Also part of David Redman’s presentation is this comparison between lockdown measures and Canada’s Annual Viral Infection Curve. Redman shows the annual viral infection curve performed exactly as usual in the past year. In this part of the presentation Redman shows how the lockdown restrictions have coincided with the curve and therefore lockdowns have not greatly affected the spread of Covid.

Alberta

No lockdowns in Alberta if Emergency Management Agency was in charge – Former Executive Director David Redman

As Canadians look south of the border it’s obvious different state governments have taken different approaches in the battle against Covid 19. Some states have been opened entirely for months while in others, children haven’t been to school in an entire year. But which approach is better when it comes to reducing Covid cases? The State of Florida has been open during the entire second wave while New York State is just beginning to lift lockdowns. Despite the different approaches in Florida and New York, in both states cases are down to a third or less of where they were in early January. Death rates are also down by two thirds since January in both states.

Alberta’s approach could have been vastly different too. Premier Jason Kenney has the tough job of trying to balance the freedom to gather, to work and to worship, with the mandate to protect the health of Albertans by isolating us from teammates, workmates, and friendships. As the ebb and flow of restrictions continues one year into the Covid experience, a growing number of people are convinced lockdowns are not an effective response. But what is the alternative?

One person qualified to answer this difficult question is David Redman. Redman is former Executive Director of the Alberta Emergency Management Agency. Before that he spent over 25 years in the military, retiring as a Lieutenant Colonel with vast experience in logistics. As ED of the Emergency Management Agency, Redman traveled side by side with then Premier Ralph Klein when tragedy struck the province. His role included formulating plans to deal with a variety of emergencies, including pandemics. When an emergency occurred, the staff would immediately gather with leaders from government agencies and relevant private companies (power companies, etc). Within 36 hours, they’d revise an existing plan and present the Premier with options for moving forward.

The province of Alberta’s website makes a bold statement about emergency management. As this screen shot indicates Alberta’s Emergency Management Agency “leads and oversees all emergency and disaster prevention, preparedness and responses.”

There’s only one problem with this bold statement. In what has become the farthest reaching emergency in modern Alberta history, for some reason Alberta’s Emergency Management Agency is not co-ordinating Alberta’s response. Premier Jason Kenney is co-ordinating Alberta’s response with Health Minister Tyler Shandro, Alberta’s Chief Medical Officer Dr. Deena Hinshaw, and others.

This is not sitting well with David Redman. Redman says when the first wave hit and Alberta announced a general lockdown, Redman was shocked such drastic measures were being taken. He knew immediately the emergency response plan had been thrown out.

Redman began contacting all Canada’s premiers. He put together a presentation to show what they were doing wrong and what they should be doing instead. It’s taken months to gain traction, but the media is starting to pay attention to Redman as he shares his presentation to people all over Canada.

His main message; governments can do a far better job of protecting the vulnerable AND protecting the economy. Even though the second major wave is ebbing and restrictions are slowly disappearing, Redman says the matter is still urgent. He’s convinced Covid variants will ensure future waves and unless they pivot to a new approach, governments will go back to the tool they’ve been relying on… lockdowns.

This is an abridged version of the presentation Redman has been showing all over the country is his effort to get at least one Premier to show the rest of Canada a different way to react to this emergency.

Alberta

Alberta bill would protect freedom of expression for doctors, nurses, other professionals

From LifeSiteNews

‘Peterson’s law,’ named for Canadian psychologist Jordan Peterson, was introduced by Alberta Premier Danielle Smith.

Alberta’s Conservative government introduced a new law that will set “clear expectations” for professional regulatory bodies to respect freedom of speech on social media and online for doctors, nurses, engineers, and other professionals.

The new law, named “Peterson’s law” after Canadian psychologist Jordan Peterson, who was canceled by his regulatory body, was introduced Thursday by Alberta Premier Danielle Smith.

“Professionals should never fear losing their license or career because of a social media post, an interview, or a personal opinion expressed on their own time,” Smith said in a press release sent to media and LifeSiteNews.

“Alberta’s government is restoring fairness and neutrality so regulators focus on competence and ethics, not policing beliefs. Every Albertan has the right to speak freely without ideological enforcement or intimidation, and this legislation makes that protection real.”

The law, known as Bill 13, the Regulated Professions Neutrality Act, will “set clear expectations for professional regulatory bodies to ensure professionals’ right to free expression is protected.”

According to the government, the new law will “Limit professional regulatory bodies from disciplining professionals for expressive off-duty conduct, except in specific circumstances such as threats of physical violence or a criminal conviction.”

It will also restrict mandatory training “unrelated to competence or ethics, such as diversity, equity, and inclusion training.”

Bill 13, once it becomes law, which is all but guaranteed as Smith’s United Conservative Party (UCP) holds a majority, will also “create principles of neutrality that prohibit professional regulatory bodies from assigning value, blame or different treatment to individuals based on personally held views or political beliefs.”

As reported by LifeSiteNews, Peterson has been embattled with the College of Psychologists of Ontario (CPO) after it mandated he undergo social media “training” to keep his license following posts he made on X, formerly Twitter, criticizing Trudeau and LGBT activists.

