Business

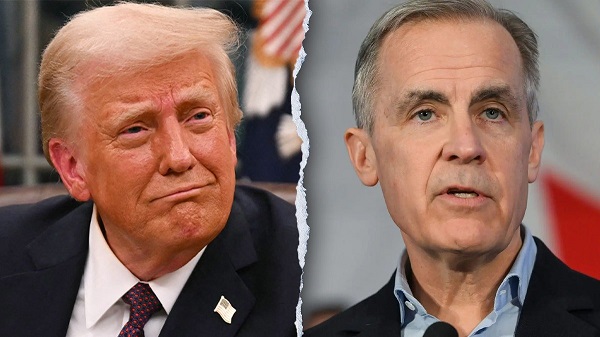

After successful anti-American election campaign, Carney pivots to embrace US: Hails Trump as a “transformational president”

MxM News

MxM News

Quick Hit:

Canadian Prime Minister Mark Carney met with President Donald Trump at the White House on Tuesday and praised the American leader as a “transformational president” with a relentless focus on workers, border security, and combatting fentanyl.

Key Details:

-

In front of reporters in the Oval Office, Carney said Trump was “focused on the economy, with a relentless focus on the American worker, securing your borders… ending the scourge of fentanyl and other opioids, and securing the world.”

-

The newly elected Canadian leader said he intends to implement a similar agenda in Canada, including heightened attention to border security, defense, and Arctic development.

-

Despite past trade friction between the two countries, Carney voiced confidence in the future of U.S.-Canada relations, stating, “We’re stronger when we work together… I look forward to addressing some of those issues that we have.”

Diving Deeper:

Canadian Prime Minister Mark Carney offered striking praise for President Donald Trump during a Tuesday visit to the White House, calling him a “transformational president” who has reshaped the global conversation on the economy, national security, and public health. Speaking alongside Trump in the Oval Office, Carney lauded the president’s focus on protecting American workers, confronting the fentanyl crisis, and reinforcing the nation’s borders.

“You’re a transformational president, focused on the economy, with a relentless focus on the American worker, securing your borders… ending the scourge of fentanyl and other opioids, and securing the world,” Carney told Trump.

According to Carney, many of the issues central to Trump’s presidency were also top concerns for Canadian voters. “I’ve been elected… with the help of my colleagues here, I’m going to spread the credit, to transform Canada with a similar focus on the economy, securing our borders, again, on fentanyl, much greater focus on defense and security, securing the Arctic and developing the Arctic,” he said.

Though the two leaders were cordial, the backdrop of their meeting carried a history of trade disputes. Early in Trump’s second term, his administration imposed tariffs on Canadian goods—a move that prompted retaliatory measures from then-Prime Minister Justin Trudeau. Still, Carney emphasized cooperation and struck a hopeful tone, noting that the U.S.-Canada relationship has endured challenges before.

“The history of Canada and the U.S. is we’re stronger when we work together, and there’s many opportunities to work together,” Carney said. “I look forward to addressing some of those issues that we have, but also finding those areas of mutual cooperation so we can go forward.”

President Trump, for his part, congratulated Carney on his election and offered warm words of welcome. “I want to just congratulate you. That was a great election, actually,” Trump said. “We were watching it with interest, and I think Canada chose a very talented person, a very good person… it’s an honor to have you at the White House and the Oval Office.”

The meeting marked Carney’s first official trip to Washington since taking office and served as an early sign that the two North American leaders may chart a path of renewed collaboration—grounded in shared priorities of national strength and economic growth.

Business

The Grocery Greed Myth

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

The Justin Trudeau and Jagmeet Singh charges of “greedflation” collapses under scrutiny.

“It’s not okay that our biggest grocery stores are making record profits while Canadians are struggling to put food on the table.” —PM Justin Trudeau, September 13, 2023.

A couple of days after the above statement, the then-prime minister and his government continued a campaign to blame rising food prices on grocery retailers.

The line Justin Trudeau delivered in September 2023, triggered a week of political theatre. It also handed his innovation minister, François-Philippe Champagne, a ready-made role: defender of the common shopper against supposed corporate greed. The grocery price problem would be fixed by Thanksgiving that year. That was two years ago. Remember the promise?

But as Ian Madsen of the Frontier Centre for Public Policy has shown, the numbers tell a different story. Canada’s major grocers have not been posting “record profits.” They have been inching forward in a highly competitive, capital-intensive sector. Madsen’s analysis of industry profit margins shows this clearly.

Take Loblaw. Its EBITDA margin (earnings before interest, taxes, depreciation, and amortization) averaged 11.2 per cent over the three years ending 2024. That is up slightly from 10 per cent pre-COVID. Empire grew from 3.9 to 7.6 per cent. Metro went from 7.6 to 9.6. These are steady trends, not windfalls. As Madsen rightly points out, margins like these often reflect consolidation, automation, and long-term investment.

