Bruce Dowbiggin

Celebrity Owners– Fun, Yes, But The Equity Is Even Better

In case you hadn’t noticed. Celebrity Sports Ownership is all the rage. When the Ottawa Senators were for sale Ryan Reynolds, Snoop and The Weeknd were all mentioned among the bidders (that eventually went to Montreal businessman Michael Andlauer). LeBron James now holds a minority position with Liverpool FC.

Jay-Z owns part of the Brooklyn Nets, Usher a piece of the Cleveland Cavaliers while Fergie of Black Eyed Peas fame also partly owns the Miami Dolphins. Gloria and Emilio Estefan, Marc Anthony, and tennis superstars Serena and Venus Williams are owners of pro sports teams. Famously, Elton John owned Watford FC, although he’s now just an honorary chairman.

And, of course, Reynolds and Rob McElhenney used a documentary TV series that showed their Welsh Wrexham soccer team promoted to the FA’s League Two. What’s the attraction?

Clearly a little PR is always a good thing. But sports team ownership has also become a lucrative equity play. As BMO reports, “The average compound annual growth rate since the last purchase price… is 15 percent, a meaningful outperformance to the TSX and S&P. Forbes estimates the Toronto Blue Jays are currently worth US$2.1 billion or roughly C$2.85 billion.

Based on recent sports franchise transactions, expansion fees and annual estimations of franchise values by Forbes Magazine, an $8 billion enterprise value is easily defendable for the Jays’ owners MLSE (who also own the Maple Leafs, Toronto FC and Argonauts).”

It’s the same across the major pro sports leagues. The estimated average franchise value in the NFL since 2013 is $5.1B with a compound annual growth rate (CAGR) of 16 percent; in the NBA it is $2.9B with a CAGR of 18 percent. For MLB it is $2.3B with a CAGR of 12 percent; the NHL is $1.0B with a CAGR of 11 percent; while MLS is $0.6B with a CAGR 21%.

But, BMO cautions, owning a sports franchise is considered “an equity investment strategy rather than a cash flow or income play.” In other words, don’t think that ticket sales and hot dogs are going to make you rich. (Although the NHL’s salary cap, which guarantees owners’ profits is a sweet deal.) The key is sports media which is thriving despite the move to cord cutting..

Sports media rights contracts have grown in tandem with franchise valuations. Not to be ignored in the advertising growth and viewer interaction is the bear knowns as legalized sports betting. Betting companies are flooding the airwaves with commercials while bettors tune in to watch how their selections work out. The casinos and online shops have replaced lower-paying traditional advertisers who’ve dropped off.

In Canada, league or team ownership of broadcast properties is still common. For that reason the real value of those broadcast rights is often opaque. (We had some irritated pushback from Rogers and Bell for writing on this tidy arrangement in the mid 2010s, forcing some limited disclosures). Rogers Sportsnet and TSN own (via MLSE) own a stable of teams in MLB, NHL, CFL and MLS. Good luck finding out what they pay themselves for media rights.

It’s more open in the U.S. Since the New York Yankees pioneered the YES network in 2002— sparking multiple imitators in other markets—the move in the U.S. has been away from outright ownerships of regional sports networks. A number of RSNs in the U.S. are either in bankruptcy or nearing it. Digital and network sources are now absorbing these sources. ESPN, via its owner Disney, is looking to find partners for its many broadcast properties as their bottom line in general has suffered.

Still, ESPN’s legacy business generates revenue and operating income of approximately $12.5 billion and $4.0 billion in 2023. It remains to be seen what new model emerges in the U.S. to answer cord cutting and the death of conventional TV. The NFL’s experiment on Monday, having two MNF games compete on separate networks is one experiment.

In Canada’s monopolistic market, “TSN/RDS penetration rates have declined at a quicker pace than ESPN over the past 10 years. ESPN penetration has dropped from 81 percent of U.S. households in 2013 to 56 percent in 2022, while TSN/RDS penetration has decreased from 89% of Canadian households in 2013 to 49 percent in 2022.

In addition, BMO admits that cord cutting is a thing. “SportsNet subscribers have decreased -23 percent to 5.8 million over the same period. Subscriber and advertising revenues are 60 percent and 40 percent of total revenue, respectively. Since 2017, TSN revenues have increased 13 percent. TSN subscribers have decreased -29 percent to ~7.8 million over the same period.”

