Business

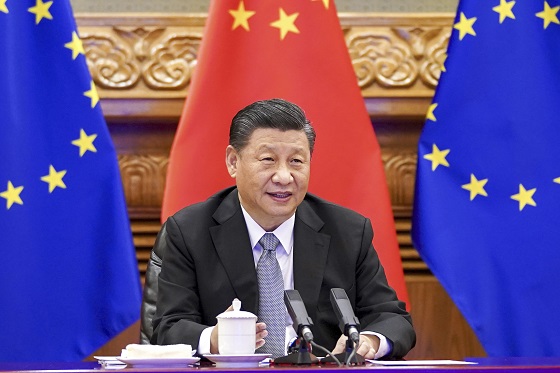

Trump: China’s tariffs to “come down substantially” after negotiations with Xi

MxM News

MxM News

Quick Hit:

President Trump said the 145% tariff rate on Chinese imports will drop significantly once a deal is struck with Chinese President Xi Jinping, expressing confidence that a new agreement is on the horizon.

Key Details:

- Trump said the current 145% tariff rate on China “won’t be anywhere near that high” after negotiations.

- He pointed to his relationship with Xi Jinping as a reason for optimism.

- The White House said it is preparing the groundwork for a deal, and Treasury officials expect a “de-escalation” of the trade war.

Diving Deeper:

President Donald Trump on Tuesday told reporters that the steep tariff rate currently imposed on Chinese imports will come down substantially after his administration finalizes a new trade deal with Chinese President Xi Jinping. While the current level stands at 145%, Trump made clear that number was temporary and would be adjusted following talks with Beijing.

“145 percent is very high. It won’t be that high, it’s not going to be that high … it won’t be anywhere near that high,” Trump said from the Oval Office, signaling a shift once a bilateral agreement is reached. “It will come down substantially, but it won’t be zero.”

The tariff, which Trump previously described as “reciprocal,” was maintained on China even after he delayed similar penalties on other trading partners. Those were cut to 10% and paused for 90 days to allow room for further negotiation.

“We’re going to be very nice. They’re going to be very nice, and we’ll see what happens. But ultimately, they have to make a deal because otherwise they’re not going to be able to deal in the United States,” Trump said, reinforcing his view that the U.S. holds the leverage.

Trump’s remarks come as markets remain wary of ongoing trade tensions, though the White House signaled progress, saying it is “setting the stage for a deal with China.” The president cited his personal rapport with Xi Jinping as a key factor in his confidence that an agreement can be reached.

“China was taking us for a ride, and it’s not going to happen,” Trump said. “They would make billions a year off us and build up their military with our money. That’s over. But we’ll still be good to China, and I think we’ll work together.”

Treasury Secretary Scott Bessent also said Tuesday that he expects a cooling of trade hostilities between the two nations, according to several reports from a private meeting with investors.

As the 90-day pause on other reciprocal tariffs nears its end, Trump emphasized that his team is prepared to finalize deals quickly. “We’ve been in talks with many, many world leaders,” he said, expressing confidence that talks will “go pretty quickly.”

White House Press Secretary Karoline Leavitt added that the administration has received 18 formal proposals from other countries engaged in trade negotiations, another sign that momentum is building behind Trump’s broader push to restructure global trade in favor of American workers and businesses.

(Li Xueren/Xinhua via AP)

Business

Federal major projects list raises questions

From Resource Works

Once more, we have to shake our collective heads at the (typical) lack of information from the government after the fanfare of announcements, news releases, and video clips.

Prime Minister Mark Carney’s addition of seven new projects to the Major Projects Office (MPO) list of ventures to be accelerated came with a vague promise from the MPO.

Now, said the MPO, it will “work with proponents, provinces, territories and Indigenous Peoples to find the right way forward for these projects.”

The new projects include the Nisga’a Nation’s Ksi Lisims LNG project in BC (and its PRGT pipeline), BC Hydro’s North Coast Transmission Line (NCTL) and the related “Northwest Critical Conservation Corridor,” plus mining projects in Ontario, Quebec and New Brunswick, and an Inuit-owned hydro project near Iqaluit in Nunavut.

In all, a federal news release said, Carney’s announcements “represent more than $56 billion in new investment.” That’s in addition to “$60 billion for investments in nuclear power, LNG, critical minerals, and new trade corridors” that were announced in September.