Meanwhile, inflation tells its own story. From March 2020 to March 2024, Canada’s money supply rose by 36 per cent. Consumer prices climbed about 20 per cent in the same window. That disparity suggests grocers helped absorb inflationary pressure rather than drive it. The Justin Trudeau and Jagmeet Singh charges of “greedflation” collapses under scrutiny.

Yet Ottawa pressed ahead with its chosen solution: the Grocery Code of Conduct. It was crafted in the wake of pandemic disruptions and billed as a tool for fairness. In practice, it is a voluntary framework with no enforcement and no teeth. The dispute resolution process will not function until 2026. Key terms remain undefined. Suppliers are told they can expect “reasonable substantiation” for sudden changes in demand. They are not told what that means. But food inflation remains.

This ambiguity helps no one. Large suppliers will continue to settle matters privately. Small ones, facing the threat of lost shelf space, may feel forced to absorb losses quietly. As Madsen observes, the Code is unlikely to change much for those it claims to protect.

What it does serve is a narrative. It lets the government appear responsive while avoiding accountability. It shifts attention away from the structural causes of price increases: central bank expansion, regulatory overload, and federal spending. Instead of owning the crisis, the state points to a scapegoat.

This method is not new. The Trudeau government, of which Carney’s is a continuation, has always shown a tendency to favour symbolism over substance. Its approach to identity politics follows the same pattern. Policies are announced with fanfare, dissent is painted as bigotry, and inconvenient facts are set aside.

The Grocery Code fits this model. It is not a policy grounded in need or economic logic. It is a ritual. It gives the illusion of action. It casts grocers as villains. It gives the impression to the uncaring public that the government is “providing solutions,” and that “it has their backs.” It flatters the state.

Madsen’s work cuts through that illusion. It reminds us that grocery margins are modest, inflation was monetary, and the public is being sold a story.

Canadians deserve better than fables, but they keep voting for the same folks. They don’t think to think that they deserve a government that governs within its limits; a government that accept its role in the crises it helped cause, and restores the conditions for genuine economic freedom. The Grocery Code is not a step in that direction. It was always a distraction, wrapped in a moral pose.

And like most moral poses in Ottawa, it leaves the facts behind.

Haultain’s Substack is a reader-supported publication.

To receive new posts and support our work, please consider becoming a free or paid subscriber.

Try it out.

Business

Tax filing announcement shows consultation was a sham

The Canadian Taxpayers Federation is criticizing Prime Minister Mark Carney for announcing that the government is expanding automatic tax filing within hours of the government’s consultation ending.

“There’s no way government bureaucrats pulled an all-nighter reading through thousands of submissions and survey responses before sending Carney out to make an announcement on automatic tax filing the next morning,” said Franco Terrazzano, CTF Federal Director. “Asking Canadians for their opinion and then ignoring them isn’t a good look for Carney, it makes it look like the government is holding sham consultations.”

The government of Canada announced consultations on automatic tax filing so Canadians could give the government “broad input through an online questionnaire.”

The government’s consultation ended on Thursday, Oct. 9, 2025.

Hours after the consultation ended, Carney today announced the government would expand automatic tax filing.

The CRA is already one of the largest arms of the federal government with 52,499 bureaucrats.

The CRA added 13,015 employees since 2016 – a 33 per cent increase. For comparison, America’s Internal Revenue Service has 90,516 bureaucrats. The CRA has one bureaucrat for every 800 Canadians. The IRS has one bureaucrat for every 3,800 Americans.

“The CRA can barely answer the phone, so Carney shouldn’t be giving those bureaucrats more busy work to do,” Terrazzano said. “The CRA is a bloated mess, and Carney should be cutting the cost of bureaucracy not scheming up ways to give the bureaucracy more power over taxpayers.”

The CRA only answered about 36 per cent of the 53.5 million calls it received between March 2016 and March 2017, according to a 2017 Auditor General report. When Canadians were able to get the CRA on the phone, call centre agents gave inaccurate information about 30 per cent of the time.

“The CRA acting as both tax collector and tax filer is a serious conflict of interest,” Terrazzano said. “Trusting the taxman to do your tax return is like trusting your dog to protect your burger.

“Carney should stop the CRA power grab and instead cut taxes and simplify the tax code.”

-

Alberta2 days ago

Alberta2 days agoFact, fiction, and the pipeline that’s paying Canada’s rent

-

Alberta2 days ago

Alberta2 days agoAlberta Is Where Canadians Go When They Want To Build A Better Life

-

International2 days ago

International2 days agoTrump-brokered Gaza peace agreement enters first phase

-

COVID-191 day ago

COVID-191 day agoTamara Lich says she has no ‘remorse,’ no reason to apologize for leading Freedom Convoy

-

Crime1 day ago

Crime1 day agoCanada’s safety minister says he has not met with any members of damaged or destroyed churches

-

Business1 day ago

Business1 day agoTrump Warns Beijing Of ‘Countermeasures’ As China Tightens Grip On Critical Resources

-

International1 day ago

International1 day agoTrump gets an honourable mention: Nobel winner dedicates peace prize to Trump

-

Business19 hours ago

Business19 hours agoCarney government plans to muddy the fiscal waters in upcoming budget