Calgary

New W.H.O. Proposed COVID-19 Mitigation: Euthanize Every Non-Essential Person Over The Age Of 65 and/or Anyone Who Tests Positive For COVID19

“Desperate times call for desperate measures, and now is the time to consider all options, no matter how Machiavellian.” says Dr. Killemall, said the head Epidemiologist for the W.H.O.

In response to this eyebrow-raising official statement, Canadian Prime Minister Justin Trudeau assured all Canadians that the W.H.O. is both infallible, and omniscient, therefore whatever they say, we will obey without question. To further bring home the point, PM Trudeau said yesterday,

“Our Government is now bringing forth new emergency legislation to immediately imprison anyone who makes any statements, either online, or otherwise which contradict, criticize, or question the recommendations of the W.H.O.

This is the type of serious response to the Pandemic that Canadians want, and it’s the response they deserve. We’re listening, and what’s more, we are taking the appropriate actions necessary for the betterment of all Canadians. We have heard the concerns of many Canadians who are facing financial hardship due to the economic impact of the Covid19 pandemic, and we are required to find a solution so we can get people back to work. Also, we must consider the mental health of Canadians. Many Canadians have already watched everything worth watching on Netflix, and now are cruelly forced to interact with family members through conversation, board games, and other interactive activities. No Canadian should have to suffer such hardships, so as a response, we have decided to follow the W.H.O. recommendations, and starting next week, we will be Euthanizing all Canadians over the age of 55, who are non-essential. Further, to save on medical costs, and eliminate the further spread of COVID19 we will also Euthanize everyone who tests positive for the virus, and is also deemed to be non-essential. Difficult times call for difficult choices, and I’m confident that Canadians will understand and support their Government. As fair warning, any protests, complaints, or obstruction of any kind will result in a minimum five-year prison sentence.”

If the parody above doesn’t make you at least a little bit uncomfortable…it should. Actions far worse than the unthinkable measures in this piece have been done before, with far less provocation. Six months ago, if someone told you that all Canadians would be confined to their homes for up to eighteen months, would you have believed it? Or, would you have responded by scoffing, “That’s ridiculous, it could never happen here! Where’s your tinfoil hat?” This is an important question to ask yourself right now. How far will the Government go? You’ve already been surprised by the current state of affairs, so be prepared for the Government to continue to expand its power by taking away your rights, with or without reasonable cause.

It starts with a well-meaning Police officer issuing an improper ticket to a family for rollerblading together. The family will likely win in court, but that’s not the point. The point is, a family who is simply spending health time together received an $800.00 fine for an action that did not actually contravene the currently imposed rules of social isolation. If you don’t respond with outrage at this, because it’s not happening to you, then let me remind you of a famous, and sadly relevant quote by the German Lutheran pastor Martin Niemöller.

First, they came for the socialists, and I did not speak out—

Because I was not a socialist.

Then they came for the trade unionists, and I did not speak out—

Because I was not a trade unionist.

Then they came for the Jews, and I did not speak out—

Because I was not a Jew.

Then they came for me—and there was no one left to speak for me.

Many people will be unable to accept that the above sentiment is either appropriate, or relevant to our current situation, and that would be an understandable response. It’s a bit much for most people to consider that we are now in a perilous position. Nearly every single time for all of recorded human history, when National Governments expand their power, they keep at least some of their new power. Often, the expansion of power continues until the only solution is a violent revolution to topple the tyrannical Government. You may not be interested in History, but I can assure you, history is directly relevant to your life right now.

Be vigilant, and be brave enough to speak out when the Government goes too far. If you don’t speak out early, you won’t have the ability to speak out at all when it’s too late. Remember, the Government is here to serve you, not subjugate you.

Yes, we all need to do our part during the Pandemic, and yes we need to be socially responsible for the good of all. We must be equally committed to fully regaining our freedoms once this is over, or we will face the very real possibility of living under a dictatorship.

for more stories, visit Todayville Calgary

Alberta

Calgary’s High Property Taxes Run Counter to the ‘Alberta Advantage’

By David Hunt and Jeff Park

Of major cities, none compare to Calgary’s nearly 50 percent property tax burden increase between censuses.

