Business

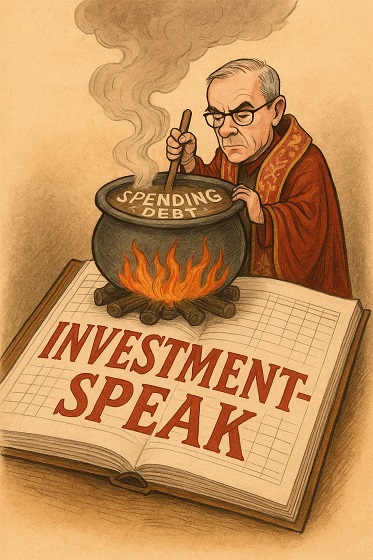

When Words Cook the Books: The Politics of ‘Investment-Speak’

The trick lies in the word “investment.” By separating “operational spending” from “capital investment,” Ottawa can now reclassify expenditures, moving them from one column to another without changing the underlying reality. A deficit remains a deficit.

Next week, Ottawa will table its first budget in nearly two years. The government has already told us what to expect. In October, the Department of Finance announced a new “Capital Budgeting Framework” that would allow Canada to “spend less so it can invest more.” The phrasing sounds prudent. It is not. It is a linguistic sleight of hand designed to obscure what the government is actually doing: spending more while pretending to exercise restraint.

The older meanings of the two words reveal the moral inversion. To spend, from the Latin dispendere, meant to weigh out and let go. It implied the careful release of what one possessed, whether money, time, or energy. In Old English and Middle English, to “spend” one’s life or strength was to pour it out, knowingly and finitely. There was gravity to the act; what was spent was gone. To invest, by contrast, came from the Latin investīre: to clothe or cover. Before it became a financial term, it referred to the ceremonial act of placing robes upon a monarch or knight, endowing them with office or honour. In its financial sense, to invest was to “clothe money” in a venture, expecting return. The first word carried finality; the second, expectancy. Spending ended a possession; investing disguised it in the promise of future gain.

From these roots, the moral difference is clear. Spending belongs to the household, measured, finite, and real. Investing belongs to the court, symbolic, ceremonial, and often self-flattering. When a government calls its spending “investment,” it does not change the transaction; it changes the costume.

The gradual adoption of this vocabulary by governments is an old habit dressed as innovation. For two decades, Ottawa has been learning to speak the language of investment as disguise. Budgets that once tabulated “program spending” now announce “investments in Canadians.” Under the Trudeau governments, tax credits and subsidies were cast as “investments in innovation.” The Canada Infrastructure Bank was sold as “leveraging private investment” rather than public debt. Even emergency COVID programs were justified as “investing in recovery.” The word became a universal solvent, dissolving distinctions between cost, borrowing, and speculation.

This year’s government has merely made the trend official. In October, the Department of Finance released Modernizing Canada’s Budgeting Approach, explaining that the new Capital Budgeting Framework would “distinguish day-to-day operational spending from capital investment.” The document asserts that this will “guide decisions and help prioritize. The trick lies in the word “investment.” By separating “operational spending” from “capital investment,” Ottawa can now reclassify expenditures, moving them from one column to another without changing the underlying reality. A deficit remains a deficit. Borrowed money is still borrowed. But call it investment, and suddenly it carries the glow of foresight and responsibility. The government plans to balance its operating budget while continuing to borrow for capital projects. The ledger will grow, but the language will comfort.

This is not merely bad accounting. It is a deliberate corruption of language in service of political evasion. And it reveals something deeper about how modern governments govern: not through honest argument but through the manipulation of words.

Ottawa has been perfecting this costume for two decades. Budgets that once listed “program spending” now announce “investments in Canadians.” Tax credits became “investments in innovation.” The Canada Infrastructure Bank was sold as “leveraging private investment,” not public debt. COVID emergency programs were justified as “investing in recovery.” The word became a universal solvent, dissolving the distinction between cost, borrowing, and speculation.

This year’s framework makes the habit official. The October document from Finance Canada promises that the new approach will “guide decisions and help prioritize investments that generate long-term benefits for Canadians, such as major projects, housing, clean energy, and infrastructure.” The tone is managerial and assured. The assumption goes unexamined: that one can divide the public purse into virtuous investment and wasteful spending, and that the government possesses the wisdom to know the difference.

