International

28-year-old Dutch woman to be killed by assisted suicide after doctors deem her autism ‘untreatable’

28-year-old Dutch woman Zoraya ter Beek (YouTube Screenshot)

From LifeSiteNews

28-year-old Zoraya ter Beek plans to die by assisted suicide over her struggles with depression and mental illness, a trend which is increasing in The Netherlands.

A 28-year-old autistic woman is scheduled to die by assisted suicide in May in The Netherlands after struggling with depression and mental illness, with her psychiatrist telling her that her condition is untreatable and will never improve.

Zoraya ter Beek, who does not suffer from any physical illness, has decided to end her life by assisted suicide after psychiatrists said they had exhausted any means of helping her deal with her mental illnesses, which includes borderline personality disorder, according to The Free Press.

Her struggles with mental illness have prevented her from being able to finish school or start a career.

READ: Canadian judge blocks imminent euthanasia death of 27-year-old autistic woman

In testimony to the nihilistic attitude adopted in the choice to end her own life on account of suffering, Ter Beek has decided that after she has been killed, her body will be cremated without a funeral and her ashes scattered in the woods.

Ter Beek’s choice to take her own life comes despite her admitted fear of death arising from the uncertainty of what happens after death.

“I’m a little afraid of dying, because it’s the ultimate unknown,” she said. “We don’t really know what’s next – or is there nothing? That’s the scary part.”

The diagnosis of autism and mental illness as “untreatable” and “unbearable” has become an increasing trend in The Netherlands, with a study published in June 2023 revealing 40 cases over a 10-year period from 2012 to 2021. In a third of those cases, those with autism or intellectual disabilities were told there was no hope of improving their lives, and so their condition was deemed “untreatable.”

READ: Autistic people in the Netherlands are being euthanized: report

Irene Tuffrey-Wijne, a palliative care physician at Britain’s Kingston University, who led the study which examined 900 cases, said, “There’s no doubt in my mind these people were suffering. But is society really OK with sending this message, that there’s no other way to help them and it’s just better to be dead?”

Tim Stainton, director of the Canadian Institute for Inclusion and Citizenship at the University of British Columbia, added, “Helping people with autism and intellectual disabilities to die is essentially eugenics.”

The scheduled killing of the 28-year-old autistic woman comes as The Netherlands continues to expand the scope of what legally qualifies for euthanasia, with a new law effective February 1 allowing the killing of terminally ill children aged 1 through 12 who are deemed to be “suffering hopelessly and unbearably.”

The law allows parents to decide to kill their child even if the child is unwilling or unable to consent.

International

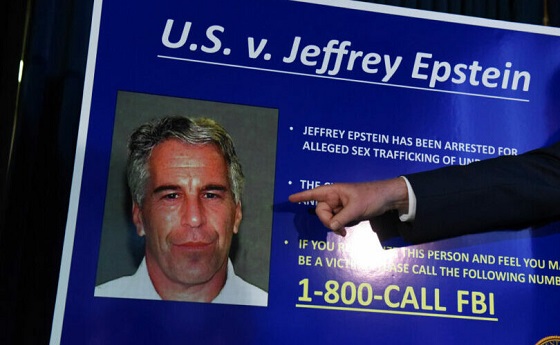

This ends now: Trump orders Bondi to unseal Epstein grand jury testimony

Quick Hit:

President Trump on Thursday directed Attorney General Pam Bondi to pursue the release of grand jury records in the Epstein case, saying “this SCAM…should end, right now!” Bondi said she’ll ask the court Friday to unseal the transcripts.

Key Details:

- Trump said on Truth Social he had asked AG Pam Bondi to release “any and all pertinent Grand Jury testimony” tied to Epstein, pending court approval.

- Bondi responded Thursday evening, posting, “President Trump — we are ready to move the court tomorrow to unseal the grand jury transcripts.”

- Trump’s directive comes just hours after The Wall Street Journal published a report about a birthday card he allegedly wrote to Epstein—an allegation Trump has called “fake” and vowed to sue over.

Diving Deeper:

President Donald Trump on Thursday took to Truth Social to instruct Attorney General Pam Bondi to pursue the release of sealed grand jury records. “Based on the ridiculous amount of publicity given to Jeffrey Epstein, I have asked Attorney General Pam Bondi to produce any and all pertinent Grand Jury testimony, subject to Court approval,” Trump wrote. He then added, “This SCAM, perpetuated by the Democrats, should end, right now!”