But! In the last five years, TSN and SN have increased advertising revenues by 13 percent and 15 percent respectively. The same figure for the top five Canadian non-sports channels (collectively) is six percent. Thank you legalized wagering in Ontario. So who wouldn’t want a piece of this action, especially in Canada?

The red flag in this surging equity market comes in the form of smaller Canadian NHL markets. The Senators sale for $950 suggests a healthy interest in owning, but the Sens sale was also tied into the new LeBreton Flats arena. Ownership or control of a Canadian arena means more than NHL games. It also includes revenue from concerts, rallies, monster-truck events etc.

Even with that can Andlauer produce a winner just two hours from the Montreal Canadiens market? Likewise, the Winnipeg Jets are desperately in need of a larger arena to replace the 15,321 Canada Life Centre. Having Canada’s richest man, David Thomson, as an owner is no guarantee of getting one. And should Thomson tire of being the saviour of a losing Jets hockey property, who in that market has C$1-2B lying around needed to fund the franchise properly?

Likewise, the Calgary Flames. Despite the political press conference this summer about as new agreement the arena that management promised by 2013 has still not seen a shovelful of dirt turned over. The latest gaffe was architect’s drawings for the rink being rejected by the NHL due to inadequate dressing-room space. Start again.

Should the rink not be available till 2025-26 will an evolving ownership group still be interested in shelling out the money to keep the Flames (and Stampeders, Roughnecks and Hitmen) operating in Calgary? And if they don’t, because losing sucks? While energy-rich Calgary has plenty of billionaires, few will want to risk the money needed to keep a competitive team in a small market.

Connor McDavid’s brilliance plasters over the same small-market crack in Edmonton. Yes, they have their new building, but can owner Darryl Katz fund the moves need to keep his stars and build a winner? Vancouver, owned by the Aqulini family, has a larger market base, but with Seattle Kraken just two hours away can they too write the cheques needed to create the first Stanley Cup winner since the Canucks entered the NHL in 1970.

If these Canadian markets do survive longterm it might have to be with foreign ownership. Certainly there is money to be made riding the equity train. But there also no guarantees that those carpetbagger owners might replicate the Montreal Expos and scoot to richer markets.

Sign up today for Not The Public Broadcaster newsletters. Hot takes/ cool slants on sports and current affairs. Have the latest columns delivered to your mail box. Tell your friends to join, too. Always provocative, always independent. https://share.hsforms.com/16edbhhC3TTKg6jAaRyP7rActsj5

Bruce Dowbiggin @dowbboy is the editor of Not The Public Broadcaster A two-time winner of the Gemini Award as Canada’s top television sports broadcaster, he’s a regular contributor to Sirius XM Canada Talks Ch. 167. Inexact Science: The Six Most Compelling Draft Years In NHL History, his new book with his son Evan, was voted the seventh-best professional hockey book of all time by bookauthority.org . His 2004 book Money Players was voted sixth best on the same list, and is available via http://brucedowbigginbooks.ca/book-personalaccount.aspx

Bruce Dowbiggin

Getting Real About Justin’s Real Estate Economy. It Won’t Last

Have you ever been to a concert where a hot new product like Tesla is mentioned and many in the crowd applaud in approval? Have you been at a dinner party when you say you went to a new Thai restaurant, and everyone at the table explodes in rhapsodic glee? Have you ever been to see a comic and he mentions he has the latest iPhone with the nifty camera and people actually cheer?

You see those people cheering a piece of tech or a style of cuisine? Those are the people who believed Justin Trudeau when he told them to sink everything into real estate when interest rates were near zero. They. Will. Believe. Anything. So long as they think it makes them cool kids. Trudeau could say he can control the weather by stopping cows from farting, and they’ll be wearing a bovine flatulence T-shirts pronto.

Now, we can hear you laughing in derision at our skepticism about the real estate-economy that has taken over the nation— the new economy that Justin fed, watered and then bragged about. (To the exclusion of the other cornerstones of our once-dynamic nation state.) The one that will be going to Market one of these days for a meeting with an air compressor.

Again, you laugh. Despite the housing shortage Justin says we can easily accommodate two million new souls a year, no problem. He says Trump was a vile racist for wanting to exclude unhinged radicals from zombie countries back in 2017. The freshly-arrived from Trump’s “shithole countries” with “shithole value systems” and “shithole economies’ will prop up the value of Canada’s two-million dollar cash-cow bungalow in West Van or Etobicoke. And the Happy People believe.

