Energy

BC should revisit nuclear energy to address BC Hydro shortages

From Resource Works

The short-term costs of nuclear SMRs are preferable to paying hundreds of millions to import foreign energy in the long-term.

British Columbia takes great pride in its tremendous hydroelectric resources, which result from the province’s many long, powerful rivers. For decades, BC has found it easy to rely on hydroelectricity as a clean, renewable source of power for homes, industry, and businesses.

However, the ongoing viability of hydropower in BC should be called into question due to worsening summer droughts and declining snowfalls, which have negatively impacted the annual supply of hydropower. BC has not seriously entertained the possibility of alternatives, even though other provinces have begun to embrace one particular source of energy that has been illegal here for over a decade: nuclear power.

By refusing to strike down the law passed in 2010 that prohibits the mining of uranium or the building of nuclear reactors, BC has made itself an outlier among its peers. Since last year, Ontario has announced plans to expand its existing nuclear capacity, which already provides the majority of the province’s electricity.

Alberta, Saskatchewan, and Nova Scotia have also begun to explore the possibility of expanding nuclear power to help power their growing provinces. BC has prohibited nuclear energy since passing the Clean Energy Act of 2010, which bans the building of reactors or mining uranium.

This prohibition is a barrier to diversifying BC’s energy supply, which has become more reliant on foreign energy. Due to energy shortages, BC Hydro had to import 15 to 20 percent of the energy required to meet the province’s needs.

Do not expect the situation to improve. Snowpacks are shrinking in the winter months, and summer droughts have become more frequent, which means BC’s dams will see a reduction in their power capacity. Power shortages may be on the horizon, leading to vastly more expensive purchases of foreign energy to meet BC’s growing electricity demand, driven by the construction of new homes and projects like LNG facilities on the coast.

Energy diversification is the solution, and nuclear power should be included, especially Small Modular Reactors (SMRs).

Low-carbon and reliable, SMRs can provide steady nuclear power in any season. They are flexible and much more cost-effective than traditional, large-scale nuclear reactors.

For a vast province like BC, filled with small communities separated by mountainous terrain, SMRs can be deployed with great ease to ensure energy stability in remote and Indigenous communities that still struggle with energy access. The Haida Nation, for example, is still reliant on diesel to supply its energy, which goes against the BC government’s clean energy goals and relies on fuel being shipped to the Haida Gwaii archipelago.

While SMRs are cheaper than massive nuclear reactors, they are still expensive and require strict safety regulations due to the ever-present risks associated with nuclear energy. However, is the cost of building nuclear facilities in the short term more expensive than importing energy for years to come?

In 2023, BC Hydro spent upwards of $300 million USD on imported energy, while the cost of the smallest SMR is $50 million, with the more expensive units costing up to $3 billion. Building SMRs now is the right decision from a cost-benefit perspective and in terms of BC’s clean energy goals because SMRs guarantee low-emitting energy, unlike imported energy.

The Clean Energy Act stands in the way of nuclear power’s emergence in BC. Amending it will be necessary for that to change.

BC is not going to need any less energy going forward.

It is high time to get over old fears and stereotypes of nuclear energy. Hydroelectricity need not be displaced as the cornerstone of BC’s energy supply, but it alone cannot face the challenges of the future.

Alberta

Pierre Poilievre – Per Capita, Hardisty, Alberta Is the Most Important Little Town In Canada

From Pierre Poilievre

Energy

If Canada Wants to be the World’s Energy Partner, We Need to Act Like It

Photo by David Bloom / Postmedia file

From Energy Now

By Gary Mar

With the Trans Mountain Expansion online, we have new access to Pacific markets and Asia has responded, with China now a top buyer of Canadian crude.

The world is short on reliable energy and long on instability. Tankers edge through choke points like the Strait of Hormuz. Wars threaten pipelines and power grids. Markets flinch with every headline. As authoritarian regimes rattle sabres and weaponize supply chains, the global appetite for energy from stable, democratic, responsible producers has never been greater.

Canada checks every box: vast reserves, rigorous environmental standards, rule of law and a commitment to Indigenous partnership. We should be leading the race, but instead we’ve effectively tied our own shoelaces together.

In 2024, Canada set new records for oil production and exports. Alberta alone pumped nearly 1.5 billion barrels, a 4.5 per cent increase over 2023. With the Trans Mountain Expansion (TMX) online, we have new access to Pacific markets and Asia has responded, with China now a top buyer of Canadian crude.

