Alberta

Alberta Preparing a New Regulatory Framework for iGaming

With the success of the iGaming market in Ontario, Alberta is looking to it as a blueprint for its own plans in that arena. Despite this, there will likely be differences in the way the two provinces regulate this industry. These potential differences will likely be based on the strategies laid out by Dale Nally, Alberta’s Minister of Service and Red Tape Reduction.

The manner in which Alberta eventually decides to handle its iGaming regulations will be crucial to maintaining a healthy balance for the industry there. Many other regions have begun seeing the drawbacks of over-regulation in this field. As a result, many new-age casinos operating offshore have been gaining popularity over traditional ones that are often stifled by restrictions.

This is because restrictions place more onerous burdens on operators and cause lengthy delays with everything from sign-up procedures to payout times. However, offshore casinos have become a revelation for players tied down by these restrictions. For example, crypto casinos and the perks found at sites like an instant payout casino have seen the number of players from regions like the US, UK, Asia, Europe, and even Canada soaring in recent years.

Instant payout casinos in particular have grown very popular in recent years as they offer players same-day access to their winnings. This phenomenon has been playing out amid ever-tightening regulations on iGaming sites being deployed in many prominent markets.

While reasonable regulations have their benefits, many players feel that most jurisdictions are over-regulating the industry now and players have begun to respond by flocking to offshore sites. Instant payout casinos offer a perfect refuge since platforms like these feature fewer restrictions, more expansive gaming libraries, more privacy, and more generous bonuses.

While Alberta is drawing heavily from Ontario’s regulatory guidelines, it also wants to retain some aspects that will distinguish it too. Minister Nally has indicated that Alberta will seek a less onerous regulatory regime than Ontario. However, as it is with Ontario, there won’t be a limit imposed on the number of iGaming operators permitted. These would also not require any partnerships with land-based casinos.

This approach is expected to foster a competitive online betting environment. As such, huge operators are expected to set up shop there and operate freely alongside the government-run Play Alberta—which currently holds a monopoly.

Nally’s ministry has already been busy working on these new regulations and is set to keep being so as it will also be directly responsible for overseeing iGaming regulations and their enforcement. This ensures a separate regulatory body need not be created. It also addresses concerns raised by operators that Alberta’s Gaming, Liquor, and Cannabis Commission (AGLC) would have a conflict of interest if it managed the new regime as the AGLC is a market operator since it runs the Play Alberta platform.

All in all, Alberta’s approach currently does look good and at least considers the need for making it as simple as possible for new entrants to gain access to the market. Alberta’s method to “conduct and manage” gambling activities is in direct contrast with Ontario’s, where iGaming Ontario (iGO) is simply a subsidiary of the Alcohol and Gaming Commission of Ontario (AGCO).

The revenue-sharing model will also be looked at. Currently, Ontario operators are taxed 20% with the province making $790 million of them last year—with more expansion on the horizon. On that note, Alberta has hinted that it may seek a higher percentage. With other things like consults with indigenous communities and other stakeholders, and setting up transition periods for “grey” market operators, there is more work to be done. However, for now, the future of the iGaming industry in Alberta looks good indeed.

Alberta

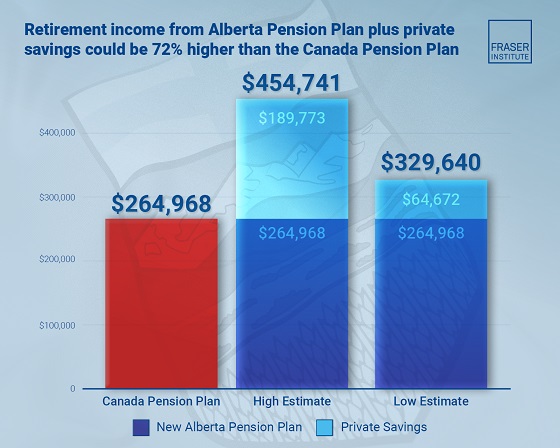

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again

-

Addictions1 day ago

Addictions1 day agoWhy B.C.’s new witnessed dosing guidelines are built to fail

-

Business2 days ago

Business2 days agoCarney government should apply lessons from 1990s in spending review

-

Uncategorized1 day ago

Uncategorized1 day agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Business22 hours ago

Business22 hours agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

COVID-1922 hours ago

COVID-1922 hours agoTrump DOJ dismisses charges against doctor who issued fake COVID passports

-

Alberta21 hours ago

Alberta21 hours agoTemporary Alberta grid limit unlikely to dampen data centre investment, analyst says

-

Entertainment2 days ago

Entertainment2 days agoStudy finds 99% of late-night TV guests in 2025 have been liberal