Business

BlackRock’s woke capitalist vision is failing: here’s why

Larry Fink, New York Times DealBook 2022. Thos Robinson/Getty Images for The New York Times

From LifeSiteNews

By Frank Wright

Corbett shows how public outrage at the unelected political power of asset managers has led to an investor backlash, with politicians and legislators taking steps against the “forcing of behaviors” which BlackRock CEO Larry Fink once trumpeted as his mission

The always engaging James Corbett has produced some of the most informative guides to the power of BlackRock – who together with second-placed Vanguard Group own a combined 15 trillion U.S. dollars of assets under management.

In this report I relate how Corbett argues for a fightback against BlackRock and the asset management giants like them, who use their power to shape the world regardless of public consent. His views are more than corroborated by the news which followed the release of his video.

Corbett’s September 21 presentation, “How to Defeat BlackRock,” followed up by his excellent, “How BlackRock Conquered the World,” begins with some very encouraging news about the fortunes of the global investment giants – and what can be done to stop them. Happily, this process is already underway.

Corbett shows how public outrage at the unelected political power of asset managers has led to an investor backlash, with politicians and legislators taking steps against the “forcing of behaviors” which BlackRock CEO Larry Fink once trumpeted as his mission.

According to Corbett, and a growing number of other sources, this pressure looks likely to force asset management giants like BlackRock out of the behavior business altogether.

READ: How Vanguard and BlackRock took control of the global economy

A faltering global agenda

The first piece of good news is that the brand of ESG (environmental, social and governance) is so toxic that not even BlackRock’s CEO wants to use it any more.

BlackRock, under the leadership of Larry Fink, has used its immense wealth for years to compel companies to adopt the ESG agenda, becoming the driving force of “woke” capitalism. Yet leveraging financial power to force social and political change in this way has led to a backlash – from the general public, from lawmakers – and from the financial sector itself.

Last December, the North Carolina State Treasurer Dale R. Folwell called for Fink’s resignation, threatening to withdraw over $14 billion in state funds from the investment firm. As The Daily Mail reported, Folwell said:

Fink is in ‘pursuit of a political agenda… A focus on ESG is not a focus on returns and potentially could force us to violate our own fiduciary duty.’

Six months later, in June 2023, Fink said he was “ashamed” of ESG which he said had become “politically weaponized.”

Though his company, BlackRock, has continued to rate businesses on the same criteria, it has removed almost every mention of the term from its communications.

Speaking in Aspen, Colorado, Fink admitted that the decision of Florida Governor Ron DeSantis to withdraw $2 billion in state assets managed by BlackRock had hurt the company. The ESG agenda advanced by BlackRock is so beleaguered, even its former champion will not speak its name.

The power of public opinion

What this shows, as Corbett argues, is a further piece of good news: that public opinion still matters. It is public knowledge of the unelected political meddling of BlackRock and others which has led to outrage – and to action.

As a result of extensive coverage – mainly from independent media – of the nefarious influence of his company, Larry Fink has faced sustained criticism for over a year. This in turn has led to the kind of legal and financial consequences which have made people like Fink think again.

READ: How Larry Fink uses ESG and AI to control the world’s money

This also shows why so much money is invested in propaganda, censorship and “narrative control.” Governments and corporations are afraid of a well-informed public, because such a public is very likely to demand they are held to account.

The case of BlackRock not only shows that what is in your mind can indeed matter, but also that the goliaths of globalism do not always win.

This is one reason for the ongoing information war, and the growing censorship-industrial complex. An informed citizenry has the power to hold the powerful to account. Taken together, public outrage can also move markets – and the money men who watch them.

I investigated some of the claims Corbett made about the financial world’s mounting unease with the involvement of BlackRock, Vanguard and other firms in pushing unelected political and social change. I found more cause for celebration than even Corbett himself would admit at the time.

Passive investments, legal actions

In further good news, mounting legal troubles have accompanied the practice of companies like BlackRock, Vanguard and State Street to leverage their enormous asset piles into social and political compliance engineering.

According to a June 2023 report from RIAbiz, an online journal for registered investment advisers (RIAs), BlackRock and Vanguard’s “fooling around” with ESG targets has left them exposed to prosecution.

The business of managing many assets is supposed to be “passive” – a legal term which means that companies such as BlackRock are prohibited from “exercising control” of the companies whose funds they manage.