Carney said: “Unlocking these resources . . . will attract hundreds of billions of dollars in new investment and create thousands of high-paying careers for miners, carpenters, and engineers across the country.”

And it’s all aimed at reducing Canada’s dependence on trade with the U.S. As journalist Thomas Seal of Bloomberg News noted: “The country sells 75% of its goods to the US and projects on the list so far aim to help change that: port developments to ramp up trade with Europe, LNG terminals to sell gas to Asia, and mines to exploit global demand for critical minerals.”

But what does “fast-track” actually mean?

Carney’s Terrace, B.C. announcement raised a so-far unanswered question: What will the addition of these projects to the federal fast-track list mean in practice?

What can, or will, Ottawa actually do to support these projects and help bring them to fruition?

Carney gave no details, but federal officials say the Major Projects Office will coordinate approvals for all components of the projects to accelerate timelines that could otherwise take years.

The MPO is supposed to fast-track resource and infrastructure projects deemed to be “in the national interest.” The new projects have not yet been designated as “in the national interest,” which would qualify them for special treatment in permitting and approvals. Instead, Carney and the MPO used the words “national importance” and “national significance.”

And some of the projects Carney announced are already in progress, and it’s not clear what the MPO could do to move them along.

Does Ottawa plan to give the projects financial support?

The prime minister spoke of Ottawa putting up “huge financing” but, again, gave no further information.

As he listed the additions to the MPO project list, though, the Canada Infrastructure Bank announced a $139.5-million loan to BC Hydro to support “the early works phase” of the NCTL power line.

Does Ottawa see a role for the MPO in negotiating with First Nations and Indigenous peoples that are opposed to one or more of the projects?

PM Carney: “Referring to the MPO, or the Major Projects Office, does not mean the project is approved. It means that all the efforts are being put in place from the federal government in order to create the conditions so it could move forward. But those decisions are taken by many parties, including, very much, First Nations.”

The prime minister’s announcement was the first since the appointment of an Indigenous advisory council that is to help the MPO integrate the United Nations Declaration on the Rights of Indigenous Peoples, UNDRIP, into its decision-making.

Carney added that the “huge financing” he promised is aimed at encouraging Indigenous equity ownership of the projects.

Alex Grzybowski, CEO of the Indigenous organization K’uul Power, sees the North Coast Transmission Line as “a pretty solid investment,” but says First Nations would need to raise $275-$300 million to take equity shares in it.

To help First Nations get there, he calls on Ottawa to provide an investment tax credit, to increase the lending cap of the Canada Infrastructure Bank to $300 million from $100 million, and to provide “a federal loan-guarantee with a provincial backstop.”

Ksi Lisims LNG project

Ksi Lisims LNG is coming from a partnership of the Nisga’a Nation, Rockies LNG Ltd. Partnership and Western LNG.

The $10-billion project in northern BC would have two floating production platforms, producing for export 12 million tonnes of LNG per year. Natural gas for Ksi Lisims would come more than 750 km through the PRGT pipeline.

Ksi Lisims LNG says it hopes for construction to begin this year, with operations to start in late 2028 or 2029. It says it aims to be “net-zero ready” by 2030.

Charles Morven, secretary-treasurer for the Nisga’a Nation, said: “A lot of major work has taken place in the past five years, getting everything put together. This announcement gets us so very close to the finish line.”

And Eva Clayton, Nisga’a president, said: “We’re showing BC, Canada, and the world what Indigenous economic independence and shared prosperity can look like.” She spoke of “meaningful opportunities” for the Nisga’a — and for all Nations and communities in northern BC.

The Nisga’a Nation, a partner in Ksi Lisims LNG and its PRGT pipeline, says it is working with Indigenous communities to strike agreements, including equity stakes in the pipeline. A final investment decision on Ksi Lisims is expected early next year.

Environmental groups have also opposed the Ksi Lisims project, and the Union of BC Indian Chiefs cited environmental and climate concerns. But Carney said Ksi Lisims LNG will be one of the world’s cleanest operations, with emissions 94 per cent below the global average.

And the Nisga’a Nation said: “With our co-developers and Treaty Partners we will ensure this project reflects . . . our high standards of environmental protection.”

