Alberta

Alberta’s financial update one for the ages – Historical investments in savings and debt reduction on the way

Q1 update: Paying down debt and saving for the future

Strong economic activity this year will see Alberta make historic investments in savings and debt reduction.

High revenue forecast for bitumen royalties, other resource revenue and corporate income taxes have increased the province’s forecast surplus to $13.2 billion for 2022-23.

This year’s surplus enables the government to make the largest single-year debt repayment in Alberta’s history, repaying $13.4 billion in debt that comes due this fiscal year. The government will also allocate $5.2 billion to debt coming due in 2023-24.

The government will make the largest ever single-year investment in the Heritage Fund, retaining the fund’s remaining 2021-22 net investment income of $1.2 billion and allocating $1.7 billion, for a total investment of $2.9 billion. This is over and above the $705 million retained for inflation-proofing last year.

“Alberta’s commitment to fiscal discipline and our unrelenting focus on economic growth has helped bring about an extraordinary turnaround in our financial situation. We promised Albertans we would get our fiscal house in order and that’s exactly what we’ve done. Now, we’re paying down debt so future generations won’t have to, saving more for a rainy day, and putting more money in Albertans’ pockets.”

“For too long, governments in Alberta refused to exercise fiscal discipline during boom times. Those days are over. Alberta’s government is making the prudent decision to save and invest surplus revenues so future generations can benefit from the prosperity of today.”

Indexing personal income taxes

The province is fulfilling a commitment made in 2019 to index personal income taxes to inflation, retroactive to the 2022 tax year. The basic personal tax amount is rising to $19,814 and will rise again in 2023.

An additional 80,000 to 95,000 Albertans will pay no provincial personal income tax by 2023, on top of the approximately 1.3 million tax filers who already pay no provincial personal income tax.

Many Albertans will first see the benefit of indexation through lower tax withholdings on their first paycheques of 2023. In addition, since indexation will resume for 2022, Albertans will receive larger refunds or owe less tax when they file their 2022 tax returns in spring 2023. In total, resuming indexation for 2022 and subsequent years will save Albertans an estimated $304 million in 2022-23, $680 million in 2023-24 and $980 million in 2024-25.

Indexing personal income taxes to inflation will contribute further to Alberta’s strong tax advantage: Albertans already pay less in overall taxes, with no PST, no payroll tax and no health premiums.

Alberta’s government has already introduced some of the most generous measures to keep more money in the pockets of Albertans, committing $2.4 billion in relief for rising prices, inflation and cost of living, including:

- Providing $300 in relief for 1.9 million homeowners, business operators and farmers over six months through the Electricity Rebate Program.

- Eliminating the 13-cent-per-litre provincial fuel tax until at least the end of September.

- Helping school authorities cover high fuel costs for buses under the Fuel Price Contingency Program.

- Providing natural gas rebates from October 2022 to March 2023 to shield consumers from natural gas price spikes.

- Maintaining Alberta senior benefits for those over 75 years of age, exempting them from the Federal Old Age Security increase.

Other economic growth indicators

Momentum has picked up in Alberta’s labour market. The province has added 68,200 jobs since the beginning of the year and most industries have surpassed employment levels from early 2020, before the pandemic first took hold of the province. Alberta’s unemployment rate fell to 4.8 per cent, the lowest since early 2015. In response to these positive developments, the province has revised its forecast for employment growth to 5.3 per cent, up from 4.1 per cent at budget. The unemployment rate has also been revised down to 5.9 per cent in 2022 from the budget forecast of 6.6 per cent.

Business output has surged in the province on the back of higher demand and prices. While energy products have led the increase, there have been gains across most industries including chemical and forestry products, food manufacturing and machinery. Merchandise exports have risen more than 60 per cent so far this year, while manufacturing shipments are up over 30 per cent.

Higher energy prices are boosting revenues and spending in the oil and gas sector. Strong drilling activity has lifted crude oil production to 3.6 million barrels per day so far this year and is expected to reach a record high this year. Outside the oil and gas sector, companies are proceeding with investment plans, buoyed by solid corporate profits.

Real gross domestic product (GDP) is expected to grow by 4.9 per cent in 2022. This is down slightly from the budget forecast of 5.4 per cent, reflecting softer expectations for growth in consumer spending and residential investment as a result of higher inflation and interest rates. Even so, real GDP is expected to fully recover from the COVID-19 downturn and surpass the 2014 peak for the first time this year. Private sector forecasters are expecting Alberta to have among the highest economic growth in the country this year and in 2023.

