Alberta

Before Trudeau Blames Alberta, Perhaps He Should Look in the Mirror

From EnergyNow.ca

There has been a lot of talk about how Premier Danielle Smith did not sign a statement of support with the Government of Canada regarding a unified response to any tariff action taken by incoming President of the United States, Donald Trump.

Trudeau singles out Alberta premier for not putting ‘Canada first’ in break with other provinces

Thanks for reading William’s Substack! Subscribe for free to receive new posts and support my work.

While it is easy to throw stones at Premier Smith and call her actions one of selfishness, placing the interests of Alberta ahead of Canada, I think there are a number of reasons why one could reply that she was well within her right to act as she did. Over the last decade, Trudeau has gone out of his way to vilify the oil and gas industry, through his continual bad mouthing of the industry as being antiquated, and implementing policies that ensured that capital flight from the space accelerated, infrastructure projects were cancelled and massive levels of uncertainty were overlaid on the investment landscape going forward. Despite all this, the oil and gas sector still remains one of the most important economic contributors to the economy and is the largest component of exports from Canada to the United States, and it isn’t even close.

The Observatory of Economic Complexity (OEC)

The ironic thing of all this? To get oil to the refineries in the east, you need to IMPORT it by pipeline from the United States or primarily by ship to Quebec and New Brunswick. Had the Energy East Pipeline been built, Canadian refineries could have had Canadian domiciled product to satiate them. Moreover, had Northern Gateway been built, we would have diversified our client list beyond the United States. Sure, the Trans Mountain Pipeline was built, at extraordinary cost and timelines, and some “credit” is due to the Government getting it done, but the proof is in the current landscape that we operate in.

Now, coming back to the beginning. Why do I think Trudeau should look in the mirror before throwing rocks at Premier Smith? I come back to 2015 when Trudeau said Canada is the world’s “first postnational state” and that “there is no core identity, no mainstream in Canada.” He has gone about taking away what many of us grew up with, namely a sense of Canadian identity, and tried to replace that with shame and no collective identity. What is a post nation state you may ask? Post-nationalism or non-nationalism is the process or trend by which nation states and national identities lose their importance relative to cross-nation and self-organized or supranational and global entities as well as local entities.

So, is it any wonder that people are starting to question what is Canadian any more? At a time when Canada is under significant threat, the irony that Alberta likely represents the best tool in this tools (Trudeau) economic toolbox, is wildly ironic. As they say, karma’s a bitch.

Thanks for reading William’s Substack! Subscribe for free to receive new posts and support for his work.

Alberta

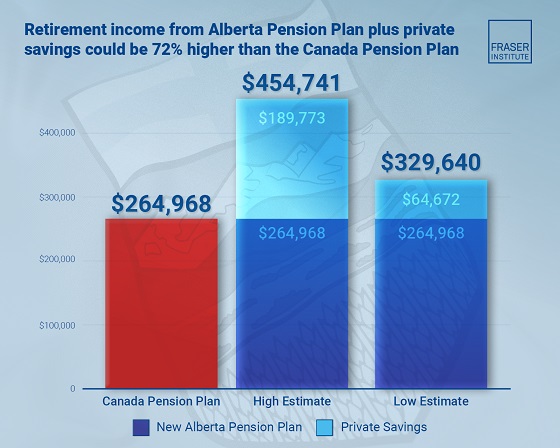

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Business24 hours ago

Business24 hours agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Business2 days ago

Business2 days agoCarney government should apply lessons from 1990s in spending review

-

Uncategorized2 days ago

Uncategorized2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

COVID-1924 hours ago

COVID-1924 hours agoTrump DOJ dismisses charges against doctor who issued fake COVID passports

-

Alberta23 hours ago

Alberta23 hours agoTemporary Alberta grid limit unlikely to dampen data centre investment, analyst says

-

Entertainment2 days ago

Entertainment2 days agoStudy finds 99% of late-night TV guests in 2025 have been liberal