Economy

Canada can’t have fast population growth, housing supply constraints, and housing affordability

From the MacDonald Laurier Institute

By Steve Lafleur

No one wants to solve the housing crisis enough to make the hard choices.

It’s tempting to try to have it all and policymakers are not immune to this. There are tradeoffs in everything. Ignoring those tradeoffs might work for awhile, but eventually reality catches up to you. Try as we might, we can’t have it all.

For instance, we can’t have rapid population growth, housing supply constraints, and housing affordability all at the same time. We’ll call this the housing affordability trilemma.

The idea of a policy trilemma comes from the Mundell-Fleming model which is included in most introductory economics textbooks. The model was named after Canadian economist Robert Mundell and British economist Marcus Fleming, who developed the idea in the early 1960s. The basic premise of the model, also called the “impossible trinity” or “trilemma” is that you can have two of three policies, but not all three (namely, free capital flow, a fixed exchange rate, and a sovereign monetary policy).

The idea of an impossible trinity can and has been applied to other situations, like the euro crisis in the early 2010s, and provides a useful way of looking at seemingly intractable problems. Plotting the related problems on a Venn Diagram helps visualize the problem. Here is the Mundell-Flemming model, visualized.

(Source: Author’s creation, graphic recreated)

Now, let’s return to housing policy. Few Canadian problems are as intractable as the now nationwide housing affordability crisis. Rents are rising quickly, apartment availability is falling, and home prices are the highest relative to incomes in the G7. As we’ve shown in a recent paper for the MacDonald Laurier Institute, Canada’s population growth is outstripping housing growth. This, unsurprisingly, has undermined housing affordability. Let’s visualize this trilemma.

(Source: Author’s creation, graphic recreated)

At the root of Canada’s housing woes is a severe shortage of homes relative to the number needed. We simply don’t build enough homes to adequately house current and future Canadians.

Not only is there cross-party consensus that there’s a housing shortage, but most parties in provincial and federal elections have proposed policies aimed at addressing it. So why do we still have a shortage?

Let’s go through the elements of the Canada’s housing trilemma (or housing impossibility trinity).

The first element is a fast-growing population. Canada has the fastest growing population in the G7, and last year alone grew by more than a million people. Barring any major shifts in immigration policy, this trend is unlikely to change any time soon. Indeed, the population grew by 430,635 in the third quarter of 2023. That’s the highest quarterly growth rate since 1957.

The second element is restrictions on homebuilding. Whether intended or not, a suite of policies processes and regulations that prevent or limit the addition of more homes both in existing neighbourhoods and at the urban fringe. Barriers to density include local zoning bylaws, lengthy and uncertain consultation processes, and growth plans that exclude building or upgrading the infrastructure necessary to enable more homebuilding in existing neighbourhoods. Policies explicitly preventing the addition of homes outside of existing neighbourhoods include Ontario’s Greenbelt and British Columbia’s Agricultural Land Reserve, while softer versions include local planning targets limiting the share of development slotted to occur on city outskirts. Given these limitations, it’s no surprise that we’ve rarely surpassed 200,000 housing completions annually since the 1970s, while the rate of population growth has reached generational highs.

The third element is housing affordability. That is, the ability for individuals and families earning local incomes to comfortably meet their housing needs. This means shelter costs don’t prevent them from feeding and clothing themselves, but also allow saving and investing in an education, for instance. For example, some peg the cut-off for affordability at 30 percent of income. By that measure, a household would require an income of over $100,000 to afford a one-bedroom apartment in Vancouver, for example.

Whether we like it or not, we can’t have fast population growth, rigid housing supply constraints, and housing affordability all at the same time.

For most of our recent past, the choice we’ve collectively made is to accelerate population growth while maintaining many (if not most) restrictions on both outward and upward growth, meaning we’ve excluded the possibility of achieving broad affordability. The consequences? All the symptoms mentioned before: rising rents, falling vacancies, higher ownership costs.

