Business

Investing In Stocks Isn’t Impossible Or Crazy If You Don’t Swing For The Fences

Investing in stocks has an allure like no other. Each day there are winners and losers, and one can easily see where they could have made a fortune if only they’d acted yesterday. Sitting down and staring at a screen full of stock prices, you can be sure of one thing: If you pick the right combination and dump all your money in, you will be rich within months. On top of that, the ease of entry and exit is remarkably simple. There are none of the challenges of starting your own business, building sales, hiring heroes and weirdos, dealing with the latter, and skating through the other million challenges only small business owners experience. It’s all a lot of work. But stocks…a few clicks and your fortune is made! Maybe!

No wonder we’re drawn to the game like moths to a flame, and the analogy is more startlingly apt than we realize. After you’ve signed your wings, or even worse piloted straight into the flame, you will nod to yourself, yup, that’s how it goes. Which is a shame.

What makes investing so challenging? Many things, but first it is imperative to understand the pricing of securities. The price will go up or down depending on the perceived fortunes of the company, and many investors sadly believe that by reading a headline or making a guess about some market development like a new demand for graphite, they can go grab a stock and ride it to the moon. And they might, but first it’s critical to understand that the pros, the people that live and breathe markets, are light years ahead of you, and have moved their money accordingly. When you get a hot stock tip from your beard-trimmer, the early/smart money has come and gone, and if not gone, is waiting for you to throw yours in before scampering.

If you don’t believe me, consider this quote from a remarkably well-placed US market commentator that goes by the mysterious name of The Heisenberg (heisenbergreport.com). The guy (I think) lives and breathes markets, and reading his output makes one realize that the market is moving in ways that retail investors can’t keep up with unless they are diligent to the point of obsession and have about 22 hours a day to devote to the topic. Here’s a quote from one of his posts at Seeking Alpha: “if, for whatever reason, the long-end of the US curve were to suddenly sell-off, the attendant bear steepener would mechanically force an unwind in all manner of equities expressions tied to the “duration infatuation,” including, but not limited to, min. vol. vehicles, momentum products, secular growth, defensives and, obviously, traditional bond proxies.”

Obviously? Huh? I’ve been around markets for decades, watching all sorts of developments, and people like this lose me by the third line. There is a whole layer of expertise in financial engineering that most people don’t even know exists. I’m pretty sure that if you don’t study market manipulations with the devotion of a dog to its feeding dish that you won’t be able to keep up with that narrative.

The coronavirus pandemonium has made things even worse. Blue-chip stocks that once seemed invincible have seen share prices collapse, because the future is unknown. If all the pros are fleeing, why would an average investor even consider entering the game?

You will at some point have to, one way or another, if you’re involved at all in being responsible for your retirement funding. You can farm it all out and pay through the nose, or learn a bit about what you’re actually investing in and if you’re getting your hard-earned money’s worth. Maybe you decide individual stocks aren’t for you, in which case ETFs (Exchange Traded Funds, which are pools of money that buy stocks that mirror stock or bond sectors, or certain sub-indices) are the next best thing (per a guy who should know – Warren Buffett). If you do buy stocks, preferably ones that grow dividends steadily, the stress of watching your portfolio pogo up and down is relieved because you can focus on the dividend cash flow instead. Then you can relax and go back to quality internet programming like funny cat videos or Russian traffic fails. Or is that just me…

For more stories, visit Todayville Calgary

Business

Canada needs serious tax cuts in 2026

What Prime Minister Mark Carney gives with his left hand, he takes away with his right hand.

Canadians are already overtaxed and need serious tax cuts to make life more affordable and make our economy more competitive. But at best, the New Year will bring a mixed bag for Canadian taxpayers.

The federal government is cutting income taxes, but it’s hiking payroll taxes. The government cancelled the consumer carbon tax, but it’s hammering Canadian businesses with a higher industrial carbon tax.

The federal government cut the lowest income tax bracket from 15 to 14 per cent. That will save the average taxpayer $190 in 2026, according to the Parliamentary Budget Officer.

But the government is taking more money from Canadians’ paycheques with higher payroll taxes.

Workers earning $85,000 or more will pay $5,770 in federal payroll taxes in 2026. That’s a $262 payroll tax hike. Their employers will also be forced to pay $6,219.

So Canadians will save a couple hundred bucks from the income tax cut in the new year, but many Canadians will pay a couple hundred bucks more in payroll taxes.