Bondi quickly responded on X, confirming her team would be in court Friday to make the request. “President Trump — we are ready to move the court tomorrow to unseal the grand jury transcripts,” she wrote.

The renewed push comes in the wake of a Wall Street Journal article published Thursday that alleged Trump sent a sexually explicit birthday card to Epstein in 2003. Trump strongly denied the claim, saying it was fabricated and promising to sue the paper for defamation.

Epstein, 66, was found dead in his Manhattan jail cell in August 2019, just a month after he was indicted by federal prosecutors in the Southern District of New York for sex trafficking minors. The official ruling was suicide, though skepticism remains widespread.

Last week, the FBI and Justice Department released the results of a long-awaited internal review. In an unsigned memo, federal officials concluded that Epstein did not have a “client list,” had not blackmailed any prominent figures, and that no further investigations into uncharged individuals were warranted. The DOJ memo said no additional disclosures would be made, effectively closing the book on the federal inquiry.

Trump, who has previously blasted the media’s obsession with Epstein, supported the memo’s findings and called the broader conspiracy a “hoax.” Still, pressure has mounted from Trump’s base and transparency advocates demanding public access to sealed documents and grand jury proceedings.

While hundreds of pages of testimony from Epstein’s 2006 Florida case were released last year, including disturbing details from victims as young as 14, the New York proceedings remain largely sealed. That Florida case ended in a controversial plea deal that saw Epstein serve just 13 months in a county jail.

With Bondi now preparing to formally request the unsealing of federal transcripts in New York, Thursday’s developments could signal a shift toward more transparency—though any release will still require approval from the court.

conflict

One of the world’s oldest Christian Communities is dying in Syria. Will the West stay silent?

This article supplied by Troy Media.

By Susan Korah

By Susan Korah

The murder of Christians during Mass demands more than statements. Canada and its allies must act or share the blame

The June 22 suicide bombing at St. Elias Greek Orthodox Church in Damascus, which killed more than 25 people and injured over 60 during Mass, has devastated Syria’s Christian community and raised urgent concerns about their safety in a fragile, post-Assad Syria.

Activists close to the victims say the attack exposes the failure of the transitional Syrian government to protect religious minorities and underscores the need for immediate international pressure to hold the regime accountable. Without it, they warn, Syria’s ancient Christian presence could vanish.

Syria is home to one of the oldest Christian communities in the world, dating back to the first century. Though once numbering in the millions, its Christian community’s population has plummeted due to years of war, persecution and mass emigration. The attacker, linked to a shadowy extremist group called Saraya Ansari al-Sunna, opened fire on the 350-person congregation before detonating an explosive vest. The massacre has shattered the cautious optimism held by some Christians who believed Syria had turned a corner after 14 years of civil war.

“Immediately after the vicious attack, no official from the al-Sharaa government came forward to offer support except the only Christian in the cabinet, Hind Kabawat, Minister of Social Affairs,” said a Syrian Christian activist in the Toronto area who requested anonymity as he feared for his safety, even though he had emigrated to Canada years ago and serves on the refugee committee of a Melkite (Eastern rite Catholic) church.

“Our Patriarch John X issued a statement, respectfully appealing to the interim government to protect the lives and religious freedom of all Syria’s

faith groups,” he said.

Mario Bard, head of information with the pontifical charity Aid to the Church in Need Canada, said it’s imperative for the international community to take action.

“What a horrific attack,” he said. “Once again, a Christian minority community in the Middle East finds itself targeted. The local Church is already speaking of the death of its martyrs. It is a testament to the incredible faith, resilience and unshakable conviction of these communities. But that does not mean we can remain idle—far from it. ACN urges the international community not to look away and to act to ensure the protection of all religious communities in the Middle East.”

While urging governments to act, Bard reiterated that ACN will stand by its partners in Syria.

“We will continue to support the Christian community in Syria, as we have since the beginning of the war, including the Greek Orthodox Church of Antioch, with whom we have stood in the past and will continue to stand with now,” he said.

Nuri Kino of A Demand for Action, the Sweden-based humanitarian and advocacy organization he founded over 10 years ago to rally international support for Christians in Syria and Iraq targeted by ISIS for genocide, says the attack is not an isolated incident but part of a broader pattern in post-Assad Syria.

“It should be a wake-up call for the international community,” he said. “We are producing video clips and a report documenting atrocities against Christians after Assad’s fall, which will be distributed to governments that defend human rights. Our aim is to pressure the international community to ensure that financial aid given to Syria is conditional on the regime protecting the security and equal rights of Christians and all other citizens.”

