Opinion

Tuesday-night Trudeau

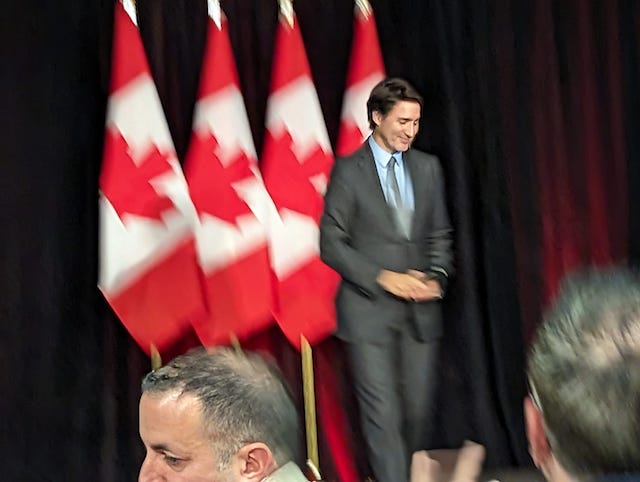

Justin Trudeau at Gatineau Airport, Oct 24 – Photo by PW

Posted with permission from Paul Wells

Justin Trudeau in a hangar, before the comeback, if there’s going to be one

If Justin Trudeau’s historic comeback happens, it will start sometime after Tuesday night, when he spoke to a Liberal Party of Canada fundraiser at the one-runway Gatineau Airport, 21 minutes’ drive from Rideau Cottage on the Quebec side of the river.

The prime minister is two months short of his 52nd birthday. Brian Mulroney was not quite 54 when he became the youngest undefeated prime minister, so far, to announce his retirement from politics. This is the sort of week when I look up numbers like that.

The polls since summer haven’t been kind to the Liberals. I have readers who get cross with me when I mention polls, but I cover the most polling-obsessed government in Canada’s history, and I must decline requests to unilaterally disarm.

Trudeau and his ministers do fundraisers all the time, as do the leaders and prominent MPs in other parties. The only difference on Tuesday was that I went to watch. After some embarrassing early headlines about fundraisers soon after the 2015 election, the Liberal Party changed its rules to increase transparency in fundraising. Now reporters get advance notice whenever Trudeau will be speaking at a fundraiser. I wanted to see what Trudeau says at such things these days, precisely because they’re routine events. Hearing how the prime minister talks to friendlies on a Tuesday night near home was, perhaps, the closest I could get to hearing how he talks to himself.

This event was a fundraiser for Gatineau MP Steven MacKinnon, a former Liberal Party national director who is serving as the government’s house leader while Karina Gould is on maternity leave. Two cabinet ministers were on hand too, Jean-Yves Duclos and Anita Anand. An organizer told the audience he’d been asked to get a smallish crowd out, “a good 50 or so;” since 67 people bought tickets, he was pretty pleased. The party had announced a ticket price up to $1,500. The crowd was of the sort that routinely gets described as overwhelmingly white and male when it’s a Conservative event, which means it was overwhelmingly white and male, but Liberal.

Trudeau spoke for twelve minutes. He opened by saying nice things about MacKinnon and thanked the two cabinet ministers. Poor Duclos thought he was just out to socialize, Trudeau joked, but Duclos is the minister of public services and procurement, “and around here we talk about a bridge.” Gales of laughter from the crowd. The riding association guy had also mentioned a bridge. There has been endless talk about a sixth bridge between Ottawa and Gatineau; neighbours near the various possible routes are leery, but a lot of people hope a new bridge would improve traffic flow, which often includes bumper-to-bumper heavy trucks on ordinary streets through the middle of Ottawa. A lot of the people who want the bridge the most run businesses. Judging from the PM’s choice of comic patter, they won’t have to wait long.

Trudeau thanked the crowd for coming out. “I know very well that everyone has plenty of choices for the various activities they could undertake on a Tuesday night in the month of October,” he said. This may have flattered the selection of fun activities in Gatineau on a Tuesday.

“You chose to come participate in a democratic event,” Trudeau continued. This was an instinct he could only applaud: “We know very well these days that it’s not always very motivating to get involved in politics. To raise your hand and say, ‘No, no, no, I want to participate in our democracy in an active and involved way. To take part in the conversations we’re having as a country in these difficult moments.’”

Trudeau contrasted this positive spirit with what certain other people, so far unnamed, like to do. “It’s very easy to point our finger at politicians, to complain about inflation or the pandemic or interest rates or labour shortages or housing or all these issues. It’s very easy, and many people decide to turn toward anger, anxiety, fear or division. Because it really pays over the short term, in politics, to rely on fear and division. But it’s so much more important to have a responsible, sensible approach, anchored in shared values. To try to bring us together rather than to divide us in an attempt to win a few points in the polls.”

