Daily Caller

US Judge Deals Devastating Blow to Climate Lawfare Campaign against Oil and Gas Producers

From the Daily Caller News Foundation

The long-running climate lawfare campaign targeting “big oil” suffered another major blow in South Carolina on Wednesday when State Judge Roger Young dismissed a case brought by the city of Charleston against Chevron, Colonial Pipeline, ExxonMobil, Shell, BP and an array of additional oil companies whose deep pockets city officials and their trial lawyers had hoped to plumb.

Judge Young granted the defendants’ motion to dismiss without wasting time and money on a trial, ruling that the city had no authority to pursue the specious claims of ill-defined harm caused by worldwide carbon emissions from the use of oil and gas. “Plaintiff does not (and cannot) predicate its claims under South Carolina law on Defendants’ allegedly wrongful conduct only in South Carolina, since this State accounts for a negligible share of the global emissions that Plaintiff alleges have caused its damages,” Young wrote in his decision, which adds to a growing list of similar rulings made by judges in at least nine other cases around the country.

The reason why these rulings are all so similar is that claims from the grasping local policymakers who’ve signed up for this cynical money grab are equally similar, and that the longstanding principles of law are so unambiguously clear. Regardless of how cleverly the trial lawyers attempt to mask their claims in various unrelated state laws or local ordinances, the practical impact of a ruling in favor of the plaintiffs would be to enable every state and local government to write and enforce their own regulations. In the end, companies trying to conduct nationwide business would be faced with trying to comply with a patchwork of hundreds of competing sets of regulations, making it almost impossible to continue to do business in the United States.

This inevitable reality is why the federal government has always asserted primacy to regulate interstate commerce in general and to specifically regulate emissions and air quality under the Clean Air Act. Judge Young addressed that longstanding principle of law in his decision, writing, “The U.S. Constitution makes certain matters the exclusive domain of federal law for good reason. If all fifty states, let alone the tens of thousands of political subdivisions therein, were permitted to apply their own laws to such federal issues as interstate and international emissions, the result would be conflicting state standards that would be impossible for energy companies to navigate.’”

Chevron’s lead counsel, Ted Boutrous, Jr. of Gibson-Dunn, applauded Judge Young’s decision, saying, “This ruling adds to a ‘growing chorus’ of climate lawsuit dismissals by federal and state courts…Judge Young rejected Plaintiffs’ ‘artful’ attempts to frame its claims as solely about consumer deception, holding that ‘Plaintiff cannot avoid that its claims turn on emissions.’ ‘These lawsuits promise to create a chaotic web of conflicting legal obligations for Defendants as each state . . . imposes its own de facto regulations on the worldwide production, marketing, transport, and sale of fossil fuels. Neither federal nor South Carolina law permits such a result.’”

So, will this latest ruling against the plaintiffs end this cynical lawfare? Unfortunately for the defendants, the answer is no. The Supreme Court had a chance to do that in the case brought by the City and County of Honolulu in January, and took a pass after the Biden-era Justice Department weighed in on the side of the trial lawyers. Given that it is safe to assume the Trump DOJ won’t be taking a similar posture, we can always hope for the highest court to do the right thing whenever another case rises to that level.

Until then, the baseless wasting of time and money will continue. It brings to mind an old saying about “the beatings will continue until morale improves.”

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

Business

Trump Warns Beijing Of ‘Countermeasures’ As China Tightens Grip On Critical Resources

From the Daily Caller News Foundation

Despite their strategic significance, the U.S. imports 80% of the rare earths it consumes, primarily from China, which dominates global production and controls roughly 92% of the world’s refining capacity.

President Donald Trump on Friday threatened China with a massive tariff hike and hinted his upcoming summit with Chinese President Xi Jinping could be canceled as a result of Beijing’s latest escalation in trade hostilities.

China ramped up its economic pressure campaign this week, first by imposing new export controls Thursday on rare earth minerals critical to the production of vehicles, weapons systems, and other advanced technologies. On Friday, Beijing escalated further, announcing new port fees on American ships and launching an antitrust investigation into U.S. tech giant Qualcomm.