Alberta once again leads the country in taking in more new residents than it loses to other provinces and territories. But if Canadians move to Calgary seeking greater affordability, are they in for a nasty surprise?

In light of declining home values and falling household incomes amidst rising property taxes, Calgary’s overall property tax burden has skyrocketed 47 percent between the last two national censuses, according to a new study by the Aristotle Foundation for Public Policy.

Between 2016 and 2021 (the latest year of available data), Calgary’s property tax burden increased about twice as fast as second-place Saskatoon and three-and-a-half times faster than Vancouver.

The average Calgary homeowner paid $3,496 in property taxes at the last census, compared to $2,736 five years prior (using constant 2020 dollars; i.e., adjusting for inflation). By contrast, the average Edmonton homeowner paid $2,600 in 2021 compared to $2,384 in 2016 (in constant dollars). In other words, Calgary’s annual property tax bill rose three-and-a-half times more than Edmonton’s.

This is because Edmonton’s effective property tax rate remained relatively flat, while Calgary’s rose steeply. The effective rate is property tax as a share of the market value of a home. For Edmontonians, it rose from 0.56 percent to 0.62 percent—after rounding, a steady 0.6 percent across the two most recent censuses. For Calgarians? Falling home prices collided with rising taxes so that property taxes as a share of (market) home value rose from below 0.5 percent to nearly 0.7 percent.

Plug into the equation sliding household incomes, and we see that Calgary’s property tax burden ballooned nearly 50 percent between censuses.

This matters for at least three reasons. First, property tax is an essential source of revenue for municipalities across Canada. City councils set their property tax rate and the payments made by homeowners are the backbone of municipal finances.

Property taxes are also an essential source of revenue for schools. The province has historically required municipalities to directly transfer 33 percent of the total education budget via property taxes, but in the period under consideration that proportion fell (ultimately, to 28 percent).

Second, a home purchase is the largest expense most Canadians will ever make. Local taxes play a major role in how affordable life is from one city to another. When municipalities unexpectedly raise property taxes, it can push homeownership out of reach for many families. Thus, homeoowners (or prospective homeowners) naturally consider property tax rates and other local costs when choosing where to live and what home to buy.

And third, municipalities can fall into a vicious spiral if they’re not careful. When incomes decline and residential property values fall, as Calgary experienced during the period we studied, municipalities must either trim their budgets or increase property taxes. For many governments, it’s easier to raise taxes than cut spending.

But rising property tax burdens could lead to the city becoming a less desirable place to live. This could mean weaker residential property values, weaker population growth, and weaker growth in the number of residential properties. The municipality then again faces the choice of trimming budgets or raising taxes. And on and on it goes.

Cities fall into these downward spirals because they fall victim to a central planner’s bias. While $853 million for a new arena for the Calgary Flames or $11 million for Calgary Economic Development—how City Hall prefers to attract new business to Calgary—invite ribbon-cuttings, it’s the decisions about Calgary’s half a million private dwellings that really drive the city’s finances.

Yet, a virtuous spiral remains in reach. Municipalities tend to see the advantage of “affordable housing” when it’s centrally planned and taxpayer-funded but miss the easiest way to generate more affordable housing: simply charge city residents less—in taxes—for their housing.

When you reduce property taxes, you make housing more affordable to more people and make the city a more desirable place to live. This could mean stronger residential property values, stronger population growth, and stronger growth in the number of residential properties. Then, the municipality again faces a choice of making the city even more attractive by increasing services or further cutting taxes. And on and on it goes.

The economy is not a series of levers in the mayor’s office; it’s all of the million individual decisions that all of us, collectively, make. Calgary city council should reduce property taxes and leave more money for people to make the big decisions in life.

Jeff Park is a visiting fellow with the Aristotle Foundation for Public Policy and father of four who left Calgary for better affordability. David Hunt is the research director at the Calgary-based Aristotle Foundation for Public Policy. They are co-authors of the new study, Taxing our way to unaffordable housing: A brief comparison of municipal property taxes.

Alberta

Calgary taxpayers forced to pay for art project that telephones the Bow River

From the Canadian Taxpayers Federation

The Canadian Taxpayers Federation is calling on the City of Calgary to scrap the Calgary Arts Development Authority after it spent $65,000 on a telephone line to the Bow River.