Federal exemptions had been granted to these asset management giants, but their habit of forcing behaviors on issues such as carbon “net zero” and “diversity” has placed their capacity to do business in jeopardy.

In May of this year, BlackRock and Vanguard saw a legal challenge emerge, and one which not only deters investors, but may also lead to their being broken up.

As Oisin Breen reported on June 1:

Seventeen AGs moved on May 10 against BlackRock on the grounds that its climate-based activism and its pro-ethical, governance and social (ESG) stance make it an active investor, in breach of a FERC antitrust agreement.

The Federal Energy Regulatory Commission (FERC) is involved due to BlackRock’s – and Vanguard’s – holdings in domestic energy utilities. Breen continues:

Separately, 13 AGs filed a motion to block Vanguard from renewing its FERC exemption. They represent mostly energy-producing states like Texas, as do the 17 now pressing to have BlackRock’s exemption revoked.

Though Breen concluded that both firms had “won a reprieve” from immediate legal censure, the message appears to have been received.

Three months later, Fortune magazine reported:

Finance giants BlackRock and Vanguard – once ESG’s biggest proponents – seem to be reversing course.

Hitting the bottom line

The global business publication noted the legal complications of mixing finance with social, environmental and governance policies, saying:

It appears these strategic shifts are being driven by a combination of public backlash and a focus on their bottom lines.

Then, on October 23, leading U.S. insurance brokerage WTW reported that BlackRock, Vanguard and State Street had all seen significant drops in their total amounts of assets under management (AUM). BlackRock’s alone fell from over 10 trillion dollars to just over 8 trillion.

By October 31, Fortune returned with the verdict that BlackRock, Vanguard and State Street had all “turned against environment and social proposals… in a clear sign of backlash.”

Their report noted a “precipitous” fall in the support of all three asset giants’ commitment to these agendas – with BlackRock’s funding of “ESG” measures falling by over 30 percent from 2021.

Real world consequences

This is the delayed result of a reality which BlackRock themselves acknowledged – and one which drove much of the public disapproval – that the ESG agenda was an economic and social wrecking ball.

Remarkably, BlackRock itself admitted that its promotion of ESG, in the aggressive pursuit of net zero and diversity policies, had actually contributed to a severe economic downturn.

In its “2023 Outlook,” the asset giant said these initiatives had been a major factor in ending the decades-long period of prosperity in the West known as the Great Moderation.

READ: The End of Prosperity? How BlackRock manipulates the West’s economic downturn

Buycotts – not boycotts

In his video Corbett is frank about the limitations of individual consumer power. You cannot “access BlackRock directly,” as it is a management firm. You can, of course, withdraw support from the companies in which it and its fellow behemoths Vanguard and State Street have holdings.

Yet Corbett moves from boycotts of individual corporations to the intriguing concept of “buycotts.” What he means by this is “taking your money from the corporations and using it to build things you want to see.”

How realistic is this solution? Already, businesses are emerging to capitalize on growing public discontent with what is done with their money – without their consent or approval.

Changing our behaviors – for good

The investment platform Reverberate, for example, allows users to “Rate companies highly (over 2.5 stars) if they make your life better, or lower if they make your life worse.”

What is more, user feedback from the public will determine which shares it buys:

Our publicly-traded investment fund buys shares of companies whose average ratings are high and/or rising, and sells shares of those whose average ratings are low and/or falling.

On their website, Reverberate says:

This is our way of trying to align capital allocation with the interests of the general public, as estimated by us in a relatively unbiased, wide-reaching way.

The decline of the asset managers’ ESG agenda is a happy corrective to the damaging belief that nothing can be done about anything.

It shows how well-informed public opinion can lead to genuine change, and with some of Corbett’s insights, how we can move from complaint to constructive action in making a better world.

You can see Corbett’s entertaining case for countering the woke asset management giants here.

Business

Dallas mayor invites NYers to first ‘sanctuary city from socialism’

From The Center Square

By

After the self-described socialist Zohran Mamdani won the Democratic primary for mayor in New York, Dallas Mayor Eric Johnson invited New Yorkers and others to move to Dallas.

Mamdani has vowed to implement a wide range of tax increases on corporations and property and to “shift the tax burden” to “richer and whiter neighborhoods.”

New York businesses and individuals have already been relocating to states like Texas, which has no corporate or personal income taxes.

Johnson, a Black mayor and former Democrat, switched parties to become a Republican in 2023 after opposing a city council tax hike, The Center Square reported.