Why? Because Justin and his cabinet are in Control, and they’ll just rein in these types when they get here and start asking that Jews be exterminated or white people surrender the merit system to DEI droogs. That little dustup at the universities where nervous trust-fund virgins claim to be onside with systemic rape? Justin can stop them anytime. Everything is cool. After all, Canada is the model for a postmodern state.

And that stuff about how the Canadian real estate market being 80 percent propped up by drug money, kleptocracy profits and Blackrock? Pshaw. That is just the Far Right Diagolons trying to panic you into hiding your money from the government which just wants to send it to the “shithole” countries in a kickback loop. If nothing else, the banks will save you— if there’s any shareholder value left after this deranged DEI diversion.

Can’t happen here? We know people who were around the EU in 2008 when the U.S. mortgage debacle cratered economies around the world. For years they’d been served by Poles in the service industry, Spaniards in the restaurant kitchens and Bulgarians doing the physical labour. Life was good. Everyone drove a Beemer and owned a condo overlooking the sea.

Then, one day, they noticed that all the airport parking lots were overflowing with Beemers that went unclaimed. No one had paid rent in months. The banks noticed that all these lovely fellow citizens of the EU had drained their savings, reached their cash credit limit on the Mastercard and skedaddled with the dough. Funny, they all must have gone on holidays to once, no?

No. They were gone. Bye bye. Adios. And the credit bubbles in Ireland, Norway, Iceland, France and other EU worthies popped like the champagne they’d been sipping for years on easy credit and idiotic notions of productivity. Nations like Iceland went bankrupt overnight. Counties in England threw their keys on the table. People’s life savings evaporated.

But Justin says that won’t happen here on his co-watch with Jagmeet the Bespoke. Sure, no one under the age of 40 can afford those two-million dollar cash-cow bungalows in West Van or Etobicoke. But those old Boomer geezers will die soon, and after we tax the daylights out of the estate, the kiddos will inherit the house. Probably after we turn it into a four-plex or fine them for having empty bedrooms because they couldn’t afford kids.

One of the ferocious beauties of market economies is their way of periodically turning on themselves when too many people are getting rich too easily. The Canadian RE economy of Justin Trudeau is one of them. It’s about a decade old without any sign of dropping. Life is good. Everyone drives a Tesla and rents a condo overlooking the sea.

Little wonder. Everything he and his faculty lounge of dimwits like Chrystia Freeland, Melanie Joly and Steven Guilbeault have done this decade has been to prop up the value of real estate owned by their real pals in Asia, Europe, the assorted kleptocracies in Africa or the sub-continent. It was like an ad for Chlorox the way these “investors” blithely laundered their dirty money in Canadian condos and low-rises. When news leaked out that mobsters were using casinos in B.C. (where Justin’s maternal side came from) as a laundering station it was covered up very quickly.

But the clock ticks. Even Justin’s former finance minister Bill Morneau is warning that the bubble is going to pop if Justin keeps printing more money to keep the real estate values so unsupportably high. The entire middle class of Canada, which has ridden the real estate train, will see their life savings evaporate like Jody Wilson Raybould’s political career.

No matter. Justin’s been living in government housing since 2015 (some of it with his Mommy). What does a trust-fund nit know about making rent cheques or a mortgage payment? Without Sophie spending like a dervish, he never needs to look at an America Express card again. He’s got 17 more months to build up credits with his future benefactors, and he’s not applying the handbrake now.

Okay, you can applaud now.

Bruce Dowbiggin @dowbboy is the editor of Not The Public Broadcaster A two-time winner of the Gemini Award as Canada’s top television sports broadcaster, he’s a regular contributor to Sirius XM Canada Talks Ch. 167. Now for pre-order, new from the team of Evan & Bruce Dowbiggin . Deal With It: The Trades That Stunned The NHL & Changed Hockey. From Espo to Boston in 1967 to Gretz in L.A. in 1988 to Patrick Roy leaving Montreal in 1995, the stories behind the story. Launching in paperback and Kindle on #Amazon this week. Destined to be a hockey best seller. https://www.amazon.ca/Deal-Trades-Stunned-Changed-Hockey-ebook/dp/B0D236NB35/

Bruce Dowbiggin

Do It Once, Shame On You; Do It Twice, Shame On Me

Now that the annoying Toronto Maple Leafs business (In Toronto The Leafs Always Fall In Spring ) is in the rearview mirror it’s time to turn Canada’s yearning eyes to… the Vancouver Canucks? Okay, the Edmonton Oilers are in the second round, too, playing the Canucks. But it’s the unlikely re-appearance of the Nucks, like some Ogopogo on skates, that commands the curious attention of Canadians.