“If someone wants to listen to a river, they can go sit next to one, but the City of Calgary should not force taxpayers to pay for this,” said Kris Sims, CTF Alberta Director. “If phoning a river floats your boat, you do you, but don’t force your neighbour to pay for your art choices.”

The City of Calgary spent $65,194 of taxpayers’ money for an art project dubbed “Reconnecting to the Bow” to set up a telephone line so people could call the Bow River and listen to the sound of water.

The project is running between September 2024 and December 2025, according to documents obtained by the CTF.

The art installation is a rerun of a previous version set up back in 2014.

Emails obtained by the CTF show the bureaucrats responsible for the newest version of the project wanted a new local 403 area code phone number instead of an 1-855 number to “give the authority back to the Bow,” because “the original number highlighted a proprietary and commercial relationship with the river.”

Further correspondence obtained by the CTF shows the city did not want its logo included in the displays, stating the “City of Calgary (does NOT want to have its logo on the artworks or advertisements).”

Taxpayers pay about $19 million per year for the Calgary Arts Development Authority. That’s equivalent to the total property tax bill for about 7,000 households.

Calgary bureaucrats also expressed concern the project “may not be received well, perceived as a waste of money or simply foolish.”

“That city hall employee was pointing out the obvious: This is a foolish waste of taxpayers’ money and this slush fund should be scrapped,” said Sims. “Artists should work with willing donors for their projects instead of mooching off city hall and forcing taxpayers to pay for it.”

-

Automotive1 day ago

Automotive1 day agoParliament Forces Liberals to Release Stellantis Contracts After $15-Billion Gamble Blows Up In Taxpayer Faces

-

National1 day ago

National1 day agoPolitically Connected Canadian Weed Sellers Push Back in B.C. Court, Seek Distance from Convicted Heroin Trafficker

-

Alberta1 day ago

Alberta1 day agoPetition threatens independent school funding in Alberta

-

Courageous Discourse1 day ago

Courageous Discourse1 day agoNo Exit Wound – EITHER there was a very public “miracle” OR Charlie Kirk’s murder is not as it appears

-

MAiD23 hours ago

MAiD23 hours agoDisabled Canadians increasingly under pressure to opt for euthanasia during routine doctor visits

-

Business1 day ago

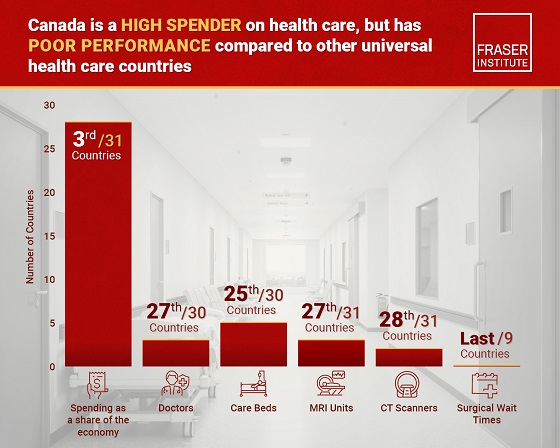

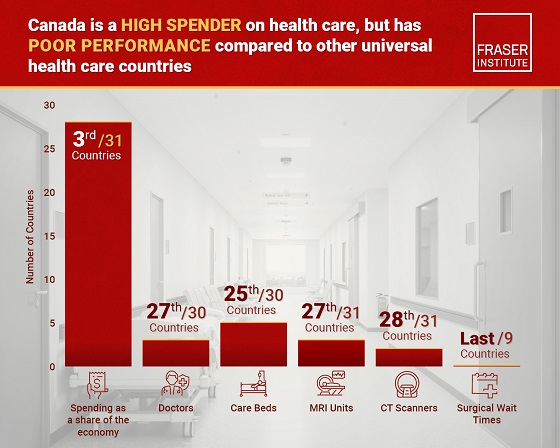

Business1 day agoCanada has fewer doctors, hospital beds, MRI machines—and longer wait times—than most other countries with universal health care

-

Business2 days ago

Business2 days agoQuebecers want feds to focus on illegal gun smuggling not gun confiscation

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoWho tries to silence free speech? Apparently who ever is in power.