Business

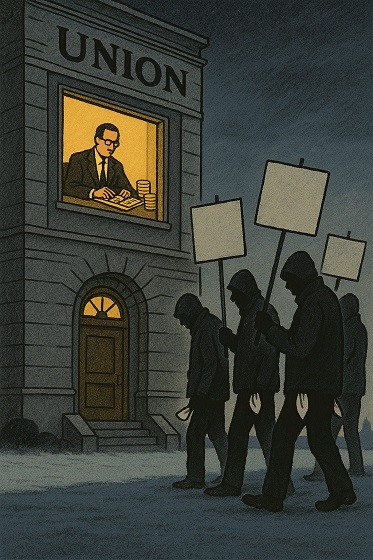

Trump wants to reduce regulations—everyone should help him

From the Fraser Institute

President Trump has made deregulation a priority and charged Elon Musk’s Department of Government Efficiency with suggesting ways to cut red tape. Some progressives are cautiously supportive of deregulation. More should be.

From Jimmy Carter to Sen. Ted Kennedy (D-Mass.), progressives once saw the wisdom of cutting red tape — especially if that tape tied the hands of consumers and would-be competitors in order to privilege industry insiders.

After the election, Sen. John Fetterman’s (D-Pa.) former chief of staff, Adam Jentleson, encouraged Democrats to embrace “supply-side progressivism,” calling for “limited deregulation that advances liberal policy goals.” He pointed to successful Democratic candidates like Marie Gluesenkamp Perez (D-Wash.) and Jared Golden (D-Maine), both of whom have raised the alarm about overregulation.

Vice President Kamala Harris recognized that the regulatory state sometimes hurts those whom it is supposed to help. In campaign proposals to address the housing crisis, she vowed to “take down barriers and cut red tape, including at the state and local levels.”

Cautious Democratic support for deregulation may surprise those who think only of the Sen. Elizabeth Warren (D-Mass.) approach. Warren once claimed that “deregulation” was “just a code word for ‘let the rich guys do whatever they want.’”

In reality, regulations often help the rich guys at the expense of consumers and fair competition. New Deal regulations, for example, forced prices up in more than 500 industries, causing consumers to pay more for necessities like food and clothing when a quarter of the workforce was unemployed. Economists have documented similar price-raising regulation in agricultural, finance and urban transportation. In other cases, regulations require customers to buy certain products such as health insurance. Licensing rules protect incumbent service providers in hundreds of occupations despite little evidence that they protect consumers from harm.

More subtly, regulations can protect industry insiders by limiting the quantity of available services. State certificate-of-need laws in health care, for example, limit dozens of medical services in two-thirds of states, raising prices, throttling access, and undermining the quality of care.

That’s one reason why Rhode Island’s Democratic governor wants to reform his state’s certificate-of-need laws.

If you don’t believe that regulations protect big businesses instead of their customers, take a closer look at how firms lobby. In 2012, the National Electrical Manufacturers Association lobbied to maintain a ban on incandescent light bulbs. Why? Because it raised the costs of smaller, rival firms that specialized in making the cheaper bulbs. Local car dealerships lobby to preserve state restrictions on direct car sales, which limit potential competitors that sell online.

In international comparisons, researchers find that heavier regulatory burdens depress productivity growth and contribute to income inequality.

In the U.S., the accumulation of regulations between 1980 and 2012 is estimated to have reduced income per person by about $13,000. Since low-income households tend to spend a greater share of their incomes on highly regulated products, they bear the heaviest burden.

Progressives can help break the symbiotic relationship between special interests and overregulation. Indeed, they’ve often been the first to identify the problem.

Writing a century ago in his book “The New Freedom,” President Woodrow Wilson warned that “regulatory capture” would grow as government itself grew: “If the government is to tell big businessmen how to run their business, then don’t you see that big businessmen have to get closer to the government even than they are now? Don’t you see that they must capture the government, in order not to be restrained too much by it?”

The capture Wilson warned of took root. By the early 1970s, progressive consumer advocates Mark Green and Ralph Nader were noting that “regulated industries are often in clear control of the regulatory process.” The problem was so acute that President Jimmy Carter tapped economist Alfred Kahn to do something about it.