The prime minister said Ksi Lisims LNG will add $4 billion a year to the nation’s economy. And federal officials say Ksi Lisims could create thousands of skilled jobs, with Indigenous workers among them.

Said Carney: “LNG is an essential fuel for the energy transition. LNG can help Canada build new trading relationships, especially in fast growing markets in Asia. . . .

“Canada will be ready. We’re home to the world’s fourth largest reserves of natural gas, and we have the potential to supply up to 100 million tons annually of new LNG exports to Asia.”

And his announcement led the Canadian Association of Petroleum Producers to say: “Canada is on a path to become one of the top five LNG exporters in the world.”

North Coast Transmission Line

The 450-km North Coast Transmission Line from Prince George to Terrace would feed clean hydro power to LNG projects such as LNG Canada and the Haisla Nation’s coming Cedar LNG project, and it would also power mining projects and regional communities.

Carney said the power line could eventually connect with Alberta and support reliability, clean power development and new industrial investment across the West. Carney also spoke the potential for a northwest trade and energy corridor running from British Columbia through the Yukon with future possibilities for connection into Alberta. But, again, he gave no details of any plans.

Later, BC Premier David Eby called the NCTL “one of the biggest, most transformational opportunities” in a century. BC says the power line “will be co-owned with First Nations and will provide BC’s 98% renewable energy to the northwest.”

The BC government says the next major steps for the NCTL include finalizing the route. It says construction is expected to start in the summer of 2026, with phased-in completion targeted for 2032-34.

BC legislation would allow First Nations equity in the project and the province also says it plans to direct the B.C. Utilities Commission to allow the project to proceed without needing to go through the usual hearing process, potentially cutting a year to 18 months off the completion date.

To help First Nations acquire equity in the NCTL, Alex Grzybowski, CEO of Indigenous K’uul Power, says three things are needed from government:

“The first and most valuable thing they could do is provide an investment tax credit. And actually that wouldn’t hit their books for six years, so from an immediate financing perspective, that might be the best. . . .

“The next best thing would be to increase the lending cap for the Canada Infrastructure Bank from $100 million to $300 million, and then we would be borrowing money at below Bank of Canada rates, and we would be able to lend that money into construction, which would lower the cost of construction, it would lower the cost for the ratepayers, and it would increase the benefits for the First Nations. . . .

“The third thing they could do is provide a federal loan guarantee with a provincial backstop.”

BC says the NCTL project is expected to create some 9,700 direct full-time jobs, contribute nearly $10 billion per year to GDP and generate approximately $950 million a year in revenues for provincial and municipal governments. BC says it will also help prevent two to three million tonnes of carbon emissions a year.

The NCTL power-line plan also raises key questions, including this: How will BC Hydro come up with the new power to feed into the line? We have seen estimates such as this: “By 2050, BC may need to double or triple its . . . power generation as transportation, buildings and industry are all or partially electrified. Current output is generated with 32 hydro dams. Can the province build another 32 or 64 hydro plants in under 30 years? Of course not, so where will all that power come from?”

And what will NCTL cost? The first estimate from BC Hydro is $6 billion, but Hydro’s costs for the Site C power dam finished up at twice what it initially estimated.

A cautious shift from past policies

Once more, we have to shake our collective heads at the (typical) lack of information from the government after the fanfare of announcements, news releases, and video clips.

We naturally wonder if Ottawa’s promises will be matched by performance, but at least we see some much-needed departure from the anti-project policies of the past Justin Trudeau government.

As CEO François Poirier of TC Energy puts it: “The policy environment is becoming increasingly supportive.”

Heather Exner-Pirot of the Macdonald-Laurier Institute says the new Carney budget shows signs of a better mix of “carrot and stick” than did the Trudeau government. “The last budget was still in the ‘stick’ era. Finally, we’re in a ‘carrot’ era.”

And she adds: “At least under this government, the bad things have stopped happening. And I would say, even with this budget, some of the bad things are actually going away.”

Let us hope so.

Photo credit to the THE CANADIAN PRESS/Sean Kilpatrick.

Business

Blacked-Out Democracy: The Stellantis Deal Ottawa Won’t Show Its Own MPs

This isn’t just bureaucracy. This is a culture. A culture where global corporations and senior officials act as partners managing public information, while Parliament and citizens are treated like security risks to be managed.

