudia Sheinbaum, who has indicated she is not willing to bend the knee to Trump’s tariff threats. The Mexican leader in November said “there will be a response in kind” to any tariff levied on Mexican goods going into the U.S., and she appeared to deny the president-elect’s claims that she agreed to do more to beef up border security in a recent phone call.

Trump, who has vowed to embark on an incredibly hawkish immigration agenda once he re-enters office, has tapped a number of hardliners to lead his efforts. The president-elect announced South Dakota Gov. Kristi Noem to lead the Department of Homeland Security, former acting Immigration and Customs Enforcement Director Tom Homan to serve as border czar and longtime aide Stephen Miller to serve as deputy chief of staff for policy.

Business

Overregulation is choking Canadian businesses, says the MEI

From the Montreal Economic Institute

From the Montreal Economic Institute

The federal government’s growing regulatory burden on businesses is holding Canada back and must be urgently reviewed, argues a new publication from the MEI released this morning.

“Regulation creep is a real thing, and Ottawa has been fuelling it for decades,” says Krystle Wittevrongel, director of research at the MEI and coauthor of the Viewpoint. “Regulations are passed but rarely reviewed, making it burdensome to run a business, or even too costly to get started.”

Between 2006 and 2021, the number of federal regulatory requirements in Canada rose by 37 per cent, from 234,200 to 320,900. This is estimated to have reduced real GDP growth by 1.7 percentage points, employment growth by 1.3 percentage points, and labour productivity by 0.4 percentage points, according to recent Statistics Canada data.

Small businesses are disproportionately impacted by the proliferation of new regulations.

In 2024, firms with fewer than five employees pay over $10,200 per employee in regulatory and red tape compliance costs, compared to roughly $1,400 per employee for businesses with 100 or more employees, according to data from the Canadian Federation of Independent Business.

Overall, Canadian businesses spend 768 million hours a year on compliance, which is equivalent to almost 394,000 full-time jobs. The costs to the economy in 2024 alone were over $51.5 billion.

It is hardly surprising in this context that entrepreneurship in Canada is on the decline. In the year 2000, 3 out of every 1,000 Canadians started a business. By 2022, that rate had fallen to just 1.3, representing a nearly 57 per cent drop since 2000.

The impact of regulation in particular is real: had Ottawa maintained the number of regulations at 2006 levels, Canada would have seen about 10 per cent more business start-ups in 2021, according to Statistics Canada.

The MEI researcher proposes a practical way to reevaluate the necessity of these regulations, applying a model based on the Chrétien government’s 1995 Program Review.

In the 1990s, the federal government launched a review process aimed at reducing federal spending. Over the course of two years, it successfully eliminated $12 billion in federal spending, a reduction of 9.7 per cent, and restored fiscal balance.

A similar approach applied to regulations could help identify rules that are outdated, duplicative, or unjustified.

The publication outlines six key questions to evaluate existing or proposed regulations:

- What is the purpose of the regulation?

- Does it serve the public interest?

- What is the role of the federal government and is its intervention necessary?

- What is the expected economic cost of the regulation?

- Is there a less costly or intrusive way to solve the problem the regulation seeks to address?

- Is there a net benefit?

According to OECD projections, Canada is expected to experience the lowest GDP per capita growth among advanced economies through 2060.

“Canada has just lived through a decade marked by weak growth, stagnant wages, and declining prosperity,” says Ms. Wittevrongel. “If policymakers are serious about reversing this trend, they must start by asking whether existing regulations are doing more harm than good.”

The MEI Viewpoint is available here.

* * *

The MEI is an independent public policy think tank with offices in Montreal, Ottawa, and Calgary. Through its publications, media appearances, and advisory services to policymakers, the MEI stimulates public policy debate and reforms based on sound economics and entrepreneurship.

Business

Canada urgently needs a watchdog for government waste

This article supplied by Troy Media.

By Ian Madsen

By Ian Madsen

From overstaffed departments to subsidy giveaways, Canadians are paying a high price for government excess

Canada’s federal spending is growing, deficits are mounting, and waste is going unchecked. As governments look for ways to control costs, some experts say Canada needs a dedicated agency to root out inefficiency—before it’s too late

Not all the Trump administration’s policies are dubious. One is very good, in theory at least: the Department of Government Efficiency. While that

term could be an oxymoron, like ‘political wisdom,’ if DOGE proves useful, a Canadian version might be, too.