In his research, Kahn meticulously showed that when “a [regulatory] commission is responsible for the performance of an industry, it is under never completely escapable pressure to protect the health of the companies it regulates.” As head of the Civil Aeronautics Board, Kahn moved to dismantle regulations that sustained anti-consumer airline cartels. Then he helped abolish the board altogether.

Liberals such as Nader and the late Sen. Ted Kennedy (D-Mass.) supported the move. Kennedy’s top committee lawyer, future Supreme Court Justice Stephen Breyer, later noted that the only ones opposed to deregulation were regulators and industry executives.

Their reform efforts unleashed competitive forces in aviation that had previously been impossible, opening up airline routes, lowering fares and increasing options for consumers.

It’s an embarrassing truth for both Democrats and Republicans that none of Carter’s successors, including Ronald Reagan, have pushed back as much as he did against the regulatory state.

Trump faces an uphill battle. He’ll stand a better chance if progressives acknowledge once again that lower-income Americans stand to gain from deregulation.

Business

Canada is failing dismally at our climate goals. We’re also ruining our economy.

From the Fraser Institute

By Annika Segelhorst and Elmira Aliakbari

Short-term climate pledges simply chase deadlines, not results

The annual meeting of the United Nations Conference of the Parties, or COP, which is dedicated to implementing international action on climate change, is now underway in Brazil. Like other signatories to the Paris Agreement, Canada is required to provide a progress update on our pledge to reduce greenhouse gas (GHG) emissions by 40 to 45 per cent below 2005 levels by 2030. After decades of massive government spending and heavy-handed regulations aimed at decarbonizing our economy, we’re far from achieving that goal. It’s time for Canada to move past arbitrary short-term goals and deadlines, and instead focus on more effective ways to support climate objectives.

Since signing the Paris Agreement in 2015, the federal government has introduced dozens of measures intended to reduce Canada’s carbon emissions, including more than $150 billion in “green economy” spending, the national carbon tax, the arbitrary cap on emissions imposed exclusively on the oil and gas sector, stronger energy efficiency requirements for buildings and automobiles, electric vehicle mandates, and stricter methane regulations for the oil and gas industry.

Recent estimates show that achieving the federal government’s target will impose significant costs on Canadians, including 164,000 job losses and a reduction in economic output of 6.2 per cent by 2030 (compared to a scenario where we don’t have these measures in place). For Canadian workers, this means losing $6,700 (each, on average) annually by 2030.

Yet even with all these costly measures, Canada will only achieve 57 per cent of its goal for emissions reductions. Several studies have already confirmed that Canada, despite massive green spending and heavy-handed regulations to decarbonize the economy over the past decade, remains off track to meet its 2030 emission reduction target.

And even if Canada somehow met its costly and stringent emission reduction target, the impact on the Earth’s climate would be minimal. Canada accounts for less than 2 per cent of global emissions, and that share is projected to fall as developing countries consume increasing quantities of energy to support rising living standards. In 2025, according to the International Energy Agency (IEA), emerging and developing economies are driving 80 per cent of the growth in global energy demand. Further, IEA projects that fossil fuels will remain foundational to the global energy mix for decades, especially in developing economies. This means that even if Canada were to aggressively pursue short-term emission reductions and all the economic costs it would imposes on Canadians, the overall climate results would be negligible.

Rather than focusing on arbitrary deadline-contingent pledges to reduce Canadian emissions, we should shift our focus to think about how we can lower global GHG emissions. A recent study showed that doubling Canada’s production of liquefied natural gas and exporting to Asia to displace an equivalent amount of coal could lower global GHG emissions by about 1.7 per cent or about 630 million tonnes of GHG emissions. For reference, that’s the equivalent to nearly 90 per cent of Canada’s annual GHG emissions. This type of approach reflects Canada’s existing strength as an energy producer and would address the fastest-growing sources of emissions, namely developing countries.

As the 2030 deadline grows closer, even top climate advocates are starting to emphasize a more pragmatic approach to climate action. In a recent memo, Bill Gates warned that unfounded climate pessimism “is causing much of the climate community to focus too much on near-term emissions goals, and it’s diverting resources from the most effective things we should be doing to improve life in a warming world.” Even within the federal ministry of Environment and Climate Change, the tone is shifting. Despite the 2030 emissions goal having been a hallmark of Canadian climate policy in recent years, in a recent interview, Minister Julie Dabrusin declined to affirm that the 2030 targets remain feasible.