Bureaucrats hid key terms of a $15-billion deal, blamed “confidentiality,” and Stellantis couldn’t even get its internet working to face MPs.

The most powerful people in Canada’s federal bureaucracy walked into a parliamentary committee this week and calmly admitted something that should make every taxpayer’s blood run cold:

When Parliament ordered them to hand over an unredacted copy of a multibillion-dollar contract with Stellantis, they didn’t obey Parliament.

They obeyed Stellantis.

This was the Standing Committee on Government Operations and Estimates (OGGO), meeting on the government’s response to a motion demanding the contracts between Canada and Stellantis for the Brampton Assembly plant. What unfolded over roughly two hours was not just a hearing. It was a live demonstration of who actually runs this country’s industrial policy: not elected MPs, not citizens, but a cozy alliance of bureaucrats and a global automaker hiding behind a black marker and a “confidentiality clause.”

And just to put a bow on the contempt: Stellantis itself didn’t even show up. We were told they had “IT issues.”

A company that builds electric vehicles and advanced manufacturing platforms apparently can’t figure out how to join a parliamentary Zoom call.

Sure.

From the start, Deputy Minister Philip Jennings of Industry Canada came in with one objective: defend the redactions.

His opening remarks were drenched in the usual Ottawa flattery. He told MPs their oversight role was “vital,” that accountability “maintains public trust,” that transparency is “important.” All the right words. Then he immediately pivoted to why they had blacked out chunks of the Stellantis–Brampton contribution agreement and why MPs, and by extension Canadians, should accept it.

He warned that some information is “commercially confidential,” that releasing it could cause “significant damage” in a “highly competitive” auto sector. He lumped in aerospace, AI, and other “knowledge-based sectors” just in case anyone missed the buzzwords. If companies couldn’t trust Ottawa to keep secrets, he said, future deals might be at risk.

So the stage was set: democracy on one side, “commercial sensitivity” on the other.

Jennings made it clear where his department chose to stand.

Conservative MP Kyle Seeback was one of the first to cut through the spin. He had actually read the documents. That’s already more than can be said for half of Ottawa on most days.

Seeback pointed out that another Strategic Innovation Fund agreement, number 810819553, had already been released under access to information and is now posted publicly on CBC’s website. That contract, same program, similar format, came out with limited redactions.

Meanwhile, the Stellantis agreement at issue – 813816251, which covers the Brampton deal – is being guarded like a state secret. Jennings insisted MPs could only see it in camera, with redactions, under strict rules: no phones, no recording devices, no notes leaving the room.

Seeback essentially asked the obvious: why is a journalist with an ATIP request allowed to see more than Parliament?

If a media outlet can obtain a contribution agreement and post it online for the entire world to download, how can the government stand there and claim that another, nearly identical contract is too sensitive for elected MPs to even discuss openly?

Jennings had no coherent answer. He kept repeating that he was only there to talk about “this” contract, that this particular agreement has “commercially confidential” elements that must be protected, that they were following a “balanced” approach used in past parliaments.

It didn’t wash. Seeback hammered the absurd logic:

Either the whole contract is commercially confidential, or it isn’t. The department itself had only redacted specific parts. It admitted that the entire document is not some sacred secret. Yet Jennings still insisted Parliament can only discuss it behind closed doors, while an access-to-information process might eventually dribble out the same text with similar or fewer black bars.

In other words: under this department’s logic, an ATIP officer and a CBC editor end up with more practical freedom to handle these documents than Canada’s elected representatives.

If that doesn’t tell you who this system was built to serve, nothing will.

Subscribe to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

It got worse.

Conservative MP Jeremy Patzer went right at the heart of the matter: who actually wielded the metaphorical Sharpie?

“Are you the one responsible for the redactions?” he asked Jennings.

“No,” said the Deputy Minister.

So who was?

Jennings admitted that his team had “direct discussions with Stellantis.” Ultimately, he said, Stellantis had to agree to what they were “willing to have” shared with the committee, even in camera. The company insisted the documents only be shared in closed doors, and that condition shaped what MPs received and how they could view it.

Let that sink in: Parliament ordered unredacted documents. Stellantis told the department what it was “willing” to allow Parliament to see. The department complied.

