Energy

World’s Most Populous Nation Has Put Solar Out To Pasture. Other Countries Should Follow Suit

From the Daily Caller News Foundation

From the Daily Caller News Foundation

During his debate with former President Donald Trump, President Joe Biden claimed: “The only existential threat to humanity is climate change.” What if I told you that it is not climate change but climate policies that are the real existential threat to billions across our planet?

The allure of a green utopia masks the harsh realities of providing affordable and reliable electricity. Americans could soon wake up to a dystopian future if the proposed Net Zero and Build Back Better initiatives — both aimed at an illogical proliferation of unreliable renewables and a clamp down on dependable fossil fuels — are implemented.

Nowhere is this better reflected than in remote regions of India where solar panels — believed to provide clean and green energy — ultimately resulted in being used to construct cattle sheds.

The transformation of Dharnai in the state of Bihar into a “solar village” was marked by great enthusiasm and high expectations. Villagers were told the solar micro-grid would provide reliable electricity for agriculture, social activities and daily living. The promise engendered a naïve trust in a technology that has failed repeatedly around the world.

The news of this Greenpeace initiative quickly spread as international news media showcased it as a success story for “renewable” energy in a third world country. CNN International’s “Connect the World” said Dharnai’s micro-grid provided a continuous supply of electricity. For an unaware viewer sitting in, say, rural Kentucky, solar energy would have appeared to be making great strides as a dependable energy source.

But the Dharnai system would end up on the long list of grand solar failures.

“As soon as we got solar power connections, there were also warnings to not use high power electrical appliances like television, refrigerator, motor and others,” said a villager. “These conditions are not there if you use thermal power. Then what is the use of such a power? The solar energy tariff was also higher compared to thermal power.”

A village shopkeeper said: “But after three years, the batteries were exhausted and it was never repaired. … No one uses solar power anymore here.” Hopefully, the solar panels will last longer as shelter for cows.

Eventually, the village was connected to the main grid, which provided fully reliable coal-powered electricity at a third of the price of the solar power.

Dharnai is not an isolated case. Several other large-scale solar projects in rural India have had a similar fate. Writing for the publication Mongabay, Mainsh Kumar said: “Once (grid) electricity reaches unelectrified villages, the infrastructure and funds used in installation of such off-grid plants could prove futile.”

While green nonprofits and liberal mainstream media have the embarrassment of a ballyhooed solar project being converted to cattle shed, conventional energy sources like coal continue to power India’s over 1.3 billion people and the industries their economies depend on.

India saw a record jump in electricity demand this year, partly due to increased use of air conditioning units and other electrical appliances as more of the population achieved the financial wherewithal to afford them. During power shortages, coal often has come to the rescue. India allows its coal plants to increase coal stockpiles and import additional fuel without restrictions.

India will add more than 15 gigawatts in the year ending March 2025 (the most in nine years) and aims to add a total of 90 gigawatts of coal-fired capacity by 2032.

Energy reality is inescapable in a growing economy like India’s, and only sources such as coal, oil and natural gas can meet the demand. Fossil fuels can be counted on to supply the energy necessary for modern life, and “green” sources cannot.

India’s stance is to put economic growth ahead of any climate-based agenda to reduce the use of fossil fuels. This was reaffirmed when the country refused to set an earlier target for its net zero commitment, delaying it until 2070.

The story of Dharnai serves as a cautionary tale for the implementation of renewable energy projects in rural India, where pragmatism is the official choice over pie in the sky.

Vijay Jayaraj is a Research Associate at the CO2 Coalition, Arlington, Virginia. He holds a master’s degree in environmental sciences from the University of East Anglia, UK.

Energy

75 per cent of Canadians support the construction of new pipelines to the East Coast and British Columbia

-

71 per cent of Canadians find the approval process too long.

-

67 per cent of Quebecers support the Marinvest Energy natural gas project.

“While there has always been a clear majority of Canadians supporting the development of new pipelines, it seems that the trade dispute has helped firm up this support,” says Gabriel Giguère, senior policy analyst at the MEI. “From coast to coast, Canadians appreciate the importance of the energy industry to our prosperity.”