Haultain Research is a reader-supported publication.

To receive new posts and support our work, consider becoming a donor or a paid subscriber.

The Prime Minister echoed the line in his own announcement: “Budget 2025 will set out our plan to spend less so we can invest more in Canada’s long-term growth.” Read carefully, the statement reveals its own dishonesty. To “spend less” no longer means reducing outlays. It means shifting expenditures into a different category where they escape the stigma of cost. The government intends to continue borrowing, but it will refer to that borrowing by a supposedly more respectable name.

The definition of capital investment is conveniently broad. It includes tax credits, corporate subsidies, and nearly any policy “that contributes to capital formation.” The Fraser Institute and others have warned that this expansiveness allows Ottawa to reclassify politically favored programs as investment, inflating the appearance of fiscal discipline while reducing transparency. A deficit becomes a “generational investment.” A subsidy becomes a “partnership.” Waste is rebranded as “capacity-building.” The language does the work that policy cannot.

Recent history exposes the fraud. Consider the electric vehicle battery subsidies, heralded as “historic investments” in the green economy. Tens of billions were promised. Projects have stalled, been postponed, or quietly abandoned. The so-called green slush fund, officially presented as an investment vehicle for sustainable innovation, turned out to be a network of cronyism and waste. These, too, were dressed as investments. When their failures emerged, the language remained untouched, as though incompetence and corruption could not breach the sanctity of the term.

The alchemy works because language shapes perception faster than arithmetic. “Investment” suggests prudence and reward. “Spending” suggests indulgence and loss. Citizens hear that the government is “investing in Canadians” and imagine return, not depletion. The moral weight of the word does the political work. Accountability fades behind aspiration.

There is a deeper danger here. Words like spend and cost belong to the vocabulary of limits. They remind us that government operates with other people’s money. Invest, as politicians now use it, belongs to the vocabulary of boundless promise. It implies benevolence without constraint, as though the state were a benefactor rather than a borrower. When the government claims to “invest in Canadians,” it implies ownership of the very people whose money it spends. The inversion of subject and object is telling. It reveals the paternalism at the heart of modern technocracy.

George Orwell wrote that political language “is designed to make lies sound truthful and murder respectable.” He understood that the corruption of speech precedes the corruption of thought. When a government renames its spending as investment, it is not simply misdescribing an accounting category. It is reshaping the citizen’s perception of what government may do. If all spending is investment, then any limit on it seems stingy, even immoral. The citizen becomes debtor to a future defined by the state.

The deceit is subtle. No one disputes that bridges or power grids can be sound investments. The deceit lies in the implication that all government activity now yields return, that every expense is productive, every grant visionary. By this logic, no spending is considered waste and no deficit is deemed reckless, as long as it is labelled as an investment. The language abolishes the distinction between consumption and creation, between present sacrifice and future gain. In doing so, it abolishes prudence itself.

Prudence, in the older sense, is not caution for its own sake. It is moral realism: the recognition that resources are finite and choices have costs. The new investment rhetoric invites the opposite illusion. Money, once moralized as investment, appears to carry no weight of trade-off. Ottawa can clothe profligacy in the robes of responsibility. The government that promises to “spend less and invest more” is like a man claiming to drink less whiskey by pouring it into crystal.

The cost of this linguistic vanity is not only fiscal. It corrodes public trust. Citizens sense the dissonance. Deficits widen, taxes climb, promises multiply. When language becomes a substitute for honesty, cynicism follows. A people that cannot trust its government’s words cannot trust its numbers.

The remedy is simple, though seldom easy: call things by their names. Spending is spending, whether on roads, welfare, or research. Some are wise, some are foolish. But none becomes virtuous by relabeling. The duty of government is not to invent euphemisms but to justify expenditures plainly and bear the consequences. That is what accountability means.

Roger Scruton observed that conservatism, properly understood, is “the politics of the tried and tested against the politics of experiment.” In fiscal speech, that means preferring accuracy to allure. A government confident in its stewardship would not fear plain-spoken spending. Only one uneasy with its own excess needs the comfort of investment.

Ottawa’s linguistic reform is therefore not a matter of diction. It is an attempt to alter reality through language, to convert liability into virtue by decree. The danger is that citizens, lulled by investment-speak, will cease to notice the arithmetic beneath. The numbers will grow; the language will glow. By the time the robe is lifted, the treasury will be bare.