Quick facts

- The surplus for 2022-23 is forecast at $13.2 billion, $12.6 billion more than what was estimated in Budget 2022.

- The revenue forecast for 2022-23 is $75.9 billion, $13.3 billion higher than reported in the budget.

- Non-renewable resource revenue is forecast at $28.4 billion in 2022-23, up $14.6 billion from budget’s $13.8 billion forecast.

- Corporate income taxes are up $2 billion from the budget, with a new forecast of $6.1 billion for 2022-23.

- Revenue from personal income taxes is forecast to be $13.3 billion in 2022-23, down $116 million from budget. Indexation of the personal income tax system, retroactive to Jan. 1, 2022, is forecast to lower revenue by $304 million. This is partially offset by increased revenue from rising primary household income.

- Total expense is forecast at $62.7 billion, up slightly from the $62.1 billion estimated at budget.

- Education is receiving an extra $52 million to support the new teachers agreement and to help school authorities pay for bus fuel.

- $279 million the province received from the federal government for the Site Rehabilitation Program is being spent this year instead of next year.

- $277 million is needed to cover the cost of selling oil due to higher prices and volumes.

- The Capital Plan in 2022-23 has increased by $389 million mainly due to carry-over of unspent funds from last fiscal year and an increase of $78 million for highway expansion.

- Taxpayer-supported debt is forecast at $79.8 billion on March 31, 2023, which is $10.4 billion lower than estimated in the budget.

- The net debt-to-GDP ratio is estimated at 10.3 per cent for the end of the fiscal year.

Alberta

Median workers in Alberta could receive 72% more under Alberta Pension Plan compared to Canada Pension Plan

From the Fraser Institute

By Tegan Hill and Joel Emes

Moving from the CPP to a provincial pension plan would generate savings for Albertans in the form of lower contribution rates (which could be used to increase private retirement savings while receiving the same pension benefits as the CPP under the new provincial pension), finds a new study published today by the Fraser Institute, an independent, non-partisan Canadian public policy think-tank.

“Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate through a separate provincial pension plan while receiving the same benefits as under the CPP,” said Tegan Hill, director of Alberta policy at the Fraser Institute and co-author of Illustrating the Potential of an Alberta Pension Plan.

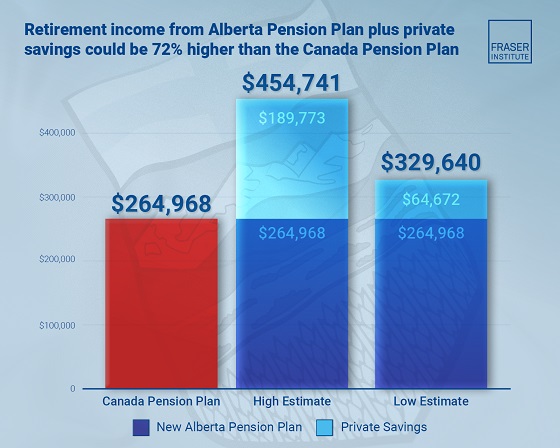

Assuming Albertans invested the savings from moving to a provincial pension plan into a private retirement account, and assuming a contribution rate of 5.85 per cent, workers earning the median income in Alberta ($53,061 in 2025) could accrue a stream of retirement payments totalling $454,741 (pre-tax)—a 71.6 per cent increase from their stream of CPP payments ($264,968).

Put differently, under the CPP, a median worker receives a total of $264,968 in retirement income over their life. If an Alberta worker saved the difference between what they pay now into the CPP and what they would pay into a new provincial plan, the income they would receive in retirement increases. If the contribution rate for the new provincial plan was 5.85 per cent—the lower of the available estimates—the increase in retirement income would total $189,773 (or an increase of 71.6 per cent).

If the contribution rate for a new Alberta pension plan was 8.21 per cent—the higher of the available estimates—a median Alberta worker would still receive an additional $64,672 in retirement income over their life, a marked increase of 24.4 per cent compared to the CPP alone.

Put differently, assuming a contribution rate of 8.21 per cent, Albertan workers earning the median income could accrue a stream of retirement payments totaling $329,640 (pre-tax) under a provincial pension plan—a 24.4 per cent increase from their stream of CPP payments.

