International

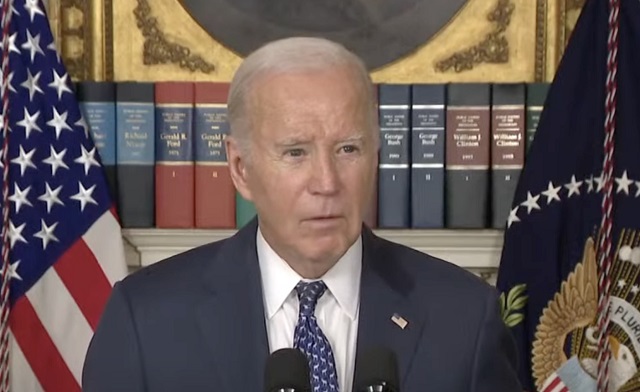

Too feeble to indict: Joe Biden’s disastrous press conference confirms diminished mental capacity

Biden delivers remarks at the White House on February 8, 2024

From LifeSiteNews

‘This is becoming a five-alarm fire for the White House’

Joe Biden attempted to do damage control at a hastily-arranged White House press conference after the Department of Justice (DOJ) published a lengthy investigative report which concluded that Biden is a “well-meaning, elderly man with a poor memory” and “diminished faculties.”

Much to the dismay of D.C. Democrats, Biden’s performance at the conference served only to confirm the report’s findings, opening the door for liberal and conservative pundits alike to question whether Biden is fit to continue as President of the United States.

The DOJ’s damning 388-page report — issued by special counsel Robert Hur on the “investigation into unauthorized removal, retention, and disclosure of classified documents”— found that Biden had willfully mishandled classified documents and had disclosed classified military and national security information, but that because of his diminished mental capacity, no criminal charges would be filed against the 81-year-old.

“In essence, the special counsel presents evidence that Biden should be removed under the 25th amendment,” noted conservative commentator Mark Levin.

The issue of Biden’s national security breaches faded into the background after he stood behind an East Room podium to dispel the report’s assertions about his increasing feeble mindedness. Even far-left national media outlets couldn’t ignore last night’s train wreck at the White House.

Biden angrily proclaimed “I am an elderly man. I know what the hell I’m doing!” during the evening presser, but few if any were buying it.

“This is becoming a five-alarm fire for the White House,” declared a panelist on CNN’s 360 with Anderson Cooper, alarmed at both the DOJ report and Biden’s performance at the press conference. “I don’t think the president did himself any favors in that speech. He undercut two of his biggest messages.”

Stunned CNN Panel Delivers Brutal Review of Biden Press Conference

“I don’t think the president did himself any favors in that speech. He undercut two of his biggest messages.”

“This is becoming a five-alarm fire for the White House.”

“Mexico? Mexico?! Where did that come… pic.twitter.com/poAUwX0v6P

— The Vigilant Fox 🦊 (@VigilantFox) February 9, 2024

A U.S. House Democrat called Biden’s verbal slip-ups “awful” and a former Biden White House official said the White House press conference was “brutal,” according to an Axios report.

Former ABC and CNN personality Chris Cuomo asked Robert F. Kennedy Jr. a question that would’ve been anathema for liberal media up until now: “Do you believe that Joe Biden is fit to be President of the United States?”

Kennedy responded:

I think we’ve reached a time where it’s no longer character assassination to ask legitimate questions about the President’s competency.

There are so many decisions that require nuance, that require complex levels of thinking and that those kinds of issues are coming at you many times a day.

The American people have a right to understand whether their President is capable of making those decisions.

There are entrenched interests and special interests in government that actually benefit from having a president who is not completely competent.

My complaint about what’s happening in the White House is that it’s become the sock puppet for these large industries, the big hedge funds, BlackRock, State Street, and Vanguard, who give equally to the Republican and Democratic Party, and now are just comfortable calling the shots.

I think we’ve reached a time where it’s no longer character assassination to ask legitimate questions about the President’s competency.

There are so many decisions that require nuance, that require complex levels of thinking and that those kind of issues are coming at you many… pic.twitter.com/nCtJkAtZRd

— Robert F. Kennedy Jr (@RobertKennedyJr) February 9, 2024

Conservatives pulled no punches

“This is the most catastrophic presidential press conference I’ve ever seen in my lifetime,” said the Daily Wire’s Matt Walsh.

“Not lucid enough to be charged for a crime but still running for President are not a complementary set of facts,” noted Andrew T. Walker, Ethics & Public Theology Professor at Southern Baptist Theological Seminary.