That is not a forecast. It is a warning. When governments clothe waste in the garments of investment, they are not modernizing accounting. They are modernizing deceit.

We are grateful that you’re reading an article from Haultain Research.

For the full experience, and to help us bring you more quality research and commentary,

Banks

Bank of Canada Cuts Rates to 2.25%, Warns of Structural Economic Damage

Governor Tiff Macklem concedes the downturn runs deeper than a business cycle, citing trade wars, weak investment, and fading population growth as permanent drags on Canada’s economy.

In an extraordinary press conference on October 29th, 2025, Bank of Canada Governor Tiff Macklem stood before reporters in Ottawa and calmly described what most Canadians have already been feeling for months: the economy is unraveling. But don’t expect him to say it in plain language. The central bank’s message was buried beneath bureaucratic doublespeak, carefully manicured forecasts, and bilingual spin. Strip that all away, and here’s what’s really going on: the Canadian economy has been gutted by a combination of political mismanagement, trade dependence, and a collapsing growth model based on mass immigration. The central bank knows it. The data proves it. And yet no one dares to say the quiet part out loud.

Start with the headline: the Bank of Canada cut interest rates by 25 basis points, bringing the policy rate down to 2.25%, its second consecutive cut and part of a 100 basis point easing campaign this year. That alone should tell you something is wrong. You don’t slash rates in a healthy economy. You do it when there’s pain. And there is. Canada’s GDP contracted by 1.6% in the second quarter of 2025. Exports are collapsing, investment is weak, and the unemployment rate is stuck at 7.1%, the highest non-pandemic level since 2016.

Macklem admitted it: “This is more than a cyclical downturn. It’s a structural adjustment. The U.S. trade conflict has diminished Canada’s economic prospects. The structural damage caused by tariffs is reducing the productive capacity of the economy.” That’s not just spin—that’s an admission of failure. A major trading nation like Canada has built its economic engine around exports, and now, thanks to years of reckless dependence on U.S. markets and zero effort to diversify, it’s all coming apart.

And don’t miss the implications of that phrase “structural adjustment.” It means the damage is permanent. Not temporary. Not fixable with a couple of rate cuts. Permanent. In fact, the Bank’s own Monetary Policy Report says that by the end of 2026, GDP will be 1.5% lower than it was forecast back in January. Half of that hit comes from a loss in potential output. The other half is just plain weak demand. And the reason that demand is weak? Because the federal government is finally dialing back the immigration faucet it’s been using for years to artificially inflate GDP growth.

The Bank doesn’t call it “propping up” GDP. But the facts are unavoidable. In its MPR, the Bank explicitly ties the coming consumption slowdown to a sharp drop in population growth: “Population growth is a key factor behind this expected slowdown, driven by government policies designed to reduce the inflow of newcomers. Population growth is assumed to slow to average 0.5% over 2026 and 2027.” That’s down from 3.3% just a year ago. So what was driving GDP all this time? People. Not productivity. Not innovation. Not exports. People.

And now that the government has finally acknowledged the political backlash of dumping half a million new residents a year into an overstretched housing market, the so-called “growth” is vanishing. It wasn’t real. It was demographic window dressing. Macklem admitted as much during the press conference when he said: “If you’ve got fewer new consumers in the economy, you’re going to get less consumption growth.” That’s about as close as a central banker gets to saying: we were faking it.

And yet despite all of this, the Bank still clings to its bureaucratic playbook. When asked whether Canada is heading into a recession, Macklem hedged: “Our outlook has growth resuming… but we expect that growth to be very modest… We could get two negative quarters. That’s not our forecast, but we can’t rule it out.” Translation: It’s already here, but we’re not going to admit it until StatsCan confirms it six months late.

Worse still, when reporters pressed him on what could lift the economy out of the ditch, he passed the buck. “Monetary policy can’t undo the damage caused by tariffs. It can’t target the hard-hit sectors. It can’t find new markets for companies. It can’t reconfigure supply chains.” So what can it do? “Mitigate spillovers,” Macklem says. That’s central banker code for “stand back and pray.”

So where’s the recovery supposed to come from? The Bank pins its hopes on a moderate rebound in exports, a bit of resilience in household consumption, and “ongoing government spending.” There it is. More public sector lifelines. More debt. More Ottawa Band-Aids.

