Business

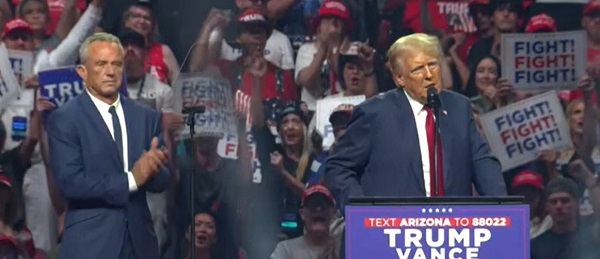

Trump And RFK Jr. To Save The Day For TikTok?

From the Daily Caller News Foundation

From the Daily Caller News Foundation

Of the many, many Biden-era policies that the new Trump administration is expected to reverse, it appears that the pending TikTok ban is high on the list.

After promising to save TikTok on the campaign trail, his spokeswoman last week confirmed that Trump’s plans to deliver. Since almost everyone — including Trump himself — as well as many companies utilize the technology, reeling in the ban is good politics and smart policy. Coincidentally, it is also consistent with the stance taken by President-elect Donald Trump’s pal and nominee to head the Department of Health and Human Services, Robert F. Kennedy Jr., whose populist and libertarian views will likely help shape Trump 2.0 even beyond the department.

Much like what has come to be known as Barack Obama’s “Facebook election” in 2008, the 2024 cycle might well be known as the “TikTok election.” Trump joined with Vice President Kamala Harris and candidates from federal to local levels in embracing the app unequivocally and successfully, quickly gaining millions of followers almost overnight. From rowdy rallies to ebullient encouragement from supporters in every part of the country and soundbites hitting at opponents and detractors, to the now-iconic dance moves, the Trump campaign made its way into the history books with a good deal of help from his TikTok content.

This was no accident. The president-elect and his campaign knew that connecting with young voters, especially those Gen-Z voters going to the polls for the first time, would be a critical part of the coalition that could return him to the White House. An NBC News poll taken last week showed that among first time voters, Trump’s support grew a whopping 22% from 2020 to 2024. As the Trump team recognized, these voters get their news and information largely from social media, and many from TikTok in particular, and little if any from traditional media outlets.

Back to RFK, Jr. As a key advisor and voice in Trump world, he has been a similarly strong advocate for protecting TikTok and undoing the legislation that now threatens to ban the app. Last Spring, Kennedy, with more than three million followers of his own, came out publicly against a ban and committed to filing a lawsuit to fight it.

In a post on X, Kennedy wrote: “Don’t be fooled — the TikTok ban is not about China harvesting your data. That’s a smoke screen. Intelligence agencies from lots of countries, especially ours, are harvesting your data from everywhere all the time. TikTok isn’t even majority Chinese-owned, and the company agreed to put its data behind a U.S. firewall. The Biden administration rejected that deal. Congress and the administration don’t understand that TikTok is an entrepreneurial platform for thousands of American young people. They want to screw them over just so they can pretend to be tough on China.”

The initial misinformation and propaganda against TikTok when the ban was first proposed came in heavy and hard, and many people initially bought it. Myself included. I thought, without having even logged on, TikTok was garbage (wrong) and admittedly I can be pretty gullible when it comes to suggestions of Chinese chicanery. Nobody’s perfect. But I digress.

The power of populism at this uniquely American moment is golden — an opportunity to give voices to the voiceless and an ear to those previously unheard. It is a good thing that both Trump and Kennedy understand that banning social media which is now a fact of American life, no matter what the app or the platform, is an attack on free speech and the populist power now driving American politics. Any politician still advocating for a TikTok ban is going against that populist sentiment and may want to re-think it — as even I have — lest they soon be looking for a new line of work.

Christian Josi is the founder and managing director of C. Josi & Company, a global communications and public affairs resource organization.

Business

Canada’s economic performance cratered after Ottawa pivoted to the ‘green’ economy

From the Fraser Institute

By Jason Clemens and Jake Fuss

There are ostensibly two approaches to economic growth from a government policy perspective. The first is to create the best environment possible for entrepreneurs, business owners and investors by ensuring effective government that only does what’s needed, maintains competitive taxes and reasonable regulations. It doesn’t try to pick winners and losers but rather introduces policies to create a positive environment for all businesses to succeed.

The alternative is for the government to take an active role in picking winners and losers through taxes, spending and regulations. The idea here is that a government can promote certain companies and industries (as part of a larger “industrial policy”) better than allowing the market—that is, individual entrepreneurs, businesses and investors—to make those decisions.

It’s never purely one or the other but governments tend to generally favour one approach. The Trudeau era represented a marked break from the consensus that existed for more than two decades prior. Trudeau’s Ottawa introduced a series of tax measures, spending initiatives and regulations to actively constrain the traditional energy sector while promoting what the government termed the “green” economy.

The scope and cost of the policies introduced to actively pick winners and losers is hard to imagine given its breadth. Direct spending on the “green” economy by the federal government increased from $600 million the year before Trudeau took office (2014/15) to $23.0 billion last year (2024/25).

Ottawa introduced regulations to make it harder to build traditional energy projects (Bill C-69), banned tankers carrying Canadian oil from the northwest coast of British Columbia (Bill C-48), proposed an emissions cap on the oil and gas sector, cancelled pipeline developments, mandated almost all new vehicles sold in Canada to be zero-emission by 2035, imposed new homebuilding regulations for energy efficiency, changed fuel standards, and the list goes on and on.

Despite the mountain of federal spending and regulations, which were augmented by additional spending and regulations by various provincial governments, the Canadian economy has not been transformed over the last decade, but we have suffered marked economic costs.