“Dear Concerned New York City Resident or Business Owner: Don’t panic,” Johnson said. “Just move to Dallas, where we strongly support our police, value our partners in the business community, embrace free markets, shun excessive regulation, and protect the American Dream!”

Fortune 500 companies and others in recent years continue to relocate their headquarters to Dallas; it’s also home to the new Texas Stock Exchange (TXSE). The TXSE will provide an alternative to the New York Stock Exchange and Nasdaq and there are already more finance professionals in Texas than in New York, TXSE Group Inc. founder and CEO James Lee argues.

From 2020-2023, the Dallas-Fort Worth-Arlington MSA reported the greatest percentage of growth in the country of 34%, The Center Square reported.

Johnson on Thursday continued his invitation to New Yorkers and others living in “socialist” sanctuary cities, saying on social media, “If your city is (or is about to be) a sanctuary for criminals, mayhem, job-killing regulations, and failed socialist experiments, I have a modest invitation for you: MOVE TO DALLAS. You can call us the nation’s first official ‘Sanctuary City from Socialism.’”

“We value free enterprise, law and order, and our first responders. Common sense and the American Dream still reside here. We have all your big-city comforts and conveniences without the suffocating vice grip of government bureaucrats.”

As many Democratic-led cities joined a movement to defund their police departments, Johnson prioritized police funding and supporting law and order.

“Back in the 1800s, people moving to Texas for greater opportunities would etch ‘GTT’ for ‘Gone to Texas’ on their doors moving to the Mexican colony of Tejas,” Johnson continued, referring to Americans who moved to the Mexican colony of Tejas to acquire land grants from the Mexican government.

“If you’re a New Yorker heading to Dallas, maybe try ‘GTD’ to let fellow lovers of law and order know where you’ve gone,” Johnson said.

Modern-day GTT movers, including a large number of New Yorkers, cite high personal income taxes, high property taxes, high costs of living, high crime, and other factors as their reasons for leaving their states and moving to Texas, according to multiple reports over the last few years.

In response to Johnson’s invitation, Gov. Greg Abbott said, “Dallas is the first self-declared “Sanctuary City from Socialism. The State of Texas will provide whatever support is needed to fulfill that mission.”

The governor has already been doing this by signing pro-business bills into law and awarding Texas Enterprise Grants to businesses that relocate or expand operations in Texas, many of which are doing so in the Dallas area.

“Texas truly is the Best State for Business and stands as a model for the nation,” Abbott said. “Freedom is a magnet, and Texas offers entrepreneurs and hardworking Texans the freedom to succeed. When choosing where to relocate or expand their businesses, more innovative industry leaders recognize the competitive advantages found only in Texas. The nation’s leading CEOs continually cite our pro-growth economic policies – with no corporate income tax and no personal income tax – along with our young, skilled, diverse, and growing workforce, easy access to global markets, robust infrastructure, and predictable business-friendly regulations.”

Business

National dental program likely more costly than advertised

From the Fraser Institute

By Matthew Lau

At the beginning of June, the Canadian Dental Care Plan expanded to include all eligible adults. To be eligible, you must: not have access to dental insurance, have filed your 2024 tax return in Canada, have an adjusted family net income under $90,000, and be a Canadian resident for tax purposes.

As a result, millions more Canadians will be able to access certain dental services at reduced—or no—out-of-pocket costs, as government shoves the costs onto the backs of taxpayers. The first half of the proposition, accessing services at reduced or no out-of-pocket costs, is always popular; the second half, paying higher taxes, is less so.

