Alberta

Alberta’s emergency grid alert underscores vital role diverse energy mix plays in Canada

From the Canadian Energy Centre

By Cody Ciona

After a major cold spell affected the capacity of Alberta’s power grid to provide electricity, experts weigh in on the need for multiple sources of energy

The crucial need for Canada to have a flexible and diverse energy grid was given a practical demonstration this past weekend as frigid winter temperatures in Alberta prompted a grid emergency.

With temperatures in some places dropping to almost –50C with the wind chill, provincial officials issued an emergency alert asking Albertans to immediately reduce electricity usage, with the grid approaching maximum capacity during peak hours.

With wind and solar assets unable to contribute power and the unexpected shutdown of two natural gas plants, Albertans faced the possibility of rolling blackouts in dangerously cold conditions.

A day after the emergency, the Alberta Electric System Operator (AESO) thanked Albertans who responded quickly to reduce the demand load.

“This is an example of why we need to ensure that we have sufficient dispatchable, dependable generation available to us as a province to meet what is always our most challenging time, which is those cold, dark winter nights,” Michael Law, CEO of AESO, told the Calgary Herald.

The prospect of failure in the worst possible circumstances prompted energy analysts to highlight the critical need for a diverse and flexible energy grid.

“You could have had 50,000 megawatts, all the solar farms and wind farms in the world located in Alberta, and it still wouldn’t have come anywhere close to closing that gap,” University of Alberta economics professor Andrew Leach told CBC News.

Wind and solar can be major contributors to the grid when conditions allow, but when the sun goes down and the wind stops, base load power sources like natural gas reliably protect the system.

Leach said system operators need to plan for supply to manage adverse weather conditions to ensure the reliability of the grid.

“Whether it’s natural gas, nuclear, import capacity, battery storage, etc., geothermal, there’s nobody that’s arguing against that.”

With policymakers pushing for more electrification, University of Alberta industrial engineering professor Tim Weis said Alberta isn’t alone in the need for resilient and stable power supply.

“I think we need to wrestle with that and realize that we are moving into a world where there’s going to be more electrical demands on the system,” he told Global News.

“We are moving into a new world. We’re not the only ones facing some of these challenges. I think we’re a little bit behind responding in terms of dispatchable demand and allowing consumers the opportunity to automatically respond to some of these things.”

As the federal government aims to decarbonize Canada’s electricity generation by 2035 with sweeping regulations, flexibility for some jurisdictions is a key factor that needs to be addressed, said University of Calgary associate professor of economics Blake Shaffer.

“I do think that this shows us that no amount of renewables would push us to have solved that winter peak on Saturday,” he told CTV Calgary.

“And that means flexibility to have a gas fleet, for example, that is capable of being there for a few hours for a few days, maybe a few weeks a year. And we need the technical and economic setup to make that worth their while to be there,” Shaffer said.

“We saw this cold weather coming, everybody was preparing for it. The wind forecast was out a week ago we saw there was going to be no wind. Thankfully, the gas thermal fleet performed amazingly well.”

Natural gas generation was able to backstop the reduction in renewable power, said ARC Energy Research Institute executive director Jackie Forrest.

“The system delivered during the deep freeze this past weekend… so reliably that no one even noticed… I have long argued that gaseous fuels are needed in the mix for energy transition and the need to become cleaner; this is why,” said Forrest on X, formerly known as Twitter.

According to Forrest’s colleague, energy economist Peter Tertzakian, Alberta’s oil sands industry also plays a big role in power generation in the province with the prominence of natural gas-powered cogeneration facilities.

“The power that’s generated in this province during this cold spell, about 40 per cent of it comes from cogeneration. The bulk of which comes from the oil sands and all their big generators which have surplus electricity that they feed into the grid,” said Tertzakian on ARC Energy Institute’s latest podcast.

“I think it’s important to understand that any policies that affect oil sands also affect the electricity grid.”

Alberta

Alberta awash in corporate welfare

From the Fraser Institute

By Matthew Lau

To understand Ottawa’s negative impact on Alberta’s economy and living standards, juxtapose two recent pieces of data.

First, in July the Trudeau government made three separate “economic development” spending announcements in Alberta, totalling more than $80 million and affecting 37 different projects related to the “green economy,” clean technology and agriculture. And second, as noted in a new essay by Fraser Institute senior fellow Kenneth Green, inflation-adjusted business investment (excluding residential structures) in Canada’s extraction sector (mining, quarrying, oil and gas) fell 51.2 per cent from 2014 to 2022.

