Environment

Wall Street’s planned theft of America’s lands and waters

From the Frontier Centre for Public Policy

When we are issued carbon allowances, owners of said lands will be able to claim tax deductions and will be able to sell carbon allowances to businesses, families and townships. In the simplest of terms, that’s where the money will be made. WE peons will be renting air from the richest people on earth.

Everything will be monetized and measured and traded, even you.

Up next on Wall Street’s exploitation list.

If not stopped, on November 17th, the U.S. government will pass a rule that allows for America’s protected lands, including parks and wildlife refuges, to be listed on the N.Y. Stock Exchange. Natural Asset Companies (NACs) will be owned, managed, and traded by companies like BlackRock, Vanguard, and even China.

Since the early 2000’s, outfits like Goldman Sachs have been trying to trade air, or specifically carbon without much success. Their 2005 carbon exchange staggered along until it was quietly discontinued, and their Climate Exchange-Traded Fund (ETF) is now facing delisting. “ESG” was the next attempt to monetize the un-monetizable, with the “E” part of that acronym standing for Environment, ill-defined as that was. Now ESG is failing. Market leaders say it is facing “a perfect storm of negative sentiment” and its U.S. investments fell by $163 billion in the first quarter of 2023 alone.

Its stepchild, Net-Zero, is so loathed, it looks like it might blow up the entire carbon scam. Says Australian senator Matt Canavan, “Net-Zero has absolutely carked it. It is a soundbite and totally insane. Almost everything we grow, we make, we do in our society relies on the use of fossil fuels.” Vanguard has pulled out of Net-Zero funds. The British government too is backing out of Net-Zero, saying “we won’t save the planet by bankrupting the British people.” New Zealand’s new government revised the country’s Net-Zero plans in its first week in office. In the hard hit Netherlands, the Farmer-Citizen movement is now the dominant party in the Dutch senate and every provincial assembly. Sweden has abandoned its 100 percent Net-Zero plans and Norway has announced another $18 billion in oil and gas investments.

Not going to happen.

Even in the submissive E.U. voters are turning from the “green” parties toward anti-E.U. parties. Renewables funds are seeing massive outflows because of rising interest rates and declining subsidies. Of course, the massive subsidies taxpayers have already given both “renewables” investors and “renewables” companies will never be clawed back. All we will get is a shrug as they move onto the next kill. Which is so obvious it is a wonder no one predicted it.

The entire universe envies the lush interior of the U.S. Increasingly empty, it is filled with a cornucopia of minerals, fiber, food, waters, extraordinarily fertile soil as well as well-ordered, educated, mostly docile people. Worth in the quadrillions, if one could monetize and trade it, financialize it, the way the market has financialized the future labor of Americans, well, it would be like golden coins raining from the sky.

On October 4th, the Securities and Exchange Commission filed a proposed rule to create Natural Asset Companies (NACs). A twenty-one day comment period was allowed, which is half the minimum number of days generally required. NACs will allow BlackRock, Bill Gates, and possibly even China to hold the ecosystem rights to the land, water, air, and natural processes of the properties enrolled in NACs. Each NAC will hold “management authority” over the land. When we are issued carbon allowances, owners of said lands will be able to claim tax deductions and will be able to sell carbon allowances to businesses, families and townships. In the simplest of terms, that’s where the money will be made. WE peons will be renting air from the richest people on earth.

The following are eligible for NACs: National Parks, National Wildlife Refuges, Wilderness Areas, Areas of Critical Environmental Concern, Conservation Areas on Private and Federal Lands, Endangered Species Critical Habitat, and the Conservation Reserve Program. Lest you think that any conserved land is conserved in your name, the largest Conservation organization in the U.S., is called The Nature Conservancy, or TNC, which, while being a 501(c)3, also holds six billion dollars of land on its books. Those lands have been taken using your money via donations and government grants, and transferred to the Nature Conservancy, which can do with those lands what it wills.

If this rule passes, America’s conserved lands and parks will move onto the balance sheets of the richest people in the world. Management of those lands will be decided by them and their operations, to say the least, will be opaque.