One sensed an emerging central theme of contrast. “Your choice to come tonight to this Liberal event is enormously touching to me,” Trudeau said. “Because for eight years now, we’ve tried to be a government that stayed rooted in real things. In facts. In shared values. We bring people together rather than divide them for strategic reasons.”

Not only does his government, in his telling, think like good people, it does things good people will like.

“We manage to deliver for people. Even in extremely difficult moments like the ones we’re living through. People are struggling, because of the global context, extremely complex geopolitics that have a direct impact on pocketbooks, on groceries and rent. We have an important role to play as a government, to respond to today’s needs. That’s why we’ve made investments to help people pay their bills, to increase competition among the big grocers. We’re there to provide more daycare spaces. We’re there to help with dental care. We’re there to help with the Canada Child Benefit, which has lifted half a million children out of poverty in recent years. We’re there to create economic growth even as we fight against climate change.”

His audience for the night being mostly Quebecers and, as far as I could tell, mostly in business, the Liberal leader refined his course of general flattery to one of specific business-oriented flattery.

“I’m very proud of what we’ve been able to deliver in Quebec: Northvolt, Rio Tinto, REM… These are investments that show how much — here in Quebec where we’ve always understood that environmental protection and economic growth go together — everyone can make progress together.”

This was a pretty upbeat message, as partisan messages often are — we have the right ideas and the right results, and the other team is trying to wreck it all — but here again, as when he lamented how “not very motivating” the political life can be, Trudeau introduced a distinctly mournful note.

“As usual, it’s a bigger challenge to get this message out in the rest of Canada,” he said. At the risk of talking about polls, I couldn’t help thinking Trudeau was referring to recent pee oh ell ells that show Quebec as the only part of the country where his Liberals are in the lead. Despite big federal spending on Volkswagen ($13 billion) and Stellantis (probably more), the clean green future seems not to tempt a lot of Canadians. “It still feels far off, because the day-to-day is still difficult for many Canadians,” he said. “But we know very well that a society and a future are built step by step.…When we stay optimistic, when we’re reasonable, everything becomes possible in the future.”

This, he said, summing up, was “the political debate we’re having now…. Within two years — probably in two years — we’ll have elections.” That’s when people will get a chance to choose directions.

“Will we go back to the Conservative ways of trickle-down, cuts to social programs, advantages for the well-off in the hopes that they’ll eventually give everyone opportunity? It’s never worked and it won’t work better now.” Or would voters stick with the government Trudeau sees in the mirror? “We’re going to stay responsible but we’re going to keep investing,” he said.

Only now, at the end of his remarks, did Trudeau switch from French to English. “It’s always an incredible pleasure to spend time with people who are dedicated every day to building stronger communities and a stronger country.” And that was the end of that. The applause lasted for sixteen seconds. PMO staff led reporters out of the room — our access ends when the big guy stops talking.

A few observations on all this.

First, I’m struck by the way Trudeau narrowed down his expectation of election timing: “Within two years — probably in two years.” Probably anyone in a position of responsibility in any party would say an election could come any time, it’s wise to be ready, and so on. But in Trudeau’s mind, the supply and confidence agreement with the NDP seems likely to hold. He is not in a rush. Judgment Day isn’t until 2025.

Second, if he’s getting any advice to hit pause on carbon taxes, he sure doesn’t sound like he’s getting ready to take the advice. The heart of his case for himself is the notion that you can have clean energy and a thriving economy, and indeed that the latter depends on the former. That argument doesn’t require a carbon tax — theoretically, if you subsidize enough battery plants gasoline will become obsolete — but nothing in Trudeau’s fundraiser stump speech sounded like he was laying the predicate for a major retreat on carbon taxes.

BIG HONKING UPDATE, MINUTES LATER:

The feds have made a large announcement that shows the risks in making predictions. I quote:

“The Prime Minister, Justin Trudeau, today announced the government is moving ahead with doubling the pollution price rebate (Climate Action Incentive Payment) rural top-up rate, increasing it from 10 to 20 per cent of the baseline amount starting in April 2024. People who live in rural communities face unique realities, and this measure would help put even more money back in the pockets of families dealing with higher energy costs because they live outside a large city.

“Given the pressures faced by households and small businesses that use oil heating, the Prime Minister also announced that the government is moving ahead with a temporary, three-year pause to the federal price on pollution (fuel charge) on deliveries of heating oil in all jurisdictions where the federal fuel charge is in effect. This pause would begin 14 days from today. While the fuel charge is already returned to consumers through the pollution price rebate, this temporary pause would save a household that uses heating oil $250 at the current rate, on average, while the federal government works with provinces to roll out heat pumps and phase out oil for heating over the longer term.”