Three-quarters of Canadians support constructing new pipelines to ports in Eastern Canada or British Columbia in order to diversify our export markets for oil and gas.

This proportion is 14 percentage points higher than it was last year, with the “strongly agree” category accounting for almost all of the increase.

For its part, Marinvest Energy’s natural gas pipeline and liquefaction plant project, in Quebec’s North Shore region, is supported by 67 per cent of Quebecers polled, who see it as a way to reduce European dependence on Russian natural gas.

Moreover, 54 per cent of Quebecers now say they support the development of the province’s own oil resources. This represents a six-point increase over last year.

“This year again, we see that this preconceived notion according to which Quebecers oppose energy development is false,” says Mr. Giguère. “Quebecers’ increased support for pipeline projects should signal to politicians that there is social acceptability, whatever certain lobby groups might think.”

It is also the case that seven in ten Canadians (71 per cent) think the approval process for major projects, including environmental assessments, is too long and should be reformed. In Quebec, 63 per cent are of this opinion.

The federal Bill C-5 and Quebec Bill 5 seem to respond to these concerns by trying to accelerate the approval of certain large projects selected by governments.

In July, the MEI recommended a revision of the assessment process in order to make it swift by default instead of creating a way to bypass it as Bill C-5 and Bill 5 do.

“Canadians understand that the burdensome assessment process undermines our prosperity and the creation of good, well-paid jobs,” says Mr. Giguère. “While the recent bills to accelerate projects of national interest are a step in the right direction, it would be better simply to reform the assessment process so that it works, rather than creating a workaround.”

A sample of 1,159 Canadians aged 18 and older were surveyed between November 27 and December 2, 2025. The results are accurate to within ± 3.5 percentage points, 19 times out of 20.

Business

Geopolitics no longer drives oil prices the way it used to

This article supplied by Troy Media.

Oil markets are shrugging off war and sanctions, a sign that oversupply now matters more than disruption

Oil producers hoping geopolitics would lift prices are running into a harsh reality. Markets are brushing off wars and sanctions as traders focus instead on expectations of a deep and persistent oil glut.

That shift was evident last week. Despite several geopolitical developments that would once have pushed prices higher, including the U.S. seizure of a Venezuelan crude tanker and fresh Ukrainian strikes on Russian energy infrastructure, oil markets barely reacted, with prices ending the week lower.

Brent crude settled Friday at US$61.12 a barrel and U.S. West Texas Intermediate at US$57.44, capping a weekly drop of more than four per cent.

Instead of responding to disruption headlines, markets were reacting to a different risk. Bearish sentiment, rather than geopolitics, continued to dominate as expectations of a “2026 glut” took centre stage.

At the heart of that outlook is a growing supply overhang. The oil market is grappling with whether sanctioned Russian and Iranian cargoes should still be counted as supply. That uncertainty helps explain why prices have been slow to react to a glut that is already forming on the water, said Carol Ryan, writing for The Wall Street Journal.

The scale of that buildup is significant. There are 1.4 billion barrels of oil “on the water,” 24 per cent higher than the average for this time of year between 2016 and 2024, according to oil analytics firm Vortexa. These figures capture shipments still in transit or cargoes that have yet to find a buyer, a clear sign that supply is running ahead of immediate demand.

Official forecasts have reinforced that view. Last week, the International Energy Agency trimmed its projected 2026 surplus to 3.84 million barrels per day, down from 4.09 million barrels per day projected previously. Even so, the IEA still sees a large oversupply relative to global demand.

Demand growth offers little relief. The IEA expects growth of 830 kb/d (thousand barrels per day) in 2025 and 860 kb/d in 2026, with petrochemical feedstocks accounting for a larger share of incremental demand. That pace remains modest against the volume of supply coming to market.

OPEC, however, has offered a different assessment. In its latest report, the group pointed to a near balance, forecasting demand for OPEC+ crude averaging about 43 million barrels per day in 2026, roughly in line with what it produced in November.

Reflecting that confidence. OPEC+ kept policy steady late in November, pausing planned output hikes for the first quarter of 2026 while more than three million barrels per day of cuts remain in place. Those measures are supportive in theory, but markets have shown little sign of being persuaded.