“I’ve said it once and I’ll say it again in a spirit of non-partisan Christian charity and a concern for human dignity: A man in Joe Biden’s condition should not be President nor running for President. It is an indignity to him and the office for him to endure a job he cannot do,” added Walker.

Many were moved to compare and contrast Biden’s press conference performance with that of Russian President Vladimir Putin whose lengthy interview with Tucker Carlson had been published on X earlier in the evening.

“One of these world leaders sat attentive for a 2 hour interview and expertly gave a 30 minute history lesson in detail,” wrote Libs of TikTok. “The other confused his colors and mixed up the Presidents of 2 countries.”

One of these world leaders sat attentive for a 2 hour interview and expertly gave a 30 minute history lesson in detail.

The other confused his colors and mixed up the Presidents of 2 countries.

Absolutely terrifying and embarrassing. pic.twitter.com/Tkai20FNWp

— Libs of TikTok (@libsoftiktok) February 9, 2024

“Absolutely terrifying and embarrassing.”

“Tonight as Putin gave intelligent, scholarly answers that delved into a thousand years of Russian history, President Biden was babbling incoherently about how the president of Egypt is actually the president of Mexico,” said Matt Walsh in a subsequent X post.

When former Obama White House political advisor Jim Messina attempted to dismiss the significance of the special counsel’s report, American Principles Project President Terry Schilling called him out:

It’s just all propaganda all the time from these people.

We see the decrepit and senile old man in the White House!

We hear him mumbling and stumbling.

You all are evil idiots destroying a great country.

Let's be clear–the special counsel isn't a dummy and we should be very careful not to take the bait after Comey pulled this in 2016. Hur, a lifelong Republican and creature of DC, didn't have a case against Biden, but he knew exactly how his swipes could hurt Biden politically.

— Jim Messina (@Messina2012) February 8, 2024

NYT: Maybe it’s time to stop pretending that Biden’s age is not an issue

The New York Times journalists offered remarkably honest, measured commentary amid the White House’s very bad day yesterday.

“The decision on Thursday not to file criminal charges against President Biden for mishandling classified documents should have been an unequivocal legal exoneration,” wrote the Times’ Michael D. Shear. “Instead, it was a political disaster.”

“Biden’s age is very clearly the most important non-Trump issue in this election,” said The New York Times politics reporter Astead Herndon. “Polling says so. Voters say so.”

“It’s just the WH/DC have had a sorta gentleman’s agreement for the last year to pretend like it’s not. Maybe that ends now,” wondered Herndon.

Biden’s age is very clearly the most impt non-Trump issue in this elec. polling says so. Voters say so. It’s just the WH/DC have had a sorta gentleman’s agreement for the last year to pretend like it’s not. Maybe that ends now https://t.co/W7d6BPK9SW

— Astead (@AsteadWH) February 8, 2024

Banks

Welcome Back, Wells Fargo!

Racket News

Racket News

By Eric Salzman

The heavyweight champion of financial crime gets seemingly its millionth chance to show it’s reformed

The past two decades have been tough ones for Wells Fargo and the many victims of its sprawling crime wave. While the banking industry is full of scammers, Wells took turning time honored street-hustles into multi-billion dollar white-collar hustles to a new level.

The Federal Reserve announced last month that Wells Fargo is no longer subject to the asset growth restriction the Fed finally enforced in 2018 after multiple scandals. This was a major enforcement action that prohibited Wells from growing existing loan portfolios, purchasing other bank branches or entering into any new activities that would result in their asset base growing.

Upon hearing the news that Wells was being released from the Fed’s penalty box, my mind turned to this pivotal moment in the classic movie “Slapshot.”

Here are some of Wells Fargo’s lowlights both before and after the Fed’s enforcement action:

- December 2022: Wells Fargo paid more than $2 billion to consumers and $1.7 billion in civil penalties after the Consumer Financial Protection Bureau (CFPB) found mismanagement — including illegal fees and interest charges — in several of its biggest product lines, such as auto loans, mortgages, and deposit accounts.

- September 2021: Wells Fargo paid $72.6 million to the Justice Department for overcharging foreign exchange customers from 2010-2017.

- February 2020: Wells Fargo paid $3 billion to settle criminal and civil investigations by the Justice Department and SEC into its aggressive sales practices between 2002 and 2016. About $500 million was eventually distributed to investors.

- January 2020: The Office of the Comptroller of the Currency (OCC) banned two senior executives, former CEO John Stumpf and ex-Head of Community Bank Carrie Tolstedt, from the banking industry. Stumpf and Tolstedt also incurred civil penalties of $17.5 million and $17 million.