While Edmonton may even win the Cup this year— should its forward-heavy strategy work better than it did for the Maple Leafs— seeing the team in blue and green re-emerge after eight seasons out of eleven with no playoffs— no postseason since 2020— has some intriguing side stories. It’s been bleak since the owner blew up his team in 2013 for fear of losing a few season-ticket holders.

Vancouver is the only Canadian team to go to Game 7 twice in the Finals since Montreal won the Cup in 1993. In 1994 it was defeat at the hands of Mark Messier and the Rangers. In 2011 it was the bastard, er… Boston Bruins who skated away with the Cup in seven. And, as everyone at HNIC reminds us, Calgary (2004), Edmonton (2006), Ottawa (2007) and Montreal (2021) all fell in the Final, too. But that’s it. Seven spins of the Plinko in 31 years.

With NHL ensuring that only one of the two remaining Canadian clubs will advance after this round, the chances of a Canadian team making it eight Finals in 31 years are slim. So why not the team that plays at 10 PM ET all the time, the team that was predicted to be among the League’s worst this year. Your Vancouver Canucks. After all, it would be so perfect for the team from the home of loony politics to win the Cup.

Primary among them is the symmetry of the Hamas disturbances across the county today that recall the 2011 Canucks riot that followed the Game Seven loss by Alain Vigneault’s team. For those who don’t remember, the bitter loss fused overly refreshed Canucks fans with an element that had nothing to do with hockey on a warm summer night.

As the fans streamed away from the Rogers Centre and the open-air watch parties, the now-familiar masked balaclava-wearing, backpack toting radicals moved among them, whipping up the fans’ monumental disappointment with urges to vandalize and loot. Viewers saw an incongruous picture of these fifth columnists and fans in the team jersey becoming involved in the smashing of windows and setting of fires. Sure, Montreal had seen recent riots after Stanley Cups but there was little element of politics in the drunken behaviour.

Not Vancouver. Not in 2011. Seeing the random anarchists and looters on Granville and Robson Streets the question was, “Why were the cops and elected officials so unprepared?”

It was an unsettling conclusion to a season of so much good feeling in Vancouver, staining the memory of a gifted hockey team that simply ran out of healthy bodies. The most common reaction to the riots was “Who were those non-hockey people in the riot?” There were jokes about the instigators were 257 Daniel Sedins, 319 Henrik Sedins and 195 Roberto Luongos. But they fell flat.

Many were shocked to see so many anarchists, Marxists, radical climate freaks, petty criminals and psychopaths in their midst. Like the reaction to the Palestinian mobs waving Death To Jews and From The River to the Sea, the impact on average Canadians— the kind who watch hockey, not Mao, as a religion— was unsettling. The damages soared into the tens of millions as Vancouver’s looked at a burned-out downtown and asked, “What happened?”

Later investigations revealed a large contingent of the rioters came from as far away as the Pacific Northwest and California. This was an organized event. Again, how did so many people with evil intent get into the country? The answer to most of the questions was very Canadian. People thought it couldn’t happen here.

It’s what most are saying about the Hamas-inspired wave of crime and insubordination now on screens. Canadians have always been so liberal and self effacing. How did they end up branded by homicidal Hamas as supporting the murder of babies? Isn’t there supposed to be some pay-off for being kind and opening the doors to unchecked immigration from countries where terror and instability are the watchwords?

What is just as unnerving about the Palestinian intifada ugliness is the realization that, memories of 2011, the anti-Israel demonstrators represent only a part of the mobs denying entry to Jewish students at schools or blocking traffic or defacing buildings with messages of hate. It’s clear that anti-capitalist nihilists are in equal numbers in the crowds, whipping up hapless coeds, grad-school nimrods and nutty professors with their messages.