He recently noted how the CPO offered him a deal to “be bought,” in which the legal fees owed to them after losing his court challenge could be waived but only if he agreed to quit his job as a psychologist.

Early this year, LifeSiteNews reported that the CPO had selected Peterson’s “re-education coach” for having publicly opposed the LGBT agenda.

The Alberta government directly referenced Peterson’s (who is from Alberta originally) plight with the CPO, noting “the disciplinary proceedings against Dr. Jordan Peterson by the College of Psychologists of Ontario, demonstrate how regulatory bodies can extend their reach into personal expression rather than professional competence.”

“Similar cases involving nurses, engineers and other professionals revealed a growing pattern: individuals facing investigations, penalties or compulsory ideological training for off-duty expressive conduct. These incidents became a catalyst, confirming the need for clear legislative boundaries that protect free expression while preserving professional standards.”

Alberta Minister of Justice and Attorney General Mickey Amery said regarding Bill 13 that the new law makes that protection of professionals “real and holds professional regulatory bodies to a clear standard.”

Last year, Peterson formally announced his departure from Canada in favor of moving to the United States, saying his birth nation has become a “totalitarian hell hole.”

Alberta

‘Weird and wonderful’ wells are boosting oil production in Alberta and Saskatchewan

From the Canadian Energy Centre

Multilateral designs lift more energy with a smaller environmental footprint

A “weird and wonderful” drilling innovation in Alberta is helping producers tap more oil and gas at lower cost and with less environmental impact.

With names like fishbone, fan, comb-over and stingray, “multilateral” wells turn a single wellbore from the surface into multiple horizontal legs underground.

“They do look spectacular, and they are making quite a bit of money for small companies, so there’s a lot of interest from investors,” said Calin Dragoie, vice-president of geoscience with Calgary-based Chinook Consulting Services.

Dragoie, who has extensively studied the use of multilateral wells, said the technology takes horizontal drilling — which itself revolutionized oil and gas production — to the next level.

“It’s something that was not invented in Canada, but was perfected here. And it’s something that I think in the next few years will be exported as a technology to other parts of the world,” he said.

Dragoie’s research found that in 2015 less than 10 per cent of metres drilled in Western Canada came from multilateral wells. By last year, that share had climbed to nearly 60 per cent.

Royalty incentives in Alberta have accelerated the trend, and Saskatchewan has introduced similar policy.

Multilaterals first emerged alongside horizontal drilling in the late 1990s and early 2000s, Dragoie said. But today’s multilaterals are longer, more complex and more productive.

The main play is in Alberta’s Marten Hills region, where producers are using multilaterals to produce shallow heavy oil.

Today’s average multilateral has about 7.5 horizontal legs from a single surface location, up from four or six just a few years ago, Dragoie said.

One record-setting well in Alberta drilled by Tamarack Valley Energy in 2023 features 11 legs stretching two miles each, for a total subsurface reach of 33 kilometres — the longest well in Canada.

By accessing large volumes of oil and gas from a single surface pad, multilaterals reduce land impact by a factor of five to ten compared to conventional wells, he said.

The designs save money by skipping casing strings and cement in each leg, and production is amplified as a result of increased reservoir contact.

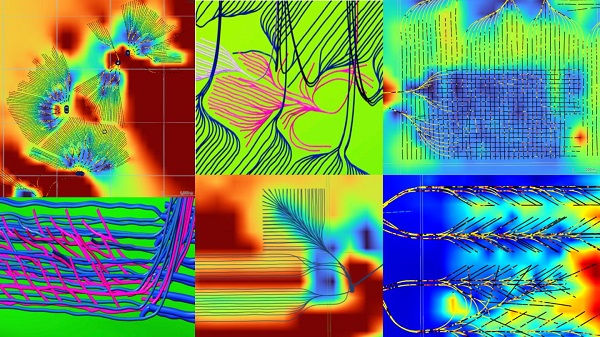

Here are examples of multilateral well design. Images courtesy Chinook Consulting Services.

Parallel

Fishbone

Fan

Waffle

Stingray

Frankenwells

-

Carbon Tax1 day ago

Carbon Tax1 day agoCarney fails to undo Trudeau’s devastating energy policies

-

Business1 day ago

Business1 day agoBudget 2025: Ottawa Fakes a Pivot and Still Spends Like Trudeau

-

Health1 day ago

Health1 day agoTens of thousands are dying on waiting lists following decades of media reluctance to debate healthcare

-

armed forces1 day ago

armed forces1 day agoCanada At Risk Of Losing Control Of Its Northern Territories

-

Business2 days ago

Business2 days agoI Was Hired To Root Out Bias At NIH. The Nation’s Health Research Agency Is Still Sick

-

Business2 days ago

Business2 days agoLarge-scale energy investments remain a pipe dream

-

International1 day ago

International1 day agoCanada’s lost decade in foreign policy

-

Opinion20 hours ago

Opinion20 hours agoLandmark 2025 Study Says Near-Death Experiences Can’t Be Explained Away