- August 2018: The Justice Department levied a $2.09 billion fine on Wells Fargo for its actions during the subprime mortgage crisis, particularly its mortgage lending practices between 2005 and 2007.

- April 2018: Federal regulators at the CFPB and OCC examined Wells’ auto loan insurance and mortgage lending practices and ordered the bank to pay $1 billion in damages.

- February 2018: The aforementioned Fed enforcement action. In addition to the asset growth restriction, Wells was ordered to replace three directors.

- October 2017: Wells Fargo admitted wrongdoing after 110,000 clients were fined for missing a mortgage payment deadline — delays for which the bank was ultimately deemed at fault.

- July 2017: As many as 570,000 Wells Fargo customers were wrongly charged for auto insurance on car loans after the bank failed to verify whether those customers already had existing insurance. As a result, up to 20,000 customers may have defaulted on car loans.

- September 2016: Wells Fargo acknowledged its employees had created 1.5 million deposit accounts and 565,000 credit card accounts between 2002 and 2016 that “may not have been authorized by consumers,” according to CFPB. As a result, the lender was forced to pay $185 million in damages to the CFPB, OCC, and City and County of Los Angeles.

Additionally, somehow in 2023 Wells even managed to drop $1 billion in a civil settlement with shareholders for overstating their progress in complying with their 2018 agreement with the Fed to clean themselves up!

I imagine if Wells were in any other business, it wouldn’t be allowed to continue. But Wells is part of the “Too Big to Fail” club. Taking away its federal banking charter would be too disruptive for the financial markets, so instead they got what ended up being a seven-year growth ban. Not exactly rough justice.

While not the biggest settlement, my favorite Wells scam was the 2021 settlement of the seven-year pilfering operation, ripping off corporate customers’ foreign exchange transactions.

Like many banks, Wells Fargo offers its corporate clients with global operations foreign exchange (FX) services. For example, if a company is based in the U.S. but has extensive dealings in Canada, it may receive payments in Canadian dollars (CAD) that need to be exchanged for U.S. dollars (USD) and vice versa. Wells, like many banks, has foreign exchange specialists who do these conversions. Ideally, the banks optimize their clients’ revenue and decrease risk, in return for a markup fee, or “spread.”

There’s a lot of trust involved with this activity as the corporate customers generally have little idea where FX is trading minute by minute, nor do they know what time of day the actual orders for FX transactions — commonly called “BSwifts” — come in. For an unscrupulous bank, it’s a license to steal, which is exactly what Wells did.

According to the complaint, Wells regularly marked up transactions at higher spreads than what was agreed upon. This was just one of the variety of naughty schemes Wells used to clobber their customers. My two favorites were “The Big Figure Trick” and the “BSwift Pinata.”

The Big Figure Trick

Let’s say a client needs to sell USD for CAD, and that the $1 USD is worth $1.32 CAD. In banking parlance, the 32 cents is called the “Big Figure.” Wells would buy the CAD at $1.32 for $1 USD and then transpose the actual exchange rate on the customer statement from $1.32 to $1.23. If the customer didn’t notice, Wells would pocket the difference. On a transaction where the client is buying 5 million CAD with USD, the ill-gotten gain for Wells would be about $277,000 USD!

Conversely, if the customer did notice the difference, Wells would just blame it on the grunts in its operational back office, saying they accidentally transposed the number and “correct” the transaction. From the complaint, here is some give and take between two Wells FX specialists:

“You can play the transposition error game if you get called out.” Another FX sales specialist noted to a colleague about a previous transaction that a customer “didn’t flinch at the big fig the other day. Want to take a bit more?”

The BSwift Piñata

The way this hustle would work is, let’s say the Wells corporate customer was receiving payment from one of their Canadian clients. The Canadian client’s bank would send a BSwift message to Wells. The Wells client was in the dark about the U.S. dollar-Canadian dollar exchange rate because it had no idea what time of day the message arrived. Wells took advantage of that by purchasing U.S. dollars for Canadian dollars first. For simplicity, think of the U.S. dollar-Canadian dollar exchange rate as a widget that Wells bought for $1. If the widget increased in value, say to $1.10 during the day, Wells would sell the widget they purchased for $1 to the client for $1.10 and pocket 10 cents. If the price of the widget Wells bought for $1 fell to 95 cents, Wells would just give up their $1 purchase to the client, plus whatever markup they agreed to.

Heads, Wells wins. Tails, client loses.