Despite recent pivots by a growing number of local and provincial governments, the balance of housing and land-use policies remains firmly tilted against reaching the level of homebuilding we need to restore some semblance of affordability, which by some estimates means more than doubling homebuilding. To wit, housing construction has remained remarkably stagnant—even slightly declining—in recent decades. Even the bold changes to zoning recently passed in British Columbia, Ontario and Nova Scotia are unlikely to double the number of housing built provincewide.

But, as the housing trilemma suggests, there are alternative routes. If Canadians remain adamant about affordability, we can demand more meaningful reduction or removal of policies preventing a growth in housing supply, or we can demand a reduction in population growth, or both. These are not easy choices but ignoring them doesn’t make them go away. We need to build upwards, outwards, or both, in order to meaningfully increase housing production. We can’t say no to every solution and expect better results.

The point is, there’s broad consensus that Canada faces a housing crisis, and that major policy actions are needed to fix the problem. There’s also a tacit consensus that the policies feeding the crisis should remain in place.

To put it more bluntly, everyone wants to solve the housing crisis, but no one wants to solve the housing crisis enough to make the hard choices. Until we collectively shift our priorities, we are choosing to sacrifice housing affordability. We can’t have it all. If we insist on maintaining fast population growth and restrictions on supply, we’ll get the broken housing market we deserve.

Steve Lafleur is a public policy analyst who researches and writes for Canadian think tanks.

Economy

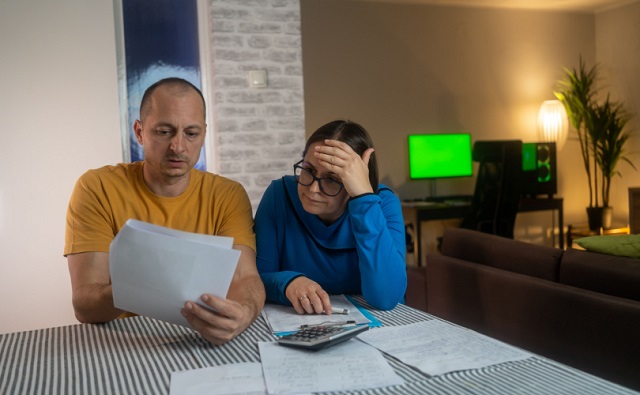

Canadians experiencing second-longest and third steepest decline in living standards in last 40 years

From the Fraser Institute

From 2019 to 2023, Canadian living standards declined—and as of the end of 2023, the decline had not yet ended, finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Despite claims to the contrary, living standards are declining in Canada,” said Grady Munro, policy analyst at the Fraser Institute and co-author of Changes in Per-Person GDP (Income): 1985 to 2023.

Specifically, from April 2019 to the end of 2023, inflation-adjusted per-person GDP, a broad measure of living standards, declined from $59,905 to $58,111 or by 3.0 per cent. This decline is exceeded only by the decline in 1989 to 1992 (-5.3 per cent) and 2008 to 2009 (-5.2 per cent). In other words, it’s the third-steepest decline in 40 years.

Moreover, the latest decline (which comprises 18 fiscal quarters) is already the second-longest in the last 40 years, surpassed only by the decline from 1989 to 1994 (which lasted 21 quarters). And if not stabilized in 2024, this decline could be the steepest and longest in four decades.

“The severity of the decline in living standards should be a wake-up call for policymakers across Canada to immediately enact fundamental policy reforms to help spur economic growth and productivity,” said Jason Clemens, study co-author and executive vice-president at the Fraser Institute.

- Real GDP per person is a broad measure of incomes (and consequently living standards). This paper analyzes changes in quarterly per-person GDP, adjusted for inflation from 1985 through to the end of 2023, the most recent data available at the time of writing.

- The study assesses the length (number of quarters) as well the percentage decline and the length of time required to recover the income lost during the decline.

- Over the period covered (1985 to 2023), Canada experienced nine periods of decline and recovery in real GDP per person.

- Of those nine periods, three (Q2 1989 to Q3 1994, Q3 2008 to Q4 2011, and Q2 2019 to Q2 2022) were most severe when comparing the length and depth of the declines along with number of quarters required for real GDP per person to recover.

