Economy

Wanted—a federal leader who will be honest about ‘climate’ policy

From the Fraser Institute

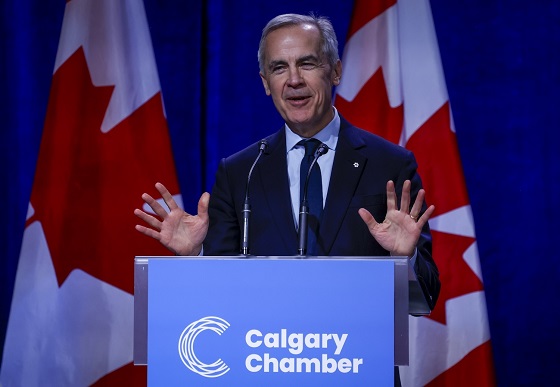

Poilievre’s anti-carbon tax rallies are popular, but what happens after we axe the tax? If he plans to replace it with regulatory measures aimed at achieving the same emission cuts he should tell his rally-goers that what he has in mind will hit them even harder than the tax they’re so keen to scrap.

Pierre Poilievre is leading anti-carbon tax rallies around the country, ginning up support for an old-fashioned tax revolt. In response, Justin Trudeau went to Calgary and trumpeted—what’s this?—his love of free markets. Contrasting the economic logic of using a carbon tax instead of regulatory approaches for reducing greenhouse gases, the prime minister slammed the latter: “But they all involve the heavy hand of government. I prefer a cleaner solution, a market-based solution and that is, if you’re behaving in a way that causes pollution, you should pay.” He added that the Conservatives would instead rely on the “heavy hand of government through regulation and subsidies to pick winners and losers in the economy as opposed to trusting the market.”

Amen to that. But someone should tell Trudeau that his own government’s Emission Reduction Plan mainly consists of heavy-handed regulations, subsidies, mandates and winner-picking grants. Within its 240 pages one finds, yes, a carbon tax. But also 139 additional policies including Clean Fuels Regulations, an electric vehicle mandate that will ban gasoline cars by 2035, aggressive fuel economy standards that will hike their cost in the meantime, costly new emission targets specifically for the oil and gas, agriculture, heavy industry and waste management sectors, onerous new energy efficiency requirements both for new buildings and renovations of existing buildings, new electricity grid requirements, and page upon page of subsidy funds for “clean technology” firms and other would-be winners in the sunlit uplands of the new green economy.

Does Trudeau oppose any of that? Hardly. But if he does, he could prove his bona fides regarding carbon pricing by admitting that the economic logic only applies to a carbon tax when used on its own. He doesn’t get to boast of the elegance of market mechanisms on behalf of a policy package that starts with a price signal then destroys it with a massive regulatory apparatus.

Trudeau also tried to warm his Alberta audience up to the carbon tax by invoking the menace of mild weather and forest fires. In fairness it was an unusual February in Calgary (which is obviously a sign of the climate emergency because we never used to get those). The month began with a week of above-zero temperatures hitting 5 degrees Celsius at one point, then there was a brief cold snap before Valentine’s Day, then the daytime highs soared to the low teens for nine days and the month finished with soupy above zero conditions. Weird.

Oops, that was 1981.

This year was weirder—February highs were above zero for 25 out of 28 days, 8 of which were even above 10 degrees C.

Oops again, that was 1991. Granted, February 2024 also had its mild patches, but not like the old days.

Of course, back then warm weather was just weather. Now it’s a climate emergency and Canadians demand action. Except they don’t want to pay for it, which is the main problem for politicians when trying to come up with a climate policy that’s both effective and affordable. You only get to pick one, and in practice we typically end up zero for two. You can claim your policy will yield deep decarbonization while boosting the economy, which almost every politician in every western country has spent decades doing, but it’s not true. With current technology, affordable policies yield only small temporary emission reductions. Population and economic growth swamp their effects over time, which is why mainstream economists have long argued that while we can eliminate some low-value emissions, for the most part we will just have to live with climate change because trying to stop it would cost far more than it’s worth.

Meanwhile the policy pantomime continues. Poilievre’s anti-carbon tax rallies are popular, but what happens after we axe the tax? If he plans to replace it with regulatory measures aimed at achieving the same emission cuts he should tell his rally-goers that what he has in mind will hit them even harder than the tax they’re so keen to scrap.