The productivity gains that raise living standards and improve economic conditions rely on business investment. But business investment in Canada has declined over the past decade and total economic growth per person (inflation-adjusted) from Q3-2015 through to Q1-2024 has been less than 1 per cent versus robust growth of nearly 16 per cent in the United States over the same period.

For Canada’s extraction sector, as Green documents, federal policies—new fuel regulations, extended review processes on major infrastructure projects, an effective ban on oil shipments on British Columbia’s northern coast, a hard greenhouse gas emissions cap targeting oil and gas, and other regulatory initiatives—are largely to blame for the massive decline in investment.

Meanwhile, as Ottawa impedes private investment, its latest bundle of economic development announcements underscores its strategy to have government take the lead in allocating economic resources, whether for infrastructure and public institutions or for corporate welfare to private companies.

Consider these federally-subsidized projects.

A gas cloud imaging company received $4.1 million from taxpayers to expand marketing, operations and product development. The Battery Metals Association of Canada received $850,000 to “support growth of the battery metals sector in Western Canada by enhancing collaboration and education stakeholders.” A food manufacturer in Lethbridge received $5.2 million to increase production of plant-based protein products. Ermineskin Cree Nation received nearly $400,000 for a feasibility study for a new solar farm. The Town of Coronation received almost $900,000 to renovate and retrofit two buildings into a business incubator. The Petroleum Technology Alliance Canada received $400,000 for marketing and other support to help boost clean technology product exports. And so on.

When the Trudeau government announced all this corporate welfare and spending, it naturally claimed it create economic growth and good jobs. But corporate welfare doesn’t create growth and good jobs, it only directs resources (including labour) to subsidized sectors and businesses and away from sectors and businesses that must be more heavily taxed to support the subsidies. The effect of government initiatives that reduce private investment and replace it with government spending is a net economic loss.

As 20th-century business and economics journalist Henry Hazlitt put it, the case for government directing investment (instead of the private sector) relies on politicians and bureaucrats—who did not earn the money and to whom the money does not belong—investing that money wisely and with almost perfect foresight. Of course, that’s preposterous.

Alas, this replacement of private-sector investment with public spending is happening not only in Alberta but across Canada today due to the Trudeau government’s fiscal policies. Lower productivity and lower living standards, the data show, are the unhappy results.

Author:

Alberta

‘Fireworks’ As Defence Opens Case In Coutts Two Trial

From the Frontier Centre for Public Policy

By Ray McGinnis

Anthony Olienick and Chris Carbert are on trial for conspiracy to commit murder and firearms charges in relation to the Coutts Blockade into mid-February 2022. In opening her case before a Lethbridge, AB, jury on July 11, Olienick’s lawyer, Marilyn Burns stated “This is a political, criminal trial that is un Canadian.” She told the jury, “You will be shocked, and at the very least, disappointed with how Canada’s own RCMP conducted themselves during and after the Coutts protest,” as she summarized officers’ testimony during presentation of the Crown’s case. Burns also contended that “the conduct of Alberta’s provincial government and Canada’s federal government are entwined with the RCMP.” The arrests of the Coutts Four on the night of February 13 and noon hour of February 14, were key events in a decision by the Clerk of the Privy Council, Janice Charette, and the National Security Advisor to the Prime Minister, Jody Thomas, to advise Prime Minister Justin Trudeau to invoke the Emergencies Act. Chief Justice Paul Rouleau, in submitting his Public Order Emergency Commission Report to Parliament on February 17, 2023, also cited events at the Coutts Blockade as key to his conclusion that the government was justified in invoking the Emergencies Act.

Justice David Labrenz cautioned attorney Burns regarding her language, after Crown prosecutor Stephen Johnson objected to some of the language in the opening statement of Olienick’s counsel. Futher discussion about the appropriateness of attorney Burns’ statement to the jury is behind a publication ban, as discussions occurred without the jury present.

Justice Labrenz told the jury on July 12, “I would remind you that the presumption of innocence means that both the accused are cloaked with that presumption, unless the Crown proves beyond a reasonable doubt the essential elements of the charge(s).” He further clarified what should result if the jurors were uncertain about which narrative to believe: the account by the Crown, or the account from the accused lawyers. Labrenz stated that such ambivalence must lead to an acquittal; As such a degree of uncertainty regarding which case to trust in does not meet the “beyond a reasonable doubt” threshold for a conviction.”

