Business

Trump’s steel tariffs will hit BC hard

From Resource Works

BC is a huge source of mettalurgical coal, which is used to make steel.

US President Donald Trump’s announcement of 25 percent tariffs on imported steel will send shockwaves through many industries but one of the hardest hit will be British Columbia’s coal industry. As the largest exporter of metallurgical coal in Canada, B.C. relies heavily on global steel production and these tariffs will reduce demand, destabilize prices and disrupt supply chains.

Unlike thermal coal used to generate electricity, over 95 percent of coal mined in British Columbia is metallurgical coal or coking coal. This coal is used to produce coke, a carbon rich fuel used to remove oxygen from iron ore in blast furnaces. Steel production is a big part of global industrial activity and B.C.’s coal industry exists because of that demand.

According to provincial data coal is B.C.’s most valuable mined commodity, generating billions of dollars in revenue each year. B.C. coal is exported mainly to Asian markets like Japan, China, South Korea and India but the US steel industry has been a customer too. A reduction in US steel production due to tariffs could disrupt global steel trade flows and reduce demand for metallurgical coal from B.C. miners.

Trump’s latest 25 percent tariffs on all steel imports is a repeat of what happened in 2018 when similar tariffs were introduced. At that time the tariffs increased costs for US manufacturers and led to retaliatory tariffs from Canada and other trade partners. The economic impact was big – Canadian steel and aluminum producers lost business and retaliatory tariffs were imposed on a range of American goods. The 2018 tariffs also didn’t revitalize US steel production which was 1 percent lower in 2024 than 2017 despite those protectionist measures.

This time the tariffs will hit even harder. Unlike 2018 when Canada and Mexico were eventually exempted after negotiations, this time Trump has said his tariffs will apply to “everybody”. That means the Canadian steel industry will once again be caught in the crossfire and with it the metallurgical coal industry that supplies it.

If Trump’s steel tariffs prevent U.S. manufacturers from importing steel due to higher costs, steel production will decline. That will mean lower global demand for metallurgical coal including B.C.’s high grade supply. B.C. coal miners are already facing challenges from environmental policies, competition from other jurisdictions and regulatory delays. A downturn in demand from steel producers could be the trigger for more mine closures or reductions in production.

Plus these tariffs could start another trade war. Canada retaliated in 2018 with tariffs on U.S. goods like orange juice and whiskey and similar measures may follow this time. The uncertainty will delay investment decisions in Canada’s mining sector especially for new projects or expansions that rely on stable steel demand.

The long term viability of metallurgical coal is already in question as the steel industry looks towards greener production methods like hydrogen based steelmaking. Sweden has already developed facilities that don’t require coking coal and while the transition to such technologies will take decades the latest trade disruptions could accelerate that shift.

Trump’s tariffs are meant to protect U.S. steel makers but history shows they often have the opposite effect, increasing costs for American manufacturers and economic instability for key trading partners. For B.C.’s coal industry the combination of declining steel demand, disrupted supply chains and potential trade retaliation puts the sector in a tough spot.

British Columbia’s coal industry is deeply connected to global steel production making it very exposed to Trump’s latest tariffs. The move will reduce demand for metallurgical coal, disrupt export markets and add more financial stress to the province’s miners. Given Trump’s track record on trade B.C. should prepare for economic uncertainty and look at diversification strategies to mitigate the impact of another round of U.S. protectionism.

Business

Looks like the Liberals don’t support their own Pipeline MOU

From Pierre Poilievre

Business

Canada Can Finally Profit From LNG If Ottawa Stops Dragging Its Feet

From the Frontier Centre for Public Policy

By Ian Madsen

Canada’s growing LNG exports are opening global markets and reducing dependence on U.S. prices, if Ottawa allows the pipelines and export facilities needed to reach those markets

Canada’s LNG advantage is clear, but federal bottlenecks still risk turning a rare opening into another missed opportunity

Canada is finally in a position to profit from global LNG demand. But that opportunity will slip away unless Ottawa supports the pipelines and export capacity needed to reach those markets.

Most major LNG and pipeline projects still need federal impact assessments and approvals, which means Ottawa can delay or block them even when provincial and Indigenous governments are onside. Several major projects are already moving ahead, which makes Ottawa’s role even more important.

The Ksi Lisims floating liquefaction and export facility near Prince Rupert, British Columbia, along with the LNG Canada terminal at Kitimat, B.C., Cedar LNG and a likely expansion of LNG Canada, are all increasing Canada’s export capacity. For the first time, Canada will be able to sell natural gas to overseas buyers instead of relying solely on the U.S. market and its lower prices.

These projects give the northeast B.C. and northwest Alberta Montney region a long-needed outlet for its natural gas. Horizontal drilling and hydraulic fracturing made it possible to tap these reserves at scale. Until 2025, producers had no choice but to sell into the saturated U.S. market at whatever price American buyers offered. Gaining access to world markets marks one of the most significant changes for an industry long tied to U.S. pricing.