- The experience following Q2 2019 is unlike any decline and recovery since 1985 because, though per person GDP recovered for one quarter in Q2 2022, it immediately began declining again and by Q4 2023 remains below the level in Q2 2019.

- This lack of meaningful recovery suggests that since mid-2019, Canada has experienced one of the longest and deepest declines in real GDP per person since 1985, exceeded only by the decline and recovery from Q2 1989 to Q3 1994.

- If per-capita GDP does not recover in 2024, this period may be the longest and largest decline in per-person GDP over the last four decades.

Read the Full Report

Read the Full Report

Authors:

Economy

Feds spend $3 million to fly 182 politicians and bureaucrats to climate conference

From the Canadian Taxpayers Federation

Author: Ryan Thorpe

Feds trip to COP28 in Dubai cost $3 million

The cost for Canada to send hundreds of people to COP28 in Dubai has doubled, rising to nearly $3 million, according to government records obtained by the Canadian Taxpayers Federation.

Included in those costs is $1.3 million the federal government dished out to host a “Canada Pavilion” at the summit, which featured a rapper performing a song on “climate disinformation,” while giving a shoutout to Environment Minister Steven Guilbeault.

“Nothing screams fighting climate change like flying around the world burning through jet fuel and millions of tax dollars,” said Franco Terrazzano, CTF Federal Director. “Here’s a crazy idea: maybe the feds don’t need to spend $3 million flying 182 politicians and bureaucrats to Dubai.”

The federal government paid for at least 182 people to go to COP28, held from Nov. 30 to Dec. 12, 2023, in Dubai, United Arab Emirates.

A previous report from the National Post pegged the cost for Canada’s delegation at $1.4 million.

But the bill now sits at $2,954,188, including $825,466 for transportation, $472,570 for accommodations and $295,455 for meals and incidentals, according to the records.

The records indicate the cost could rise even higher, as certain invoices and travel claims “have yet to be processed.”

Costs included $1.3 million for a “Canada Pavilion” to “showcase the breadth of Canadian climate leadership.”

At the Canada Pavilion, a Canadian rapper known as Baba Brinkman – the son of Liberal MP Joyce Murray – performed a rap on “climate disinformation.”

“Climate disinformation, get that immunization, the vaccine for bad meme infiltration,” Brinkman rapped. “Climate misinformation, it leads to polarization, which leads to radical conspiracy ideation.”

Environment Minister Steven Guilbeault also received a shoutout during Brinkman’s rap.

“Really? Hosting a rapper half-way around the world to drop rhymes at a government podium will help the environment?” Terrazzano said.

The records were released in response to an order paper question from Conservative MP Dan Mazier (Dauphin-Swan River-Neepawa).

Most of the hotel expenses came from the Dubai Marriott and the Premier Inn at the Dubai Investment Park, with rooms coming in between $150 and $400 per night.

The most expensive digs was a $816-per-night suite at the Pullman Dubai Jumeriah Lakes Towers, a “five-star hotel offering upscale accommodations.”

The Canadian delegation also handed out $650 worth of gifts during the trip.

-

Automotive1 day ago

Automotive1 day agoBiden’s Climate Agenda Is Running Headfirst Into A Wall Of His Own Making

-

Economy1 day ago

Economy1 day agoFeds spend $3 million to fly 182 politicians and bureaucrats to climate conference

-

Addictions15 hours ago

Addictions15 hours agoLiberals shut down motion to disclose pharma payments for Trudeau’s ‘safe supply’ drug program

-

Energy6 hours ago

Energy6 hours agoTech giants’ self-made AI energy crisis

-

Energy1 day ago

Energy1 day agoNew Report Reveals Just How Energy Rich America Really Is

-

Great Reset1 day ago

Great Reset1 day agoBiden Administration Eager to Sign WHO Pandemic Treaty

-

Economy1 day ago

Economy1 day agoCanadians experiencing second-longest and third steepest decline in living standards in last 40 years

-

espionage9 hours ago

espionage9 hours agoThe Scientists Who Came in From the Cold: Canada’s National Microbiology Laboratory Scandal, Part I