But maybe he has the courage to do the sensible thing and follow the mainstream economics advice. If he wants to be honest with Canadians, he must explain that the affordable options will not get us to the Paris target, let alone net-zero, and even if they did, what Canada does will have no effect on the global climate because we’re such small players. Maybe new technologies will appear over the next decade that change the economics, but until that day we’re better off fixing our growth problems, getting the cost of living down and continuing to be resilient to all the weather variations Canadians have always faced.

Author:

Business

Socialism vs. Capitalism

People criticize capitalism. A recent Axios-Generation poll says, “College students prefer socialism to capitalism.”

Why?

Because they believe absurd myths. Like the claim that the Soviet Union “wasn’t real socialism.”

Socialism guru Noam Chomsky tells students that. He says the Soviet Union “was about as remote from socialism as you could imagine.”

Give me a break.

The Soviets made private business illegal.

If that’s not socialism, I’m not sure what is.

“Socialism means abolishing private property and … replacing it with some form of collective ownership,” explains economist Ben Powell. “The Soviet Union had an abundance of that.”

Socialism always fails. Look at Venezuela, the richest country in Latin America about 40 years ago. Now people there face food shortages, poverty, misery and election outcomes the regime ignores.

But Al Jazeera claims Venezuela’s failure has “little to do with socialism, and a lot to do with poor governance … economic policies have failed to adjust to reality.”

“That’s the nature of socialism!” exclaims Powell. “Economic policies fail to adjust to reality. Economic reality evolves every day. Millions of decentralized entrepreneurs and consumers make fine tuning adjustments.”

Political leaders can’t keep up with that.

Still, pundits and politicians tell people, socialism does work — in Scandinavia.

“Mad Money’s Jim Cramer calls Norway “as socialist as they come!”

This too is nonsense.

“Sweden isn’t socialist,” says Powell. “Volvo is a private company. Restaurants, hotels, they’re privately owned.”

Norway, Denmark and Sweden are all free market economies.

Denmark’s former prime minister was so annoyed with economically ignorant Americans like Bernie Sanders calling Scandanavia “socialist,” he came to America to tell Harvard students that his country “is far from a socialist planned economy. Denmark is a market economy.”

Powell says young people “hear the preaching of socialism, about equality, but they don’t look on what it actually delivers: poverty, starvation, early death.”

For thousands of years, the world had almost no wealth creation. Then, some countries tried capitalism. That changed everything.

“In the last 20 years, we’ve seen more humans escape extreme poverty than any other time in human history, and that’s because of markets,” says Powell.

Capitalism makes poor people richer.

Former Rep. Jamaal Bowman (D-N.Y.) calls capitalism “slavery by another name.”

Rep. Alexandria Ocasio-Cortez (D-N.Y.) claims, “No one ever makes a billion dollars. You take a billion dollars.”

That’s another myth.

People think there’s a fixed amount of money. So when someone gets rich, others lose.

But it’s not true. In a free market, the only way entrepreneurs can get rich is by creating new wealth.

Yes, Steve Jobs pocketed billions, but by creating Apple, he gave the rest of us even more. He invented technology that makes all of us better off.

“I hope that we get 100 new super billionaires,” says economist Dan Mitchell, “because that means 100 new people figured out ways to make the rest of our lives better off.”

Former Labor Secretary Robert Reich advocates the opposite: “Let’s abolish billionaires,” he says.

He misses the most important fact about capitalism: it’s voluntary.

“I’m not giving Jeff Bezos any money unless he’s selling me something that I value more than that money,” says Mitchell.

It’s why under capitalism, the poor and middle class get richer, too.

“The economic pie grows,” says Mitchell. “We are much richer than our grandparents.”

When the media say the “middle class is in decline,” they’re technically right, but they don’t understand why it’s shrinking.

“It’s shrinking because more and more people are moving into upper income quintiles,” says Mitchell. “The rich get richer in a capitalist society. But guess what? The rest of us get richer as well.”

I cover more myths about socialism and capitalism in my new video.

