From The Center Square

President Donald Trump told Congress on Tuesday that tariffs would make America rich again, but predicted minor “disturbances” on the path ahead.

Trump said he would put reciprocal tariffs on foreign countries starting April 2.

“Whatever they tariff us, we tariff them. Whatever they tax us, we tax them,” Trump said. “If they do non-monetary tariffs to keep us out of their market, then we do non-monetary barriers to keep them out of our market. We will take in trillions of dollars and create jobs like we have never seen before.”

Trump didn’t detail the potential disturbance in his speech, but economists and business groups have raised concerns about higher prices for U.S. consumers.

Trump also promised Congress would balance the federal budget and reduce taxes. Making good on those promises could come with challenges.

Trump previously said he wants a balanced budget, but his promise to extend the tax cuts in the 2017 Tax Cuts and Jobs Act could make that difficult for both the House and Senate. Extending the tax rates could cost about $4 trillion in federal revenue, independent groups say.

In the past 50 years, the federal government has ended with a fiscal year-end budget surplus four times, most recently in 2001. Congress has run a deficit every year since then.

During his inauguration, Trump touted the benefits of tariffs. He said tariff revenue would make the U.S. “rich as hell ” and lower the tax burden on American taxpayers.

Trump’s comments Tuesday before a joint session of Congress came after he put 25% tariffs on Mexico and Canada and added an additional 10% duty on imports from China. He has said he plans to keep those tariffs in place until Mexico and Canada stop illegal immigration and drug trafficking at the U.S. borders.

The tariffs spooked investors on Wall Street, causing a second day of market losses Tuesday. Consumers and economists have raised concerns about higher prices on a wide range of products as a result of the tariffs.

Tariffs are taxes on imported goods paid by the importer, which are often passed along to consumers through higher prices on the imported products.

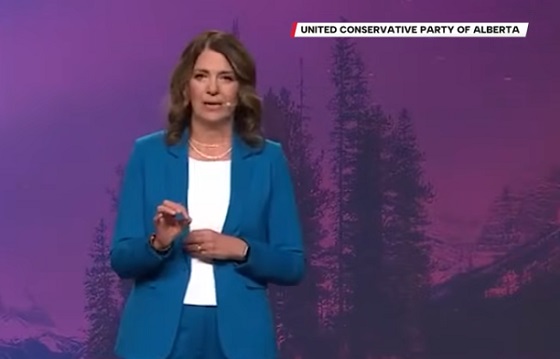

Canada responded with plans to put 25% tariffs on nearly $100 billion of U.S. imports. Mexico said it would retaliate with moves to be announced Sunday. China filed a complaint with the World Trade Organization.

The U.S. Chamber of Commerce and the American Farm Bureau Federation called on Trump to change course on tariffs.

Later Tuesday, Commerce Secretary Howard Lutnick said Trump could announce trade compromises with Canada and Mexico as soon as Wednesday.