Worse, the uniform tents, signs, chants and more across the continent are the products of donors linked to some of the most famous names in finance— Rockefeller, Gates, Soros.

Citizens are right to wonder how the toxic politics of the Middle East has fused with a bottomless pit of money to upend their capitalist society. And to realize that the liberal tenets of toleration and friendliness espoused by feckless politicians have only brought on this crisis.

And to think that most thought it all behind them after they’d cleaned up the broken glass and burned cars in 2011. As they say, do it once, shame on you. Do it twice, shame on me.

Bruce Dowbiggin @dowbboy is the editor of Not The Public Broadcaster A two-time winner of the Gemini Award as Canada’s top television sports broadcaster, he’s a regular contributor to Sirius XM Canada Talks Ch. 167. Now for pre-order, new from the team of Evan & Bruce Dowbiggin . Deal With It: The Trades That Stunned The NHL & Changed Hockey. From Espo to Boston in 1967 to Gretz in L.A. in 1988 to Patrick Roy leaving Montreal in 1995, the stories behind the story. Launching in paperback and Kindle on #Amazon this week. Destined to be a hockey best seller. https://www.amazon.ca/Deal-Trades-Stunned-Changed-Hockey-ebook/dp/B0D236NB35/

-

COVID-1923 hours ago

COVID-1923 hours agoKenyan doctor: WHO pandemic treaty aims to ‘maim and kill’ and ‘establish a one-world government’

-

Agriculture2 days ago

Agriculture2 days agoFarming group accuses Canadian gov’t of trying to blame agriculture for ‘climate change’

-

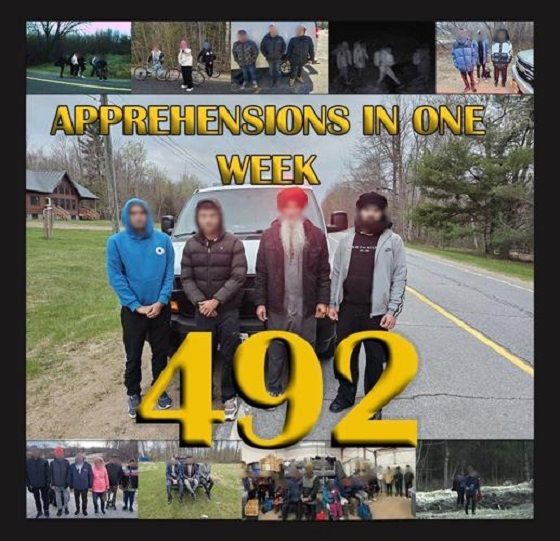

illegal immigration2 days ago

illegal immigration2 days agoNorthern border apprehensions highest in US history first 6 months of fiscal ’24

-

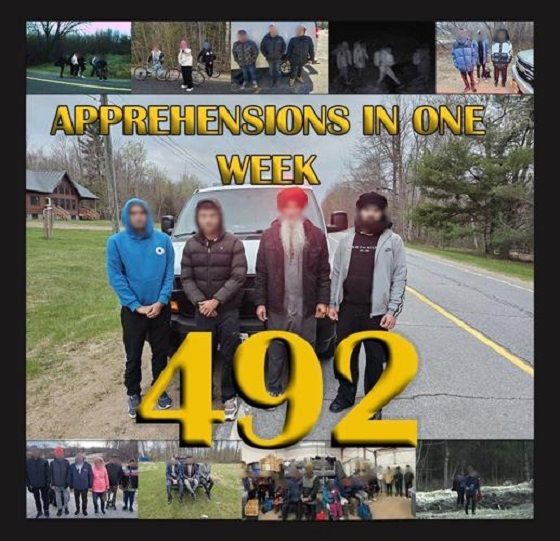

illegal immigration2 days ago

illegal immigration2 days agoTerrorist watch list apprehensions at northern border continue to break records

-

espionage1 day ago

espionage1 day agoEXCLUSIVE: House Committee To Investigate Spike In Chinese Illegal Immigration Following DCNF Report

-

Automotive21 hours ago

Automotive21 hours agoElectric vehicle mandates mean misery all around

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoQuebec court greenlights class action suit against YouTube’s COVID-related content censorship

-

Bruce Dowbiggin12 hours ago

Bruce Dowbiggin12 hours agoGetting Real About Justin’s Real Estate Economy. It Won’t Last