μολὼν λαβέ, buddy.

Farm country is fighting back. American Stewards of Liberty, Committee for a Constructive Tomorrow, Kansas Natural Resource Coalition, Financial Fairness Alliance and Blue Ribbon Coalition have filed comments, Republican senators Pete Ricketts, James Risch and Mike Crapo have sent pointed queries to the SEC. This week, Rep. Harriet Hageman (R-WY) offered an amendment that would defund the SEC proposed rule to approve listing “NACs.”

Most of us ill-understand “financialization.” It is a complex set of maneuvers best explained by the behavior that crashed the economy in 2008 which bundled up questionable mortgages and brokered off the risk to dozens of different funds in order to share that risk. NACs are asset grabs. From ’09-’20, funds asset-stripped America’s manufacturing via debt obligations, buying the company, selling off the equipment, firing the most expensive employees, and gutting, if they could, pension funds. Then they upped the price and sold on the assets. Which were bundled and brokered off. These are called collateralized debt obligations and they thunder doom underneath the debt-fueled economy.

Natural Asset Companies are an attempt to grab hard assets to make up for an inevitable collapse. But taking more land out of production makes it certain that collapse moves ever closer. Land needs to be used, cared for, and maintained by the people who live on and use the land. Otherwise, it runs to desert and invasive species. The mad push to “green” and net-zero has triggered financialization, or a brokering of the future, because only energy spurs real growth — and energy has been increasingly restricted over the past twenty years. NACs are another destroyer of America’s heartland.

Elizabeth Nickson is a Senior Fellow at the Frontier Centre for Public Policy. Her studies and commentaries at the Frontier Centre can be accessed here. Follow her on Substack here. Her best-selling book Eco-Fascists can be purchased here.

Energy

Affordable Energy: Everything you need to know about energy and the environment

The Dual Challenge: Energy and Environment

Scott Tinker

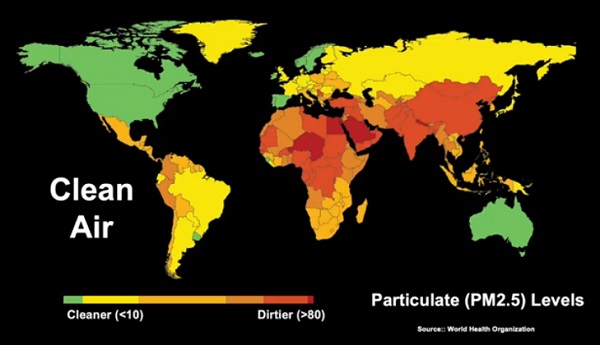

The world faces two important and interrelated challenges. Affordable and reliable energy for all, and protecting the environment. The energy-environment challenge is not simple, but it is solvable if we understand and address the complex fabric of energy security, scale of energy demand, physics of energy density, distribution of energy resources, interconnectedness of the land, air, water and atmosphere, and the extreme disparity in global wealth and economic health. The truth is that there are no good and bad, clean and dirty, renewable and nonrenewable energy sources. They all have benefits, and they all have challenges. Climate change is an important issue, but it is not the only environmental issue. Solar and wind are important low carbon solutions, but they are only part of the solution. We must put our best minds to the task of addressing the dual challenge, working together to better the world.

Economy

Canadian Natural Gas Exports Could Significantly Reduce Global Emissions

From the Fraser Institute

By Elmira Aliakbari and Julio Mejía

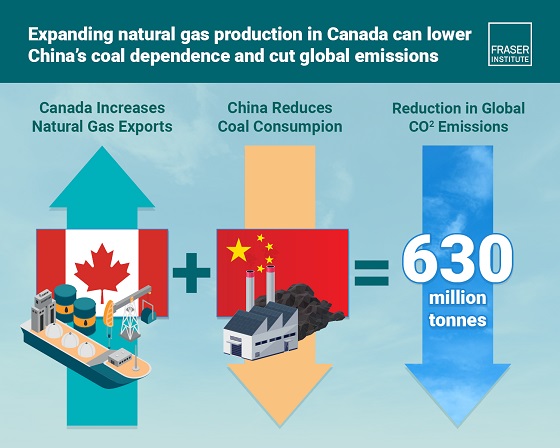

Doubling Canadian natural gas production and exporting to Asia could reduce global emissions by up to 630 million tonnes—nearly as much as Canada produces in a year

Canada could help significantly reduce global greenhouse gas emissions by increasing natural gas production and exporting the additional supply to Asia in the form of liquefied natural gas (LNG), according to a new study from the Fraser Institute, an independent, non-partisan Canadian public policy think tank.