Patzer reminded Jennings that OGGO had passed a motion for fully unredacted documents and that previous committees in earlier Parliaments had managed to view contracts in camera without this kind of corporate veto. He asked what gave the department the authority to ignore Parliament’s order.

Jennings invoked clause 16.1 of the contract, a confidentiality provision. He claimed Canada had a “contractual obligation” to protect Stellantis’ information and that he didn’t want to “breach the contract.”

So Patzer turned to the law clerk.

Does clause 16.1 supersede Parliament?

The law clerk’s answer was blunt: no. Confidentiality clauses do not override Parliament’s power to compel documents. The same way they don’t trump a court order.

There it was, spelled out on the record: nothing in the contract legally prevented the department from giving MPs exactly what they asked for. The cover-up was a choice.

Bloc Québécois MP Marie-Hélène Gaudreau cut through the legal fog with the kind of language normal people understand.

“Who’s the boss?” she asked. “Is it democracy, is it the government, or is it the company?”

She reminded everyone that MPs were elected to oversee public money – not to sit politely while a multinational corporation decides which parts of a taxpayer-funded contract Parliament is allowed to see. She recalled the WE Charity affair, when MPs were forced to review sensitive documents in a locked-down room with no phones, no staff, no notes. That was considered acceptable and workable then. Why not now?

She pressed Jennings on why he had never even asked Stellantis if the full contract could be shared in camera. He admitted they didn’t raise that option with the company at all.

So Parliament asked for everything. The department didn’t even test the limits of what the corporate partner might accept. It simply defaulted to the company’s comfort zone.

Later, as Stellantis continued to “struggle” with its connection, Gaudreau’s frustration boiled over. She stated plainly that a corporation of this size, working at the cutting edge of EV technology, claiming to have internet issues for over an hour was unbelievable. She asked the clerk what the committee could do. The answer: they can summon the company. If Stellantis ignores a summons, it can be referred to the House as a breach of privilege.

Gaudreau ended one of her interventions with a warning directly into the microphone: “Stellantis, if you’re listening to me, we’re waiting for you. If not, we will summon you.”

They were listening. They just weren’t coming.

The sheer number of absurd redactions was another scandal inside the scandal.

Seeback pointed out that provincial funding “envelopes” were partially blacked out. The total dollar figures were visible, but the specific provincial programs providing money were removed – even though those programs are already public and appear in provincial budgets and estimates.

How is the name of an existing public program “commercially sensitive”?

No answer that wasn’t insulting.

Whole schedules of work – the detailed project plans that are supposed to be the core accountability tool in a multi-billion-dollar deal – were fully blacked out. Every word. Conservative MP Tamara Jansen called that out as creating “the appearance of a deliberate cover-up.” No one watching needed a law degree to see she was right.

Conservative MP Vincent Niel Ho drilled into section 6.35, the part that details Stellantis’ legally binding R&D commitments in Canada. Those are the supposed returns on this enormous “investment” of taxpayer cash: research, innovation, jobs.

The exact R&D dollar amounts in that section?

Redacted.

So Canadians are told this deal will bring R&D investment. They’re told the commitments are legally binding. But the specific figures – the actual numbers that might allow someone to test whether the deal is remotely fair – are hidden. Meanwhile the boilerplate legal clauses, the governing law, the confidentiality language, all of that remains neatly visible.

When Ho asked why, Jennings refused to discuss the specifics in public, citing the company’s conditions. When pressed, he fell back again on the contract: under its terms, he said, Canada must consult Stellantis on any disclosure and treat information as confidential “unless the company is willing to share it.”

The interests of the Canadian public never seem to get that kind of deference.

Then there was the question of how many people inside government have actually seen this sacred, unredacted agreement that Parliament apparently cannot be trusted with.

Jennings acknowledged that only a small group at the department had read the full contract: the negotiation team, a few program officers, a couple of finance people. He estimated maybe four to six people beyond those sitting at the witness table. That makes perhaps eight to ten in total.

Notably absent from that list: the current minister. Jennings admitted she has not seen the fully unredacted contract, and that he himself hasn’t either. The agreement was negotiated under his predecessor, he said, and he “did not need to know.”

The Privy Council Office? Also likely in the dark. The law clerk? No. Parliament? Absolutely not.