In response to what he described as “great trade hostility,” Trump said there was “no reason” to meet with Xi in South Korea later this month.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

“Dependent on what China says about the hostile ‘order’ that they have just put out, I will be forced, as President of the United States of America, to financially counter their move. For every Element that they have been able to monopolize, we have two,” the president posted on Truth Social.

Trump announced later on Friday that the U.S. would impose a 100% tariff on China starting Nov. 1, in addition to existing levies, and implement export controls on “any and all critical software.” He added that the tariffs could go into effect sooner, “depending on any further actions or changes taken by China.”

Despite their strategic significance, the U.S. imports 80% of the rare earths it consumes, primarily from China, which dominates global production and controls roughly 92% of the world’s refining capacity.

Under the new rules, foreign suppliers must obtain Beijing’s approval to export any product made with Chinese rare-earth processing technology or containing rare-earth materials that comprise as little as 0.1% of the item’s value. The restrictions also extend to the export of technology used in rare-earth mining, smelting, and magnet manufacturing, and add five more rare-earth elements to China’s existing control list.

Trump warned that Beijing’s move could “clog” global markets and “make life difficult for virtually every country in the world.”

“I have always felt that they’ve been lying in wait, and now, as usual, I have been proven right! There is no way that China should be allowed to hold the World “captive,” but that seems to have been their plan for quite some time,” the president wrote.

“But the U.S. has Monopoly positions also, much stronger and more far reaching than China’s. I have just not chosen to use them, there was never a reason for me to do so — UNTIL NOW!” Trump said.

The Chinese Transport Ministry also said it will begin collecting port fees on vessels owned by U.S. companies or individuals — and even those built in America — starting Oct. 14. The rollout overlaps with Washington’s plan to impose new charges on large Chinese vessels docking at U.S. ports the same day.

The president also noted that Beijing’s timing was “especially inappropriate,” noting that it coincides with the peace deal he helped broker between Israel and Hamas to bring the two-year conflict to an end.

Daily Caller

Now Is A Great Time To Be Out Of America’s Offshore Wind Business

From the Daily Caller News Foundation

Is the push and pull in the energy and climate regulatory environment hurting the ability for companies to finance and complete energy projects in the United States? The head of Shell in the United States, Colette Hirstius, said she believes it is in a recent interview.

“I think uncertainty in the regulatory environment is very damaging,” Hirstius said, adding, “However far the pendulum swings one way, it’s likely that it’s going to swing just as far the other way.”

Hirstius was addressing the moves made by the Trump administration to slow the progress of the offshore wind industry, which was the crown jewel of the Biden administration’s headlong rush into a government-subsidized energy transition. Trump’s regulators, led by Secretary of Interior Doug Burgum and Energy Secretary Chris Wright, have taken a series of actions in compliance with executive orders signed by Trump since January to halt several projects that were under construction, roll back federal subsidies, and review permits they believe were hastily issued in non-compliance with legally required processes.

Dear Readers:

As a nonprofit, we are dependent on the generosity of our readers.

Please consider making a small donation of any amount here.

Thank you!

That hope seems discordant, coming as it does amid Shell’s ongoing effort to step back from offshore wind and refocus more of its capital budget back to its core oil and gas business following years of unprofitable ventures into renewables. It also seems fair to point out that the political pendulum about which Hirstius warns already swung wildly in favor of offshore wind and other wind and solar projects in the Biden administration. It is odd that Shell only now decides to roll out that particular warning.

Shell was pulling back from its major offshore wind investments while Trump was still fighting off efforts by an array of Democratic prosecutors to put him in prison. In June 2023, for example, the company announced its intent to offload its 50% share in the Southcoast project offshore Connecticut amid Biden era high inflation and supply chain challenges that were already rocking the industry at the time. Nine months later, Shell sold the interest to another party.