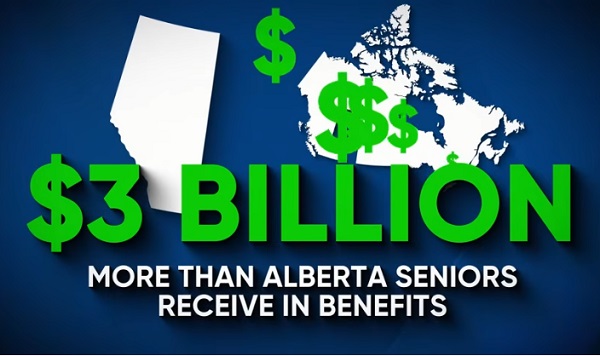

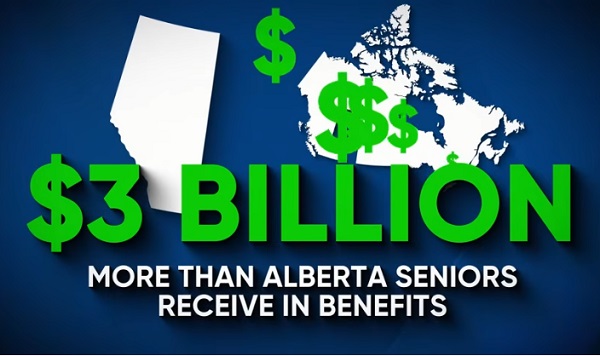

A Leger poll conducted in 2022 found 72 per cent of Canadians supported a national dental program for Canadians with family incomes up to $90,000—but when asked whether they would support the program if it’s paid for by an increase in the sales tax, support fell to 42 per cent. The taxpayer burden is considerable; when first announced two years ago, the estimated price tag was $13 billion over five years, and then $4.4 billion ongoing.

Already, there are signs the final cost to taxpayers will far exceed these estimates. Dr. Maneesh Jain, the immediate past-president of the Ontario Dental Association, has pointed out that according to Health Canada the average patient saved more than $850 in out-of-pocket costs in the program’s first year. However, the Trudeau government’s initial projections in the 2023 federal budget amounted to $280 per eligible Canadian per year.

Not all eligible Canadians will necessarily access dental services every year, but the massive gap between $850 and $280 suggests the initial price tag may well have understated taxpayer costs—a habit of the federal government, which over the past decade has routinely spent above its initial projections and consistently revises its spending estimates higher with each fiscal update.

To make matters worse there are also significant administrative costs. According to a story in Canadian Affairs, “Dental associations across Canada are flagging concerns with the plan’s structure and sustainability. They say the Canadian Dental Care Plan imposes significant administrative burdens on dentists, and that the majority of eligible patients are being denied care for complex dental treatments.”

Determining eligibility and coverage is a huge burden. Canadians must first apply through the government portal, then wait weeks for Sun Life (the insurer selected by the federal government) to confirm their eligibility and coverage. Unless dentists refuse to provide treatment until they have that confirmation, they or their staff must sometimes chase down patients after the fact for any co-pay or fees not covered.

Moreover, family income determines coverage eligibility, but even if patients are enrolled in the government program, dentists may not be able to access this information quickly. This leaves dentists in what Dr. Hans Herchen, president of the Alberta Dental Association, describes as the “very awkward spot” of having to verify their patients’ family income.

Dentists must also try to explain the program, which features high rejection rates, to patients. According to Dr. Anita Gartner, president of the British Columbia Dental Association, more than half of applications for complex treatment are rejected without explanation. This reduces trust in the government program.

Finally, the program creates “moral hazard” where people are encouraged to take riskier behaviour because they do not bear the full costs. For example, while we can significantly curtail tooth decay by diligent toothbrushing and flossing, people might be encouraged to neglect these activities if their dental services are paid by taxpayers instead of out-of-pocket. It’s a principle of basic economics that socializing costs will encourage people to incur higher costs than is really appropriate (see Canada’s health-care system).

At a projected ongoing cost of $4.4 billion to taxpayers, the newly expanded national dental program is already not cheap. Alas, not only may the true taxpayer cost be much higher than this initial projection, but like many other government initiatives, the dental program already seems to be more costly than initially advertised.

-

armed forces1 day ago

armed forces1 day agoCanada’s Military Can’t Be Fixed With Cash Alone

-

Alberta1 day ago

Alberta1 day agoCOVID mandates protester in Canada released on bail after over 2 years in jail

-

International1 day ago

International1 day agoTrump transportation secretary tells governors to remove ‘rainbow crosswalks’

-

Business1 day ago

Business1 day agoCanada’s loyalty to globalism is bleeding our economy dry

-

Business1 day ago

Business1 day agoCarney’s spending makes Trudeau look like a cheapskate

-

Alberta1 day ago

Alberta1 day agoAlberta Next: Alberta Pension Plan

-

Crime2 days ago

Crime2 days agoProject Sleeping Giant: Inside the Chinese Mercantile Machine Linking Beijing’s Underground Banks and the Sinaloa Cartel

-

C2C Journal23 hours ago

C2C Journal23 hours agoCanada Desperately Needs a Baby Bump