The bad news is that we’re limiting where energy can leave the country. Bill C-48, the so-called tanker ban, prohibits tankers carrying over 12,500 tons of crude oil from stopping or unloading crude at ports or marine installations along B.C.’s northern coast. That includes Kitimat and Prince Rupert, two ports with strategic access to Indo-Pacific markets. Yes, we must do all we can to mitigate risks to Canada’s coastlines, but this should be balanced against a need to reduce our reliance on trade with the U.S. and increase our access to global markets.

Add to that the Impact Assessment Act (IAA) which was designed in part to shorten approval times and add certainty about how long the process would take. It has not had that effect and it’s scaring off investment. Business confidence in Canada has dropped to pandemic-era lows, due in part to unpredictable rules.

At a time when Canada is facing a modest recession and needs to attract private capital, we’ve made building trade infrastructure feel like trying to drive a snowplow through molasses.

What’s needed isn’t revolutionary, just practical. A start would be to maximize the amount of crude transported through the Trans Mountain Expansion pipeline, which ran at 77 per cent capacity in 2024. Under-utilization is attributed to a variety of factors, one of which is higher tolls being charged to producers.

Canada also needs to overhaul the IAA and create a review system that’s fast, clear and focused on accountability, not red tape. Investors need to know where the goalposts are. And, while we are making recommendations, strategic ports like Prince Rupert should be able to participate in global energy trade under the same high safety standards used elsewhere in Canada.

Canada needs a national approach to energy exporting. A 10-year projects and partnerships plan would give governments, Indigenous nations and industry a common direction. This could be coupled with the development of a category of “strategic export infrastructure” to prioritize trade-enabling projects and move them through approvals faster.

Of course, none of this can take place without bringing Indigenous partners into the planning process. A dedicated federal mechanism should be put in place to streamline and strengthen Indigenous consultation for major trade infrastructure, ensuring the process is both faster and fairer and that Indigenous equity options are built in from the start.

None of this is about blocking the energy transition. It’s about bridging it. Until we invent, build and scale the clean technologies of tomorrow, responsibly produced oil and gas will remain part of the mix. The only question is who will supply it.

Canada is the most stable of the world’s top oil producers, but we are a puzzle to the rest of the world, which doesn’t understand why we can’t get more of our oil and natural gas to market. In recent years, Norway and the U.S. have increased crude oil production. Notably, the U.S. also increased its natural gas exports through the construction of new LNG export terminals, which have helped supply European allies seeking to reduce their reliance on Russian natural gas.

Canada could be the bridge between demand and security, but if we want to be the world’s go-to energy partner, we need to act like it. That means building faster, regulating smarter and treating trade infrastructure like the strategic asset it is.

The world is watching. The opportunity is now. Let’s not waste it.

Gary Mar is president and CEO of the Canada West Foundation

-

Crime2 days ago

Crime2 days agoNational Health Care Fraud Takedown Results in 324 Defendants Charged in Connection with Over $14.6 Billion in Alleged Fraud

-

Health2 days ago

Health2 days agoRFK Jr. Unloads Disturbing Vaccine Secrets on Tucker—And Surprises Everyone on Trump

-

Business1 day ago

Business1 day agoElon Musk slams Trump’s ‘Big Beautiful Bill,’ calls for new political party

-

International21 hours ago

International21 hours agoCBS settles with Trump over doctored 60 Minutes Harris interview

-

Business14 hours ago

Business14 hours agoLatest shakedown attempt by Canada Post underscores need for privatization

-

Business14 hours ago

Business14 hours agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoGlobal media alliance colluded with foreign nations to crush free speech in America: House report

-

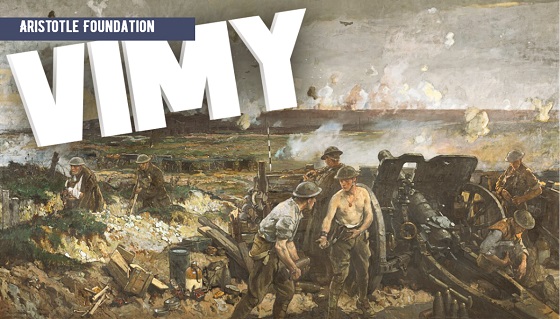

Aristotle Foundation22 hours ago

Aristotle Foundation22 hours agoHow Vimy Ridge Shaped Canada