Business

What if Canada’s Income Tax Rate Was Zero?

By David Clinton

By David Clinton

It won’t happening. And perhaps it shouldn’t happen. But we can talk.

By reputation, income tax is an immutable fact of life. But perhaps we can push back against that popular assumption. Or, to put it a different way, thinking about how different things can be is actually loads of fun.

That’s not to suggest that accurately anticipating the full impact of blowing up central economic pillars is simple. But it’s worth a conversation.

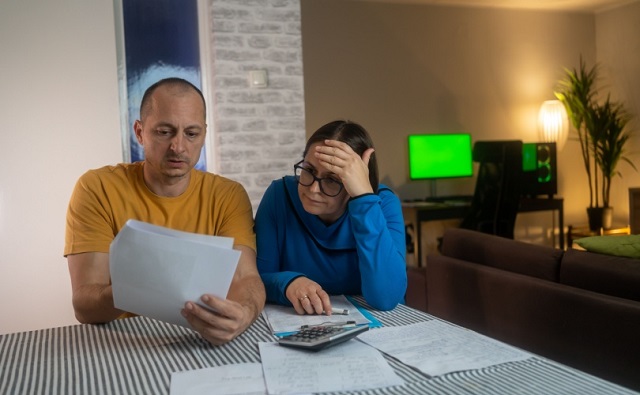

First off, because they’ve been around so long, we can easily lose sight of the fact that income taxes cause real economic pain. The median Canadian household earns around $85,000 in a year. Of that, some 13 percent ($11,000) is lost to federal income tax. Provincial income tax and sales taxes, of course, drive that number a lot higher. If owning a house is out of reach for so many Canadians, that’s one of the biggest reasons why.

Having said that, the $200 billion or so in personal income taxes that Canada collects each year represents around 40 percent of federal spending. In fact, in the absence of other policy changes, eliminating federal personal income tax would probably lead to significant drops in business tax revenues too. (I could see many small businesses choosing to maximize employee salaries to reduce their corporate tax liability.)

So if we wanted to cut taxes without piling on even more debt, we’d need to replace that amount either by finding alternate revenue sources or by cutting spending. If you’ve been keeping up with The Audit, you’ve already seen where and how we might find some serious budget savings in previous posts.

But for fascinating reasons, some of that $200 billion (or, including corporate taxes, $300 billion) shortfall could be made up by wiping out income tax itself. How’s that?

For one thing, many government entitlements and payouts essentially exist to make up for income lost through taxes. For example, the federal government will spend around $26 billion on child tax credits (CCB) in 2025. Since those payments are indexed to income, eliminating federal income tax would, de facto, raise everyone’s income. That increase would drop CCB spending by as much as $15 billion. Naturally, we’d want to reset the program eligibility thresholds to ensure that low-income working families aren’t being hurt by the change, but the savings would still be significant.

There are more payment programs of that sort than you might imagine. Without income taxes to worry about:

- The $6.2 billion GST/HST credit would cost us around $3 billion less each year.

- The Canada Workers Benefit (CWB) could cost $1.5 billion dollars less.

- The Old Age Security (OAS) Clawback would likely generate an extra billion dollars each year in taxes.

- The Guaranteed Income Supplement for low-income OAS recipients could save $4 billion a year.

Even when factoring in for threshold recalculations to protect vulnerable families from unintended consequences, all those indirect consequences of a tax cut could easily add up to $20 billion in federal spending cuts. And don’t forget how the cost of administering and enforcing the income tax system would disappear. That’ll save us most of the $11 billion CRA costs us each year.

Nevertheless, last I heard, $30 billion (in savings) was a long, long way from $300 billion (in tax revenue shortfalls). No matter how hard we look, we’re not going to find $270 billion in government waste, fraud, and marginal programs to eliminate. And adding more government debt will benefit exactly no one (besides bond holders).

Ok then, let’s say we can find $100 billion in reasonable cuts (see The Audit for details). That would get us close to half way there. But it would also generate some serious economic turbulence.

On the one hand, such cuts would require dropping hundreds of thousands of workers off the federal payroll¹. It would also exert powerful downward pressure on our gross domestic product (GDP).

On the plus side however, a drop in government borrowing of this scale would likely reduce interest rates. That, in turn, could spark private investment activities that partially offset the GDP hit. If you add the personal wealth freed up by our income tax cuts to that mix, you’d likely see another nice GDP bump from sharp increases in household spending and investments.

Precisely predicting how a proposed change might affect all these moving parts is hard. Perhaps the ideal scenario would involve 20 percent or 50 percent cuts to taxes rather than 100 percent. Or maybe we’d be better off by playing around with sales tax rates. But I’m not convinced that anyone is even seriously and objectively thinking about our options right now.