On July 15, 2024, a Lethbridge jury heard evidence from a former employer of Olienicks’ named Brian Lambert. He stated that he had tasked Olienick run his sandstone quarry and mining business. He was a business partner with Olienick. In that capacity, Olienick made use of what Lambert referred to as “little firecrackers,” to quarry the sandstone and reduce it in size. Reducing the size of the stone renders it manageable to get refined and repurposed so it could be sold to buyers of stone for other uses (building construction, patio stones, etc.) Lambert explained that the “firecrackers” were “explosive devices” packaged within tubing and pipes that could also be used for plumbing. He detailed how “You make them out of ordinary plumbing pipe and use some kind of propellant like shotgun powder…” Lambert explained that the length of the pipe “…depended on how big a hole or how large a piece of stone you were going to crack. The one I saw was about six inches long … maybe an inch in diameter.”

One of Olienick’s charges is “unlawful possession of an explosive device for a dangerous purpose.” The principal evidence offered up by RCMP to the Crown is what the officers depicted as “pipe bombs” which they obtained at the residence of Anthony Olienick in Claresholm, Alberta, about a two-hour drive from Coutts. Officers entered his home after he was arrested the night of February 13, 2022. Lambert’s testimony offers a plausible common use for the “firecrackers” the RCMP referred to as “pipe bombs.” Lambert added, these “firecrackers” have a firecracker fuse, and in the world of “explosive” they are “no big deal.”

Fellow accused, Chris Carbert, is does not face the additional charge of unlawful possession of explosives for a dangerous purpose. This is the first full week of the case for the defence. The trial began on June 6 when the Crown began presenting its case.

Ray McGinnis is a Senior Fellow with the Frontier Centre for Public Policy who recently attended several days of testimony at the Coutts Two trial.

-

International19 hours ago

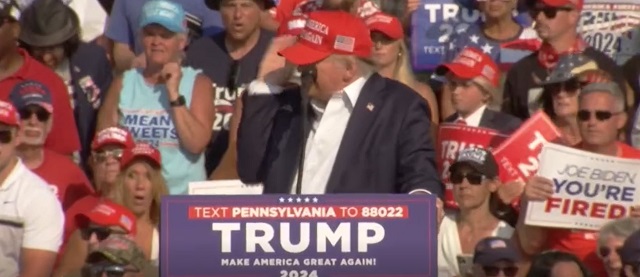

International19 hours agoSecret Service Repeatedly Rejected Offers To Use Drones At Deadly Trump Rally, Whistleblower Says

-

Business1 day ago

Business1 day agoEstonia’s solution to Canada’s stagnating economic growth

-

Alberta1 day ago

Alberta1 day ago‘Fireworks’ As Defence Opens Case In Coutts Two Trial

-

International19 hours ago

International19 hours agoHouse Passes Bipartisan Resolution Establishing Trump Assassination Attempt Task Force

-

Bruce Dowbiggin12 hours ago

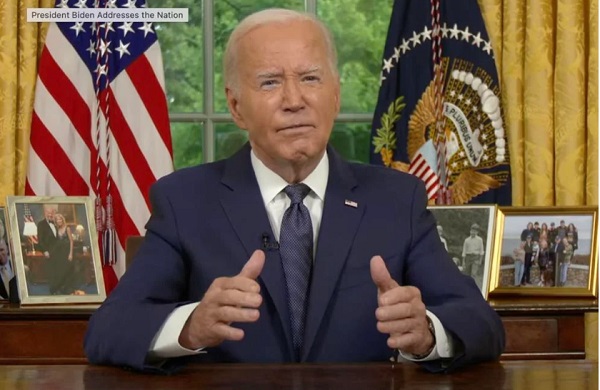

Bruce Dowbiggin12 hours agoGarbage In, Garbage Out: The Democrats 2024 Election Coup

-

COVID-191 day ago

COVID-191 day agoLeaked documents: German gov’t lied about shots preventing COVID, knew lockdowns did more harm than good

-

Business1 day ago

Business1 day agoFederal government seems committed to killing investment in Canada

-

International1 day ago

International1 day agoSwitzerland’s new portable suicide ‘pod’ set to claim its first life ‘soon’