It’s the same story with carbon taxes.

After massive backlash from ordinary Canadians, the federal government dropped its consumer carbon tax that cost average families hundreds of dollars every year and increased the price of gas by about 18 cents per litre.

But Carney’s first budget shows he wants higher carbon taxes on Canadian businesses. Carney still hasn’t provided Canadians a clear answer on how much his business carbon tax will cost. He did, however, provide a hint during a press conference he held after signing a memorandum of understanding with the Alberta government.

“It means more than a six times increase in the industrial price on carbon,” Carney said.

Carney previously said that by “changing the carbon tax … We are making the large companies pay for everybody.”

Carney’s problem is that Canadians aren’t buying what he’s selling on carbon taxes.

Just 12 per cent of Canadians believe Carney that businesses will pay most of the cost of his carbon tax, according to a Leger poll. Nearly 70 per cent of Canadians say businesses will pass most or some of the cost to consumers.

Canadians understand that it doesn’t matter what type of lipstick politicians put on their carbon tax pig, all carbon taxes make life more expensive.

Carney is also continuing his predecessor’s tradition of automatically increasing booze taxes.

Ottawa will once again hike taxes on beer, wine and spirits in 2026 through its undemocratic alcohol tax escalator.

First passed in the 2017 federal budget, the alcohol escalator tax automatically increases federal taxes on beer, wine and spirits every year without a vote in Parliament.

Federal alcohol taxes are expected to increase by two per cent on April 1, and cost taxpayers $41 million in 2026. Since being imposed, the alcohol escalator tax has cost taxpayers about $1.6 billion, according to industry estimates.

Canadians are overtaxed and need the federal government to seriously lighten the load.

The biggest expense for the average Canadian family isn’t the home they live in, the food they eat or the clothes they buy. It’s the taxes they pay to all levels of government. More than 40 per cent of the average family’s budget goes to paying taxes, according to the Fraser Institute.

Politicians are taking too much money from Canadians. And their high taxes are driving away investment and jobs.

Canada ranks a dismal 27th out of 38 industrialized countries on individual tax competitiveness, according to the Tax Foundation. Canada ranks 22nd on business tax competitiveness. Canada is behind the United States on both measures.

A little bit of tax relief here and there isn’t going to cut it. Carney’s New Year’s resolution needs to be to embark on a massive tax cutting campaign.

Business

DOOR TO DOOR: Feds descend on Minneapolis day cares tied to massive fraud

Federal agents are now going “DOOR TO DOOR” in Minneapolis, launching what the Department of Homeland Security itself describes as an on-the-ground sweep of businesses and day-care centers tied to Minnesota’s exploding fraud scandal — a case that has already burned through at least $1 billion in taxpayer money and is rapidly closing in on Democrat Gov. Tim Walz and his administration.

ICE agents, working under the umbrella of the Department of Homeland Security, fanned out across the city this week, showing up unannounced at locations suspected of billing state and federal programs for services that never existed. One day-care worker told reporters Monday that masked agents arrived at her facility, demanded paperwork, and questioned staff about operations and enrollment.

“DHS is on the ground in Minneapolis, going DOOR TO DOOR at suspected fraud sites,” the agency posted on X. “The American people deserve answers on how their taxpayer money is being used and ARRESTS when abuse is found.”

DHS is on the ground in Minneapolis, going DOOR TO DOOR at suspected fraud sites.

The American people deserve answers on how their taxpayer money is being used and ARRESTS when abuse is found. Under the leadership of @Sec_Noem, DHS is working to deliver results. pic.twitter.com/7XtRflv36b

— Homeland Security (@DHSgov) December 29, 2025

Authorities say the confirmed fraud already totals roughly $300 million tied to fake food programs, $220 million linked to bogus autism services, and more than $300 million charged for housing assistance that never reached the people it was meant to help. Investigators from the FBI, Justice Department, and Department of Labor have now expanded their probes after a viral investigation exposed taxpayer-funded day cares that received more than $1 million each while allegedly serving few — or zero — children.

One of the most glaring examples, the Minneapolis-based Quality “Learing” Center — infamous for its misspelled sign — suddenly appeared busy Monday as national media arrived. Locals told reporters the center is typically empty and often looks permanently closed, despite receiving about $1.9 million in public funds. State inspection records show the facility has racked up 95 violations since 2019. Employees allegedly cursed at reporters while children were bused in during posted afternoon hours.

