Alberta

Boreal forests could hold the key to achieving Canada’s climate goals

This article supplied by Troy Media.

By Science and Technology Desk

By Science and Technology Desk

New study finds billions more trees than expected, making boreal forests a bigger carbon sink than we thought

Canada’s boreal forests may be far more resilient to climate change than previously believed, with new research showing they contain billions more trees than past estimates, potentially boosting Canada’s natural defences in the fight against global warming.

Spanning from Yukon to Newfoundland, the boreal forest is one of the largest intact ecosystems in the world. It plays a crucial role in absorbing carbon dioxide, protecting biodiversity and supporting Indigenous and rural communities.

A new University of Alberta study provided the most accurate estimate to date of how many trees populate the boreal region, reducing long-standing uncertainties in forest carbon modelling and management.

The result: 277 billion trees across the boreal zone, including 30 billion in Alberta—31 per cent more than estimated in a major 2015 global study.

“Our research provides by far the most accurate and credible answer to the question of how many trees are in our boreal forests,” said study lead Fangliang He, a forest ecologist and Canada Research Chair in Biodiversity and Landscape Modelling.

“Knowing that there are 31 per cent more trees than previously estimated suggests our boreal forests have greater capacity to mitigate climate change.”

Tree counts like this help scientists and policymakers understand how much carbon forests can absorb and store, critical for estimating how large a role boreal ecosystems can play in national emissions strategies.

To improve on the earlier global estimate, He’s team compiled data from a record 4,367 tree plots across Canada and Alaska, compared with just 346 used in the 2015 study.

“This provides a large set of data with extensive geographic coverage in North America,” He said.

To measure trees 10 centimetres or larger in diameter—the same threshold used in the 2015 analysis—He and his team used an artificial intelligence algorithm to develop competition-based models that included tree height, a key indicator of forest competition. The use of AI allowed the researchers to detect patterns that traditional methods might miss.

“These innovative models represent a major advance in improving the accuracy of estimating tree count.”

The researchers also projected future tree density under a range of climate scenarios to see how the boreal forest might respond to a warming planet. The findings were surprising: under increasingly warmer conditions, tree density in the boreal forest would rise overall by at least 11 per cent by 2050.

“This result suggests that boreal forests might be more resilient to climate change than we thought,” He said.

The study, he added, underscores the need for better data and forecasting tools to support forest management and climate policy.

While the federal government has pledged to plant two billion trees by 2030, He said that effort is nowhere near enough.

“That number only accounts for 0.83 per cent of our estimated total number of 240 billion boreal trees in Canada, speaking to the mitigation challenge through tree-planting,” he said.

At current planting rates, he said, it would take centuries to match the natural regeneration and density needed to make a measurable impact.

“Protection of natural forests is the best nature-based solution.”

The study contributes to a growing body of research using artificial intelligence to model complex ecological systems, and could influence Canada’s future forestry and climate strategies.

Science and Technology Desk

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country

Alberta

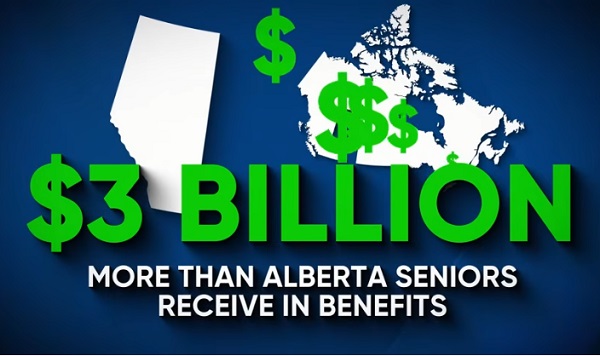

Alberta Next: Alberta Pension Plan

From Premier Danielle Smith and Alberta.ca/Next

Let’s talk about an Alberta Pension Plan for a minute.