The complaint notes that a Wells FX specialist wrote that he:

“Bumped spreads up a pinch,” that “these clients who are in the mode of just processing wires will most likely not notice this slight change in pricing” and that it “could have a very quick positive impact on revenue without a lot of risk.”

Talk about a boiler room operation. Personally, I think calling what you are doing to a client a “piñata” should have easily put Wells in the Fed’s penalty box another 5 years at least!

Wells has been released from the Fed’s 2018 enforcement order. I would like to think they have learned their lesson and are reformed, but I would lay good odds against it. A leopard can’t change its spots.

Racket News is a reader-supported publication.

Consider becoming a free or paid subscriber.

International

Woman wins settlement after YMCA banned her for complaining about man in girls’ locker room

From LifeSiteNews

Julie Jaman will receive $65,000 as part of the settlement after being banned from a local swimming pool for objecting to a man in a female shower with little girls present

A Washington State grandmother won a $65,000 settlement from the City of Port Townsend and the Olympic Peninsula YMCA after she was banned from a swimming pool for objecting to a cross-dressing man watching small girls change clothes.

As covered by LifeSiteNews in 2022, Julie Jaman testified before the Port Townsend City Council about her experience showering in the local pool’s facilities when she heard “a man’s voice in the women’s dressing area.” When she investigated, she said that she saw “a man in a women’s swimsuit, watching little girls pull down their bathing suits in order to use the toilets in the dressing room.”

She also told a local newspaper, “There were gaps in the curtain and there I was, naked, with soap and water on me, and this guy, right there very close to me. I asked, ‘Do you have a penis?’ He said, ‘That’s none of your business.’ That’s when I told him, ‘Get out of here, right now.” She appealed to a nearby female manager, who she says replied, “you’re discriminating and you can’t use the pool anymore and I’m calling the police.”

After speaking to police and reviewing police reports, the Port Townsend FreePress reported that Jaman had an “emotional response to a strange male being in the bathroom and helping a young girl take off her bathing suit,” and was described as “screaming” by a complainant.

“In an effort by the city and the YMCA to apply the neo-cultural gender rules at Mountain View Pool dressing, shower room facilities, women and children are being put at risk,” Jaman declared at the time.

A YMCA marketing and communications manager responded at the time by disputing her version of events, claiming the male was not “engaging” with the young girls but was simply escorting them to the dressing room, and that the confrontation was just one in a series of many that led to her ban.

She sued, however, and on June 30 the group representing her, the Center for American Liberty (CAL), announced that the city and the YMCA chapter had agreed to a $65,000 settlement, which also provides that the city will “remove certain information about Ms. Jaman from its website, further underscoring the baselessness of the actions taken against her.”

“This case was never just about one woman being banned from a publicly owned pool, it was about the fundamental right of every American to speak truth without fear of retaliation,” said Mark Trammell, CEO of CAL. “Julie Jaman bravely stood her ground, endured attacks on her character, and today’s settlement affirms that government officials cannot silence dissenting voices through intimidation or retribution.”

“I never imagined that expressing concerns about the safety and privacy of women and girls would lead to me being shunned and banned,” Jaman added. “I’m grateful that justice has been served and that my voice was heard. This is a victory for common sense, women’s rights, and the right to speak the truth.”

Despite being demanded by LGBT activists as a matter of “fairness,” policies forcing girls to share intimate facilities such as bathrooms, showers, or changing areas with males who “identify” as the opposite sex violates their privacy rights, subjects them to needless emotional stress, and gives potential male predators a viable pretext to enter female bathrooms or lockers by simply claiming transgender status.

-

Business2 days ago

Business2 days agoElon Musk slams Trump’s ‘Big Beautiful Bill,’ calls for new political party

-

Business2 days ago

Business2 days agoRFK Jr. says Hep B vaccine is linked to 1,135% higher autism rate

-

International1 day ago

International1 day agoCBS settles with Trump over doctored 60 Minutes Harris interview

-

Business22 hours ago

Business22 hours agoWhy it’s time to repeal the oil tanker ban on B.C.’s north coast

-

MxM News21 hours ago

MxM News21 hours agoUPenn strips Lia Thomas of women’s swimming titles after Title IX investigation

-

Crime19 hours ago

Crime19 hours agoBryan Kohberger avoids death penalty in brutal killing of four Idaho students

-

Censorship Industrial Complex2 days ago

Censorship Industrial Complex2 days agoGlobal media alliance colluded with foreign nations to crush free speech in America: House report

-

Business22 hours ago

Business22 hours agoLatest shakedown attempt by Canada Post underscores need for privatization