Recent geopolitical events underline that scepticism. The ongoing Russia-Ukraine war and Ukrainian strikes on Russian energy infrastructure, including reported hits on facilities such as the Slavneft-YANOS refinery in Yaroslavl, again failed to lift prices. Russia-Ukraine headlines pulled prices down more than strikes lifted them, according to media reports, suggesting traders were more attuned to “peace deal” risk than to supply disruption.

Washington’s move against Venezuelan crude shipments offered another test. The U.S. seizure of a Venezuelan tanker, the first formal seizure under the 2019 sanctions framework, had a muted price impact, writes Marcin Frackiewicz of Oilprice.com.

Venezuela’s exports fell sharply in the days that followed, but markets remained largely unmoved. One explanation is that Venezuela’s output is no longer large enough to tighten global balances the way it once did, and that abundant global supply has reduced the geopolitical premium.

Taken together, the signal is hard to miss. Oil producers, including in Canada, face a reality check in a market that no longer rewards headlines, only discipline and demand.

Toronto-based Rashid Husain Syed is a highly regarded analyst specializing in energy and politics, particularly in the Middle East. In addition to his contributions to local and international newspapers, Rashid frequently lends his expertise as a speaker at global conferences. Organizations such as the Department of Energy in Washington and the International Energy Agency in Paris have sought his insights on global energy matters.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

-

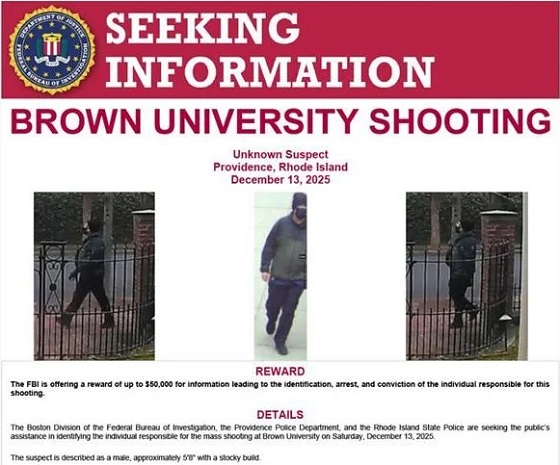

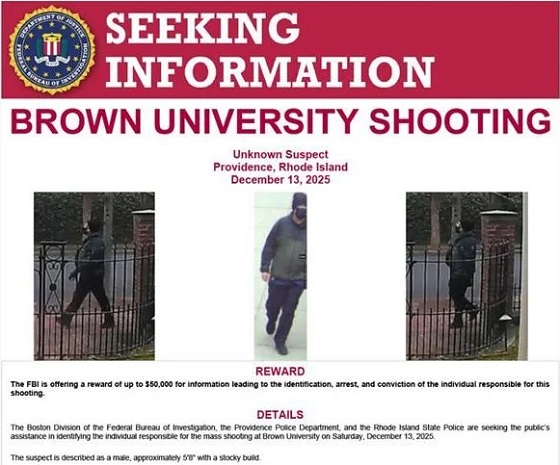

Crime2 days ago

Crime2 days agoBrown University shooter dead of apparent self-inflicted gunshot wound

-

Health1 day ago

Health1 day agoRFK Jr reversing Biden-era policies on gender transition care for minors

-

Alberta1 day ago

Alberta1 day agoAlberta’s new diagnostic policy appears to meet standard for Canada Health Act compliance

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoCanadian university censors free speech advocate who spoke out against Indigenous ‘mass grave’ hoax

-

Business19 hours ago

Business19 hours agoArgentina’s Milei delivers results free-market critics said wouldn’t work

-

Daily Caller1 day ago

Daily Caller1 day agoEx-FDA Commissioners Against Higher Vaccine Standards Took $6 Million From COVID Vaccine Makers

-

Business2 days ago

Business2 days agoTrump signs order reclassifying marijuana as Schedule III drug

-

COVID-191 day ago

COVID-191 day agoFreedom Convoy protester appeals after judge dismissed challenge to frozen bank accounts