From The Center Square

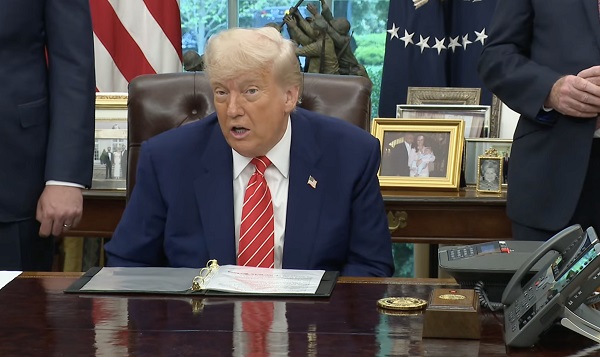

President Donald Trump threatened fresh tariffs on the European Union and iPhone maker Apple on Friday, prompting a sell-off on Wall Street.

Trump said trade talks with the European Union, which represents 27 nations, are “going nowhere.” The president said he was recommending a 50% tariff on imported goods from the EU starting June 1.

“The European Union, which was formed for the primary purpose of taking advantage of the United States on TRADE, has been very difficult to deal with,” Trump wrote on Truth Social. “Their powerful Trade Barriers, Vat Taxes, ridiculous Corporate Penalties, Non-Monetary Trade Barriers, Monetary Manipulations, unfair and unjustified lawsuits against Americans Companies, and more, have led to a Trade Deficit with the U.S. of more than $250,000,000 a year, a number which is totally unacceptable.”

The U.S. is the EU’s largest trading partner, buying 21% of the block’s exports, according to EU data.

Trump announced a slate of higher reciprocal tariffs on dozens of nations April 2. Seven days later, he suspended those higher rates for 90 days to give his trade team time to make deals. Since then, Trump signed two deals, a starter deal with the United Kingdom and temporary truce with China. The president has kept a 10% baseline tariff on all imports as talks continue. Goods from China face 30% import duties.

Trump said Friday that talks with the EU had stalled.

“Our discussions with them are going nowhere! Therefore, I am recommending a straight 50% Tariff on the European Union, starting on June 1, 2025,” he wrote on Truth Social. “There is no Tariff if the product is built or manufactured in the United States.”

Trump also threatened 25% tariffs on Apple, calling out the company’s CEO in a Truth Social post.

“I have long ago informed Tim Cook of Apple that I expect their iPhone’s that will be sold in the United States of America will be manufactured and built in the United States, not India, or anyplace else,” Trump wrote. “If that is not the case, a Tariff of at least 25% must be paid by Apple to the U.S.”

Trump has made tariffs the centerpiece of his foreign policy agenda during his second term. His on-again, off-again approach has frequently sent markets up and down with little notice, to the chagrin of those looking for stability in stocks.

Some business groups, including the U.S. Chamber of Commerce, have asked Trump to avoid tariff threats and work toward more free-trade agreements.

Trump’s focus on tariffs comes after years of inflation that frustrated American consumers and helped bring Trump back to the White for a second term. However, economists have warned that tariffs could push up prices for consumers.

Trump has said he wants to use tariffs to restore manufacturing jobs lost to lower-wage countries in decades past, shift the tax burden away from U.S. families, and pay down the national debt.

A tariff is a tax on imported goods. The importer pays the tax and can either absorb the cost or pass the cost on to consumers through higher prices.