Third, and more generally, the case Trudeau was building was for more of the same. “It still feels far off, because the day-to-day is still difficult for many Canadians,” he said, which is how you talk when you’re hoping your ship comes in before people get a chance to pass judgment.

Incidentally, here I think it’s only fair to point out there’s been recent progress on files I often point to as evidence that Liberal plans never pan out. The Canada Growth Fund, the object of this newsletter’s first post, made its first investment this week, a $90 million equity play in a Calgary geothermal energy company. The Canada-US Energy Transformation Task Force held a second meeting. Maybe two years of process news like that will add up to an electorate that’s excited about Canada’s energy transformation. I mean, it’s possible.

Most of all, I was struck by how “more of the same” had better work for the Liberals, because if the boss has a better idea, he’s hiding it well. A leader who once ran on cost-of-living issues…

… is now running on the clean-energy future that feels tantalizingly out of reach, and lamenting his opponent’s insistence on running on cost-of-living issues. His best hunch about timing is that he has no reason to rush, and his best assessment of his work to date is that he needs to do more of it.

Liberals who feel more of a sense of urgency, futility or wasted energy will just have to get on board, I guess. The leader’s not for turning.

Business

Taxing food is like slapping a surcharge on hunger. It needs to end

This article supplied by Troy Media.

Cutting the food tax is one clear way to ease the cost-of-living crisis for Canadians

About a year ago, Canada experimented with something rare in federal policymaking: a temporary GST holiday on prepared foods.

It was short-lived and poorly communicated, yet Canadians noticed it immediately. One of the most unavoidable expenses in daily life—food—became marginally less costly.

Families felt a modest but genuine reprieve. Restaurants saw a bump in customer traffic. For a brief moment, Canadians experienced what it feels like when government steps back from taxing something as basic as eating.

Then the tax returned with opportunistic pricing, restoring a policy that quietly but reliably makes the cost of living more expensive for everyone.

In many ways, the temporary GST cut was worse than doing nothing. It opened the door for industry to adjust prices upward while consumers were distracted by the tax relief. That dynamic helped push our food inflation rate from minus 0.6 per cent in January to almost four per cent later in the year. By tinkering with taxes rather than addressing the structural flaws in the system, policymakers unintentionally fuelled volatility. Instead of experimenting with temporary fixes, it is time to confront the obvious: Canada should stop taxing food altogether.

Start with grocery stores. Many Canadians believe food is not taxed at retail, but that assumption is wrong. While “basic groceries” are zero-rated, a vast range of everyday food products are taxed, and Canadians now pay over a billion dollars a year in GST/HST on food purchased in grocery stores.

That amount is rising steadily, not because Canadians are buying more treats, but because shrinkflation is quietly pulling more products into taxable categories. A box of granola bars with six bars is tax-exempt, but when manufacturers quietly reduce the box to five bars, it becomes taxable. The product hasn’t changed. The nutritional profile hasn’t changed. Only the packaging has changed, yet the tax flips on.

This pattern now permeates the grocery aisle. A 650-gram bag of chips shrinks to 580 grams and becomes taxable. Muffins once sold in six-packs are reformatted into three-packs or individually wrapped portions, instantly becoming taxable single-serve items. Yogurt, traditionally sold in large tax-exempt tubs, increasingly appears in smaller 100-gram units that meet the definition of taxable snacks. Crackers, cookies, trail mixes and cereals have all seen slight weight reductions that push them past GST thresholds created decades ago. Inflation raises food prices; Canada’s outdated tax code amplifies those increases.

At the same time, grocery inflation remains elevated. Prices are rising at 3.4 per cent, nearly double the overall inflation rate. At a moment when food costs are climbing faster than almost everything else, continuing to tax food—whether on the shelf or in restaurants—makes even less economic sense.

The inconsistencies extend further. A steak purchased at the grocery store carries no tax, yet a breakfast wrap made from virtually the same inputs is taxed at five per cent GST plus applicable HST. The nutritional function is not different. The economic function is not different. But the tax treatment is entirely arbitrary, rooted in outdated distinctions that no longer reflect how Canadians live or work.

Lower-income households disproportionately bear the cost. They spend 6.2 per cent of their income eating outside the home, compared with 3.4 per cent for the highest-income households. When government taxes prepared food, it effectively imposes a higher burden on those often juggling two or three jobs with limited time to cook.

But this is not only about the poorest households. Every Canadian pays more because the tax embeds itself in the price of convenience, time and the realities of modern living.

And there is an overlooked economic dimension: restaurants are one of the most effective tools we have for stimulating community-level economic activity. When people dine out, they don’t just buy food. They participate in the economy. They support jobs for young and lower-income workers. They activate foot traffic in commercial areas. They drive spending in adjacent sectors such as transportation, retail, entertainment and tourism.

