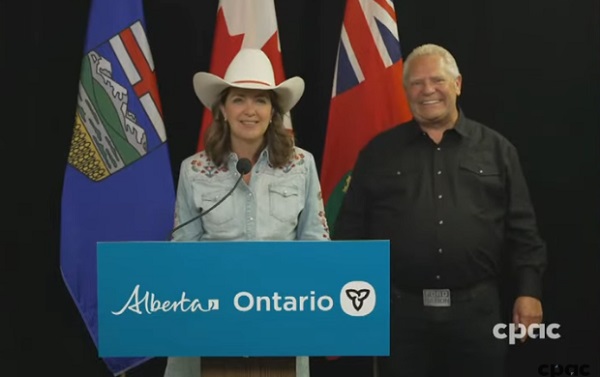

Alberta

U.S. tariffs or not, Canada needs to build new oil and gas pipeline space fast

From the Canadian Energy Centre

Expansion work underway takes on greater importance amid trade dispute

Last April, as the frozen landscape began its spring thaw, a 23-kilometre stretch of newly built pipeline started moving natural gas across northwest Alberta.

There was no fanfare when this small extension of TC Energy’s Nova Gas Transmission Limited (NGTL) system went online – adding room for more gas than all the homes in Calgary use every day.

It’s part of the ongoing expansion of the NGTL system, which connects natural gas from British Columbia and Alberta to the vast TC Energy network. In fact, one in every 10 molecules of natural gas moved across North America touches NGTL.

With new uncertainty emerging from Canada’s biggest oil and gas customer – the United States – there is a rallying cry to get new major pipelines built to reach across Canada and to wider markets.

Canada’s Natural Resources Minister Jonathan Wilkinson recently said the country should consider building a new west-east oil pipeline following U.S. President Donald Trump’s threat of tariffs, calling the current lack of cross-country pipelines a “vulnerability,” CBC reported.

“I think we need to reflect on that,” Wilkinson said. “That creates some degree of uncertainty. I think, in that context, we will as a country want to have some conversations about infrastructure that provides greater security for us.”

Many industry experts see the threat to Canada’s economy as a wake-up call for national competitiveness, arguing to keep up the momentum following the long-awaited completion of two massive pipelines across British Columbia over the last 18 months. Both of which took more than a decade to build amidst political turmoil, regulatory hurdles, activist opposition and huge cost overruns.

On May 1, 2024, the Trans Mountain pipeline expansion (TMX) started delivering crude oil to the West Coast, providing a much-needed outlet for Alberta’s growing oil production.

Several months before that, TC Energy finished work on the 670-kilometre Coastal Gaslink pipeline, which provides the first direct path for Canadian natural gas to reach international markets when the LNG Canada export terminal in Kitimat begins operating later this year.

TMX and Coastal GasLink provide enormous benefits for the Canadian economy, but neither are sufficient to meet the long-term growth of oil and gas production in Western Canada.

More oil pipeline capacity needed soon

TMX added 590,000 barrels per day of pipeline capacity, nearly tripling the volume of crude reaching the West Coast where it can be shipped to international markets.

In less than a year, the extra capacity has enabled Canadian oil production to reach all-time highs of more than five million barrels per day.

More oil reaching tidewater has also shrunk the traditional discount on Alberta’s heavy oil, generating an extra $10 billion in revenues, while crude oil exports to Asia have surged from $49 million in 2023 to $3.6 billion in 2024, according to ATB analyst Mark Parsons.

With oil production continuing to grow, the need for more pipeline space could return as soon as next year, according to analysts and major pipeline operators.

With oil production continuing to grow, the need for more pipeline space could return as soon as next year, according to analysts and major pipeline operators.

Even shortly after TMX began operation, S&P Global analysts Celina Hwang and Kevin Birn warned that “by early 2026, we forecast the need for further export capacity to ensure that the system remains balanced on pipeline economics.”

Pipeline owners are hoping to get ahead of another oil glut, with plans to expand existing systems already underway.

Trans Mountain vice-president Jason Balasch told Reuters the company is looking at projects that could add up to 300,000 barrels per day (bpd) of capacity within the next five years.

Meanwhile, Canada’s biggest oil pipeline company is working with Alberta’s government and other customers to expand its major export pipelines as part of the province’s plan to double crude production in the coming years.

Enbridge expects it can add as much as 300,000 bpd of capacity out of Western Canada by 2028 through optimization of its Mainline system and U.S. market access pipelines.

Enbridge spokesperson Gina Sutherland said the company can add capacity in a number of ways including system optimizations and the use of so-called drag reducing agents, which allow more fluid to flow by reducing turbulence.

LNG and electricity drive strong demand for natural gas

Growing global demand for energy also presents enormous opportunities for Canada’s natural gas industry, which also requires new transportation infrastructure to keep pace with demand at home and abroad.

The first phase of the LNG Canada export terminal is expected to begin shipping 1.8 billion cubic feet of gas per day (Bcf/d) later this year, spurring the first big step in an expected 30 per cent increase in gas production in Western Canada over the next decade.