Consider the share of the total economy in 2014 linked with the “green” sector, a term used by Statistics Canada in its measurement of economic output, was 3.1 per cent. In 2023, the green economy represented 3.6 per cent of the Canadian economy, not even a full one-percentage point increase despite the spending and regulating.

And Ottawa’s initiatives did not deliver the green jobs promised. From 2014 to 2023, only 68,000 jobs were created in the entire green sector, and the sector now represents less than 2 per cent of total employment.

Canada’s economic performance cratered in line with this new approach to economic growth. Simply put, rather than delivering the promised prosperity, it delivered economic stagnation. Consider that Canadian living standards, as measured by per-person GDP, were lower as of the second quarter of 2025 compared to six years ago. In other words, we’re poorer today than we were six years ago. In contrast, U.S. per-person GDP grew by 11.0 per cent during the same period.

Median wages (midpoint where half of individuals earn more, and half earn less) in every Canadian province are now lower than comparable median wages in every U.S. state. Read that again—our richest provinces now have lower median wages than the poorest U.S. states.

A significant part of the explanation for Canada’s poor performance is the collapse of private business investment. Simply put, businesses didn’t invest much in Canada, particularly when compared to the United States, and this was all pre-Trump tariffs. Canada’s fundamentals and the general business environment were simply not conducive to private-sector investment.

These results stand in stark contrast to the prosperity enjoyed by Canadians during the Chrétien to Harper years when the focus wasn’t on Ottawa picking winners and losers but rather trying to establish the most competitive environment possible to attract and retain entrepreneurs, businesses, investors and high-skilled professionals. The policies that dominated this period are the antithesis of those in place now: balanced budgets, smaller but more effective government spending, lower and competitive taxes, and smart regulations.

As the Carney government prepares to present its first budget to the Canadian people, many questions remain about whether there will be a genuine break from the policies of the Trudeau government or whether it will simply be the same old same old but dressed up in new language and fancy terms. History clearly tells us that when governments try to pick winners and losers, the strategy doesn’t lead to prosperity but rather stagnation. Let’s all hope our new prime minister knows his history and has learned its lessons.

Business

Canadians paid $90 billion in government debt interest in 2024/25

From the Fraser Institute

By Jake Fuss, Tegan Hill and William Dunstan

Next week, the Carney government will table its long-awaited first budget. Earlier this year, Prime Minister Mark Carney launched a federal spending review to find $25 billion in savings by 2028. Even if the government meets this goal, it won’t be enough to eliminate the federal deficit—projected to reach as high as $92.2 billion in 2025/26—and start paying down debt. That means a substantial amount of taxpayer dollars will continue to flow towards federal debt interest payments, rather than programs and services or tax relief for Canadians.

When a government spends more than it raises in revenue and runs a budget deficit, it accumulates debt. As of 2024/25, the federal and provincial governments will have accumulated a total projected $2.3 trillion in combined net debt (total debt minus financial assets).

Of course, like households, governments must pay interest on their debt. According to our recent study, the provinces and federal government expect to spend a combined $92.5 billion on debt interest payments in 2024/25.

And like any government spending, taxpayers fund these debt interest payments. The difference is that instead of funding important programs, such as health care, these taxpayer dollars will finance government debt. This is the cost of deficit spending.

How much do Canadians pay each year in government debt interest costs? On a per-person basis, combined provincial and federal debt interest costs in 2024/25 are expected to range from $1,937 in Alberta to $3,432 in Newfoundland and Labrador. These figures represent provincial debt interest costs, plus the federal portion allocated to each province based on a five-year average (2020-2024) of their share of Canada’s population.

For perspective, it’s helpful to compare debt interest payments to other budget items. For instance, the federal government estimates that in 2024/25 it will spend more on debt interest costs ($53.8 billion) than on child-care benefits ($35.1 billion) or the Canada Health Transfer ($52.1 billion), which supports provincial health-care systems.

Provincial governments too spend more money on interest payments than on large programs. For example, in 2024/25, Ontario expects to spend more on debt interest payments ($15.2 billion) than on post-secondary education ($14.2 billion). That same year, British Columbia expects to spend more on debt interest payments ($4.4 billion) than on child welfare ($4.3 billion).

Unlike other forms of spending, governments cannot simply decide to spend less on debt interest payments in a given year. To lower their debt interest payments, governments must rein in spending and eliminate deficits so they can start to pay down debt.

Unfortunately, most governments in Canada are doing the opposite. All but one province (Saskatchewan) plans to run a deficit in 2025/26 while the federal deficit could exceed $90 billion.

To stop racking up debt, governments must balance their budgets. By spending less today, governments can ensure that a larger share of tax dollars go towards programs or tax relief to benefit Canadians rather than simply financing government debt.

-

International15 hours ago

International15 hours agoPrince Andrew banished from the British monarchy

-

Business1 day ago

Business1 day agoCanada’s attack on religious charities makes no fiscal sense

-

Banks2 days ago

Banks2 days agoBank of Canada Cuts Rates to 2.25%, Warns of Structural Economic Damage

-

Health2 days ago

Health2 days agoLeslyn Lewis urges Canadians to fight WHO pandemic treaty before it’s legally binding

-

Alberta2 days ago

Alberta2 days agoNobel Prize nods to Alberta innovation in carbon capture

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoPro-freedom group to expose dangers of Liberal ‘hate crime’ bill before parliamentary committee

-

Business2 days ago

Business2 days agoFord’s Liquor War Trades Economic Freedom For Political Theatre

-

Business15 hours ago

Business15 hours ago“We have a deal”: Trump, Xi strike breakthrough on trade and fentanyl