According to an International Gas Union report, “Global liquefied natural gas (LNG) trade grew by 2.4 per cent in 2024 to 411.24 million tonnes, connecting 22 exporting markets with 48 importing markets.” LNG still represents a small share of global natural gas production, but it opens the door to buyers willing to pay more than U.S. markets.

LNG Canada is expected to export a meaningful share of Canada’s natural gas when fully operational. Statistics Canada reports that Canada already contributes to global LNG exports, and that contribution is poised to rise as new facilities come online.

Higher returns have encouraged more development in the Montney region, which produces more than half of Canada’s natural gas. A growing share now goes directly to LNG Canada.

Canadian LNG projects have lower estimated break-even costs than several U.S. or Mexican facilities. That gives Canada a cost advantage in Asia, where LNG demand continues to grow.

Asian LNG prices are higher because major buyers such as Japan and South Korea lack domestic natural gas and rely heavily on imports tied to global price benchmarks. In June 2025, LNG in East Asia sold well above Canadian break-even levels. This price difference, combined with Canada’s competitive costs, gives exporters strong margins compared with sales into North American markets.

The International Energy Agency expects global LNG exports to rise significantly by 2030 as Europe replaces Russian pipeline gas and Asian economies increase their LNG use. Canada is entering the global market at the right time, which strengthens the case for expanding LNG capacity.

As Canadian and U.S. LNG exports grow, North American supply will tighten and local prices will rise. Higher domestic prices will raise revenues and shrink the discount that drains billions from Canada’s economy.

Canada loses more than $20 billion a year because of an estimated $20-per-barrel discount on oil and about $2 per gigajoule on natural gas, according to the Frontier Centre for Public Policy’s energy discount tracker. Those losses appear directly in public budgets. Higher natural gas revenues help fund provincial services, health care, infrastructure and Indigenous revenue-sharing agreements that rely on resource income.

Canada is already seeing early gains from selling more natural gas into global markets. Government support for more pipelines and LNG export capacity would build on those gains and lift GDP and incomes. Ottawa’s job is straightforward. Let the industry reach the markets willing to pay.

Ian Madsen is a senior policy analyst at the Frontier Centre for Public Policy.

-

Bruce Dowbiggin1 day ago

Bruce Dowbiggin1 day agoWayne Gretzky’s Terrible, Awful Week.. And Soccer/ Football.

-

Business1 day ago

Business1 day agoCanada invests $34 million in Chinese drones now considered to be ‘high security risks’

-

Opinion2 days ago

Opinion2 days agoThe day the ‘King of rock ‘n’ roll saved the Arizona memorial

-

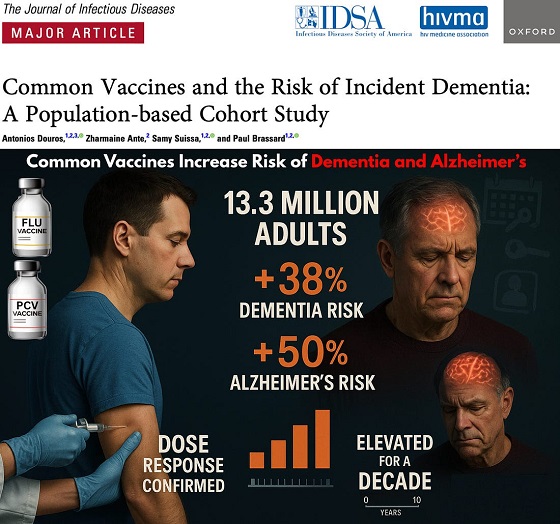

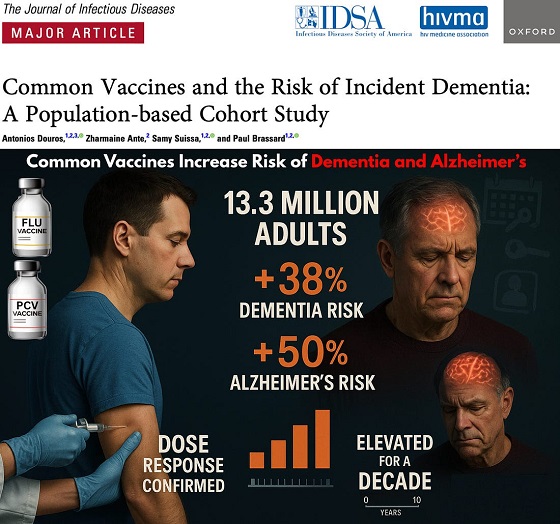

Focal Points2 days ago

Focal Points2 days agoCommon Vaccines Linked to 38-50% Increased Risk of Dementia and Alzheimer’s

-

espionage1 day ago

espionage1 day agoWestern Campuses Help Build China’s Digital Dragnet With U.S. Tax Funds, Study Warns

-

Health1 day ago

Health1 day agoCDC Vaccine Panel Votes to End Universal Hep B Vaccine for Newborns

-

Agriculture1 day ago

Agriculture1 day agoCanada’s air quality among the best in the world

-

Business1 day ago

Business1 day agoThe EU Insists Its X Fine Isn’t About Censorship. Here’s Why It Is.