One way or the other, the impact of such radical economic changes would be historic. I think it would be fascinating to develop data models to calculate and rank the macro economic consequences of applying various combinations of variables to the problem.

But taxation is a problem. And it’d be an important first step to recognize it as such.

Although on the bright side, as least they wouldn’t have to worry about delayed or incorrect Phoenix payments anymore.

Automotive

The high price of green virtue

By Jerome Gessaroli for Inside Policy

Reducing transportation emissions is a worthy goal, but policy must be guided by evidence, not ideology.

In the next few years, the average new vehicle in British Columbia could reach $80,000, not because of inflation, but largely because of provincial and federal climate policy. By forcing zero-emission-vehicle (ZEV) targets faster than the market can afford, both governments risk turning climate ambition into an affordability crisis.

EVs are part of the solution, but mandates that outpace market acceptance risk creating real-world challenges, ranging from cold-weather travel to sparse rural charging to the cost and inconvenience for drivers without home charging. As Victoria and Ottawa review their ZEV policies, the goal is to match ambition with evidence.

Introduced in 2019, BC’s mandate was meant to accelerate electrification and cut emissions from light-duty vehicles. In 2023, however, it became far more stringent, setting the most aggressive ZEV targets in North America. What began as a plan to boost ZEV adoption has now become policy orthodoxy. By 2030, automakers must ensure that 90 per cent of new light-duty vehicles sold in BC are zero-emission, regardless of what consumers want or can afford. The evidence suggests this approach is out of step with market realities.

The province isn’t alone in pursuing EV mandates, but its pace is unmatched. British Columbia, Quebec, and the federal government are the only ones in Canada with such rules. BC’s targets rise much faster than California’s, the jurisdiction that usually sets the bar on green-vehicle policy, though all have the same goal of making every new vehicle zero-emission by 2035.

According to Canadian Black Book, 2025 model EVs are about $17,800 more expensive than gas-powered vehicles. However, ever since Ottawa and BC removed EV purchase incentives, sales have fallen and have not yet recovered. Actual demand in BC sits near 16 per cent of new vehicle sales, well below the 26 per cent mandate for 2026. To close that gap, automakers may have to pay steep penalties or cut back on gas-vehicle sales to meet government goals.

The mandate also allows domestic automakers to meet their targets by purchasing credits from companies, such as Tesla, which hold surplus credits, transferring millions of dollars out of the country simply to comply with provincial rules. But even that workaround is not sustainable. As both federal and provincial mandates tighten, credit supplies will shrink and costs will rise, leaving automakers more likely to limit gas-vehicle sales.

It may be climate policy in intent, but in reality, it acts like a luxury tax on mobility. Higher new-vehicle prices are pushing consumers toward used cars, inflating second-hand prices, and keeping older, higher-emitting vehicles on the road longer. Lower-income and rural households are hit hardest, a perverse outcome for a policy meant to reduce emissions.

Infrastructure is another obstacle. Charging-station expansion and grid upgrades remain far behind what is needed to support mass electrification. Estimates suggest powering BC’s future EV fleet alone could require the electricity output of almost two additional Site C dams by 2040. In rural and northern regions, where distances are long and winters are harsh, drivers are understandably reluctant to switch. Beyond infrastructure, changing market and policy conditions now pose additional risks to Canada’s EV goals.

Major automakers have delayed or cancelled new EV models and battery-plant investments. The United States has scaled back or reversed federal and state EV targets and reoriented subsidies toward domestic manufacturing. These shifts are likely to slow EV model availability and investment across North America, pushing both British Columbia and Ottawa to reconsider how realistic their own targets are in more challenging market conditions.

Meanwhile, many Canadians are feeling the strain of record living costs. Recent polling by Abacus Data and Ipsos shows that most Canadians view rising living costs as the country’s most pressing challenge, with many saying the situation is worsening. In that climate, pressing ahead with aggressive mandates despite affordability concerns appears driven more by green ideology than by evidence. Consumers are not rejecting EVs. They are rejecting unrealistic timelines and unaffordable expectations.

Reducing transportation emissions is a worthy goal, but policy must be guided by evidence, not ideology. When targets become detached from real-world conditions, ideology replaces judgment. Pushing too hard risks backlash that can undo the very progress we are trying to achieve.

Neither British Columbia nor the federal government needs to abandon its clean-transportation objectives, but both need to adjust them. That means setting targets that match realistic adoption rates, as EVs become more affordable and capable, and allowing more flexible compliance based on emissions reductions rather than vehicle type. In simple terms, the goal should be cutting emissions, not forcing people to buy a specific type of car. These steps would align ambition with reality and ensure that environmental progress strengthens, rather than undermines, public trust.