“While the full costs and benefits of a provincial pension plan must be considered, its clear that Albertans could benefit from higher retirement payments under a provincial pension plan, compared to the CPP,” Hill said.

Illustrating the Potential of an Alberta Pension Plan

- Due to Alberta’s comparatively high rates of employment, higher average incomes, and younger population, Albertans would pay a lower contribution rate with a separate provincial pension plan, compared with the CPP, while receiving the same benefits as under the CPP.

- Put differently, moving from the CPP to a provincial pension plan would generate savings for Albertans, which could be used to increase private retirement income. This essay assesses the potential savings for Albertans of moving to a provincial pension plan. It also estimates an Albertan’s potential increase in total retirement income, if those savings were invested in a private account.

- Depending on the contribution rate used for an Alberta pension plan (APP), ranging from 5.85 to 8.2 percent, an individual earning the CPP’s yearly maximum pensionable earnings ($71,300 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $429,524 and $584,235. This would be 22.9 to 67.1 percent higher, respectively, than their stream of CPP payments ($349,545).

- An individual earning the median income in Alberta ($53,061 in 2025), would accrue a stream of retirement payments under the total APP (APP plus private retirement savings), yielding a total retirement income of between $329,640 and $454,741, which is between 24.4 percent to 71.6 percent higher, respectively, than their stream of CPP payments ($264,968).

Joel Emes

Alberta

Alberta ban on men in women’s sports doesn’t apply to athletes from other provinces

From LifeSiteNews

Alberta’s Fairness and Safety in Sport Act bans transgender males from women’s sports within the province but cannot regulate out-of-province transgender athletes.

Alberta’s ban on gender-confused males competing in women’s sports will not apply to out-of-province athletes.

In an interview posted July 12 by the Canadian Press, Alberta Tourism and Sport Minister Andrew Boitchenko revealed that Alberta does not have the jurisdiction to regulate out-of-province, gender-confused males from competing against female athletes.

“We don’t have authority to regulate athletes from different jurisdictions,” he said in an interview.

Ministry spokeswoman Vanessa Gomez further explained that while Alberta passed legislation to protect women within their province, outside sporting organizations are bound by federal or international guidelines.

As a result, Albertan female athletes will be spared from competing against men during provincial competition but must face male competitors during inter-provincial events.

In December, Alberta passed the Fairness and Safety in Sport Act to prevent biological men who claim to be women from competing in women’s sports. The legislation will take effect on September 1 and will apply to all school boards, universities, as well as provincial sports organizations.

The move comes after studies have repeatedly revealed what almost everyone already knew was true, namely, that males have a considerable advantage over women in athletics.

Indeed, a recent study published in Sports Medicine found that a year of “transgender” hormone drugs results in “very modest changes” in the inherent strength advantages of men.

Additionally, male athletes competing in women’s sports are known to be violent, especially toward female athletes who oppose their dominance in women’s sports.

Last August, Albertan male powerlifter “Anne” Andres was suspended for six months after a slew of death threats and harassments against his female competitors.

In February, Andres ranted about why men should be able to compete in women’s competitions, calling for “the Ontario lifter” who opposes this, apparently referring to powerlifter April Hutchinson, to “die painfully.”

Interestingly, while Andres was suspended for six months for issuing death threats, Hutchinson was suspended for two years after publicly condemning him for stealing victories from women and then mocking his female competitors on social media. Her suspension was later reduced to a year.

-

Business1 day ago

Business1 day agoMark Carney’s Fiscal Fantasy Will Bankrupt Canada

-

Entertainment2 days ago

Entertainment2 days agoStudy finds 99% of late-night TV guests in 2025 have been liberal

-

Alberta24 hours ago

Alberta24 hours agoTemporary Alberta grid limit unlikely to dampen data centre investment, analyst says

-

Opinion1 day ago

Opinion1 day agoCharity Campaigns vs. Charity Donations

-

Frontier Centre for Public Policy2 days ago

Frontier Centre for Public Policy2 days agoCanada’s New Border Bill Spies On You, Not The Bad Guys

-

Daily Caller19 hours ago

Daily Caller19 hours ago‘Strange Confluence Of Variables’: Mike Benz Wants Transparency Task Force To Investigate What Happened in Butler, PA

-

Uncategorized2 days ago

Uncategorized2 days agoCNN’s Shock Climate Polling Data Reinforces Trump’s Energy Agenda

-

Opinion1 day ago

Opinion1 day agoPreston Manning: Three Wise Men from the East, Again