Instead of scrambling to satisfy short-term national emissions limits, governments in Canada should prioritize strategies that will reduce global emissions where they’re growing the fastest.

Elmira Aliakbari

Artificial Intelligence

Lawsuit Claims Google Secretly Used Gemini AI to Scan Private Gmail and Chat Data

Whether the claims are true or not, privacy in Google’s universe has long been less a right than a nostalgic illusion.

|

When Google flipped a digital switch in October 2025, few users noticed anything unusual.

Gmail loaded as usual, Chat messages zipped across screens, and Meet calls continued without interruption.

Yet, according to a new class action lawsuit, something significant had changed beneath the surface.

We obtained a copy of the lawsuit for you here.

Plaintiffs claim that Google silently activated its artificial intelligence system, Gemini, across its communication platforms, turning private conversations into raw material for machine analysis.

The lawsuit, filed by Thomas Thele and Melo Porter, describes a scenario that reads like a breach of trust.

It accuses Google of enabling Gemini to “access and exploit the entire recorded history of its users’ private communications, including literally every email and attachment sent and received.”

The filing argues that the company’s conduct “violates its users’ reasonable expectations of privacy.”

Until early October, Gemini’s data processing was supposedly available only to those who opted in.

Then, the plaintiffs claim, Google “turned it on for everyone by default,” allowing the system to mine the contents of emails, attachments, and conversations across Gmail, Chat, and Meet.

The complaint points to a particular line in Google’s settings, “When you turn this setting on, you agree,” as misleading, since the feature “had already been switched on.”

This, according to the filing, represents a deliberate misdirection designed to create the illusion of consent where none existed.

There is a certain irony woven through the outrage. For all the noise about privacy, most users long ago accepted the quiet trade that powers Google’s empire.

They search, share, and store their digital lives inside Google’s ecosystem, knowing the company thrives on data.

The lawsuit may sound shocking, but for many, it simply exposes what has been implicit all along: if you live in Google’s world, privacy has already been priced into the convenience.

Thele warns that Gemini’s access could expose “financial information and records, employment information and records, religious affiliations and activities, political affiliations and activities, medical care and records, the identities of his family, friends, and other contacts, social habits and activities, eating habits, shopping habits, exercise habits, [and] the extent to which he is involved in the activities of his children.”

In other words, the system’s reach, if the allegations prove true, could extend into nearly every aspect of a user’s personal life.

The plaintiffs argue that Gemini’s analytical capabilities allow Google to “cross-reference and conduct unlimited analysis toward unmerited, improper, and monetizable insights” about users’ private relationships and behaviors.

The complaint brands the company’s actions as “deceptive and unethical,” claiming Google “surreptitiously turned on this AI tracking ‘feature’ without informing or obtaining the consent of Plaintiffs and Class Members.” Such conduct, it says, is “highly offensive” and “defies social norms.”

The case invokes a formidable set of statutes, including the California Invasion of Privacy Act, the California Computer Data Access and Fraud Act, the Stored Communications Act, and California’s constitutional right to privacy.

Google is yet to comment on the filing.

|

|

|

|

Reclaim The Net is reader-supported. Consider becoming a paid subscriber.

|

|

|

|

-

Alberta1 day ago

Alberta1 day agoAlberta on right path to better health care

-

Crime1 day ago

Crime1 day ago‘Modern-Day Escobar’: U.S. Says Former Canadian Olympian Ran Cocaine Pipeline with Cartel Protection and a Corrupt Toronto Lawyer

-

Great Reset2 days ago

Great Reset2 days agoAre climate-obsessed elites losing their grip over global politics?

-

Business18 hours ago

Business18 hours agoCanada is failing dismally at our climate goals. We’re also ruining our economy.

-

Daily Caller2 days ago

Daily Caller2 days agoDemocrats Explicitly Tell Spy Agencies, Military To Disobey Trump

-

Alberta1 day ago

Alberta1 day agoAlberta Emergency Alert test – Wednesday at 1:55 PM

-

Business2 days ago

Business2 days agoNearly One-Quarter of Consumer-Goods Firms Preparing to Exit Canada, Industry CEO Warns Parliament

-

Daily Caller2 days ago

Daily Caller2 days agoALAN DERSHOWITZ: Can Trump Legally Send Troops Into Our Cities? The Answer Is ‘Wishy-Washy’