And looming behind all of this is the elephant in the room: U.S. trade policy. The Bank explicitly warns that the situation could worsen depending on the outcome of next year’s U.S. election. The MPR highlights that tariffs are already cutting into Canadian income, raising business costs, and eliminating entire trade-dependent sectors. Governor Macklem put it plainly: “Unless something else changes, our incomes will be lower than they otherwise would have been.”

Canadians should be furious. For years, we were told everything was fine. That our economy was “resilient.” That inflation was “transitory.” That population growth would solve all our problems. Now we’re being told the economy is structurally impaired, trade-dependent to a fault, and stuck with weak per-capita growth, high unemployment, and sticky core inflation between 2.5–3%. And the people responsible for this mess? They’ve either resigned (Trudeau), failed upward (Carney), or still refuse to admit they spent a decade selling us a fantasy.

This isn’t just bad economics. It’s political malpractice.

Canada isn’t failing because of interest rates or some mysterious global volatility. It’s failing because of deliberate choices—trade dependence, mass immigration without infrastructure, and a refusal to confront reality. The central bank sees the iceberg. They’re easing the throttle. But the ship has already taken on water. And no one at the helm seems willing to turn the wheel.

So here’s the truth: The Bank of Canada just rang the alarm bell. Quietly. Cautiously. But clearly. The illusion is over. The fake growth era is ending. And the reckoning has begun.

Business

Ford’s Liquor War Trades Economic Freedom For Political Theatre

From the Frontier Centre for Public Policy

By Conrad Eder

Consumer choice, not government coercion, should shape the market. Doug Ford’s alcohol crackdown trades symbolic outrage for sound policy and Ontarians will pay the price

Ontario politicians have developed an insatiable appetite for prohibition. Having already imposed a sweeping ban on all American alcohol, Premier Doug Ford has now threatened to remove Crown Royal, Smirnoff and potentially other brands from LCBO shelves. Such authoritarian impulses reflect a disturbing shift in our political culture—one that undermines economic prosperity and individual liberty.

After Diageo, the multinational behind brands like Crown Royal and Smirnoff, announced in August that it would close its Amherstburg, Ont., bottling facility, affecting 200 workers, the political response was swift. NDP MPP Lisa Gretzky urged the government to retaliate by pulling Crown Royal from LCBO shelves. Days later, Ford dramatically dumped a bottle of the whisky during a press conference, signalling he might follow through.

Now, the premier has escalated the threat, vowing to remove Smirnoff and potentially other Diageo products.

These gestures may make headlines, but they come at a cost. They undermine business confidence, discourage investment, and send the wrong message to employers. More fundamentally, they reflect a poor understanding of how free societies settle disputes and make decisions.

To understand what’s at stake, it helps to consider the two basic mechanisms available to democratic societies: the marketplace and the ballot box. At the ballot box, citizens vote once, and majority rule determines a single outcome. The marketplace, by contrast, allows people to vote continuously with their dollars. Individuals make countless choices reflecting their own values and priorities. You get what you choose—without overriding anyone else’s preference.

There’s a role for government in correcting market failures, where there’s fraud, monopoly power or public risk. But banning legal products simply because of political displeasure with a company’s decision is not market correction. It’s coercion.

Diageo’s decision to close a facility may be unfortunate, but it doesn’t involve deception, unfair dominance, or harm to the public. Bans aren’t rooted in sound principle; they’re political, plain and simple.

Some argue the government is justified in acting to protect Ontario jobs. But that line of thinking is short-sighted. If job protection alone warranted banning products, we’d resist every innovation or trade deal that disrupted the status quo. Sustainable job growth depends on encouraging investment and innovation, not shielding every position from change.

The appropriate response to plant closures is policy reform, not retaliation. Ontario should focus on creating an environment where businesses want to invest and grow. That means fostering a stable, competitive business climate with clear rules, reasonable taxes, and efficient regulation. Threatening companies with bans only creates uncertainty and drives investment elsewhere.

With Ontarians spending $740 million annually on Diageo products, removing them from store shelves would impose real economic costs. Consumers would face fewer choices, weaker competition, and higher prices. Restaurants and retailers would be forced to adjust. The LCBO, Ontario’s government-run liquor retailer, would lose sales.

This isn’t hypothetical. The province’s ban on American alcohol is already projected to block nearly $1 billion in annual sales, while doing nothing to benefit Ontario consumers. The LCBO is serving political interests, not the public.