DOGE aims to identify wasteful, duplicative, unnecessary or destructive government programs and replace outdated data systems. It also seeks to

lower overall costs and ensure mechanisms are in place to evaluate proposed programs for effectiveness and value for money. This can, and often does, involve eliminating departments and, eventually, thousands of jobs. Some new roles within DOGE may need to become permanent.

The goal in the U.S. is to reduce annual operating costs and ensure government spending grows more slowly than revenues. Washington’s spending has exploded in recent years. The U.S. federal deficit now exceeds six per cent of gross domestic product. According to the U.S. Treasury Department, the cost of servicing that debt is rising at an unsustainable rate.

Canada’s latest budget deficit of $61.9 billion in fiscal 2023-24 amounts to about two per cent of GDP—less alarming than our neighbour’s situation, but still significant. It adds to the federal debt of $1.236 trillion, about 41 per cent of our estimated $3 trillion GDP. Ottawa’s public accounts show expenses at 17.8 per cent of GDP, up from about 14 per cent just eight years ago. Interest on the growing debt accounted for 9.1 per cent of

revenues in the most recent fiscal year, up from five per cent just two years ago.

The Canadian Taxpayers Federation (CTF) consistently highlights dubious spending, outright waste and extravagant programs: “$30 billion in subsidies to multinational corporations like Honda, Volkswagen, Stellantis and Northvolt. Federal corporate subsidies totalled $11.2 billion in 2022 alone. Shutting down the federal government’s seven regional development agencies would save taxpayers an estimated $1.5 billion annually.”

The CTF also noted that Ottawa hired 108,000 additional staff over the past eight years, at an average annual cost of more than $125,000 each. Hiring based on population growth alone would have added just 35,500 staff, saving about $9 billion annually. The scale of waste is staggering. Canada Post, the CBC and Via Rail collectively lose more than $5 billion a year. For reference, $1 billion could buy Toyota RAV4s for over 25,600 families.

Ottawa also duplicates functions handled by provincial governments, often stepping into areas of constitutional provincial jurisdiction. Shifting federal programs in health, education, environment and welfare to the provinces could save many more billions annually. Poor infrastructure decisions have also cost Canadians dearly—most notably the $33.4 billion blown on what should have been a relatively simple expansion of the Trans Mountain pipeline. Better project management and staffing could have prevented that disaster. Federal IT systems are another money pit, as shown by the $4-billion Phoenix payroll debacle. Then there’s the Green Slush Fund, which misallocated nearly $900 million.

Even more worrying, the rapidly expanding Old Age Supplement and Guaranteed Income Security programs are unfunded, unlike the Canada Pension Plan. Their combined cost is already roughly equal to the federal deficit and could soon become unmanageable.

Canada is sleepwalking toward financial ruin. A Canadian version of DOGE—Canada Accountability, Efficiency and Transparency Team, or CAETT—is urgently needed. The Office of the Auditor General does an admirable job identifying waste and poor performance, but it’s not proactive and lacks enforcement powers. At present, there is no mechanism in place to evaluate or eliminate ineffective programs. CAETT could fill that gap and help secure a prosperous future for Canadians.

Ian Madsen is a senior policy analyst at the Frontier Centre for Public Policy.

The views, opinions, and positions expressed by our columnists and contributors are solely their own and do not necessarily reflect those of our publication.

© Troy Media

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

Business1 day ago

Business1 day agoTrump’s bizarre 51st state comments and implied support for Carney were simply a ploy to blow up trilateral trade pact

-

Business2 days ago

Business2 days agoNew federal government plans to run larger deficits and borrow more money than predecessor’s plan

-

Business2 days ago

Business2 days agoScott Bessent says U.S., Ukraine “ready to sign” rare earths deal

-

International2 days ago

International2 days agoJavier Millei declassifies 1850+ files on Nazi leaders in Argentina

-

Frontier Centre for Public Policy1 day ago

Frontier Centre for Public Policy1 day agoTrust but verify: Why COVID-19 And Kamloops Claims Demand Scientific Scrutiny

-

Alberta1 day ago

Alberta1 day agoAlberta’s future in Canada depends on Carney’s greatest fear: Trump or Climate Change

-

Mental Health2 days ago

Mental Health2 days agoHeadline that reads ‘Ontario must pay for surgery to give trans resident both penis and vagina: appeal court’ a sign of the times in Canada

-

Bjorn Lomborg2 days ago

Bjorn Lomborg2 days agoHow Canada Can Respond to Climate Change Smartly