The company announced last December that it was “stepping back from new offshore wind investments” as part of a company-wide review implemented by then-new CEO Wael Sawan in mid-2023. A month later, it cancelled its interest in the Atlantic Shores project, writing off $1 billion in investments in the process. Shell’s ventures into the U.S. offshore wind arena had run head-long into economic reality long before the second Trump presidency came along.

That Atlantic Shores project has become an item of special interest inside the Interior Department’s Bureau of Ocean Energy Management (BOEM) in recent days. In a court filing last Friday, BOEM Deputy Director Matthew Giacona said the Bureau plans to conduct a full review of the process that went into approving Atlantic Shores during the Biden presidency. He also said the review would likely expand to other offshore wind projects given the administration’s concerns that Biden’s regulators failed to properly assess the true environmental impacts these major industrial installations create.

In addition to that, the Daily Caller’s Audrey Streb reported on Monday that Biden regulators gave the go-ahead to some of these offshore projects despite internal concerns expressed as early as 2021 that granting long delays in their decommissioning processes “increases risk to the federal taxpayer.” Offshore developers are normally required to provide financial assurance to pre-fund such costs, but big Danish developer Orsted and others were requesting delays as long as 15 years in that requirement to make their project economics work.

Hirstius’s concerns about regulation are absolutely valid: Having such certainty is a crucial element for any company to be able to plan its future business endeavors. But every presidency has a duty to ensure that actions by prior administrations meet the mandates of prevailing laws. It has long been feared that the Biden regulators cut important corners related to environmental and marine mammal protections to speed some offshore wind projects through the process.

As this current review process plays itself out, Shell might well find itself glad it cut its losses in this failing offshore wind sector when it did.

David Blackmon is an energy writer and consultant based in Texas. He spent 40 years in the oil and gas business, where he specialized in public policy and communications.

-

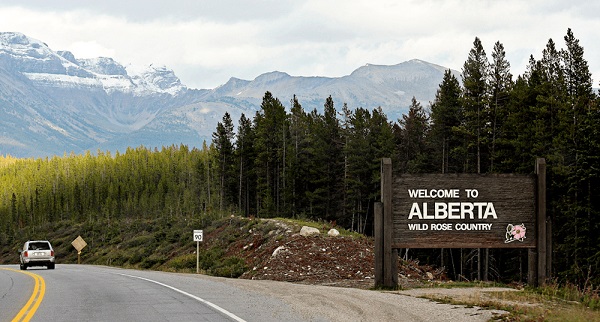

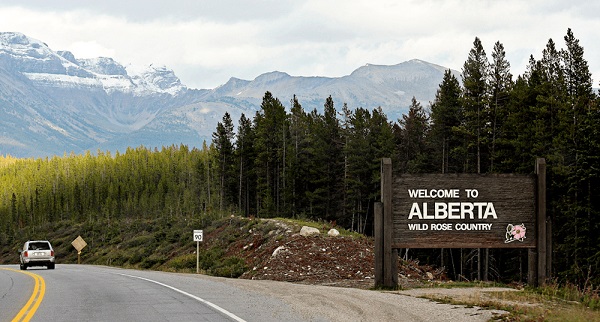

Alberta1 day ago

Alberta1 day agoFact, fiction, and the pipeline that’s paying Canada’s rent

-

Crime2 days ago

Crime2 days agoFlorida teens credited for averting school shooting plot in Washington state

-

Alberta1 day ago

Alberta1 day agoAlberta Is Where Canadians Go When They Want To Build A Better Life

-

International1 day ago

International1 day agoTrump-brokered Gaza peace agreement enters first phase

-

Energy2 days ago

Energy2 days ago“It is intellectually dishonest not to acknowledge the … erosion of trust among global customers in Canada’s ability to deliver another oil pipeline.”

-

Energy2 days ago

Energy2 days agoIn the halls of Parliament, Ellis Ross may be the most high-profile advocate of Indigenous-led development in Canada.

-

Aristotle Foundation2 days ago

Aristotle Foundation2 days agoEfforts to halt Harry Potter event expose the absurdity of trans activism

-

International2 days ago

International2 days agoIsraeli government approves Gaza ceasefire