With additional LNG projects in development and demand increasing, the spiderweb of pipes that gathers Alberta and B.C.’s abundant gas supplies need to continue to grow.

TC Energy CEO Francois Poirier is “very bullish” about the prosect of building a second phase of the recently completed Coastal GasLink pipeline connecting natural gas in northeast B.C. to LNG terminals on the coast at Kitimat.

The company is also continuously expanding NGTL, which transports about 80 per cent of Western Canada’s production, with more than $3 billion in growth projects planned by 2030 to add another 1 Bcf/d of capacity.

Meanwhile Enbridge sees about $7 billion in future growth opportunities on its natural gas system in British Columbia.

In addition to burgeoning LNG exports from Canada, the U.S. and Mexico, TC Energy sees huge potential for gas to continue replacing coal-fired electricity generation, especially as a boom in power-hunger data centres unfolds.

With such strong prospects for North America’s highly integrated energy system, Poirier recently argued in the Wall Street Journal that leaders should be focused on finding common ground for energy in the current trade dispute.

“Our collective strength on energy provides a chance to expand our economies, advance national security and reduce global emissions,“ he wrote in a Feb. 3 OpEd.

“By working together across North America and supporting the free flow of energy throughout the continent, we can achieve energy security, affordability and reliability more effectively than any country could achieve on its own.”

Alberta

Sheriffs shut down Olds drug house

News release from the Province of Alberta

The Alberta Sheriffs have shut down a problem property where suspected drug activity threatened nearby playgrounds and other community spaces.

The Safer Communities and Neighbourhoods (SCAN) unit of the Alberta Sheriffs obtained a court order against the property owner of 5222 42 Street. The property will be closed for 90 days, beginning on Oct. 7 at noon. All individuals must vacate the premises, including the property owner.

The community safety order, obtained in the Court of King’s Bench, bars all people from the property until the closure period ends on Jan. 5, 2026, and prohibits certain individuals from accessing the property altogether, while the order is in place. The property will be boarded up, fenced and all the locks will be changed. SCAN members will continue to monitor the property for activity while their investigation remains ongoing. Community safety order conditions remain in effect until Jan. 5, 2028.

“SCAN now adds Olds to the long and growing list of Alberta communities that have benefited from its diligent investigative work. My thanks to members of the southern SCAN unit and the RCMP for the closure of another disruptive problem property that posed a risk to nearby playgrounds and the surrounding community and threatened public safety. Criminal activity has no home in our province. I encourage all Albertans to report suspicious activity where and when they see it.”

“Close collaboration with local police was essential for a successful investigation of this property and I thank the Olds RCMP for its partnership on this file. Residents are relieved to see this property close, putting an end to the illegal activities centred around it. Here and across Alberta, SCAN is dedicated to maintaining the peace and safety of neighbourhoods and communities.”

“Olds RCMP remains fully committed to building safer communities by working in partnership with our community as well as through investigative and enforcement efforts to achieve this goal. Olds RCMP would like to thank the Olds RCMP crime reduction member on conducting an excellent investigation and the Alberta Sheriffs SCAN unit for its assistance during this project.”

The Alberta Sheriffs work with other law enforcement agencies to shut down properties being used for illegal activities. The SCAN unit operates under the Safer Communities and Neighbourhoods Act, which uses legal sanctions and court orders to hold owners accountable for illegal activity happening on their property.

Since its inception in 2008, Alberta’s SCAN unit has investigated more than 10,000 properties and has issued more than 135 community safety orders. Most complaints are resolved by working with owners to stop the illegal activity on their property.

Quick facts

- Between February 2022 and May 2025, the RCMP attended the property 65 times for various types of calls for service.

- The RCMP executed three search warrants between January 2024 and April 2025, during which stolen property, illegal drugs and drug paraphernalia were recovered.

- SCAN investigators and the RCMP continued to receive complaints of suspected drug and criminal activities at the property throughout the course of their investigation and observed activity consistent with drug dealing.

Alberta

‘Visionary’ Yellowhead Pipeline poised to launch Alberta into the future

From the Canadian Energy Centre

Heartland leaders welcome proposed new natural gas connector

As a lifelong farmer, entrepreneur and community leader, Alanna Hnatiw knows first-hand the crucial role energy plays in a strong and diverse economy.

The mayor of Sturgeon County, a sprawling rural municipality northeast of Edmonton, Hnatiw has spent much of the last decade working to protect its agricultural roots while building new industries that support the jobs and services families and businesses rely on every day.

Hnatiw says there is widespread appreciation among the county’s 20,000 residents for the opportunities afforded by the province’s oil and gas resources. That’s why she joined other leaders in Alberta’s Industrial Heartland region to applaud a major new natural gas pipeline planned for the area.

“Natural gas is an integral to all the industrial operations in Sturgeon County and the surrounding area. It goes beyond just burning it to turn turbines, it is the feedstock for all kinds of value-added processing. From fertilizer and plastics to petrochemicals and hydrogen, natural gas is the lynchpin for us into the future,” she said.