So here is the structure: a tiny inner circle of unelected officials and their counterparts at Stellantis have full knowledge of how billions of public dollars are being deployed. The minister gets briefed selectively. The Prime Minister’s department isn’t fully looped in. Parliament is handed a blacked-out version and told to be grateful.

If that isn’t the definition of the swamp, what is?

Subscribe to The Opposition with Dan Knight .

For the full experience, upgrade your subscription.

The Liberal MPs on the committee did their best to provide cover without looking like they were providing cover.

Jenna Sudds, Karim Bardizzi, Vince Gasparro, Tim Watchorn, and Iqra Khalid all, in different ways, repeated the same talking points: the Strategic Innovation Fund is a great program; Canada is competing with the U.S. and Mexico; other jurisdictions also keep their deals secret; confidentiality is “standard”; and we must protect a vague thing called “competitiveness” or risk losing future investments.

Gasparro, in particular, leaned heavily into the foreign-investment argument. He asked whether other advanced economies would publish contracts like this. Jennings said that “by and large” they would not, and even went so far as to say that having less information in the public domain can be “a comparative advantage” for Canada.

So secrecy isn’t just tolerated. It is defended as a strategic tool.

What none of the Liberal MPs wanted to confront head-on was the core fact: Parliament ordered unredacted documents, and the department decided to obey a corporate confidentiality preference instead.

They expressed frustration that Stellantis wasn’t there. They lamented the move of Jeep Compass production to the United States. They talked about workers and communities. But when it came time to challenge the bureaucracy on why a private company was allowed to dictate what Parliament could see, their questions magically softened into process inquiries and philosophical musings about trust.

If you strip away the jargon and the procedural dance, this committee hearing revealed something very simple and very ugly.

A multinational corporation signed a contract with the Government of Canada for a massive subsidy deal.

That contract contained a confidentiality clause.

Parliament, the supposed supreme body in our constitutional system, ordered that contract to be produced without redactions.

The senior bureaucrat responsible for the file admitted:

He did not even ask the company if it would allow a full in-camera disclosure to MPs.

He let the company decide what was “commercially confidential.”

He allowed the company to set the conditions under which Parliament could see even a redacted version.

He invoked a contract clause that the law clerk plainly stated does not and cannot override Parliament’s powers.

He claimed he was trying to “balance” interests, but every time the balance had to be struck, it tilted toward Stellantis and away from transparency.

And while all of this was being dissected in real time, Stellantis itself allegedly couldn’t get on a video call.

Canadians were told to believe that a company sophisticated enough to negotiate billions in subsidies, design electric vehicle platforms, and build advanced manufacturing facilities somehow hit the one technological barrier it just couldn’t overcome: logging into a parliamentary committee.

This isn’t just bureaucracy. This is a culture. A culture where global corporations and senior officials act as partners managing public information, while Parliament and citizens are treated like security risks to be managed.

It is not an accident that the entire schedule of work is blacked out. It is not a fluke that R&D commitments are hidden. It is not a coincidence that the law clerk had to remind everyone that Parliament outranks a boilerplate confidentiality clause.

This is the system functioning exactly as it was built: to shield the details of massive public-private deals from the people paying for them, while everyone involved talks earnestly about “trust.”

Trust, in this case, has a very specific meaning: trust the bureaucrats, trust the company, trust the process.

Just don’t trust yourself with the truth.

-

International2 days ago

International2 days ago“The Largest Funder of Al-Shabaab Is the Minnesota Taxpayer”

-

Alberta2 days ago

Alberta2 days agoAlberta introducing dual practice health care model to increase options and shorten wait times while promising protection for publicly funded services

-

Business2 days ago

Business2 days agoUS Supreme Court may end ‘emergency’ tariffs, but that won’t stop the President

-

International1 day ago

International1 day agoBoris Johnson Urges Ukraine to Continue War

-

International2 days ago

International2 days agoBeijing’s blueprint for breaking Canada-U.S. unity

-

Great Reset1 day ago

Great Reset1 day agoRCMP veterans’ group promotes euthanasia presentation to members

-

espionage2 days ago

espionage2 days agoSoros family has been working with State Department for 50 years, WikiLeaks shows

-

Health16 hours ago

Health16 hours agoOrgan donation industry’s redefinitions of death threaten living people