With both Ottawa and Victoria reviewing their EV mandates, their next moves will show whether Canadian climate policy is driven by evidence or by ideology. Adjusting targets to reflect real-world affordability and adoption rates would signal pragmatism and strengthen public trust in the country’s clean-energy transition.

Jerome Gessaroli is a senior fellow at the Macdonald-Laurier Institute and leads the Sound Economic Policy Project at the BC Institute of British Columbia

Business

Carney shrugs off debt problem with more borrowing

Ottawa, we’ve got some problems.

The first problem is government debt is spiralling out of control because government spending is spiralling out of control. The second problem is no one within government is taking the first problem seriously.

Prime Minister Mark Carney’s first budget shows Ottawa will borrow about $80 billion this year.

Massive government borrowing means debt interest charges cost taxpayers more than $1 billion every week.

That’s enough money to build a brand-new hospital every week, but that money is going to the bond fund managers on Bay Street to pay interest on the government credit card.

Or think about it this way the next time you’re standing in the check-out line:

Every dollar you pay in federal sales tax goes to pay interest on the debt.

The government’s own non-partisan, independent budget watchdog pulled the fire alarm back in September.

“The current path we’re on in terms of federal debt as the share of the economy is unsustainable,” the Parliamentary Budget Officer said.

Here are other ways the PBO described the government’s financial situation:

Stupefying. Shocking. Something is going to break. Everybody should be concerned.

That’s how the PBO described the situation when he projected the deficit to be $10 billion lower than Carney’s deficit in Budget 2025.

How is Carney responding to Canada’s debt crunch? Instead of acting, Carney is obfuscating.

Instead of balancing the budget, Carney promises to balance the operating budget.

Carney isn’t balancing squat when he continues to borrow tens of billions of dollars every year. The closest Carney is willing to get to a balanced budget is a $57 billion deficit in 2029.

Instead of cutting the debt, Carney is changing the budget guardrails.

Even under the Trudeau government, politicians repeatedly promised to keep the debt as a share of the economy going down.

Carney used a sneaky sleight of hand in Budget 2025 to change that guardrail.

Because Carney’s debt will grow faster than Canada’s economy, he’s changing the previous guardrail of a declining debt-to-GDP ratio to a declining “deficit-to-GDP ratio.”

Carney plans to add $324 billion to the debt by 2030. For comparison, former prime minister Justin Trudeau planned to add $154 billion to the debt over those same years.

Instead of cutting spending, Carney muddies the waters with slogans of “spending less to invest more.”

The Carney government wrote Budget 2025 in a way to try to convince Canadians that it will save about $60 billion over five years.

But the government is spending billions of dollars more every year.

The government will spend $581 billion this year. That’s $38 billion more than the government spent last year. The government will spend $644 billion in 2029.

Does that look like saving money to you?

Even if you want to be as charitable as possible, nearly all the savings Carney promises to find occur in future years.

This should give taxpayers flashbacks of the Trudeau era.

Trudeau initially promised to run “modest” deficits and balance the budget in four years. But Trudeau never balanced the budget, he doubled the debt.

Trudeau promised to find $15 billion in savings. But Trudeau never cut spending, he ballooned the bureaucracy and spent billions more.

Here’s the key lesson: When the government promises to start its diet on Monday, Monday never comes.

The government debt problem is serious.

The government is now wasting more money paying interest on the debt than it sends to provinces in health-care transfers. In 2029, thirteen cents of every dollar the government takes will be used to make debt interest payments.

But instead of acting, Carney is trying to convince Canadians that everything is fine.

Instead of acting, Carney is using slogans and changing budget guardrails to paint a rosier picture of government finances.

Carney needs to change course. Shrugging off the debt won’t make things better. Only urgent action to cut spending will.

-

Business2 days ago

Business2 days agoLiberals refuse to disclose the amount of taxpayer dollars headed to LGBT projects in foreign countries

-

Alberta2 days ago

Alberta2 days agoSchool defunding petition in Alberta is a warning to parents

-

Daily Caller2 days ago

Daily Caller2 days agoUS Nuclear Bomber Fleet Shares Fence With Trailer Park Linked To Chinese Intel-Tied Fraudster

-

Digital ID2 days ago

Digital ID2 days agoCanada moves forward with digital identification for federal benefits seekers

-

espionage2 days ago

espionage2 days agoChinese-Owned Trailer Park Beside U.S. Stealth Bomber Base Linked to Alleged Vancouver Repression Case

-

Daily Caller2 days ago

Daily Caller2 days agoLaura Ingraham Presses Trump On Allowing Flood Of Chinese Students Into US

-

COVID-192 days ago

COVID-192 days agoSpy Agencies Cozied Up To Wuhan Virologist Before Lying About Pandemic

-

Environment1 day ago

Environment1 day agoThe Myths We’re Told About Climate Change | Michael Shellenberger