With our young Alberta workforce paying billions more into the CPP each year than our seniors get back in benefits, it’s time to ask whether we stay with the status quo or create our own Alberta Pension Plan that would guarantee as good or better benefits for seniors and lower premiums for workers.

I want to hear your perspective on this idea and please check out the video. Get the facts. Join the conversation.

Visit Alberta.ca/next

Alberta

COVID mandates protester in Canada released on bail after over 2 years in jail

Chris Carbert (right) and Anthony Olienick, two of the Coutts Four were jailed for over two years for mischief and unlawful possession of a firearm for a dangerous purpose.

From LifeSiteNews

The “Coutts Four” were painted as dangerous terrorists and their arrest was used as justification for the invocation of the Emergencies Act by the Trudeau government, which allowed it to use draconian measures to end both the Coutts blockade and the much larger Freedom Convoy

COVID protestor Chris Carbert has been granted bail pending his appeal after spending over two years in prison.

On June 30, Alberta Court of Appeal Justice Jo-Anne Strekaf ordered the release of Chris Carbert pending his appeal of charges of mischief and weapons offenses stemming from the Coutts border blockade, which protested COVID mandates in 2022.

“[Carbert] has demonstrated that there is no substantial likelihood that he will commit a criminal offence or interfere with the administration of justice if released from detention pending the hearing of his appeals,” Strekaf ruled.

“If the applicant and the Crown are able to agree upon a release plan and draft order to propose to the court, that is to be submitted by July 14,” she continued.

Carbert’s appeal is expected to be heard in September. So far, Carbert has spent over two years in prison, when he was charged with conspiracy to commit murder during the protest in Coutts, which ran parallel to but was not officially affiliated with the Freedom Convoy taking place in Ottawa.

Later, he was acquitted of the conspiracy to commit murder charge but still found guilty of the lesser charges of unlawful possession of a firearm for a dangerous purpose and mischief over $5,000.

In September 2024, Chris Carbert was sentenced to six and a half years for his role in the protest. However, he is not expected to serve his full sentence, as he was issued four years of credit for time already served. Carbert is also prohibited from owning firearms for life and required to provide a DNA sample.

Carbert was arrested alongside Anthony Olienick, Christopher Lysak and Jerry Morin, with the latter two pleading guilty to lesser charges to avoid trial. At the time, the “Coutts Four” were painted as dangerous terrorists and their arrest was used as justification for the invocation of the Emergencies Act by the Trudeau government, which allowed it to use draconian measures to end both the Coutts blockade and the much larger Freedom Convoy occurring thousands of kilometers away in Ottawa.

Under the Emergency Act (EA), the Liberal government froze the bank accounts of Canadians who donated to the Freedom Convoy. Trudeau revoked the EA on February 23 after the protesters had been cleared out. At the time, seven of Canada’s 10 provinces opposed Trudeau’s use of the EA.

Since then, Federal Court Justice Richard Mosley ruled that Trudeau was “not justified” in invoking the Emergencies Act, a decision that the federal government is appealing.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoCanada Day 2025: It’s Time For Boomers To Let The Kids Lead

-

Agriculture2 days ago

Agriculture2 days agoCanada’s supply management system is failing consumers

-

Alberta20 hours ago

Alberta20 hours agoCOVID mandates protester in Canada released on bail after over 2 years in jail

-

MxM News2 days ago

MxM News2 days agoDiddy found not guilty of trafficking, faces prison on lesser charge

-

Business2 days ago

Business2 days agoPrairie provinces and Newfoundland and Labrador see largest increases in size of government

-

Alberta2 days ago

Alberta2 days agoAlberta government records $8.3 billion surplus—but the good times may soon end

-

armed forces17 hours ago

armed forces17 hours agoCanada’s Military Can’t Be Fixed With Cash Alone

-

Canadian Energy Centre2 days ago

Canadian Energy Centre2 days agoAlberta oil sands legacy tailings down 40 per cent since 2015