Business

Residents in economically free states reap the rewards

From the Fraser Institute

A report published by the Fraser Institute reaffirms just how much more economically free some states are compared with others. These are places where citizens are allowed to make more of their economic choices. Their taxes are lighter, and their regulatory burdens are easier. The benefits for workers, consumers and businesses have been clear for a long time.

There’s another group of states to watch: “movers” that have become much freer in recent decades. These are states that may not be the freest, but they have been cutting taxes and red tape enough to make a big difference.

How do they fare?

I recently explored this question using 22 years of data from the same Economic Freedom of North America index. The index uses 10 variables encompassing government spending, taxation and labour regulation to assess the degree of economic freedom in each of the 50 states.

Some states, such as New Hampshire, have long topped the list. It’s been in the top five for three decades. With little room to grow, the Granite State’s level of economic freedom hasn’t budged much lately. Others, such as Alaska, have significantly improved economic freedom over the last two decades. Because it started so low, it remains relatively unfree at 43rd out of 50.

Three states—North Carolina, North Dakota and Idaho—have managed to markedly increase and rank highly on economic freedom.

In 2000, North Carolina was the 19th most economically free state in the union. Though its labour market was relatively unhindered by the state’s government, its top marginal income tax rate was America’s ninth-highest, and it spent more money than most states.

From 2013 to 2022, North Carolina reduced its top marginal income tax rate from 7.75 per cent to 4.99 per cent, reduced government employment and allowed the minimum wage to fall relative to per-capita income. By 2022, it had the second-freest labour market in the country and was ninth in overall economic freedom.

North Dakota took a similar path, reducing its 5.54 per cent top income tax rate to 2.9 per cent, scaling back government employment, and lowering its minimum wage to better reflect local incomes. It went from the 27th most economically free state in the union in 2000 to the 10th freest by 2022.

Idaho saw the most significant improvement. The Gem State has steadily improved spending, taxing and labour market freedom, allowing it to rise from the 28th most economically free state in 2000 to the eighth freest in 2022.

We can contrast these three states with a group that has achieved equal and opposite distinction: California, Delaware, New Jersey and Maryland have managed to decrease economic freedom and end up among the least free overall.

What was the result?

The economies of the three liberating states have enjoyed almost twice as much economic growth. Controlling for inflation, North Carolina, North Dakota and Idaho grew an average of 41 per cent since 2010. The four repressors grew by just 24 per cent.

Among liberators, statewide personal income grew 47 per cent from 2010 to 2022. Among repressors, it grew just 26 per cent.

In fact, when it comes to income growth per person, increases in economic freedom seem to matter even more than a state’s overall, long-term level of freedom. Meanwhile, when it comes to population growth, placing highly over longer periods of time matters more.

The liberators are not unique. There’s now a large body of international evidence documenting the freedom-prosperity connection. At the state level, high and growing levels of economic freedom go hand-in-hand with higher levels of income, entrepreneurship, in-migration and income mobility. In economically free states, incomes tend to grow faster at the top and bottom of the income ladder.

These states suffer less poverty, homelessness and food insecurity and may even have marginally happier, more philanthropic and more tolerant populations.

In short, liberation works. Repression doesn’t.

-

Censorship Industrial Complex10 hours ago

Censorship Industrial Complex10 hours agoUS Under Secretary of State Slams UK and EU Over Online Speech Regulation, Announces Release of Files on Past Censorship Efforts

-

Alberta1 day ago

Alberta1 day agoAlberta project would be “the biggest carbon capture and storage project in the world”

-

Energy1 day ago

Energy1 day agoNew Poll Shows Ontarians See Oil & Gas as Key to Jobs, Economy, and Trade

-

Business12 hours ago

Business12 hours ago“Magnitude cannot be overstated”: Minnesota aid scam may reach $9 billion

-

Business1 day ago

Business1 day agoSocialism vs. Capitalism

-

Energy1 day ago

Energy1 day agoCanada’s debate on energy levelled up in 2025

-

Fraser Institute2 days ago

Fraser Institute2 days agoCarney government sowing seeds for corruption in Ottawa

-

Daily Caller1 day ago

Daily Caller1 day agoIs Ukraine Peace Deal Doomed Before Zelenskyy And Trump Even Meet At Mar-A-Lago?