“As countries like China and India continue to burn coal for power, Canadian LNG offers a lower-emission alternative with the potential for major global impact,” said Elmira Aliakbari, director of natural resource studies at the Fraser Institute and coauthor of the study, Exporting Canadian LNG to the World: A Practical Solution for Reducing GHG Emissions

The study estimates the impact from Canada doubling its natural gas production and exporting to Asia to replace coal-fired power. In that scenario, global emissions could drop up to 630 million tonnes annually, which is the equivalent of removing approximately 137 million cars from the road. More specifically, replacing coal-fired power in China with Canadian LNG could cut emissions by up to 62 per cent for every unit of power produced.

“Focusing only on domestic emissions ignores Canada’s potential to support global climate goals,” said Aliakbari. “By displacing coal abroad, Canadian LNG can play a critical role in cutting total global emissions even if domestic emissions were to increase.”

However, regulatory uncertainty and a range of federal and provincial policies continue to hinder LNG development in Canada, despite strong global demand.

“Policymakers need to clear a path if Canada is going to play a meaningful role in reducing global emissions,” Aliakbari added.

Exporting Canadian LNG to the World: A Practical Solution for Reducing GHG Emissions

- Coal, a major source of greenhouse gas (GHG) emissions, remains a leading energy source in many Asian countries, especially China and India. Some European countries have also turned back to coal as sanctions on Russian energy intensified following the invasion of Ukraine.

- As the world seeks practical solutions for reducing greenhouse-gas emissions, natural gas, with its lower carbon footprint, offers a promising alternative to coal.

- With abundant reserve, Canada is well positioned to help reduce global reliance on coal. By exporting Canadian liquified natural gas (LNG) and helping Asian and European countries reduce their reliance on coal, Canada can lower net global GHG emissions.

- Exporting LNG from Canada to China and substituting LNG for coal in the generation of power there can eliminate between 291 and 687 gCO₂eq per kWh of power generated, a reduction of between 34% and 62%.

- If Canada were to double its current natural gas production and export the additional supply to Asia as LNG to displace an equivalent amount of coal used to generate power, global GHG emissions could be reduced by up to 630 million tonnes annually, a significant reduction equivalent to 89% of Canada’s total GHG emissions.

- Canada enjoys several competitive advantages, including cooler temperatures that reduce liquefaction energy costs and a strategic location that offers shorter shipping routes to Europe and Asia compared to many other suppliers.

- Regulatory challenges and a mix of federal and provincial policies, however, have slowed or blocked LNG developments in Canada.

-

Health1 day ago

Health1 day agoLast day and last chance to win this dream home! Support the 2025 Red Deer Hospital Lottery before midnight!

-

Business2 days ago

Business2 days agoCarney’s European pivot could quietly reshape Canada’s sovereignty

-

Aristotle Foundation1 day ago

Aristotle Foundation1 day agoThe Canadian Medical Association’s inexplicable stance on pediatric gender medicine

-

Alberta2 days ago

Alberta2 days agoAlberta’s grand bargain with Canada includes a new pipeline to Prince Rupert

-

conflict1 day ago

conflict1 day ago“Evacuate”: Netanyahu Warns Tehran as Israel Expands Strikes on Iran’s Military Command

-

Energy1 day ago

Energy1 day agoCould the G7 Summit in Alberta be a historic moment for Canadian energy?

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoWOKE NBA Stars Seems Natural For CDN Advertisers. Why Won’t They Bite?

-

Crime1 day ago

Crime1 day agoMinnesota shooter arrested after 48-hour manhunt