As a major donor to Syria’s humanitarian recovery, Canada has leverage to tie funding to human rights protections. But so far, the Canadian government’s response has been muted, save for the usual diplomatic clichés

“Canada strongly condemns the terrorist attack at St. Elias Church in Damascus, which killed and injured civilians attending Mass on June 22, 2025. The targeting of civilians in a place of worship is deplorable,” said an email from the media relations team in response to a question posed to Foreign Affairs Minister Anita Anand. “Canada stands in solidarity with Syria’s Christian community and encourages the Syrian transitional authorities to work with partners to strengthen protections for all religious and ethnic minorities. Civilians must be protected, the dignity and human rights of all religious and ethnic groups must be upheld and perpetrators must be held accountable.”

Global Affairs has acknowledged that Syria’s security apparatus is under resourced and is not in full control of the country, as have others.

“The government’s military and security forces have not yet become organized under a central command and there is a power vacuum in that space,” said Ouhanes Shehrian, a Christian journalist based in Aleppo, Syria. “Different militias are in control of different parts of Syria, and this is a problem for the government.”

Although President Ahmed al-Sharaa’s HTS (Hayat Tahrir al-Sham) coalition led the effort to topple Assad, it now governs amid deep internal fractures. Al-Sharaa has tried to distance his party from its Islamist roots and has made some gestures toward minority groups, but observers warn that extremist factions still exert influence across various regions.

Canada, the U.S. and the EU lifted sanctions on Syria after the fall of the Assad government, a move Syriac Catholic Archbishop Jacques Mourad of Homs praised as a hopeful step for the Syrian people. Canada pledged $84 million in new funding for humanitarian assistance and temporarily eased existing sanctions to support democratization, stabilization and aid delivery during this transitional period.

Unless the international community demands real reforms and enforces conditions tied to aid, Christian leaders fear a future where minority

communities are simply left to endure or vanish.

As one local priest said after the bombing, “We prayed for peace, and we thought it had come. But now we bury our dead and wonder if we were wrong to hope.” Without swift action, what remains of Syria’s Christian presence may not survive the peace.

Susan Korah is Ottawa correspondent for The Catholic Register, a Troy Media Editorial Content Provider Partner

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

International2 days ago

International2 days agoMatt Walsh slams Trump administration’s move to bury Epstein sex trafficking scandal

-

National2 days ago

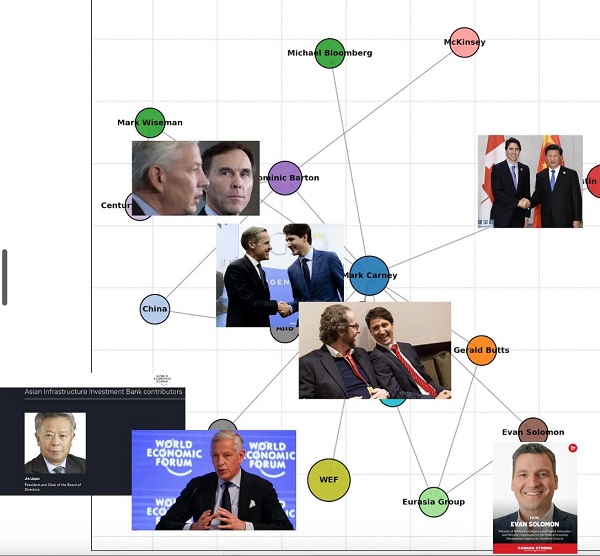

National2 days agoDemocracy Watch Blows the Whistle on Carney’s Ethics Sham

-

Energy2 days ago

Energy2 days agoIs The Carney Government Making Canadian Energy More “Investible”?

-

Business2 days ago

Business2 days agoCompetition Bureau is right—Canada should open up competition in the air

-

Immigration1 day ago

Immigration1 day agoUnregulated medical procedures? Price Edward Islanders Want Answers After Finding Biomedical Waste From PRC-Linked Monasteries

-

Business1 day ago

Business1 day agoDemocracy Watchdog Says PM Carney’s “Ethics Screen” Actually “Hides His Participation” In Conflicted Investments

-

Business2 days ago

Business2 days agoIt’s Time To End Canada’s Protectionist Supply Management Regime

-

COVID-192 days ago

COVID-192 days agoFreedom Convoy leaders’ sentencing hearing to begin July 23 with verdict due in August