Supporters of such bans often reveal their lack of confidence in public opinion. Rather than persuade others to boycott a product voluntarily, they demand that government enforce a blanket restriction.

There’s a better way. Consumer-led boycotts offer accountability without coercion. They allow individuals to act on their beliefs without forcing others to comply. And they tend to be more effective, as companies respond faster to falling sales than to political theatrics.

But the issue at hand goes beyond liquor. It’s about whether elected officials should impose a single set of preferences on everyone, or whether citizens are trusted to decide for themselves.

Each new ban makes the next one easier to justify. Over time, these interventions accumulate and normalize government interference in private choice. Unlike consumer preferences, which can shift quickly and reverse, government prohibitions often persist. The LCBO’s century-old structure is evidence of how long some policies endure, even when they no longer serve the public interest.

This isn’t a call to eliminate government’s role. But it is a call for principled governance, the kind that distinguishes between legitimate oversight and overreach rooted in symbolism or political frustration.

Ontario’s government would do better to focus on long-term prosperity. That means building an economy where investors feel welcome, businesses can grow, and consumers are free to choose.

Ontarians are perfectly capable of making their own choices about which products to buy and which companies to support. They don’t need politicians like Ford making those decisions for them.

Conrad Eder is a policy analyst at the Frontier Centre for Public Policy.

-

Business2 days ago

Business2 days agoTrans Mountain executive says it’s time to fix the system, expand access, and think like a nation builder

-

Addictions2 days ago

Addictions2 days agoThe Shaky Science Behind Harm Reduction and Pediatric Gender Medicine

-

Business2 days ago

Business2 days agoClean energy transition price tag over $150 billion and climbing, with very little to show for it

-

Business1 day ago

Business1 day agoCanada has given $109 million to Communist China for ‘sustainable development’ since 2015

-

International1 day ago

International1 day agoStrongest hurricane in 174 years makes landfall in Jamaica

-

Business2 days ago

Business2 days agoFlying saucers, crystal paperweights and branded apples: inside the feds’ promotional merch splurge

-

Business2 days ago

Business2 days agoCanada’s combative trade tactics are backfiring

-

International2 days ago

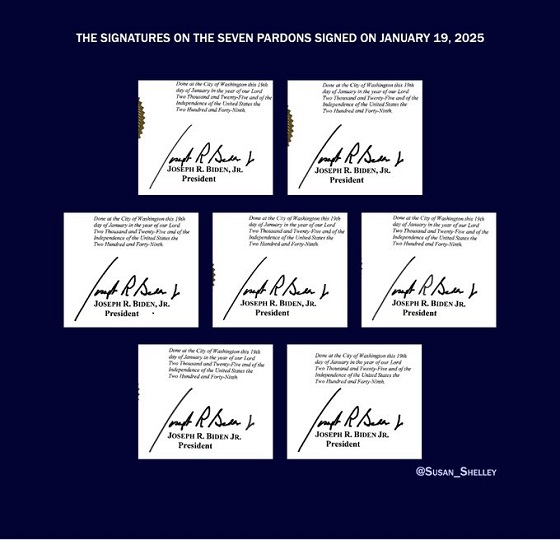

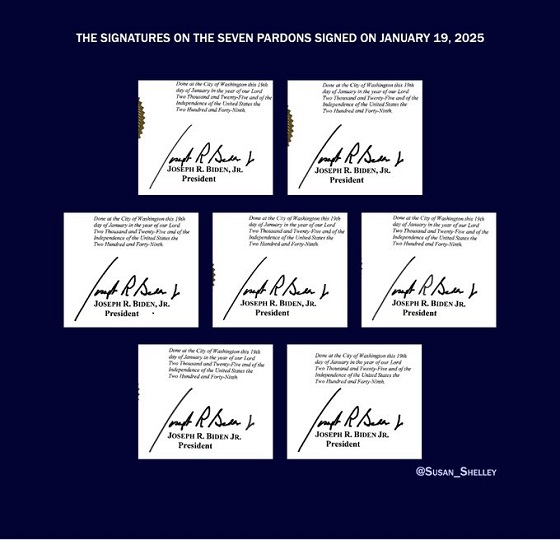

International2 days agoBiden’s Autopen Orders declared “null and void”