A healthy restaurant sector is a signal of economic confidence; it is often the first place consumers re-engage when they feel financially secure. Taxing prepared food, therefore, is not simply a tax on convenience—it is a tax on economic participation.

Restaurants Canada has been calling for the permanent removal of GST/HST on all food, and they are right. Eliminating the tax would generate $5.4 billion in consumer savings annually, create more than 64,000 foodservice jobs, add over 15,000 jobs in related sectors and support the opening of more than 2,600 new restaurants across the country. No other affordability measure available to the federal government delivers this combination of economic stimulus and direct relief.

And Canadians overwhelmingly agree. Eighty-four per cent believe food should not be taxed, regardless of where it is purchased. In a polarized political climate, a consensus of that magnitude is rare.

Ending the GST/HST on all food will not solve every affordability issue but it is one of the simplest, fairest and most effective measures the federal government can take immediately.

Food is food. The tax system should finally accept that.

Dr. Sylvain Charlebois is a Canadian professor and researcher in food distribution and policy. He is senior director of the Agri-Food Analytics Lab at Dalhousie University and co-host of The Food Professor Podcast. He is frequently cited in the media for his insights on food prices, agricultural trends, and the global food supply chain.

Troy Media empowers Canadian community news outlets by providing independent, insightful analysis and commentary. Our mission is to support local media in helping Canadians stay informed and engaged by delivering reliable content that strengthens community connections and deepens understanding across the country.

Energy

75 per cent of Canadians support the construction of new pipelines to the East Coast and British Columbia

-

71 per cent of Canadians find the approval process too long.

-

67 per cent of Quebecers support the Marinvest Energy natural gas project.

“While there has always been a clear majority of Canadians supporting the development of new pipelines, it seems that the trade dispute has helped firm up this support,” says Gabriel Giguère, senior policy analyst at the MEI. “From coast to coast, Canadians appreciate the importance of the energy industry to our prosperity.”

Three-quarters of Canadians support constructing new pipelines to ports in Eastern Canada or British Columbia in order to diversify our export markets for oil and gas.

This proportion is 14 percentage points higher than it was last year, with the “strongly agree” category accounting for almost all of the increase.

For its part, Marinvest Energy’s natural gas pipeline and liquefaction plant project, in Quebec’s North Shore region, is supported by 67 per cent of Quebecers polled, who see it as a way to reduce European dependence on Russian natural gas.

Moreover, 54 per cent of Quebecers now say they support the development of the province’s own oil resources. This represents a six-point increase over last year.

“This year again, we see that this preconceived notion according to which Quebecers oppose energy development is false,” says Mr. Giguère. “Quebecers’ increased support for pipeline projects should signal to politicians that there is social acceptability, whatever certain lobby groups might think.”

It is also the case that seven in ten Canadians (71 per cent) think the approval process for major projects, including environmental assessments, is too long and should be reformed. In Quebec, 63 per cent are of this opinion.

The federal Bill C-5 and Quebec Bill 5 seem to respond to these concerns by trying to accelerate the approval of certain large projects selected by governments.

In July, the MEI recommended a revision of the assessment process in order to make it swift by default instead of creating a way to bypass it as Bill C-5 and Bill 5 do.

“Canadians understand that the burdensome assessment process undermines our prosperity and the creation of good, well-paid jobs,” says Mr. Giguère. “While the recent bills to accelerate projects of national interest are a step in the right direction, it would be better simply to reform the assessment process so that it works, rather than creating a workaround.”

A sample of 1,159 Canadians aged 18 and older were surveyed between November 27 and December 2, 2025. The results are accurate to within ± 3.5 percentage points, 19 times out of 20.

-

Crime2 days ago

Crime2 days agoBrown University shooter dead of apparent self-inflicted gunshot wound

-

Alberta1 day ago

Alberta1 day agoAlberta’s new diagnostic policy appears to meet standard for Canada Health Act compliance

-

Health1 day ago

Health1 day agoRFK Jr reversing Biden-era policies on gender transition care for minors

-

Censorship Industrial Complex1 day ago

Censorship Industrial Complex1 day agoCanadian university censors free speech advocate who spoke out against Indigenous ‘mass grave’ hoax

-

Business21 hours ago

Business21 hours agoGeopolitics no longer drives oil prices the way it used to

-

Business21 hours ago

Business21 hours agoArgentina’s Milei delivers results free-market critics said wouldn’t work

-

Business2 days ago

Business2 days agoTrump signs order reclassifying marijuana as Schedule III drug

-

Business20 hours ago

Business20 hours agoDeadlocked Jury Zeroes In on Alleged US$40 Million PPE Fraud in Linda Sun PRC Influence Case