DHS officials say the “DOOR TO DOOR” operation is deliberate. In videos released online, agents are seen questioning nearby business owners about whether adjacent buildings ever had foot traffic, whether they appeared open, and whether operators used subcontractors or outside partners to pad billing. DHS Secretary Kristi Noem posted footage of agents pressing workers about business relationships and transportation services used by suspected fraud sites.

“This is a large-scale investigation,” DHS Assistant Secretary Tricia McLaughlin told the New York Post, confirming that Homeland Security Investigations and ICE are targeting fraudulent day-care and health-care centers as well as related financial schemes.

FBI Director Kash Patel warned that what investigators have uncovered so far is “just the tip of a very large iceberg.” He pointed to the bureau’s dismantling of a $250 million COVID-era food-aid scam tied to the Feeding Our Future network, a case that resulted in 78 indictments and 57 convictions. Patel has also made clear that denaturalization and deportation remain on the table for convicted fraudsters where the law allows.

Dozens of arrests have already been made across the broader scheme, many involving Somali immigrants, though federal officials stress the investigation targets criminal behavior — not communities. Some local residents say the scandal is hurting law-abiding families. One Somali Uber driver told reporters he works 16-hour days and is furious that “some people are taking advantage of the system,” making the entire community look bad.

Now, with federal agents going “DOOR TO DOOR” across Minneapolis, the era of polite indifference appears to be over. The message from Washington is blunt: the money trail is being followed, the paperwork is being checked, and the days of treating taxpayer-funded programs like an open vault are coming to an end.

-

Energy1 day ago

Energy1 day agoWhy Japan wants Western Canadian LNG

-

Business2 days ago

Business2 days agoWhat Do Loyalty Rewards Programs Cost Us?

-

Business1 day ago

Business1 day agoMainstream media missing in action as YouTuber blows lid off massive taxpayer fraud

-

Business1 day ago

Business1 day agoLand use will be British Columbia’s biggest issue in 2026

-

International21 hours ago

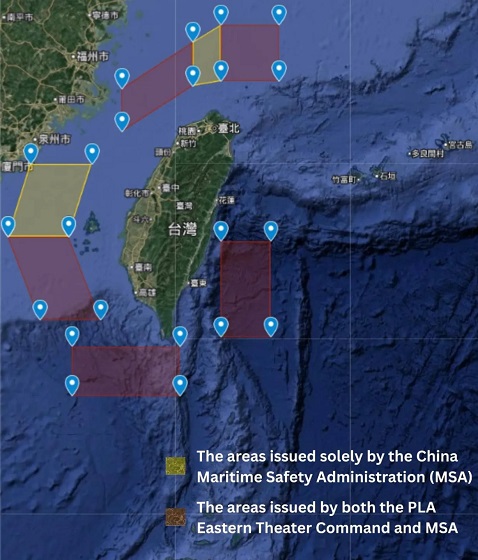

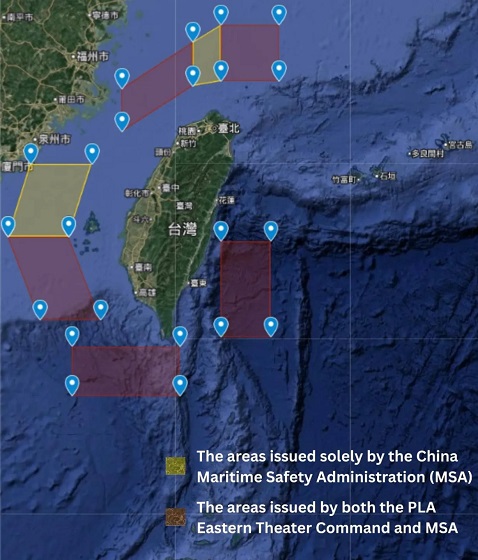

International21 hours agoChina Stages Massive Live-Fire Encirclement Drill Around Taiwan as Washington and Japan Fortify

-

Digital ID20 hours ago

Digital ID20 hours agoThe Global Push for Government Mandated Digital IDs And Why You Should Worry

-

Energy22 hours ago

Energy22 hours agoRulings could affect energy prices everywhere: Climate activists v. the energy industry in 2026

-

Haultain Research2 days ago

Haultain Research2 days agoSweden Fixed What Canada Won’t Even Name