Filling growing demand

Hnatiw is one of more than a dozen community and industry leaders who sent letters of support to the Alberta Utilities Commission (AUC) last year endorsing ATCO Energy Systems’ proposed Yellowhead Pipeline project.

The project achieved a significant milestone in August when the AUC approved ATCO’s application determining the pipeline is needed.

The largest infrastructure investment in the company’s history, the 230-kilometre pipeline from Peers to Fort Saskatchewan will transport more than 1.1 billion cubic feet of natural gas per day when operational in late 2027.

For context, Alberta produced about 11 billion cubic feet per day of natural gas in 2024, according to the Alberta Energy Regulator.

The Yellowhead Pipeline will boost deliveries to the greater Edmonton area as demand continues to grow for power generation, manufacturing, petrochemical processing and residential use.

Industrial customers have reserved 90 per cent of the pipeline’s capacity to meet their future needs.

This includes Dow Chemical, which plans to build an $8.9-billion net-zero ethylene processing facility in Fort Saskatchewan, Heidelberg Materials’ Edmonton facility that aims to be the world’s first full-scale cement plant equipped with carbon capture and storage (CCS), and McCain Foods, which requires more natural gas for a planned expansion of its French fry factory in Coaldale.

Prosperity driver

Edmonton Global CEO Malcolm Bruce described the Yellowhead Pipeline as a “visionary” infrastructure project in his letter of support to the AUC.

“The [project] will create jobs, enable billions in new investment and drive Alberta’s hydrogen roadmap and natural gas vision and strategy.”

ATCO’s projections show the pipeline will generate substantial economic benefits. The company estimates that during construction, it will support 12,000 jobs and contribute $1.6 billion per year to Alberta’s economy.

Once in operation, the pipeline is expected to support 23,700 jobs per year and add $3.9 billion annually to Alberta’s GDP.

For Sturgeon County, the project also provides much-needed certainty that natural gas will be available for the $30 billion in new industrial investments the region is hoping to attract in the coming years.

Future plans

The municipality is already home to major operations including the NWR Sturgeon Refinery and Nutrien fertilizer plant, both of which capture carbon dioxide emissions that are transported through the Alberta Carbon Trunk Line for deep underground storage near Clive, Alberta.

Hnatiw said future development may include hydrogen production with CCS, petrochemical processing, gas-fired power plants and large-scale data centres.

“With our operations running near capacity right now, this new pipeline helps alleviate the uncertainty around gas supplies for industrial developers,” Hnatiw said.

The county’s industrial goals are inextricably tied to ensuring its farming sector continues to flourish, she said.

“Eighty per cent of our land base is agricultural, but it only accounts for one per cent of our budget as far as taxes go, so we need our industrial residents to support our rural way of life,” she said.

“We don’t want people to have to leave our community to make a living. We want a future that is full of opportunity, and one that is also sustainable for the families that produce our food, our fuel, and all the other value-added products we can provide.”

ATCO’s next step is to file for AUC approval to build the pipeline later this year. The company expects construction to begin in 2026.

-

Bruce Dowbiggin2 days ago

Bruce Dowbiggin2 days agoElbows Up Part Deux: Liberal Canada Now Riding The Blue Jays

-

International2 days ago

International2 days agoNegotiations continue in Israel-Hamas peace deal

-

Crime1 day ago

Crime1 day agoThe Bureau Exclusive: Chinese–Mexican Syndicate Shipping Methods Exposed — Vancouver as a Global Meth Hub

-

Business2 days ago

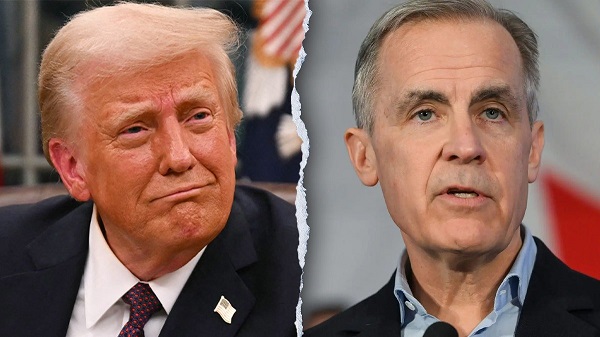

Business2 days agoCarney’s Bungling of the Tariff Issue Requires a Reset in Canada’s Approach to Trump

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoWinnipeg Universities Flunk The Free Speech Test

-

espionage2 days ago

espionage2 days agoCanada’s federal election in April saw ‘small scale’ foreign meddling: gov’t watchdog

-

Crime1 day ago

Crime1 day agoCanadian Sovereignty at Stake: Stunning Testimony at Security Hearing in Ottawa from Sam Cooper

-

Opinion2 days ago

Opinion2 days agoJordan Peterson needs prayers as he battles serious health issues, daughter Mikhaila says